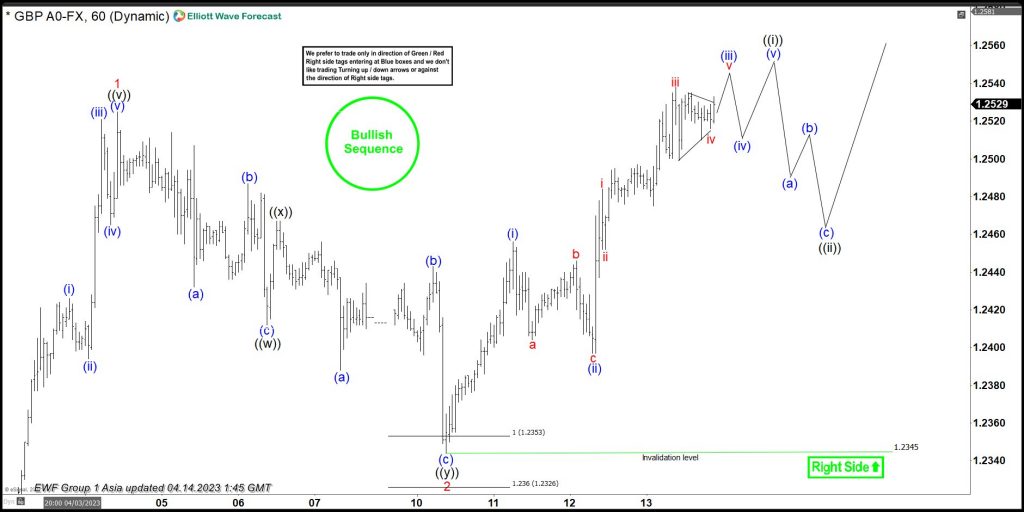

GBPUSD ended 5 wave impulse Elliott Wave sequence as wave 1 of (C) at 1.2525 high on 4/04/2023 started from 3/08/2023 low. It already confirmed higher high sequence against September-2022 low, calling for further upside to continue in wave (C). It placed ((i)) of 1 at 1.2204 high & ((ii)) at 1.2009 low. ((ii)) was 0.5 Fibonacci retracement of ((i)). It ended ((iii)) at 1.2423 high & ((iv)) at 1.2273 low. ((iv)) was typical 0.382 Fibonacci retracement of ((iii)). Finally, it ended ((v)) at 1.2525 high as wave 1. Below there, it ended wave 2 at 1.2345 low in 7 swings correction. Currently, it favors higher in 3 of (C).

Above wave 2 low, it placed (i) at 1.2456 high & (ii) at 1.2397 low as 0.5 Fibonacci retracement in 3 swing sequence. Currently, it favors higher in (iii) of ((i)) of 3. It placed i at 1.2484 high, ii at 1.2452 low, iii at 1.2538 high & iv as triangle at 1.2516 low. Above there, it favors higher in v of (iii) & expects small upside before starts correcting in (iv) in ((i)) soon. It expects short term upside in ((i)) of 3 before starts correcting in ((ii)) later in 3, 7 or 11 swings against 4/10/2023 low. The pair should remain supported in correction at extreme areas to resume higher in bullish sequence.