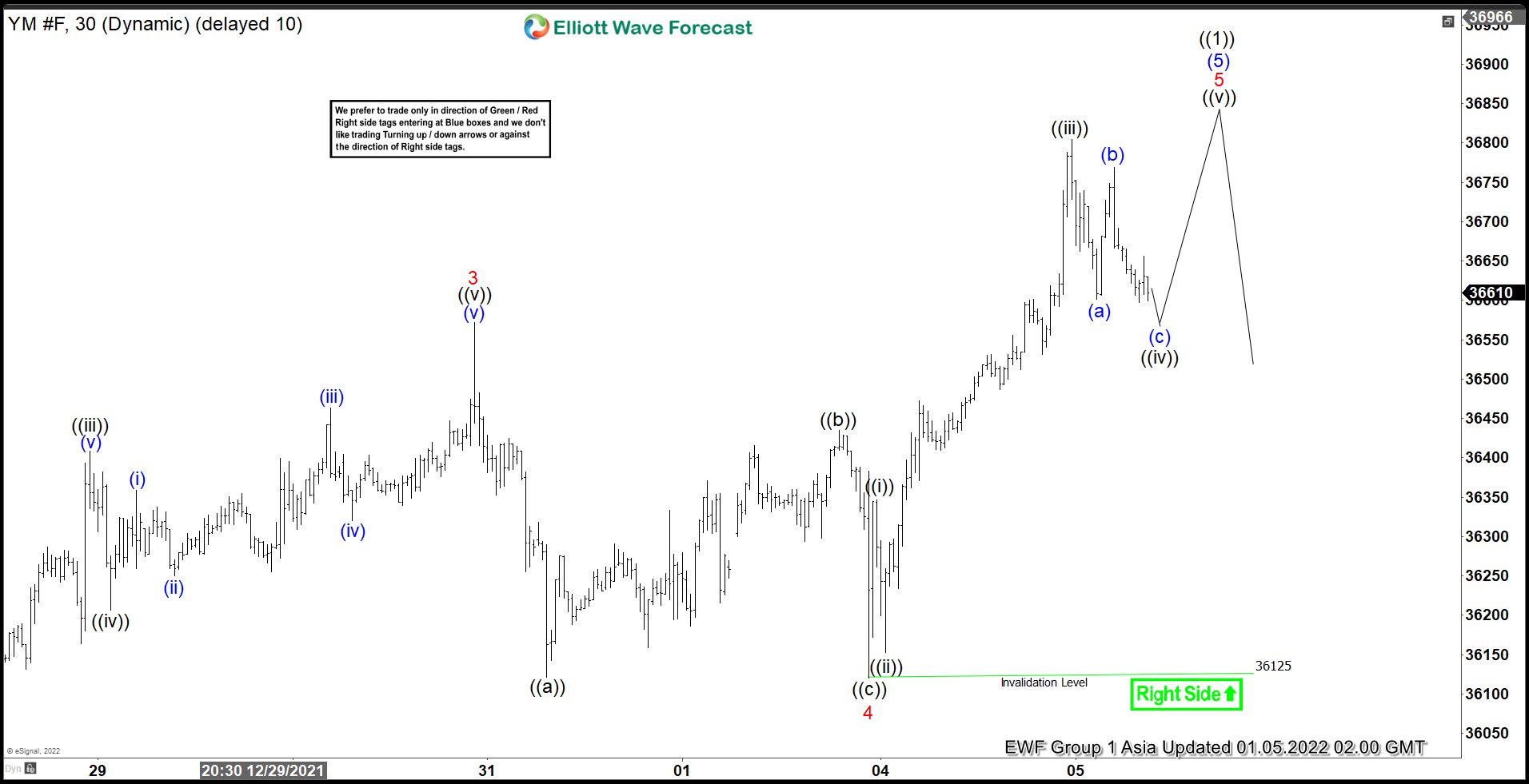

Short Term Elliott Wave View in Dow Futures (YM) suggests rally from December 2, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from December 2 low, wave 1 ended at 36030 and dips in wave 2 ended at 34547. Index then resumes higher in wave 3 towards 36572 and pullback in wave 4 ended at 36120. The internal subdivision of wave 4 unfolded as a zigzag structure where wave ((a)) ended at 36121, wave ((b)) ended at 36435, and wave ((c)) ended at 36125.

Wave 5 is currently in progress as another impulse in lesser degree. Up from wave 4, wave ((i)) ended at 36347 and pullback in wave ((ii)) ended at 36153. Index then resumes higher in wave ((iii)) towards 36804. Near term, as far as pivot at 36125 low stays intact, expect wave ((iv)) dips to find support in the sequence of 3, 7, or 11 swing for 1 more push higher to end wave ((v)). The move higher should also complete wave 5 of 5 of ((1)) in higher degree. Afterwards, expect a larger pullback in 3 waves at least to correct cycle from December 2, 2021 low.