In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

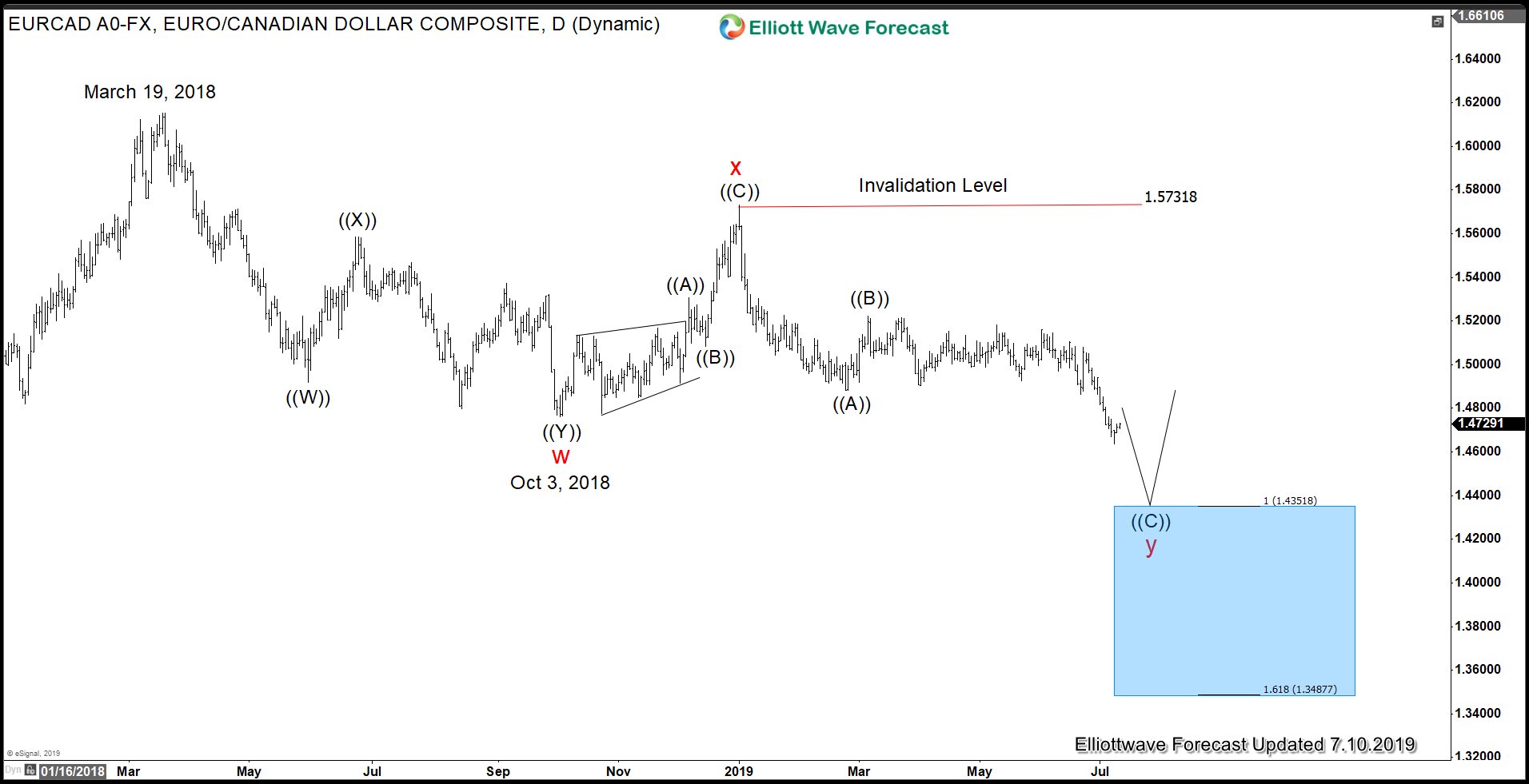

EURCAD Elliott Wave View: Forecasting The Rally Higher

Read MoreIn this blog, we take a look at the past Elliott Wave charts of EURCAD, In which our members took advantage of the blue box areas.

-

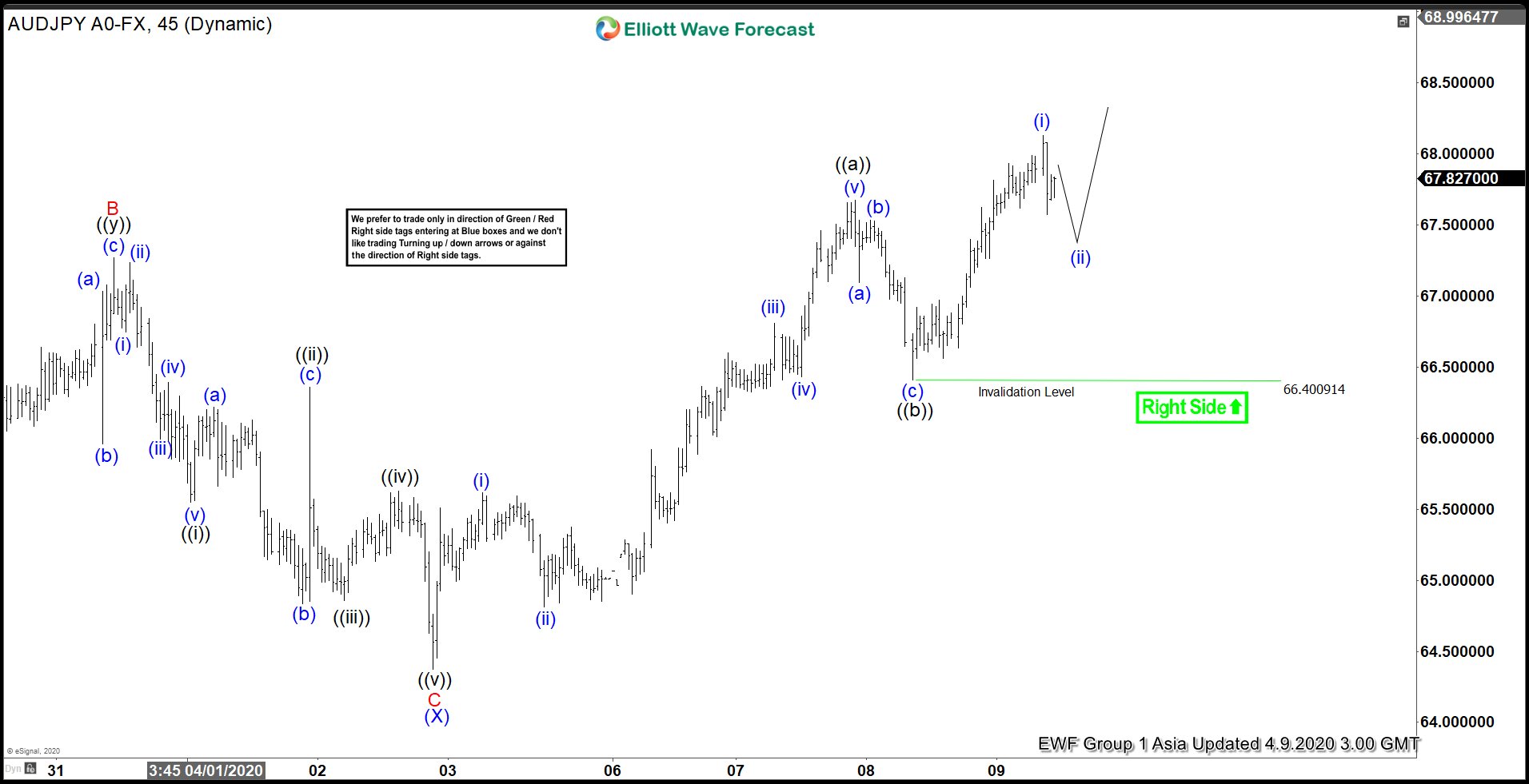

Elliott Wave View: Further Upside in AUDJPY

Read MoreAUDJPY shows incomplete sequence from April 2 low, favoring more upside. This article and video looks at the Elliott Wave path.

-

Elliott Wave Forecast: USDCHF Dips Can See Support

Read MoreUSDCHF rally from March 28 low is impulsive and while dips stay above there, pair can see further upside.This article & video look at the Elliott Wave path.

-

Elliott Wave View: EURJPY Has Resumed Lower

Read MoreEURJPY has completed correction and resumed lower in an impulsive structure. This article and video looks at the Elliott Wave path.

-

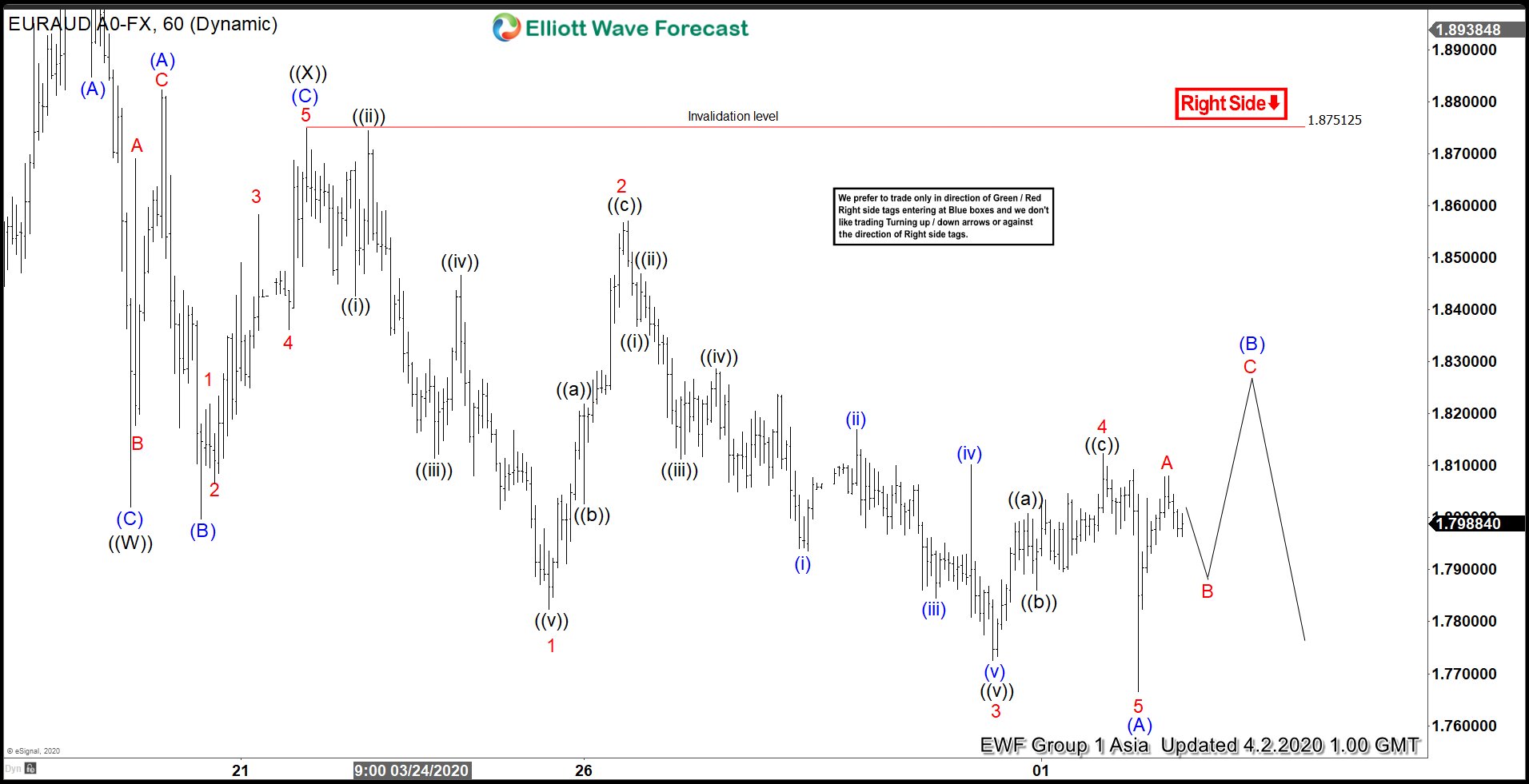

Elliott Wave View: EURAUD Can See More Downside

Read MoreEURAUD has incomplete sequence from March 19 high and can see further downside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: EURUSD Bounce May Extend

Read MoreEURUSD shows an incomplete sequence from Feb 16, 2018 high favoring further downside while below March 9 high (1.1496). Near term, the decline from March 9, 2020 high (1.1496) ended wave ((1)). Bounce in wave ((2)) is unfolding as a zigzag Elliott Wave structure where wave (A) ended at 1.1147. Internal of wave (A) unfolded […]