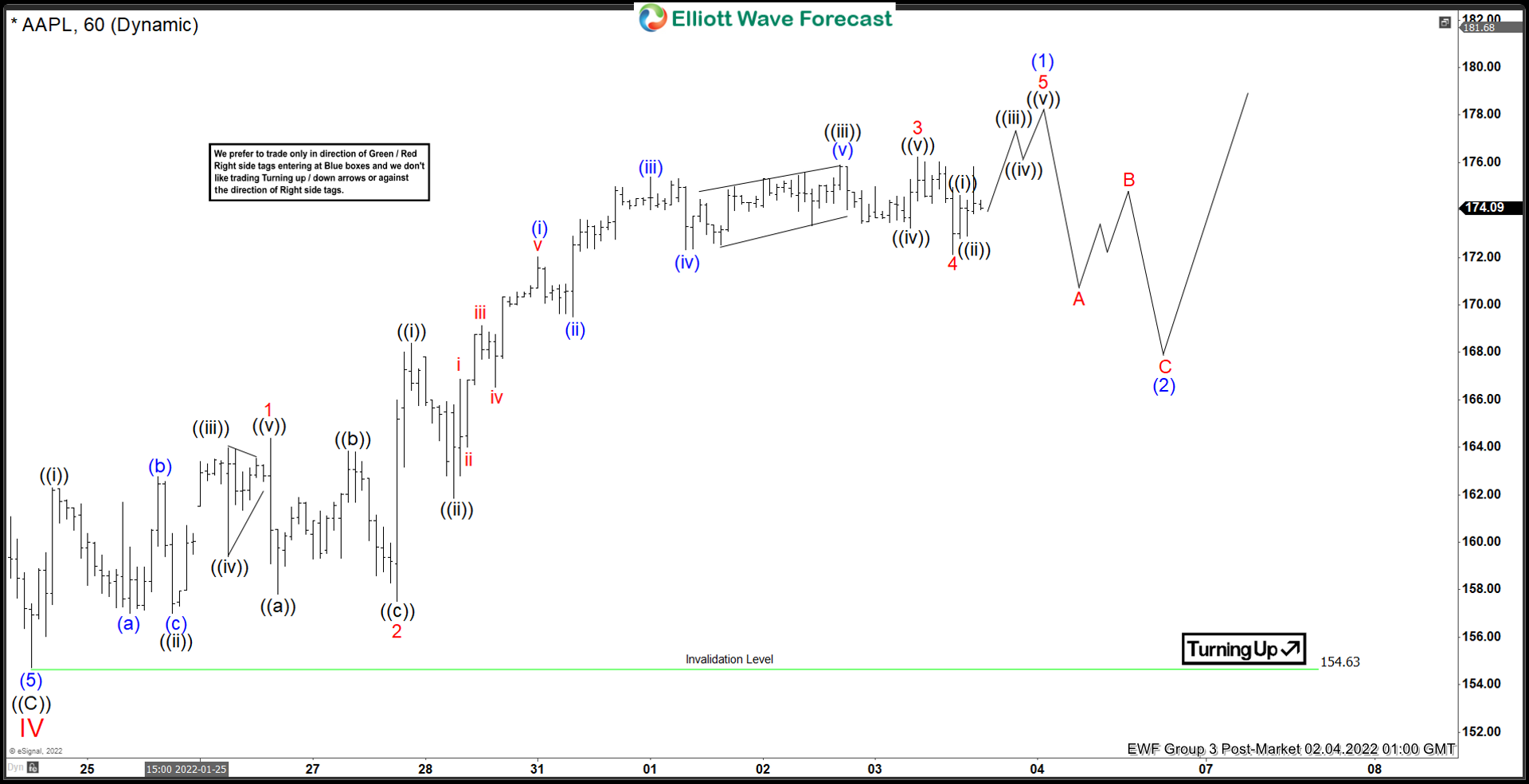

The short-term Elliott wave view in Apple (AAPL) shows that wave IV pullback ended at 154.63. The stock has resumed wave V higher as a 5 waves impulse structure. However, it still needs to break above wave III at 182.94 to rule out a double correction. Up from wave IV, wave ((i)) ended at 162.30 and pullback in wave ((ii)) ended at 157.01. Stock then resumes higher in wave ((iii)) towards 163.98, dips in wave ((iv)) ended at 162.57, and wave ((v)) ended at 164.39. This completed wave 1 in higher degree.

Wave 2 pullback ended at 157.50 with internal structure as a zigzag Elliott Wave structure. Down from wave 1, wave ((a)) ended at 157.82, wave ((b)) ended at 163.84, and wave ((c)) ended at 157.50. This completed wave 2 pullback. Up from there, wave ((i)) of 3 ended at 168.38 and wave ((ii)) of 3 is finished at 161.86. Stock resumed higher in wave ((iii)) of 3 towards 175.88, wave ((iv)) of 3 ended at 173.23. Finally wave ((v)) of 3 ended at 176.24. Pullback in wave 4 ended at 172.12. Expect the stock to extend higher 1 more leg to finish wave 5 and complete wave (1). Afterwards, it should pullback in wave (2) to correct cycle from January 25, 2022 low before it resumes higher again.