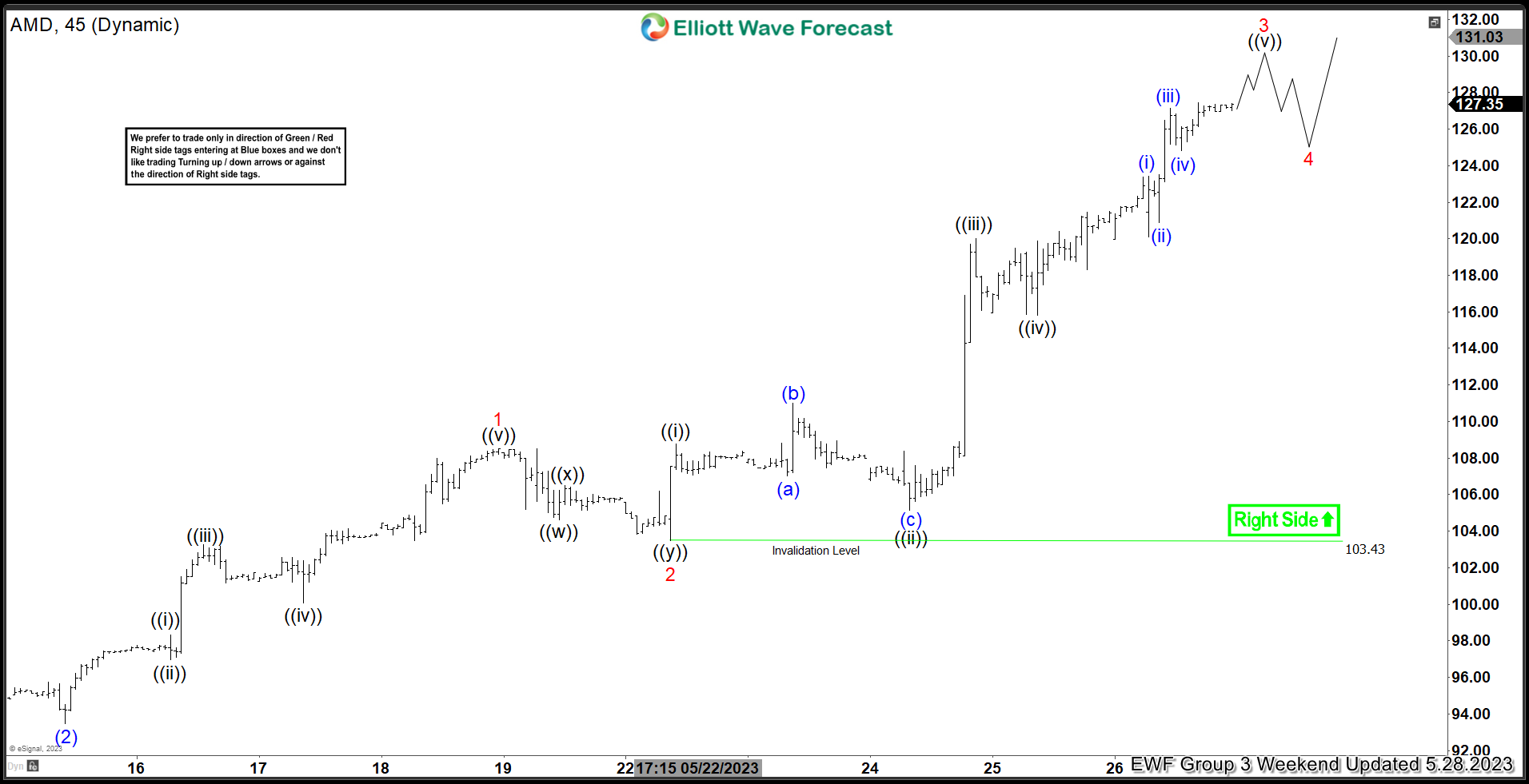

Short term Elliott Wave View in Advanced Micro Device (ticker: $AMD) suggests the rally from 5.4.2023 low is in progress as a 5 waves impulse Elliott Wave structure. Up from 5.4.2023 low, wave (1) ended at 99.94 and pullback in wave (2) ended at 93.45. The stock resumes higher in wave (3) with subdivision as another 5 waves in lesser degree. Up from wave (2), wave ((i)) ended at 97.73 and dips in wave ((ii)) ended at 96.97. The stock resumes higher in wave ((iii)) towards 103.28 and dips in wave ((iv)) ended at 100.05. Final leg higher wave ((v)) ended at 108.50 which completed wave 1.

Pullback in wave 2 ended at 103.43 with internal subdivision as a double three Elliott Wave structure. Down from wave 1, wave ((w)) ended at 104.62, wave ((x)) ended at 106.49, and wave ((y)) lower ended at 103.49. This completed wave 2. The stock has resumed higher in wave 3. Up from wave 2, wave ((i)) ended at 108.79 and pullback in wave ((ii)) ended at 105.15. Stock resumes higher in wave ((iii)) towards 120 and dips in wave ((iv)) ended at 115.80. Final leg higher wave ((v)) is expected to complete soon which should end wave 3. Afterwards, the stock should pullback in wave 4 to correct cycle from 5.22.2023 low before the stock resumes higher again. Near term, as far as pivot at 103.43 low stays intact, expect pullback to find support in 3, 7, 11 swing for further upside.