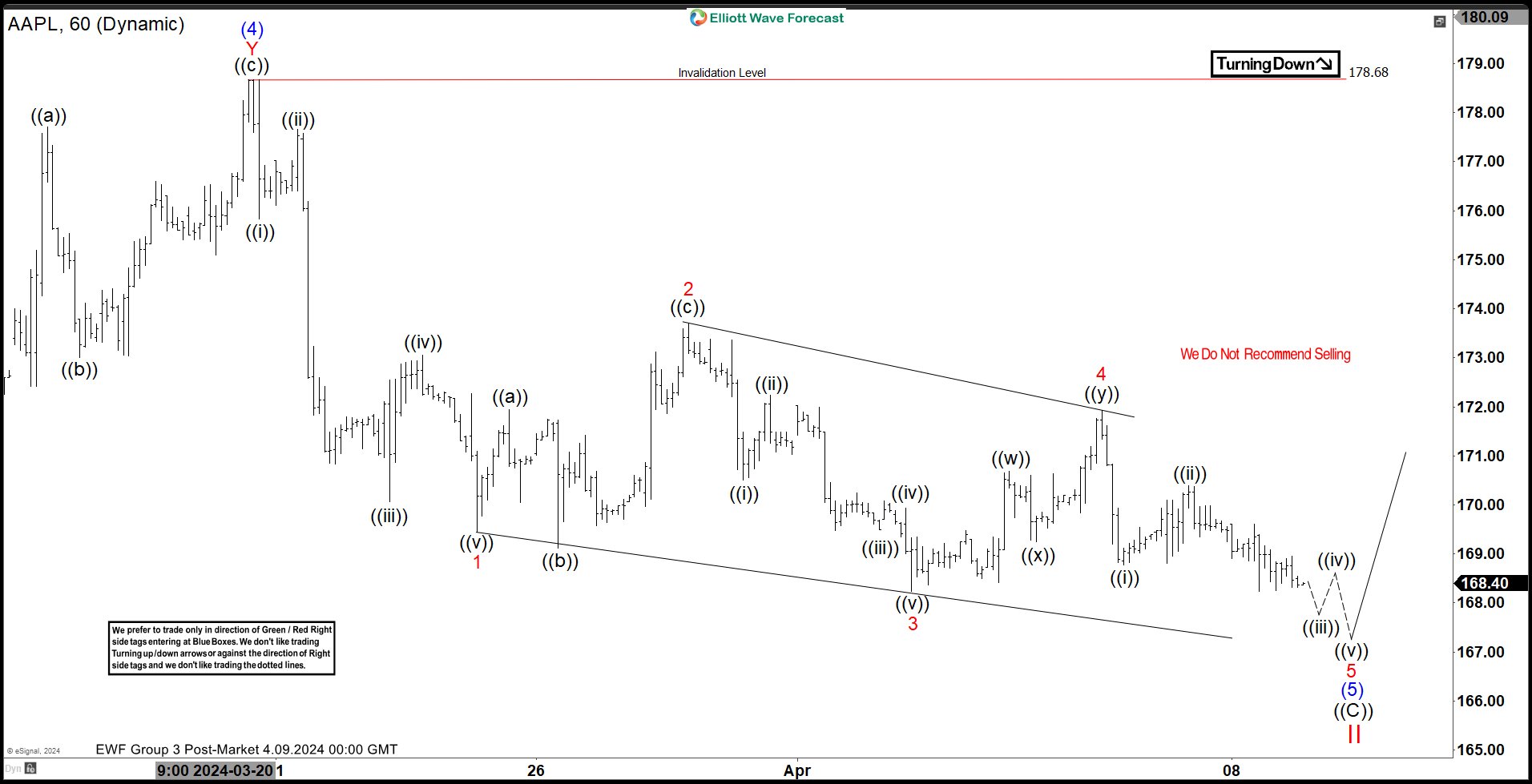

Short Term Elliott Wave structure in Apple ($AAPL) suggests that the stock is correcting cycle from 1.3.2023 low in wave II. The rally to 199.62 on December 14, 2023 high ended wave I. Pullback in wave II is in progress as a zigzag structure. Down from December 14, wave ((A)) ended at 180.17 and rally in wave ((B)) ended at 196.38. Down from wave ((B)), wave (1) ended at 180.17 and wave (2) ended at 196.38. Wave (3) lower ended at 167.35 and wave (4) rally ended at 178.68 as the 1 hour chart below shows.

The stock extended lower in wave (4) with internal subdivision as a 5 waves diagonal. Down from wave (4), wave 1 ended at 169.45 and wave 2 ended at 173.69. The stock then extended lower in wave 3 towards 168.23. Rally in wave 4 ended at 171.92. Expect the stock to extend a few more lows to complete wave 5 of (5). This should also end wave ((C)) of II in higher degree. Afterwards, the stock can then turn higher. Near term, as far as pivot at 178.68 high stays intact, expect the stock to continue lower to resume the correction within wave II.