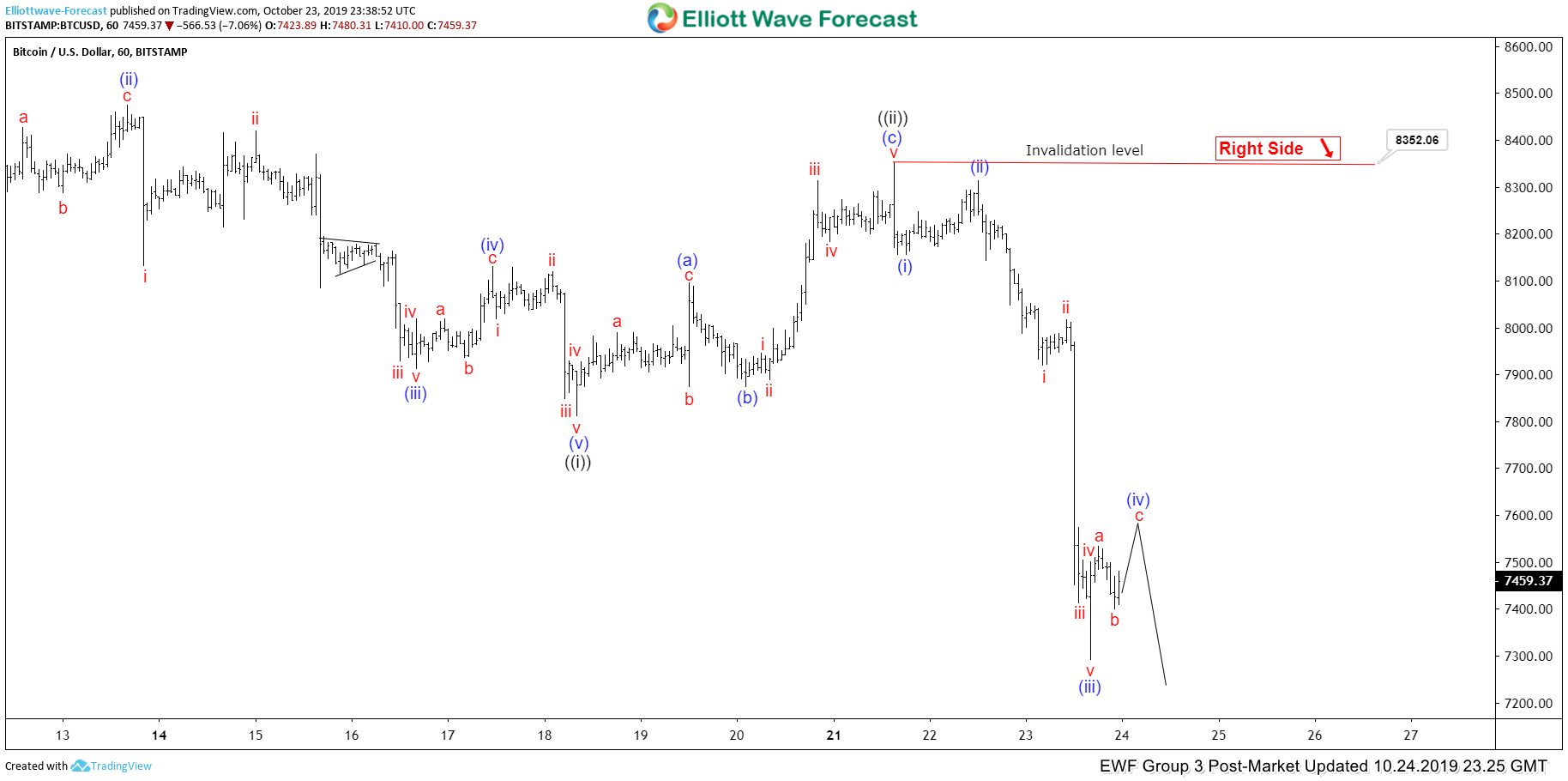

Short Term Elliott Wave view on Bitcoin (BTCUSD) suggests the decline October 11, 2019 high ($8820) is unfolding as a 5 waves impulse Elliott Wave structure. Down from 8820, wave ((i)) ended at 7811.62 as a 5 waves impulse in lesser degree, and wave ((ii)) rally ended at 8352. It has since resumed lower again in wave ((iii)).

Down from 8352, wave (i) of ((iii)) ended at 8156 and wave (ii) of ((iii)) bounce ended at 8314.77. Wave (iii) of ((iii)) ended at 7291.55. Expect the crypto currency to bounce in wave (iv) before turning lower 1 more leg to end wave (v) of ((iii)). Near term, while bounce stays below 8352, expect Bitcoin to continue extending lower to end 5 waves down from October 2019 high.

Longer term view suggests Bitcoin has reached 100% minimum daily target from June 26, 2019 high. Thus the cycle from June 26 high is mature and it’s expected to end soon, although further downside is still expected in short term. We have forecasted this decline to $7500 area since August this year in our previous Chart of The Day. Short Term traders then might still position for further downside, while long term investors should start preparing the eventual rally after current correction is complete.