In this blog, we are going to take a look at 7 swing structure, equal leg, and market correlation between AUD/CHF and EUR/AUD.

Some of our members would like to know when EUR/AUD would find a medium term low. To find out a possible inflection zone for EUR/AUD, we will take a look at AUD/CHF, which is the inverse of EUR/AUD. The reason we want to look at AUD/CHF is because it has a more clearly defined structure than EUR/AUD. AUD/CHF shows a 7 swing structure and it still has a scope higher to the equal leg.

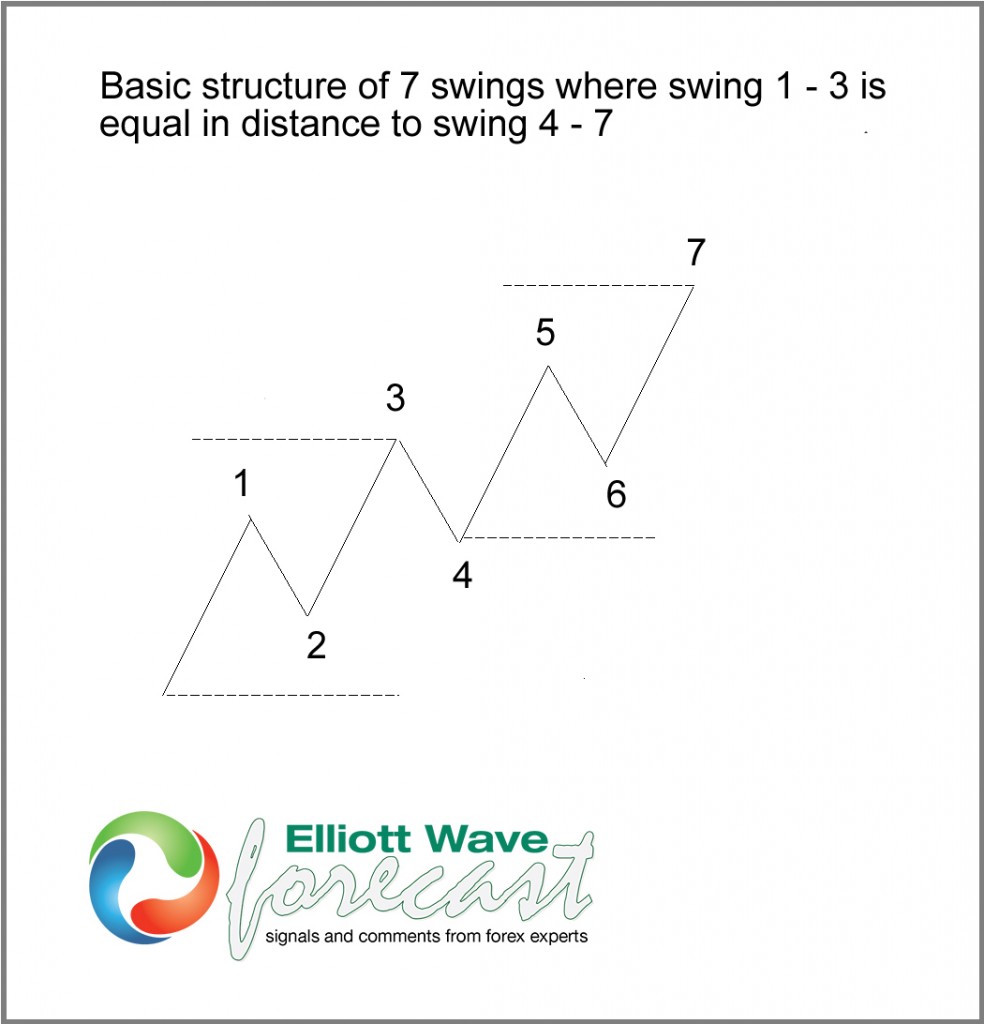

First, let’s take a look at the basic structure of 7 swing and equal leg below:

Next, let’s take a look at AUD/CHF chart, overlaid with EUR/AUD, for market correlation analysis below

From the chart above, blue line is EUR/AUD whereas the regular candle chart is the AUD/CHF. We can see how AUD/CHF is inversely correlated with EUR/AUD. The peak in EUR/AUD equals to the low in AUD/CHF, and vice versa.

As we start counting the swing in AUD/CHF, we can see that the structure needs one more high in swing 7. If we measure the distance between swing 1 to swing 3, and swing 4 to swing 7, and we get equal leg of the 7th swing at 0.8717.

From this analysis, we can conclude that AUD/CHF’s rally, and therefore EUR/AUD’s decline (since they are inversely correlated), is not yet done. And we can use AUD/CHF 0.87 as a timing tool for a medium term low in EUR/AUD.

I hope that you find the information in this blog helpful. Thank you for reading and if you would like to know more about us and how we can help you, I invite you to join us with our 14 day Trial. We have 24 hour coverage of 26 instruments from Monday – Friday. We provide Elliott Wave chart in 4 different time frames, four times update of 1 hour chart throughout the day, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! With our expert team at your side to provide you with all the timely and accurate analysis, you will never be left in the dark and you can concentrate more on the actual trading and making profits.

Kind regards,

Hendra Lau – Technical Analyst at Elliott Wave Forecast