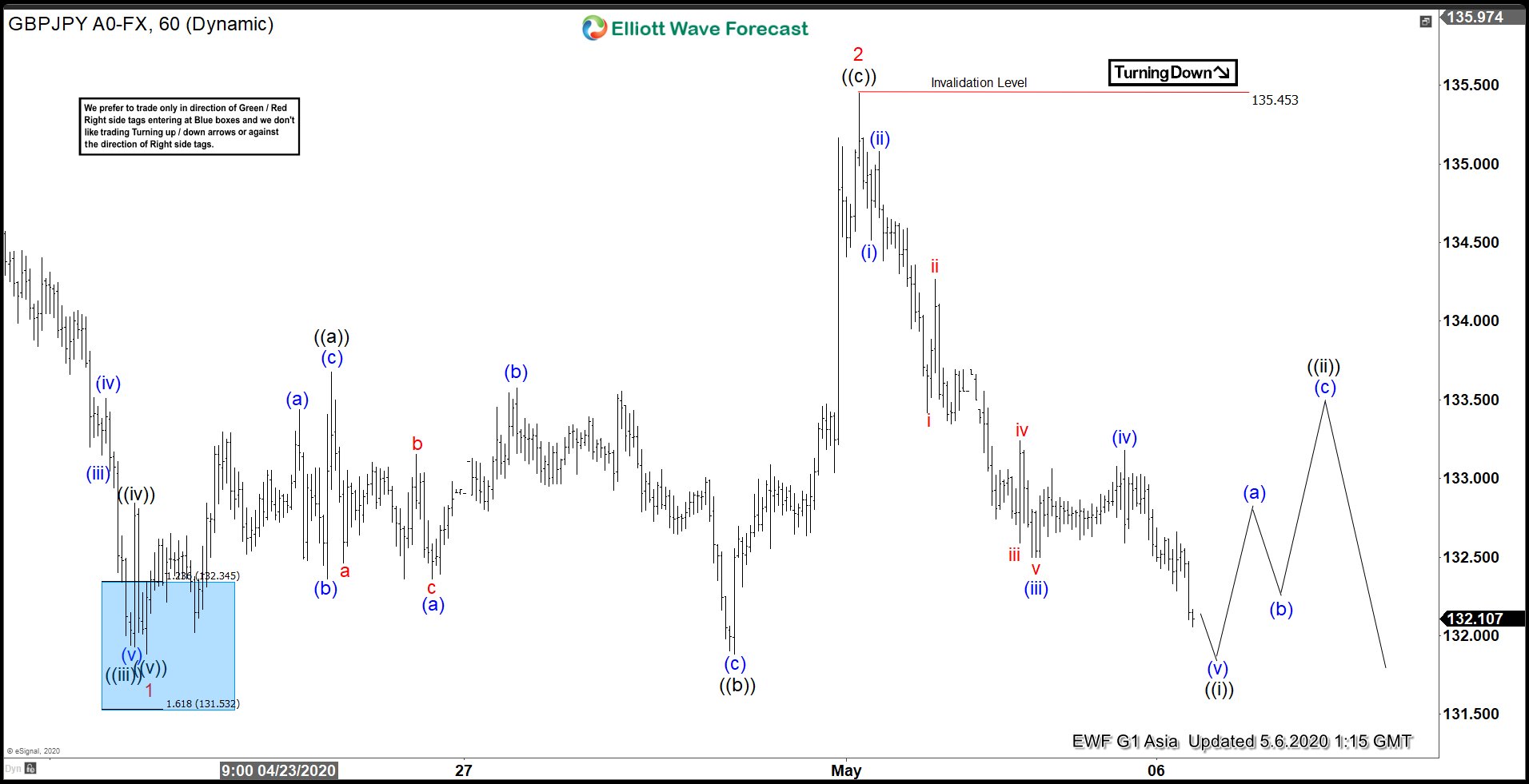

GBPJPY decline from April 9, 2020 high is unfolding as a 5 waves impulse Elliott Wave structure. Down from April 9 high, wave 1 ended at 132.65 and wave 2 bounce ended at 135.45. Internal of wave 2 unfolded as an expanded Flat Wave where ((a)) of 2 ended at 133.68, and pullback in wave ((b)) of 2 ended at 131.88. Final leg wave ((c)) of 2 ended at 135.45.

Wave 3 lower is currently in progress and subdivides as a 5 waves impulse in lesser degree. Down from wave 2 at 135.45, wave (i) ended at 134.51, and bounce in wave (ii) ended at 135.08. Pair resumes lower in wave (iii) towards 132.5, and bounce in wave (iv) ended at 133.18. Last leg wave (v) is expected to end soon and it should complete wave ((i)) in higher degree as well. Pair should afterwards bounce in wave ((ii)) to correct cycle from May 1, 2020 high before the decline resumes. Near term, as far as pivot at 135.45 high stays intact, expect bounce to fail in 3, 7, or 11 swing for further downside in wave ((iii)) of 3.