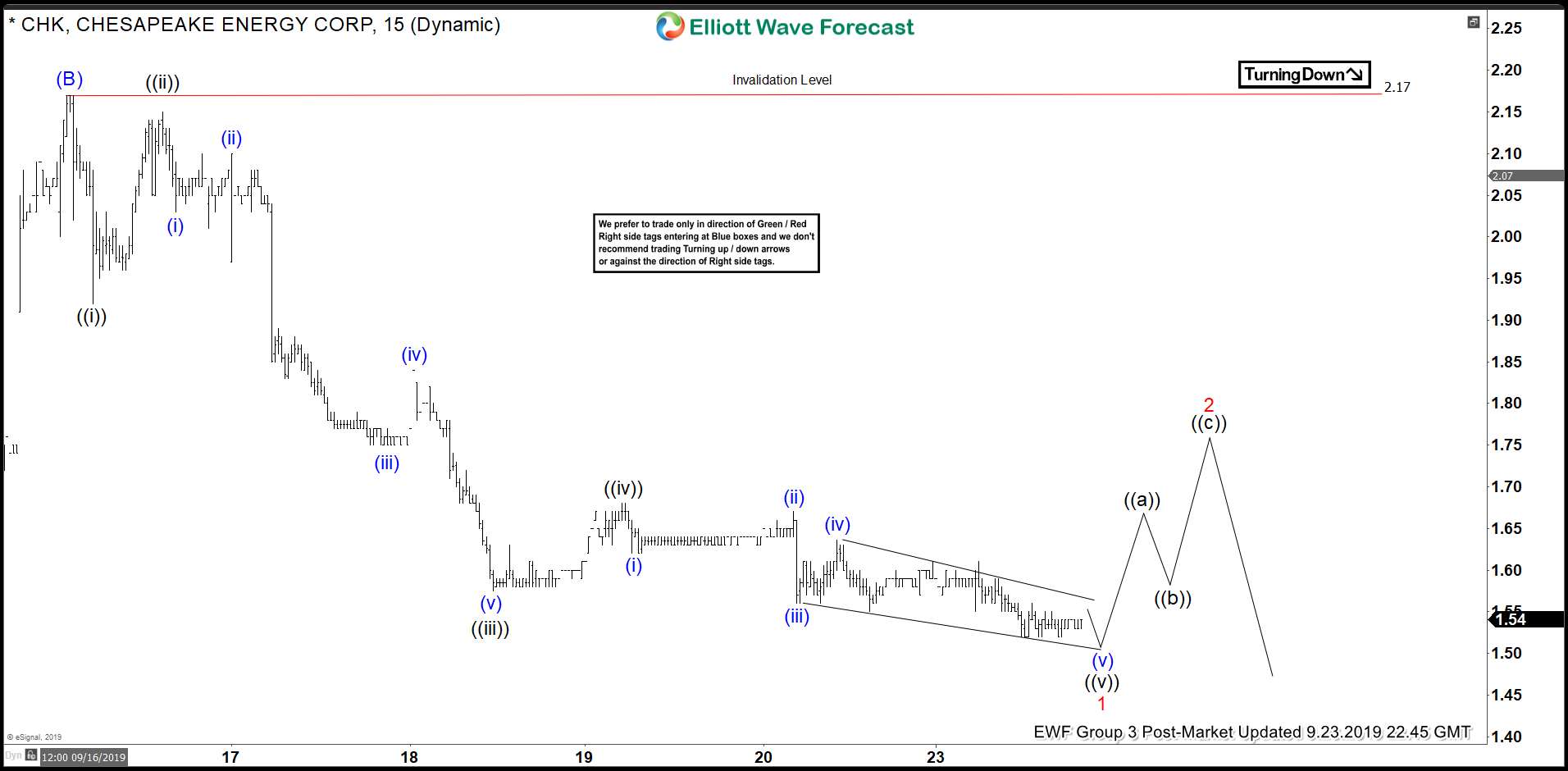

Elliott Wave view on Chesapeake Energy Corp (ticker symbol: CHK) suggests the rally to 2.17 ended wave (B). This suggests the stock has turned lower in wave (C) and can break below August 7 low (1.26). The stock however needs to break below 1.26 to confirm the bearish view and avoid a double correction in wave (B).

Down from September 16, 2019 high (2.17), wave ((i)) ended at 1.92 and wave ((ii)) ended at 2.15. The stock then extends lower with separation in wave ((iii)) towards 1.58 and wave ((iv)) bounce ended at 1.68. Internal of wave ((iii)) subdivided into another impulse in lesser degree.

Wave ((v)) is currently in progress as a diagonal and expected to complete soon. The 5 waves impulsive move lower should complete wave 1 in higher degree. The stock should then bounce in wave 2 to correct cycle from Sept 16 high (2.17) before the decline resumes. Bounce should find sellers in the sequence of 3, 7, or 11 swing for further downside as far as pivot at 2.17 high stays intact. Assuming the stock can break below 1.26 in the next move lower, potential target to the downside is 61.8 – 76.4 fibonacci extension of wave (A)-(B) towards as low as 0.39 – 0.73.