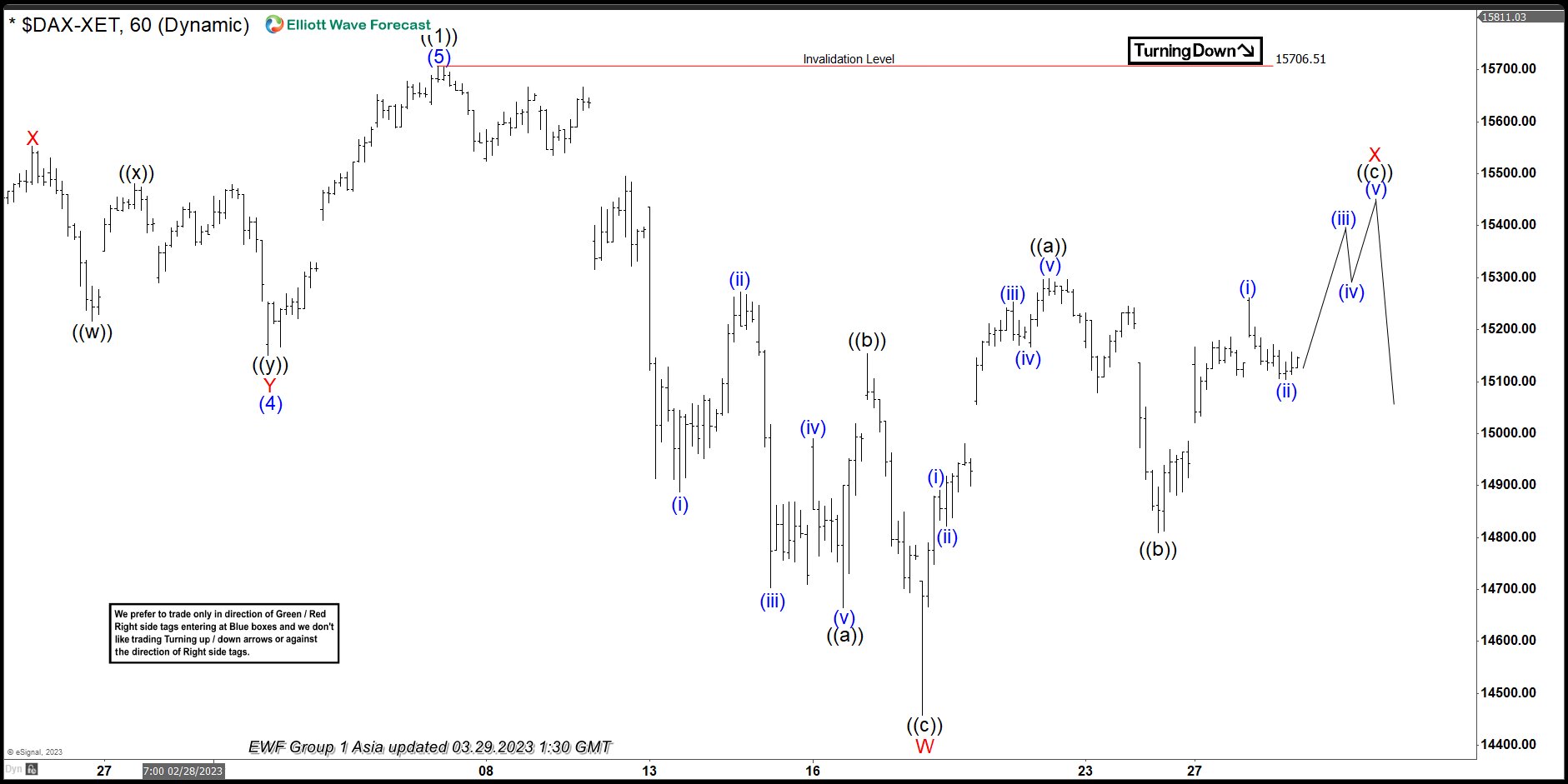

Cycle from 9.28.2022 low has ended as a 5 waves impulse at 15706.51. We labelled this rally as wave ((1)) as the 1 hour chart below shows. Wave ((2)) pullback is currently in progress to correct cycle from 9.28.2022 low. The decline from wave ((1)) peak on March 7, 2023 is unfolding as a double three Elliott Wave structure. Down from March 7, 2023 high, wave ((a)) ended at 14664.17 and rally in wave ((b)) ended at 15153.11. Final leg wave ((c)) lower ended at 14458.39 which completed wave W in higher degree. Wave X rally is now in progress to correct cycle from 3.7.2023 high with internal subdivision as a zigzag structure.

Up from wave W, wave ((a)) ended at 15298.49 and pullback in wave ((b)) ended at 14809.82. Wave ((c)) higher is in progress to retest wave ((1)) high at 15706.51 before the Index turns lower. A 100% Fibonacci extension of wave ((a)) comes at 15644.18 which is a possible target for wave ((c)) of X. Near term, as far as pivot at 15706.51 high stays intact, expect the rally to fail and the Index to resume lower again.