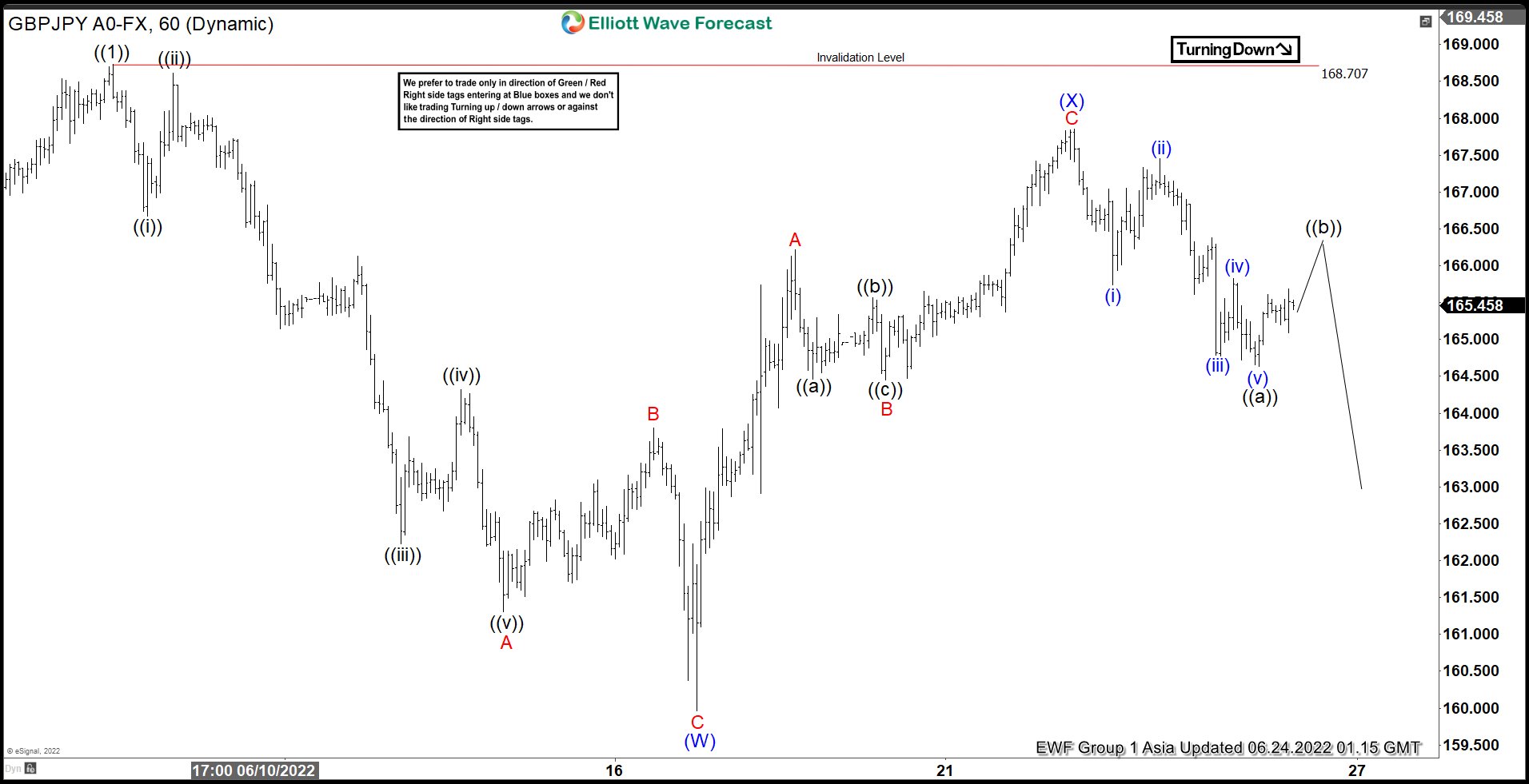

Short term Elliott Wave in GBPJPY suggests cycle from 12/3/2021 low has ended as wave ((1)) with the rally to 168.7. Wave ((2)) pullback is currently in progress to correct cycle from December 2021 low. Internal subdivision of wave ((2)) is unfolding as a double three Elliott Wave structure. Down from wave ((1)), wave A ended at 161.31 and rally in wave B ended at 163.8. Pair then extended lower in wave C towards 159.96 and this completed wave (W).

Wave (X) rally ended at 167.856 with internal subdivision as a zigzag structure. Up from wave (W), wave A ended at 166.22 and pullback in wave B ended at 164.44. Final leg higher wave C ended at 167.85 which also completed wave (X). Pair has started to turn lower in wave (Y). Down from wave (X), wave ((a)) ended at 164.63. Expect rally in wave ((b)) to correct cycle from 6/22/2022 high before the decline resumes. Near term, while pivot at 167.85 high and more importantly at 168.7 remains intact, expect rally to fail in 3, 7, or 11 swing for further downside. Potential target lower for wave (Y) is 100% -123.6% Fibonacci extension of (W) which comes at 157 – 159.1 area.