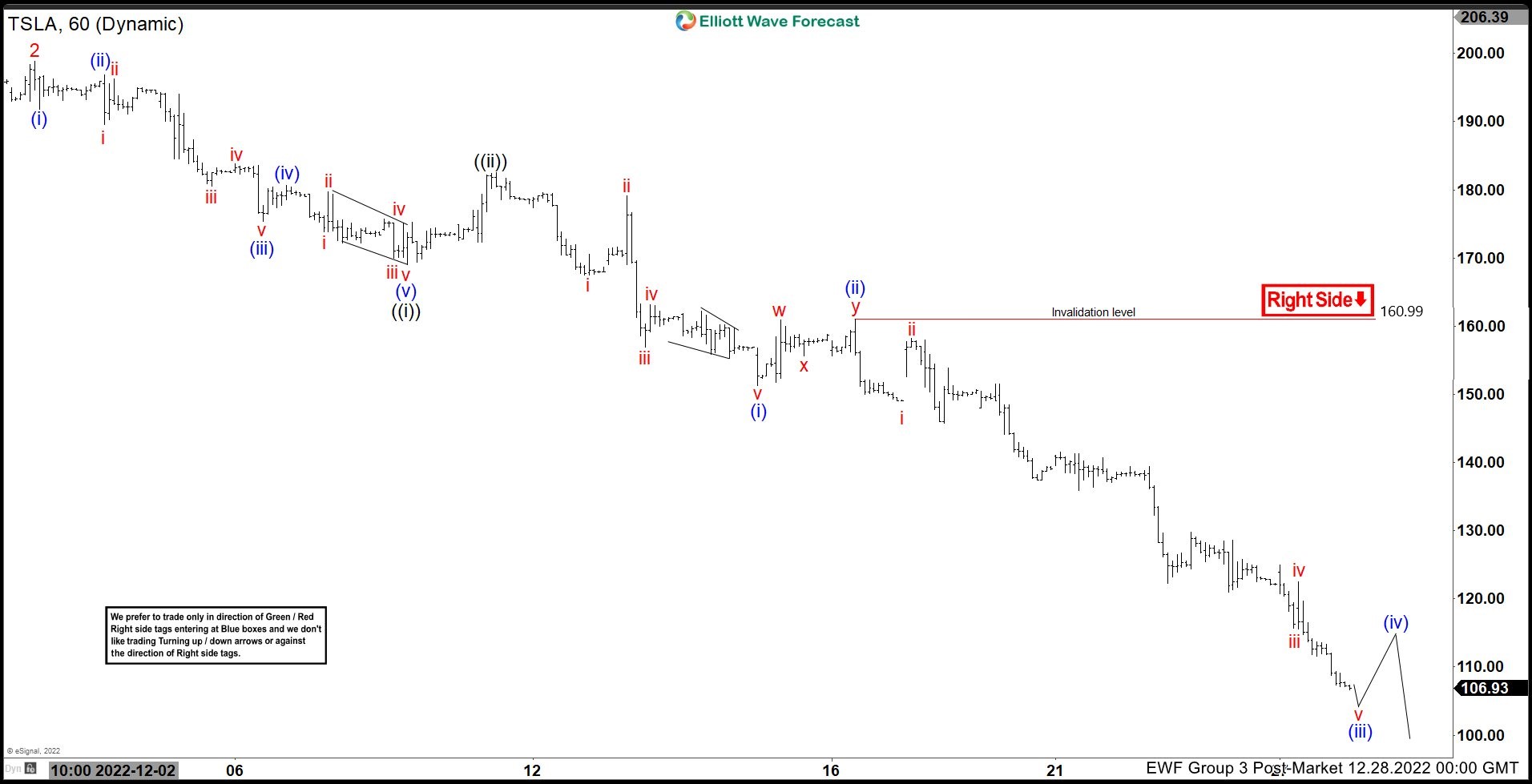

Short term, Elliott wave view in Tesla (TSLA) suggests that the decline from 11.01.2022 high is unfolding as a 5 waves impulse Elliott Wave structure. Down from 11.01.2022 high, wave ((i)) ended at 210.14 and rally in wave ((ii)) ended at 223.80. The stock extended lower in wave ((iii)) towards 172.01, and bounce in wave ((iv)) ended at 200.82. Final leg lower wave ((v)) ended at 165.38 which completed wave 1 in higher degree. Wave 2 corrective rally ended at 198.92 with internal subdivision as a zigzag structure. Up from wave 1, wave ((a)) ended at 188.5, pullback in wave ((b)) ended at 178, and wave ((c)) higher ended at 198.92.

The stock then extended lower in Wave 3. Down from wave 2, wave ((i)) ended at 169.06 and rally in wave ((ii)) ended at 182.50. Wave ((iii)) is currently in progress as an impulse in lesser degree. Down from wave ((ii)), wave (i) ended at 156.79 and rally in wave (ii) ended at 160.98. Expect wave (iii) to end soon, then it should bounce in wave (iv) before turning lower again. Near term, while below 12.16.2022 high at 160.98, expect rally to fail in 3, 7, 11 swing for further downside.