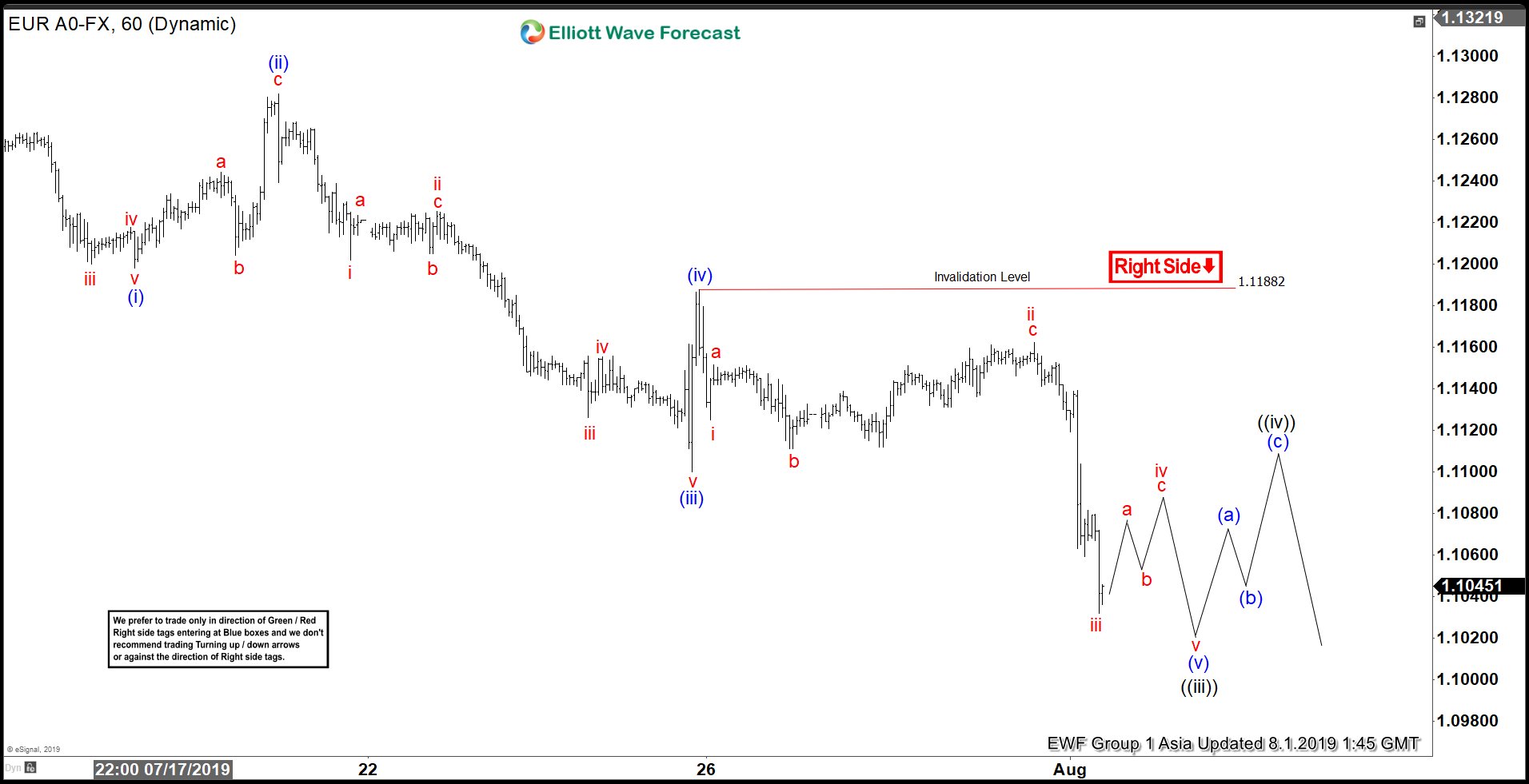

Elliott Wave view suggests the decline in EURUSD from June 25 high (1.1412) is in progress as a 5 waves impulse Elliott Wave structure. Wave ((iii)) of this 5 waves can be seen on the chart below and subdivides in another impulse of lesser degree. Wave (i) ended at 1.1198, and wave (ii) bounce ended at 1.1282. Pair then declined in wave (iii) towards 1.11. and wave (iv) ended at 1.118. Wave (v) seems to be missing 1 leg, thus while pair stays below 1.118, it can see a marginal low to end wave (v) of ((iii)).

Afterwards, pair should do larger bounce within wave ((iv)) to correct cycle from July 11 high (1.1286) before the decline resumes. Shorter cycle, as we are near the end of wave ((iii)), it is risky to chase the weakness at this stage. However, we don’t like buying the pair and expect any rally to find sellers in 3, 7, or 11 swing for further downside. Later bounce in wave ((iv)) should fail while pivot at 1.1286 stays intact. Pair should then decline 1 more leg lower within wave ((v)) to complete a 5 waves down from June 25 high.