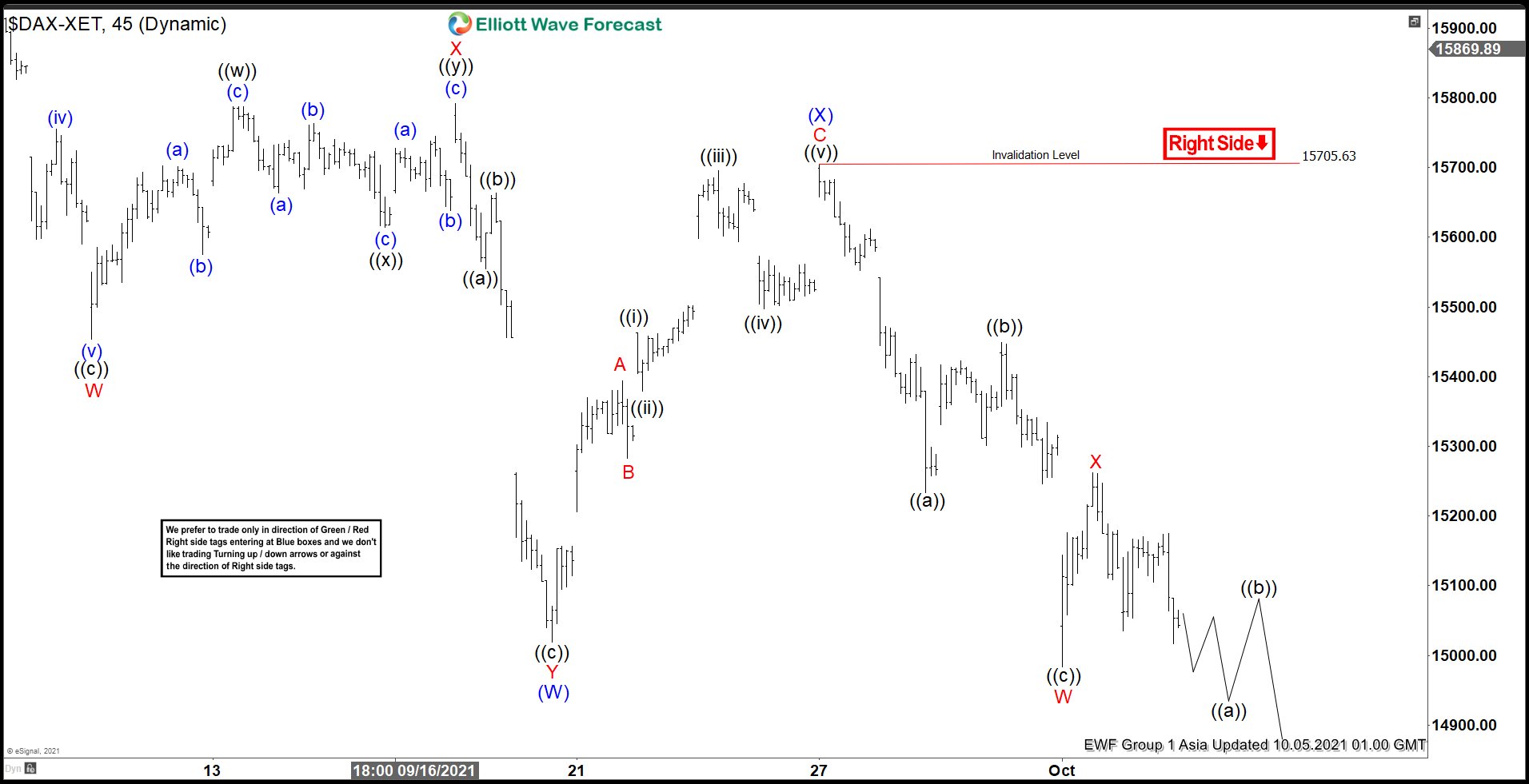

Short-term Elliott wave view in DAX suggests the decline from August 13, 2021 high is unfolding as a double three Elliott Wave structure. Down rom August 13 high, wave W ended at 15453.96 and rally in wave X ended at 15791.90. Index then resumed lower in wave Y towards 15019.49. This completed wave (W) in higher degree. Correction in wave (X) has also ended at 15705.63. Internal subdivision of wave (X) unfolded as a zigzag structure. Up from wave (W), wave A ended at 15394.33 and pullback in wave B ended at 15282.63. Index then resumed higher in wave C towards 15705.63 which ended wave (X).

Index turned lower and broke below wave (W) at 15019.49 suggesting the next leg lower wave (Y) has started. Down from wave (X), wave ((a)) ended at 15232.97 and rally in wave ((b)) ended at 15448.52. Index then resumed lower in wave ((c)) towards 14983.80 which also ended wave W. Correction in wave X ended at 15262.75. Near term, expect rally to fail below 15705.63 invalidation level for further downside. Potential target lower is 100% – 161.8% Fibonacci extension from August 13, 2021 peak towards 14063.49 – 14686.14. Near term, as far as September 27 pivot high at 15705.63 remains intact, expect rally to fail in 3, 7, or 11 swing for further downside.