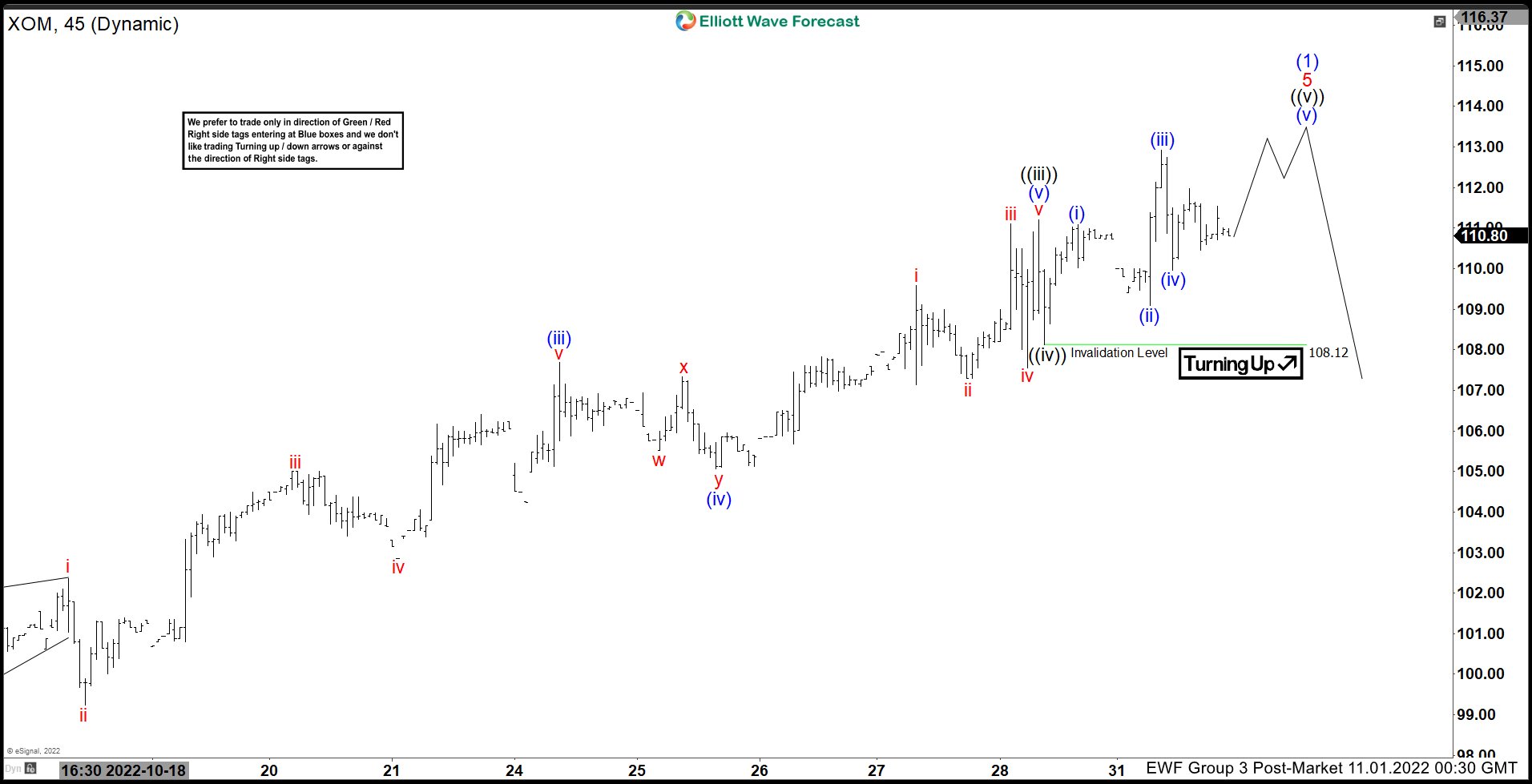

Short Term Elliott Wave structure of Exxon Mobil (ticker: XOM) suggests cycle from 9.26.2022 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from 9.26.2022 low, wave 1 ended at 89.36 and pullback in wave 2 ended at 87.13. The stock then extends higher in wave 3 towards 103.32 and pullback in wave 4 ended at 96.75.

Wave 5 is now in progress with subdivision as an impulse in lesser degree. Up from wave 4, wave ((i)) ended at 99.76 and dips in wave ((ii)) ended at 97.06. Stock then extended higher in wave ((iii)) towards 111.21 as the 45 minutes chart below shows. Stock then pullback in wave ((iv)) towards 108.12. Near term, expect wave ((v)) of 5 to complete soon with a marginal high. This should also complete wave (1) and end cycle from 9.26.2022 low. Stock should then pullback in wave (2) to correct cycle from 9.26.2022 low before the rally resumes. Wave (2) dips should unfold in the sequence of 3 ,7, or 11 swing before the rally resumes. Near term, while above 108.12, expect the stock to extend marginally to end wave ((v)) of 5 of (1).