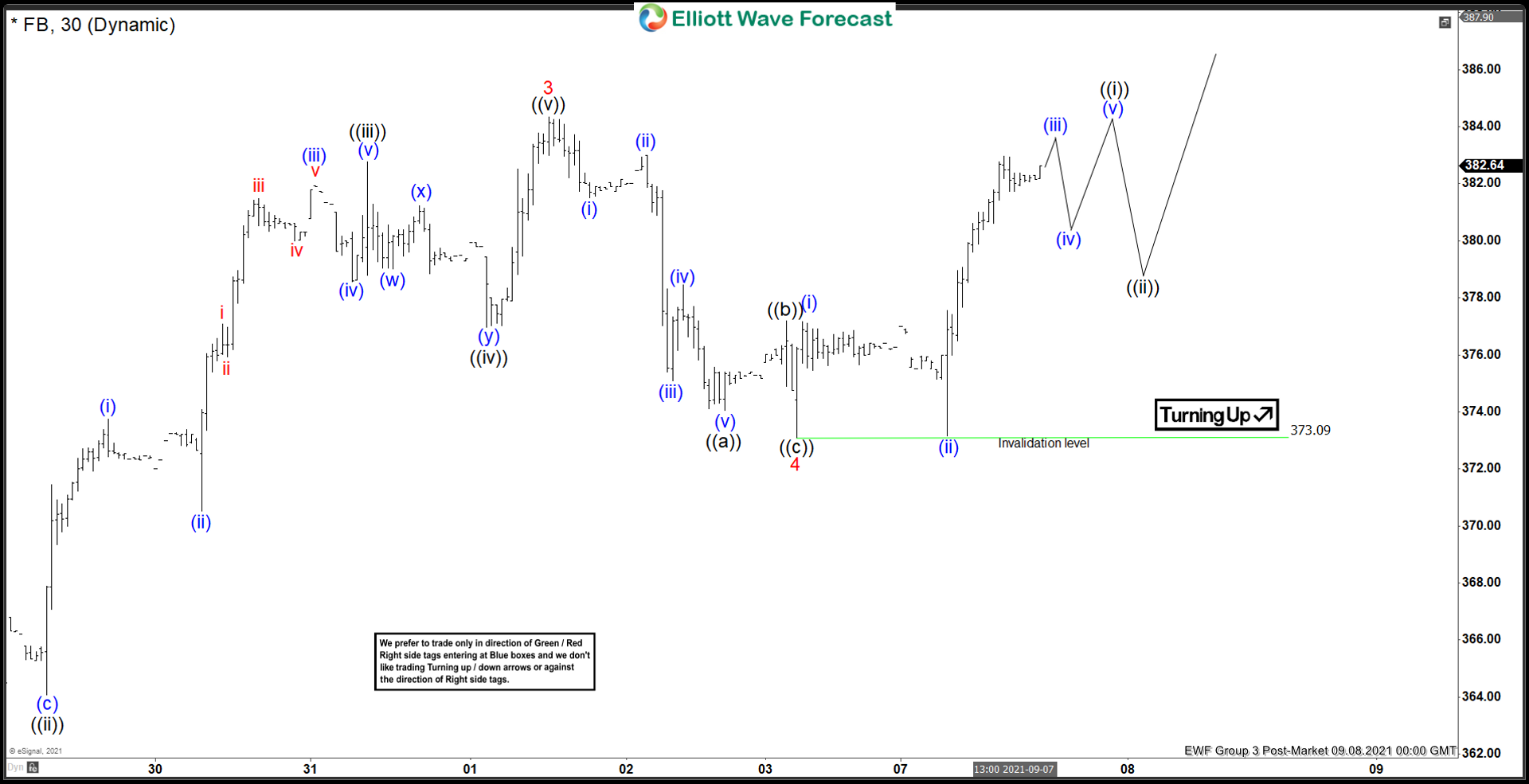

Short Term Elliott Wave view in Facebook suggests the rally from August 3, 2021 low is unfolding as a 5 waves impulse structure. Up from August 3 low, wave 1 ended at 365.77 and pullback in wave 2 ended at 350.20. The stock has resumed higher in wave 3 towards 384.33. The internal of wave 3 unfolded as 5 waves in lesser degree. Wave ((i)) ended at 370.86 and pullback in wave ((ii)) ended at 364.08. Wave ((iii)) ended at 382.76, wave ((iv)) ended at 376.97, and wave ((v)) of 3 ended at 384.33.

Pullback in wave 4 ended at 373.09 as a zigzag structure. Down from wave 3, wave ((a)) ended at 374.06, wave ((b)) ended at 377.20, and wave ((c)) ended at 373.09. The stock has turned higher in wave 5 but still needs to break above wave 3 at 384.33 to avoid a double correction. Up from wave 4, wave (i) ended at 377.16 and dips in wave (ii) ended at 373.15. Expect wave (iii) to complete soon, then it should pullback in wave (iv) before another leg higher in wave (v) to end wave ((i)) of 5. Near term, as far as pullback stays above 373.09, expect the stock to resume higher.