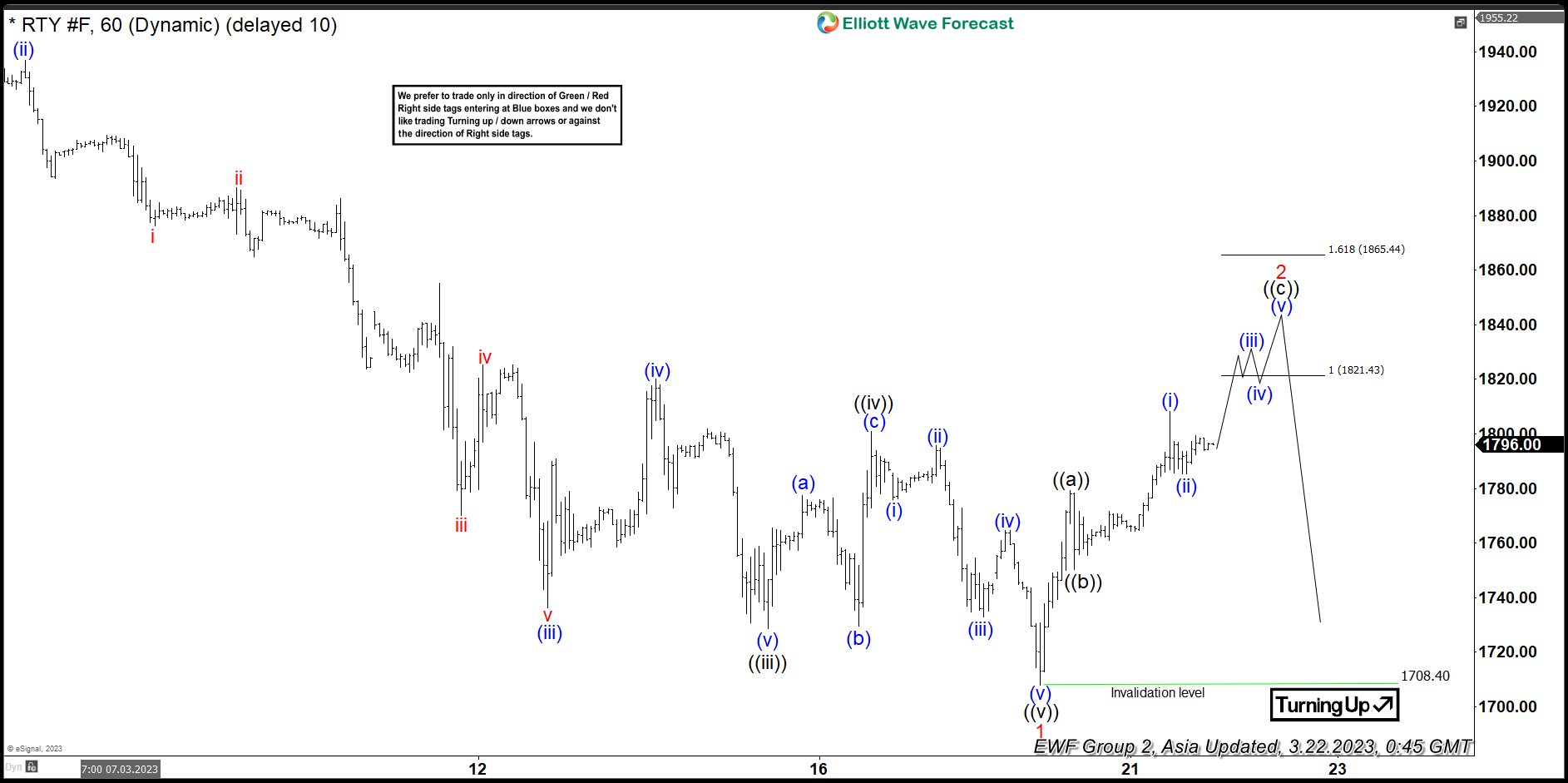

Russell 2000 (RTY) ended a 3 swing corrective rally from 10.13.2022 low at 2016.90 on 2.2.2023 high. From this level, the Index declines lower with internal subdivision as a 5 waves impulse Elliott Wave structure. Down from 2.2.2023 high, wave ((i)) ended at 1906.2 and rally in wave ((ii)) ended at 1970.10. The Index resumes lower in wave ((iii)) towards 1728.5 and wave ((iv)) rally ended at 1800.8. Final leg wave ((v)) ended at 1708 which completed wave 1 in higher degree. Rally in wave 2 is now in progress to correct cycle from 2.3.2023 high in 3, 7, or 11 swing before the decline resumes.

Internal subdivision of wave 2 is unfolding as a zigzag Elliott Wave structure. Up from wave 1, wave ((a)) ended at 1779.4 and pullback in wave ((b)) ended at 1750.40. Wave ((c)) higher is in progress as 5 waves. Up from wave ((b)), wave (i) ended at 1808.2 and wave (ii) pullback ended at 1785.30. Expect the Index to extend higher before it completes wave ((c)) of 2. Potential target higher is 100% – 161.8% fibonacci extension of wave ((a)). This area comes at 1821.4 – 1865.4 where the rally in Russell may fail and the Index starts to resume lower. As far as pivot at 2.2.2023 high at 2016.9 stays intact, expect rally to fail in 3, 7, or 11 swing for more downside.