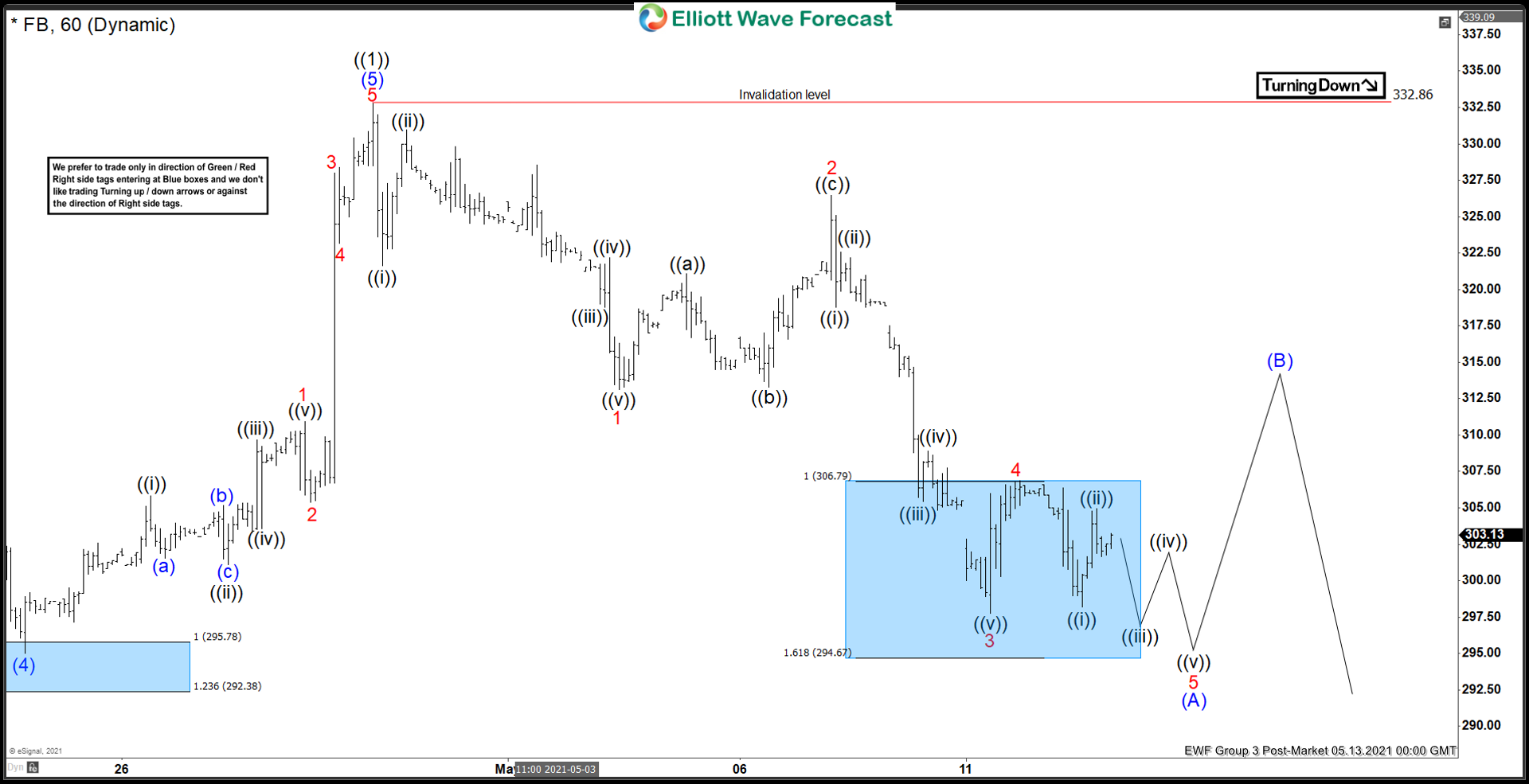

Short Term Elliott Wave structure for Facebook (FB) suggests the rally from January 14, 2021 low ended wave ((1)) at 322.86 as an impulse Elliott Wave structure. In the 1 hour chart below, we can see wave (4) of this impulse ended at 295 and from there it rallied in wave (5) as an impulse in lesser degree towards 322.86. This completed wave ((1)) in higher degree.

Wave ((2)) pullback is currently in progress to correct cycle from January 14 low before the rally in the stock resumes. Internal subdivision of wave ((2)) is proposed to be in a zigzag Elliott Wave structure. Down from wave ((1)), wave 1 ended at 313 and wave 2 bounce ended at 326.44. Stock then resumed lower in wave 3 towards 297.75, and bounce in wave 4 ended at 306.83. Facebook now can see 1 more leg lower to end wave 5 which should complete wave (A) in higher degree.

Afterwards, the stock should see a wave (B) bounce to correct cycle from April 29 high before the decline resumes in wave (C) of ((2)). As far as pivot at 332.86 high stays intact, expect rally to fail in the sequence of 3, 7, or 11 swing for another leg lower.