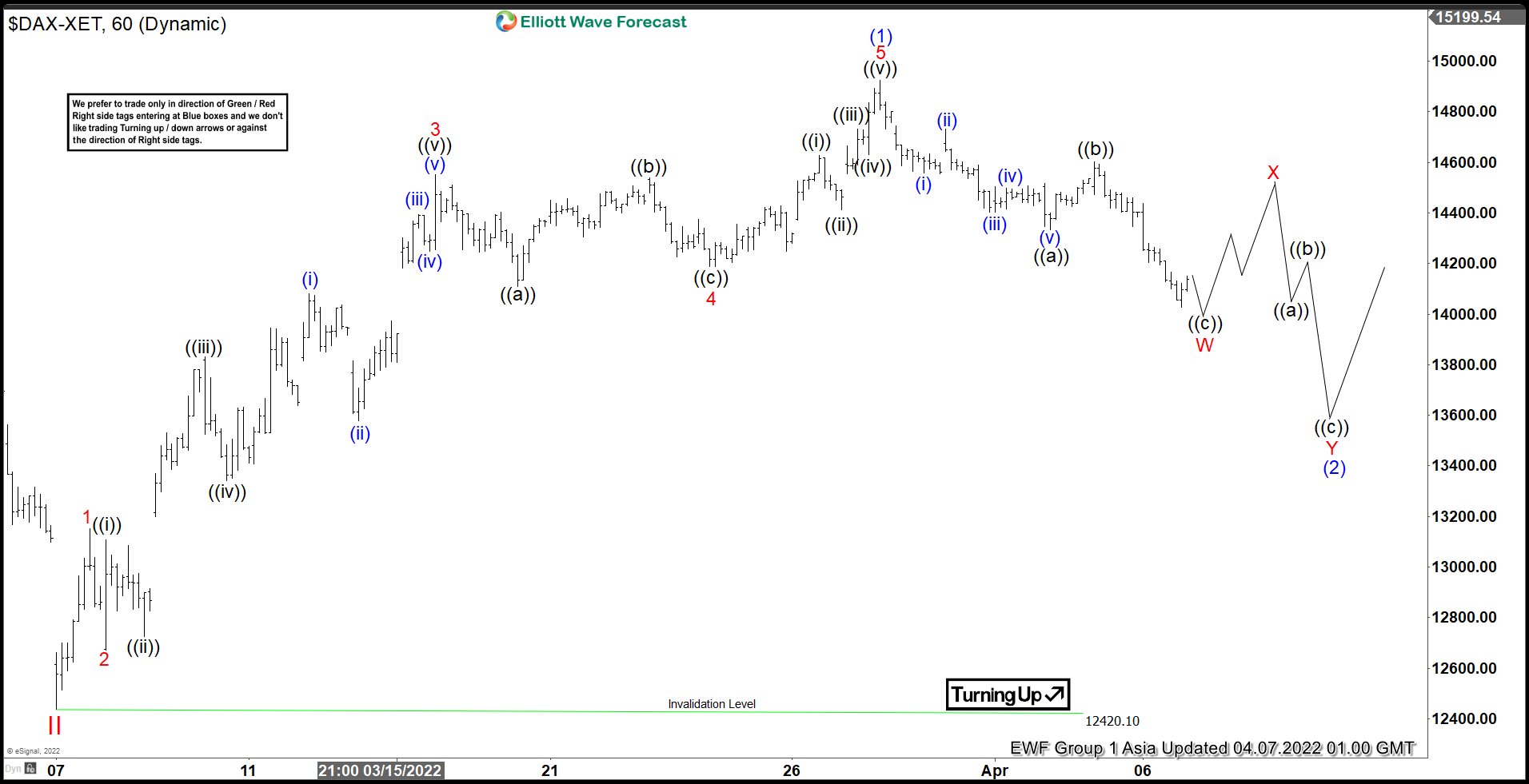

Short term outlook in DAX suggests the decline to 12420.10 ended wave II. This ended the correction of the rally starting from March 2020 Covid-19 low. The Index has started to rally again in wave III. This view however needs validation by breaking above the previous wave I high at 16290.19 on November 2021. Until it breaks to new high above 16290.19, we can’t completely rule out a larger double correction in DAX. The primary view expressed in the 60 minutes chart below however is calling wave II completed at 12451.75. Internal subdivision of wave III is unfolding as a 5 waves impulse Elliott Wave structure. Up from there, wave 1 ended at 13150.35, and dips in wave 2 ended at 12672. Index then rallies again in wave 3 towards 14553.10 and pullback in wave 4 ended at 14188.62. Final leg higher wave 5 ended at 14925.25 which completes wave (1) in higher degree.

Wave (2) pullback is currently in progress to correct the rally from wave II low before the Index resumes higher again. Structure of wave (2) pullback is in the form of a double three (double zigzag). Down from wave (1), wave ((a)) ended at 14334.10 and wave ((b)) ended at 14603.44. Expect wave ((c)) to complete soon which should end wave W of the double zigzag in higher degree. Index should then rally in wave X, followed by another turn lower in wave Y as a the second zigzag. Near term, as far as wave II pivot low at 12420.10 stays intact, expect dips to find support in 3, 7, or 11 swing for more upside.