Last week’s tweet by president Trump to slap a new round of tariffs to Chinese goods has sparked risk aversion in the market. Trump announced that he is imposing an additional 10% tariff on $300 billion of Chinese imports beginning on September 1. Trump said the additional tariff is due to China being slow to offer concession and fail to buy U.S. agricultural goods. The move came one day after Washington and Beijing concluded the latest round of trade talks.

This week, China responded by allowing the Yuan to weaken beyond 7 per dollar. The move stokes fear that the trade war has transitioned into currency war. The Chinese authorities have tried to keep the exchange rate below 7 per dollar in recent years. In the last few months, this became an important sign of good will in the trade dispute. The latest move to allow the rate to move beyond 7 therefore is a sign that China no longer offers any goodwill.

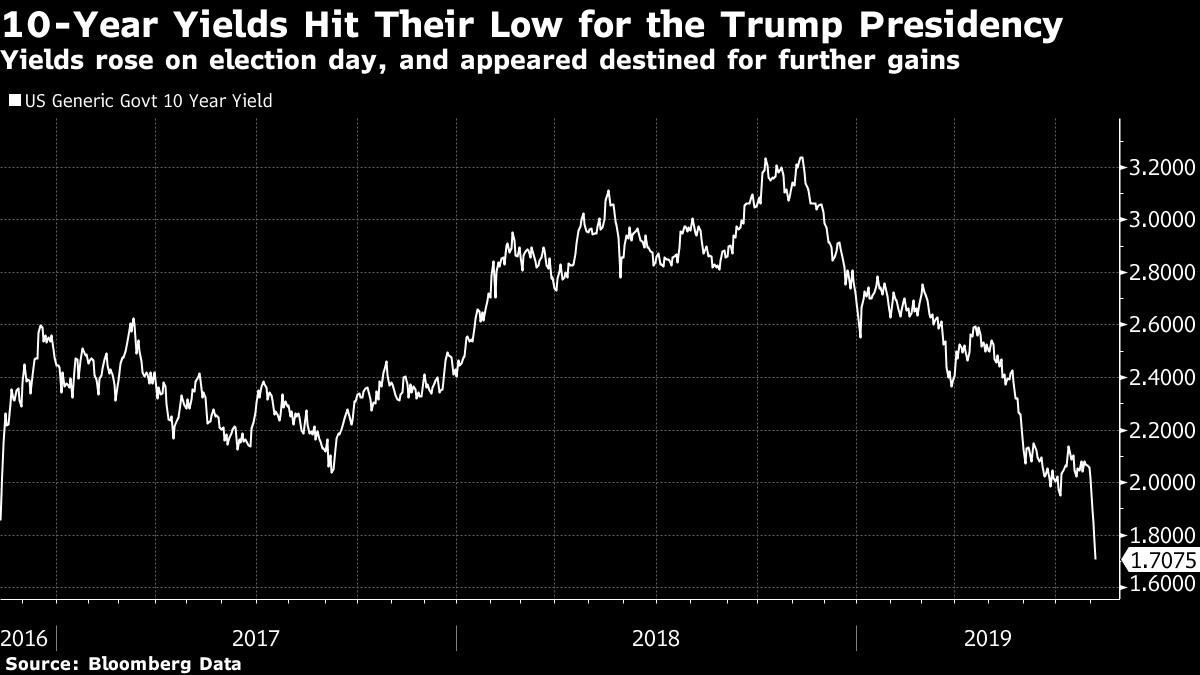

The S&P 500 plunged 3% on Monday after China let the Yuan to weaken. U.S. Treasury, Gold, and Yen surged which is an indication of safe haven demand. In fact, benchmark 10 year US Treasury yield is now lower than it was on Trump’s election day for the first time.

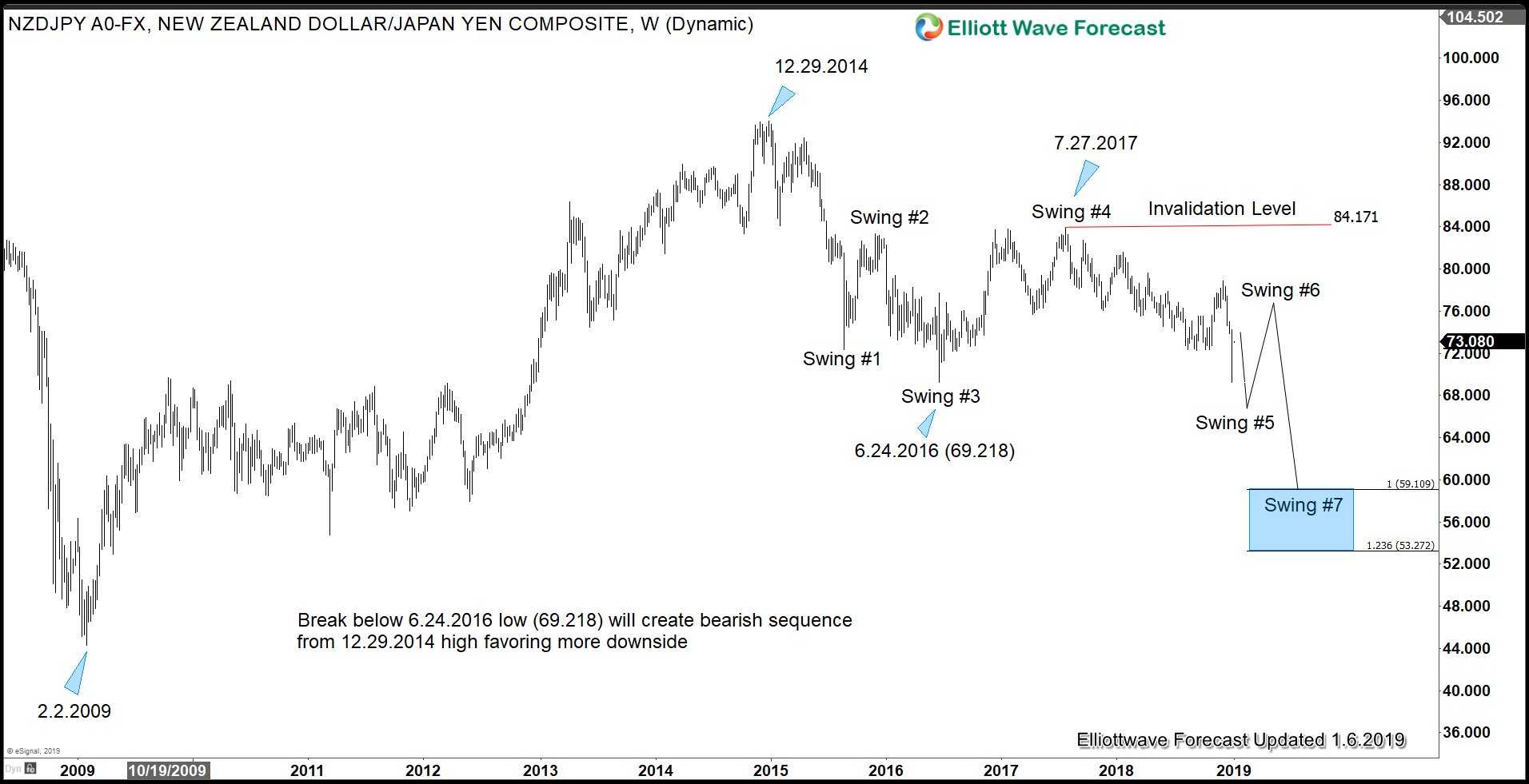

Yen strengthens due to safe haven demand. Many Yen pairs extend lower and continue the bearish trend that as we forecast since the beginning of the year. Here’s our article from earlier this year on the Yen pairs outlook in 2019. One Yen cross that we highlighted in that article is the NZDJPY which we said has potential to extend lower to reach 100% target towards 53.2 – 59.1 if the pair can break below June 24, 2016 low (69.21). Here’s the chart we presented in January 6, 2019 this year.

NZDJPY Elliott Wave View Confirms the Bearish Sequence from December 2014 High

The combination of safe haven demand for Yen as well as weak commodity pairs and RBNZ cutting rate by 50 basis point causes the pair to finally break below 69.2. Thus the pair has confirmed the bearish sequence from December 2014 and should continue to see further downside.

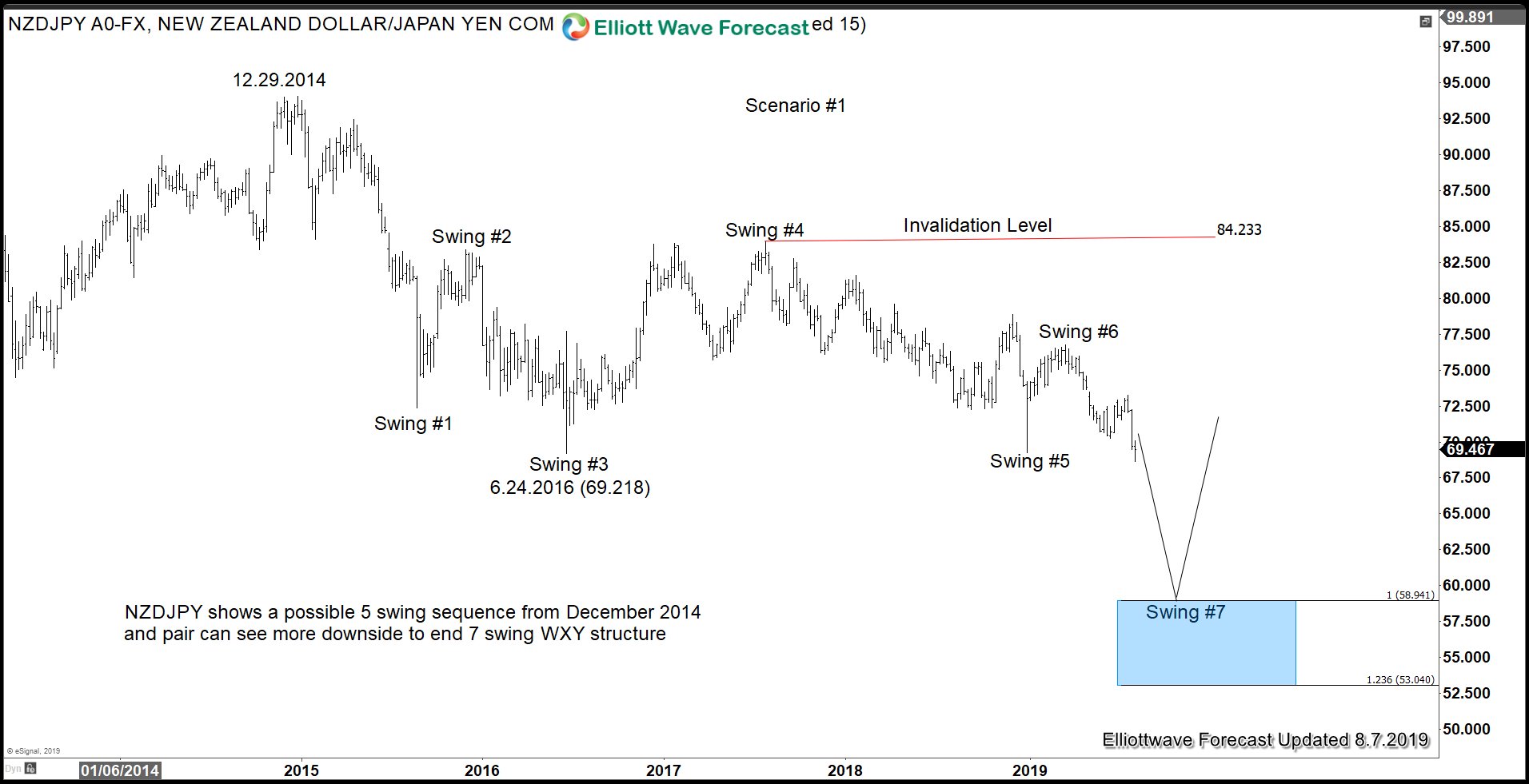

We have two possibilities for the move to the 59.1 target. Below is the first possibility in which the fifth swing and sixth swing have ended and we will continue to drop to the target in the next few months.

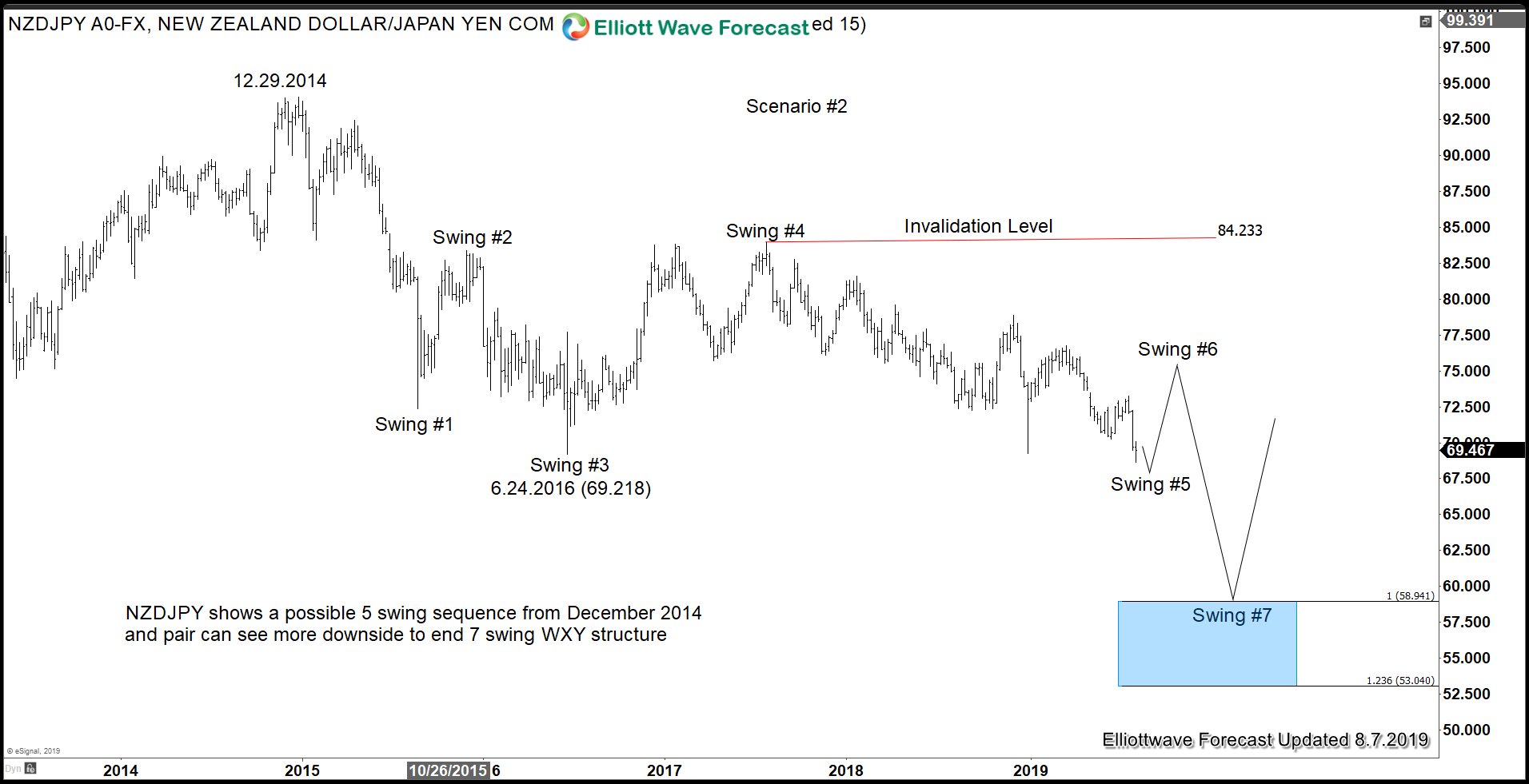

The second scenario below suggests that pair is still in the process of ending the fifth swing. Pair should then bounce again in the sixth swing to correct the decline from 84.23 before the next leg lower.

In either case, the next few months should see NZDJPY and other Yen pairs to continue lower. The right side therefore continues to be lower and rally should continue to fail in 3, 7, or 11 swing for more downside. Yen can continue to benefit for the market uncertainty due to trade war and geopolitical tensions.

For more analysis and Elliott Wave charts for 78 instrument, new members can try our service 14 days FREE here –> 14 days FREE Trial.

Back