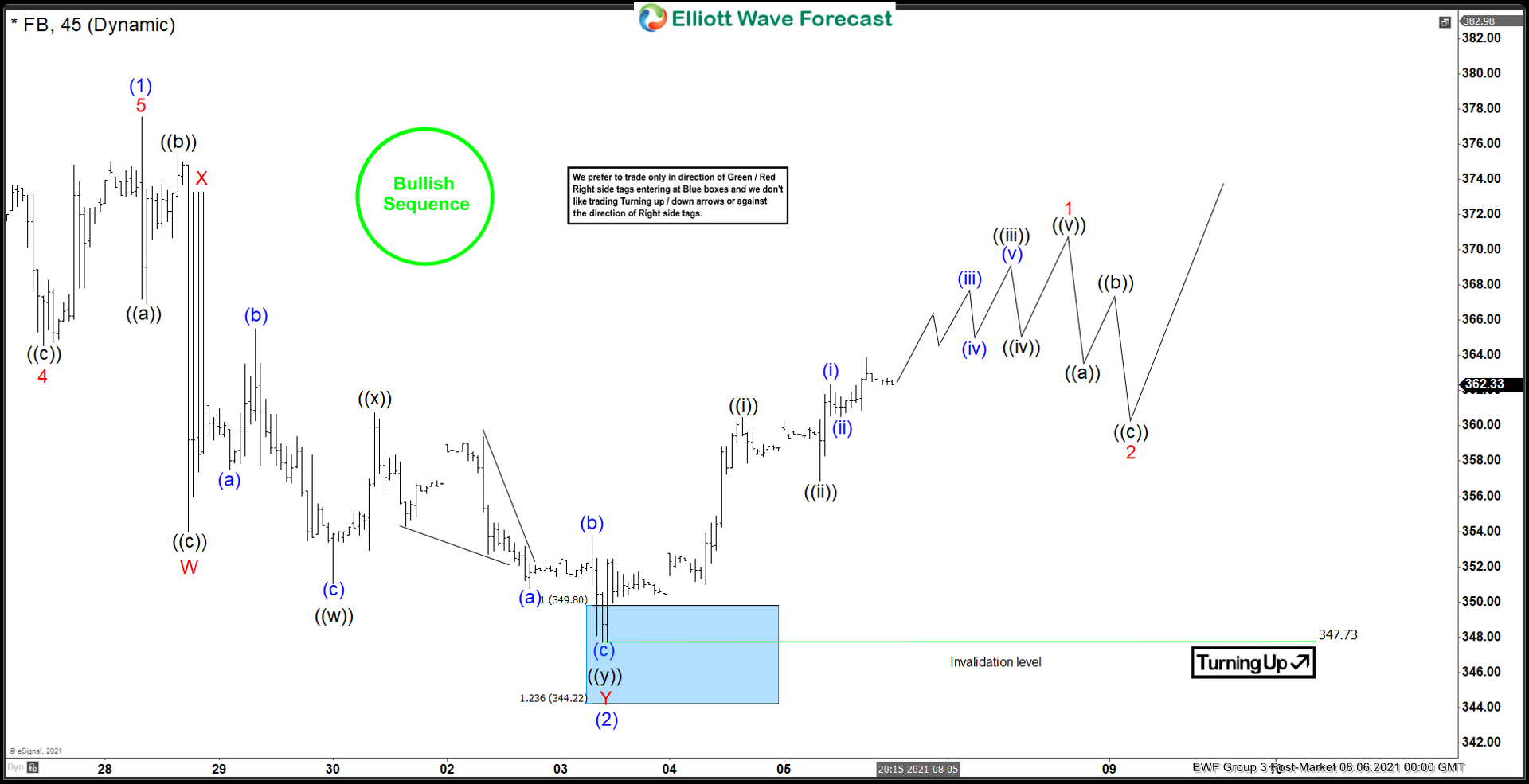

Short Term Elliott Wave view in Facebook (FB) suggests the rally from July 20 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from July 20 low, wave (1) ended at 377.55 and dips in wave (2) ended at 347.73. Internal structure of wave (2) unfolded as a double three Elliott Wave structure. Down from wave (1), wave ((a)) ended at 366.93, wave ((b)) ended at 375.41, and wave ((c)) ended at 354. This completed wave W in higher degree. Rally in wave X ended at 373.28. The stock then resumed lower in wave Y. Down from wave X, wave ((w)) ended at 351.05, rally in wave ((x)) ended at 360.73, and wave ((y)) of Y ended at 347.73.

This completed wave (2) in higher degree at the blue box area. This area is the 100% – 161.8% Fibonacci extension of the wave W. From the blue box area, the stock has turned higher in wave (3). However, at this stage it still needs to break above wave (1) at 377.55 to rule out a larger double correction. Up from wave (2), wave ((i)) ended at 360.48 and pullback in wave ((ii)) ended at 356.90. Near term, as far as pivot at 347.73 low stays intact, expect the stock to continue higher.