In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

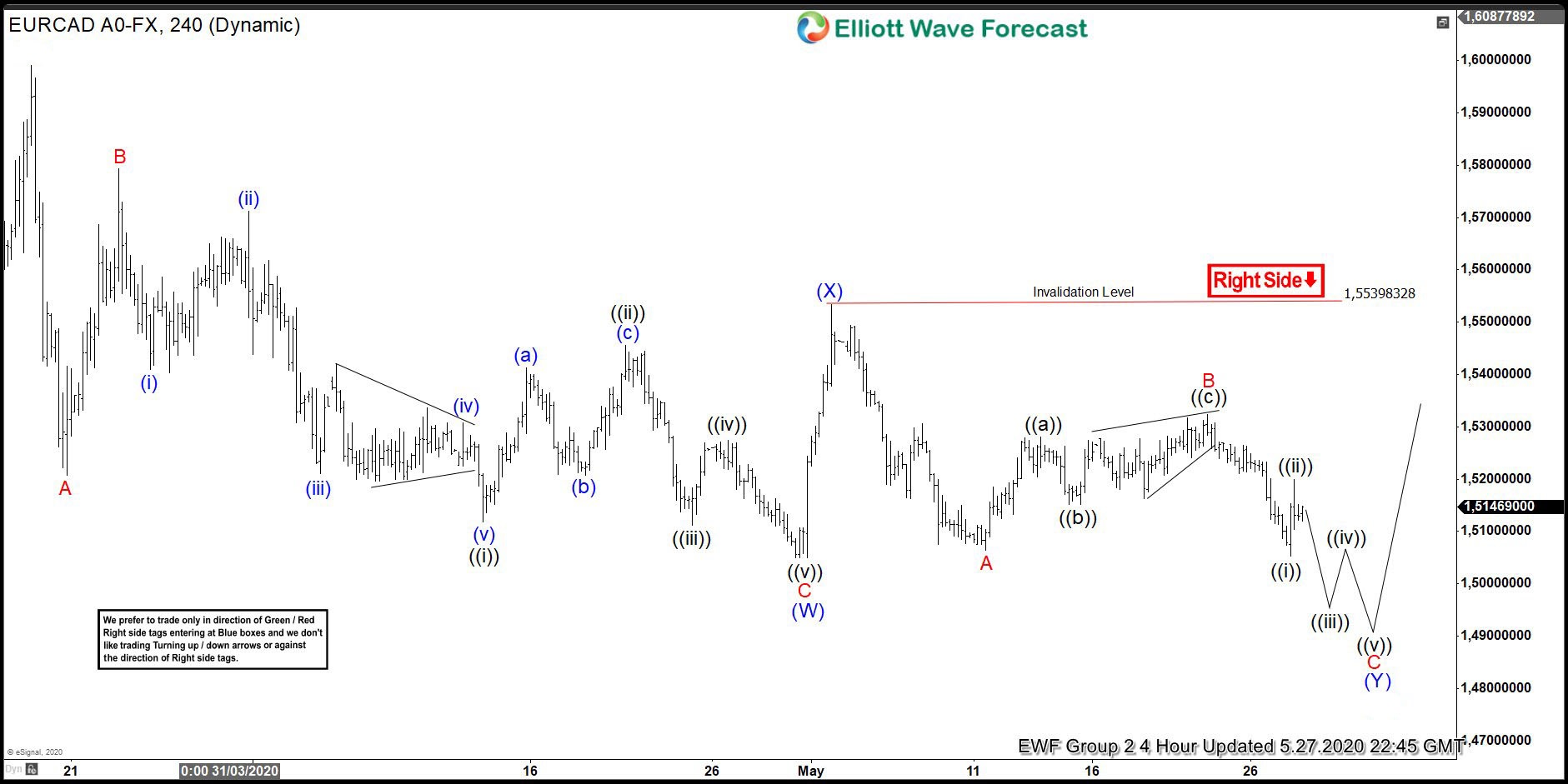

EURCAD Incomplete Bearish Sequence Pointing Lower

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of EURCAD. The 4 hour chart update from May 29 shows that the pair has continued to extend lower from March 19 peak. From March 19 peak, the pair extended lower in wave (W) as a zig-zag. Wave A ended […]

-

Elliott Wave View: Further Downside in GBPNZD

Read MoreGBPNZD broke below 3.19.2020 low creating bearish sequence from 3.9.2020 high. This article & video look at the Elliott Wave path.

-

$EURGBP FX Pair Elliott Wave and Longer Term Cycles

Read More$EURGBP FX Pair Elliott Wave and Longer Term Cycles Firstly as seen on the monthly chart below there is data back to January 1975 in the pair. The EUR part being derived from the German Deutsche Mark up until the point EURUSD currency existed. Secondly as seen on the monthly chart below I will describe how I think […]

-

Elliott Wave View: Pound Sterling in a New Impulsive Lower

Read MoreDecline in Pound Sterling from April 15 high is proposed to be in impulsive structure favoring further downside.This article looks at the Elliott Wave path.

-

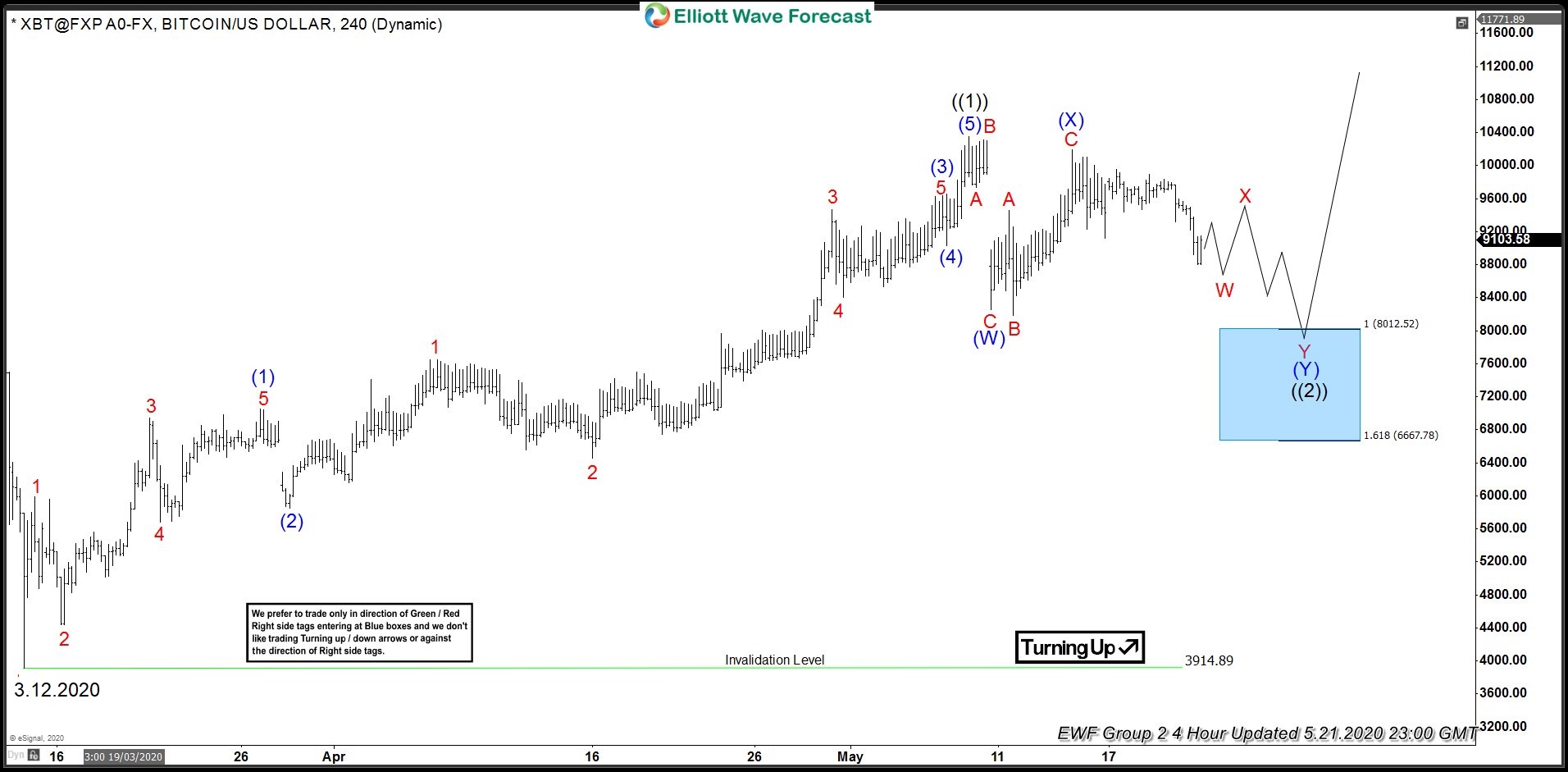

Outlook in Bitcoin after Halving

Read MoreRetail investors may return to Bitcoin again after the digital currency completed the one-in-four year adjustment called halving. Halving provides less rewards to miners who run high-powered computers to solve complex mathematical puzzles in order to generate new bitcoins. After this Monday, the current reward for unlocking a “block” has halved from 12.5 new coins […]

-

Elliott Wave View: USDJPY Has Scope for Further Downside

Read MoreUSDJPY has incomplete sequence from 3.26.2020 high and has scope for further downside. This article and video looks at the Elliott Wave path.