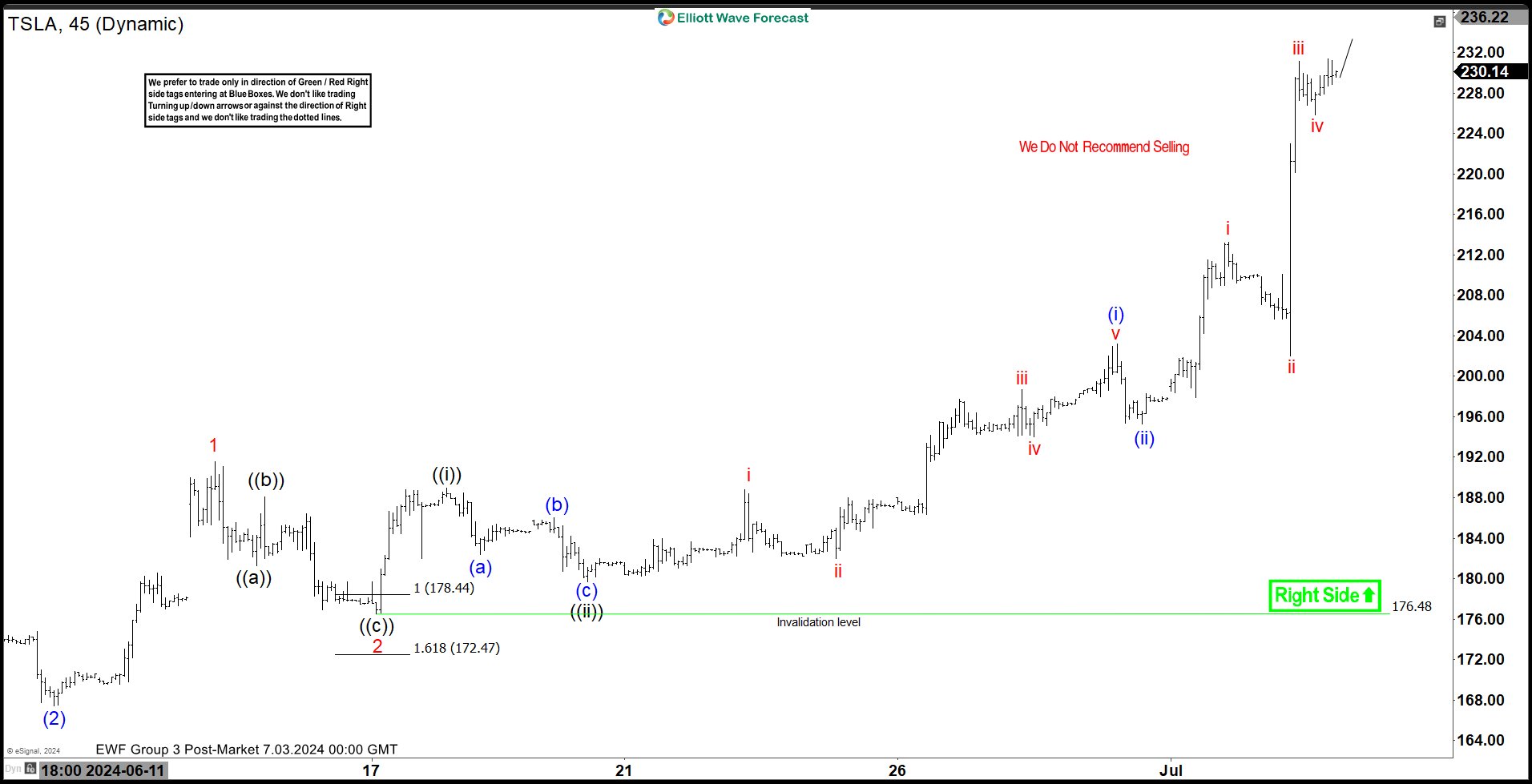

Short Term Elliott Wave in Tesla (TSLA) shows an impulsive rally from 4.22.2024 low. Up from 4.22.2024 low, wave (1) ended at 198.87 and pullback in wave (2) ended at 167.41. The stock then nested higher in wave (3). Up from wave (2), wave 1 ended at 191.08 and dips in wave 2 ended at 176.92. The stock then rallies higher in wave 3. Internal subdivision of wave 3 unfolded as another impulse in lesser degree. Up from wave 2, wave ((i)) ended at 188.95 and pullback in wave ((ii)) ended at 179.66.

From wave ((ii)) low, the stock nested higher again within wave ((iii)). Up from wave ((ii)), wave i ended at 188.8 and wave ii pullback ended at 182.01. Wave iii rally ended at 198.72 and pullback in wave iv ended at 194.05. Final leg wave v ended at 203.2 which completed wave (i). Pullback in wave (ii) ended at 195.26. Up from there, wave i of (iii) ended at 213.19 and wave ii of (iii) ended at 202. Wave iii higher ended at 231.15 and dips in wave iv ended at 225.87. Near term, as far as pivot at 176.48 low stays intact, expect pullback to find buyers in 3, 7, or 11 swing for further upside.