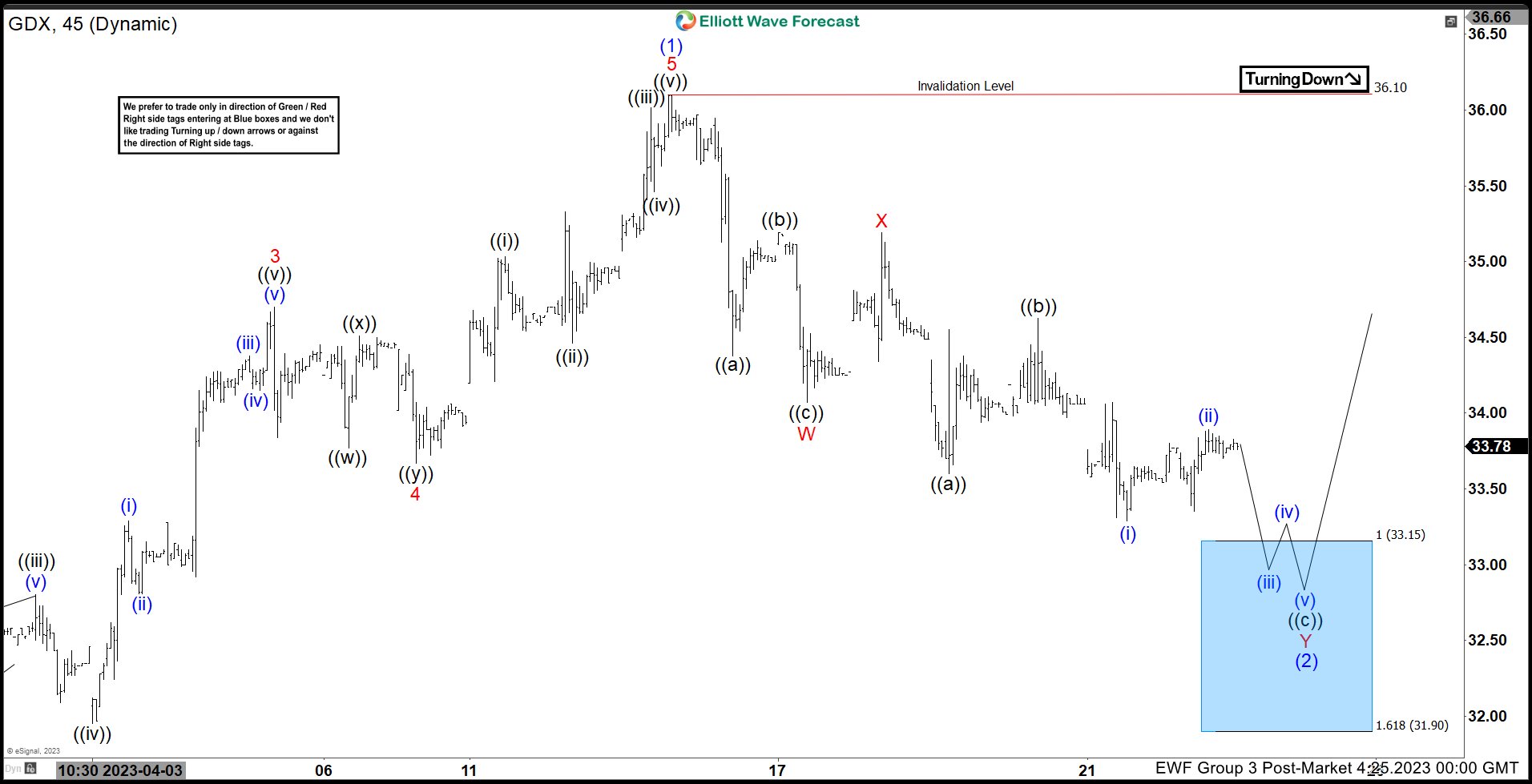

Gold Miners ETF (GDX) shows a bullish sequence from 9.26.2022 low favoring further upside. The 100% – 161.8% Fibonacci extension target from 9.26.2022 low comes at 38.3 – 45.7 area. Rally from there is unfolding as a nest where wave ((1)) ended at 33.34 and wave ((2)) pullback ended at 26.64. Wave ((3)) is in progress as another 5 waves in lesser degree. Up from wave ((2)), wave (1) ended at 36.10. Pullback in wave (2) is in progress to correct cycle from 2.24.2023 low in 3, 7, or 11 swing before the rally resumes.

Internal of wave (2) is in progress as a double three Elliott Wave structure. Down from wave (1), wave ((a)) ended at 34.38, wave ((b)) ended at 35.19, and wave ((c)) ended at 34.07. This completed wave W in higher degree. Corrective rally in wave X ended at 35.19. Wave Y lower is in progress as a zigzag structure. Down from wave X, wave ((a)) ended at 33.60, wave ((b)) ended at 34.63, and wave ((c)) of Y should reach the extreme area at 31.9 – 33.15 blue box area. From this area, the ETF can extend higher in wave (3) or rally in 3 waves at least.