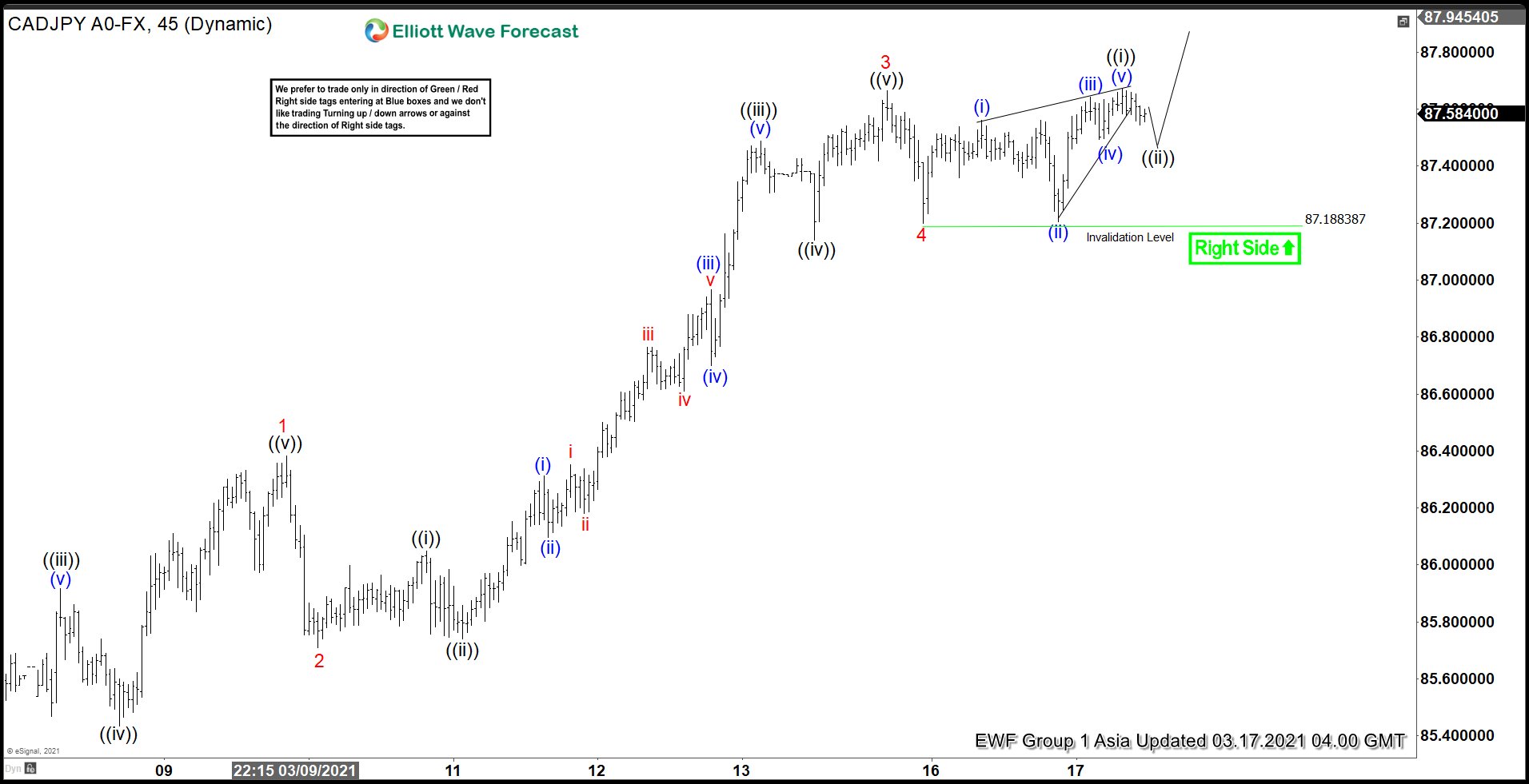

Short term Elliott Wave View suggests that CADJPY’s rally from March 1, 2021 low is unfolding a 5 waves impulse Elliott Wave structure. Up from March 1, 2021 low, wave 1 ended at 86.38 and pullback in wave 2 ended at 85.708. Up from there, wave ((i)) ended at 86.048 and wave ((ii)) pullback ended at 85.74. Pair then extended higher in wave ((iii)) towards 87.489, and wave ((iv)) ended at 87.14. Final leg higher wave ((v)) of 3 ended at 87.665.

Pullback in wave 4 has ended at 87.18 and pair has resumed higher in wave 5. Up from wave 4 low, wave (i) ended at 87.56, and wave (ii) ended at 87.205, Wave (iii) ended at 87.64, wave (iv) ended at 87.49, and wave (v) ended at 87.674. This should complete wave ((i)) in higher degree as a leading diagonal. Pair now is looking to pullback in wave ((ii)) to correct rally from March 15 low before turning higher again. As far as pivot at 87.188 low stays intact in the first degree, expect dips to find support and pair to extend higher within wave 5. The right side remains higher in the pair.