In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

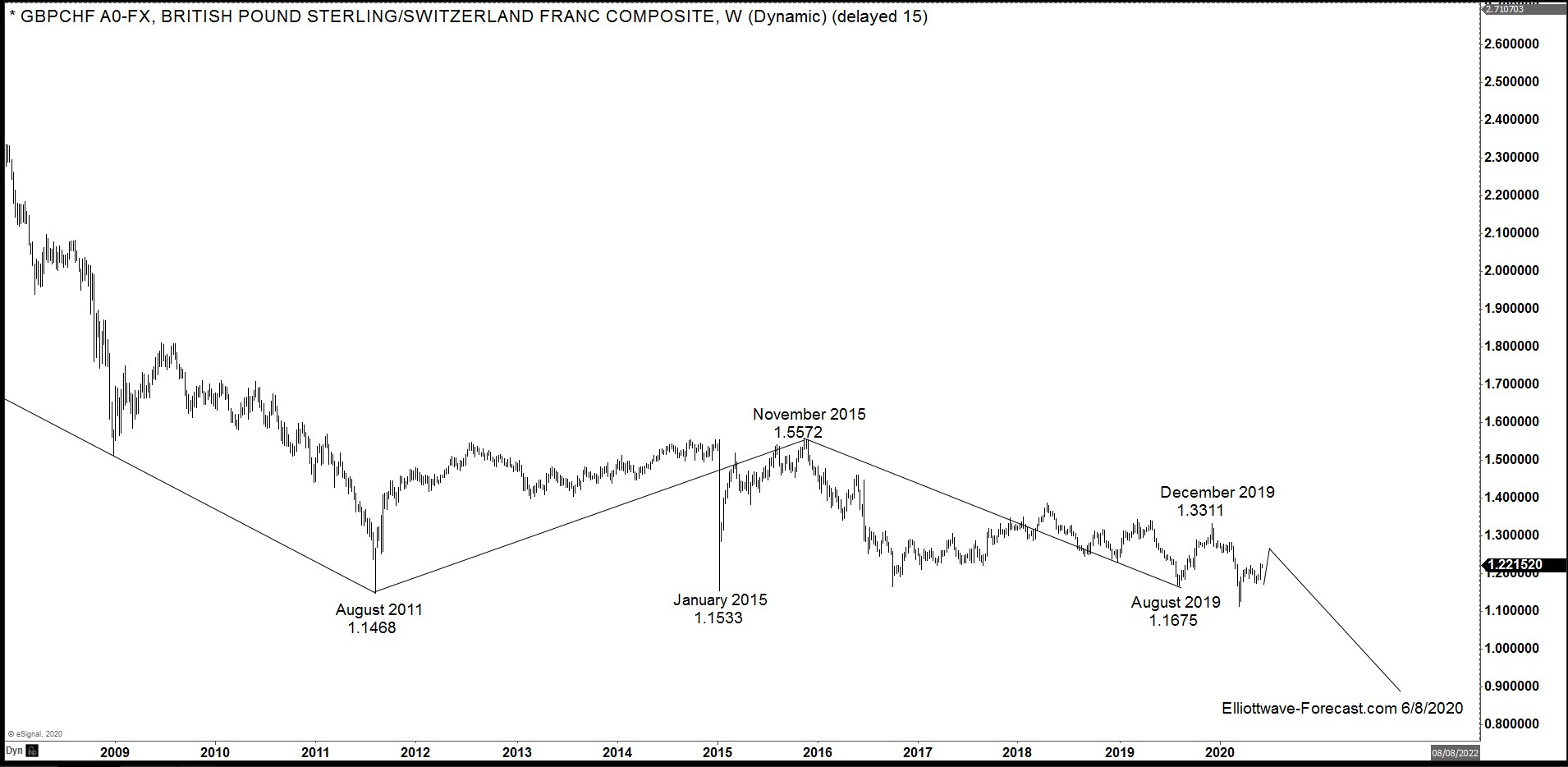

$GBPCHF FX Pair Swings & Long Term Cycles

Read More$GBPCHF FX Pair Swings & Long Term Cycles Firstly as seen on the monthly chart below there is data back to the early 1970’s readily available in the pair. It obviously had a central bank intervention during the month of October 1974 where price topped out at 6.3387. Most all Elliott Wave practitioners are geared […]

-

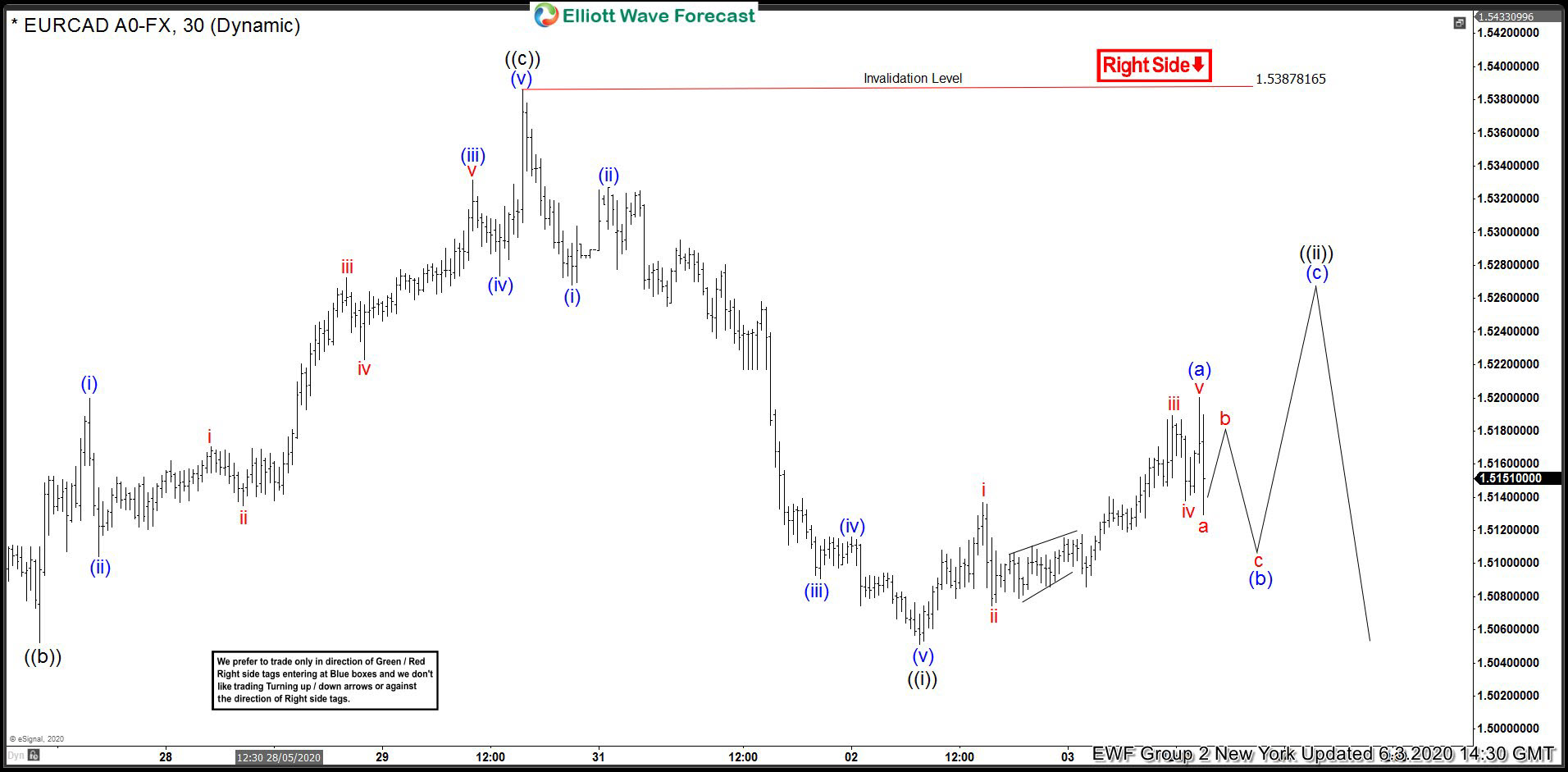

EURCAD Forecasting The Decline After Elliott Wave Zig Zag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURCAD. As our members know, recently the pair gave us 3 waves bounce against the 1.53878 peak. Recovery unfolded as Elliott Wave Zig Zag pattern (a)(b)(c). Once the price reached equal legs (a)-(b) we knew […]

-

Elliott Wave View: EURUSD in Impulsive Rally

Read MoreEURUSD shows an impulsive rally from 5.14.2020 low and dips should be supported. This article and video look at the Elliott Wave path.

-

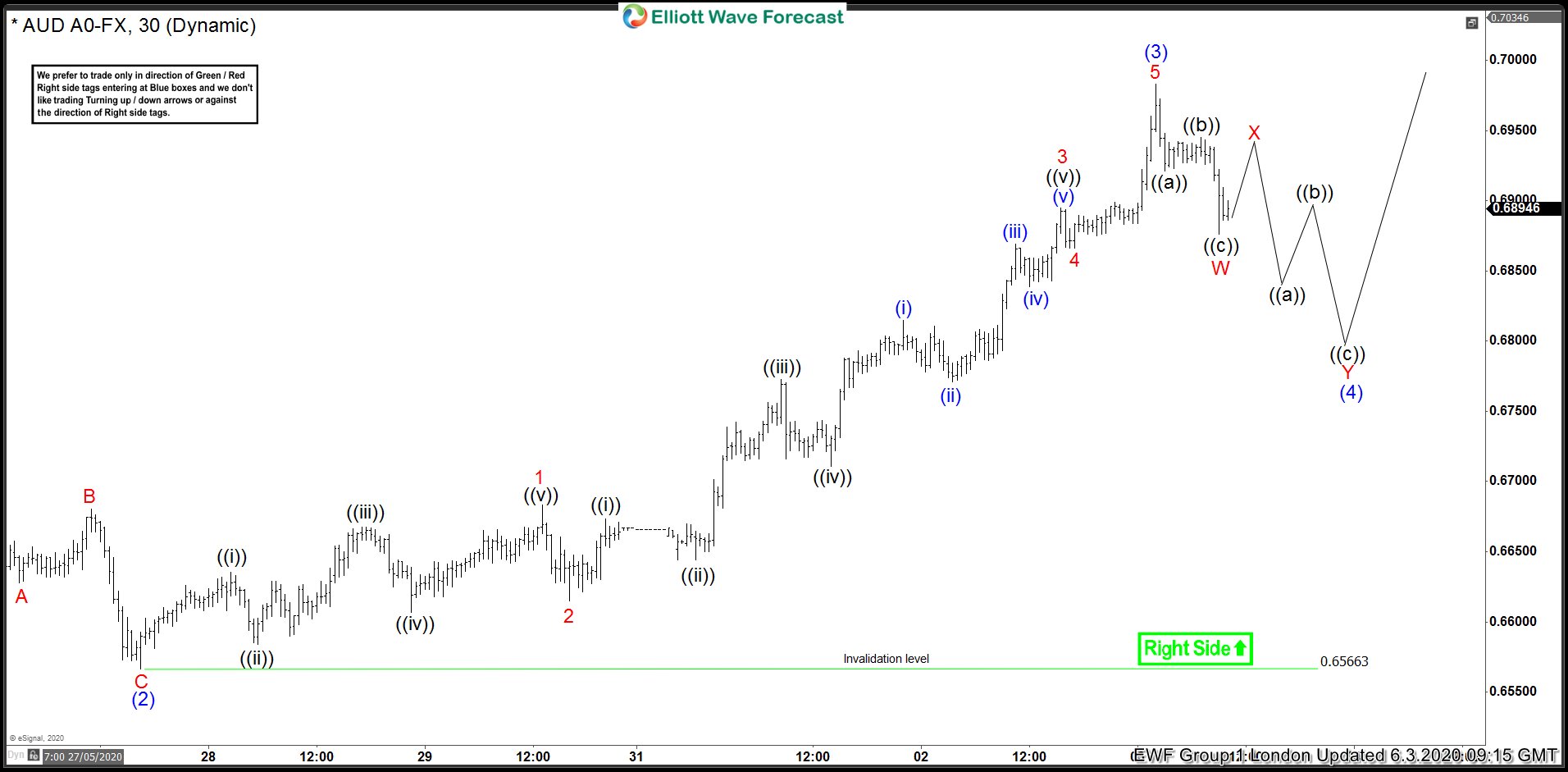

Elliottwave View: Incomplete Bullish Sequence in AUDUSD

Read MoreAUDUSD shows an impulsive rally from 5.22.2020 low and dips should continue to find support. This article & video look at the Elliott Wave path.

-

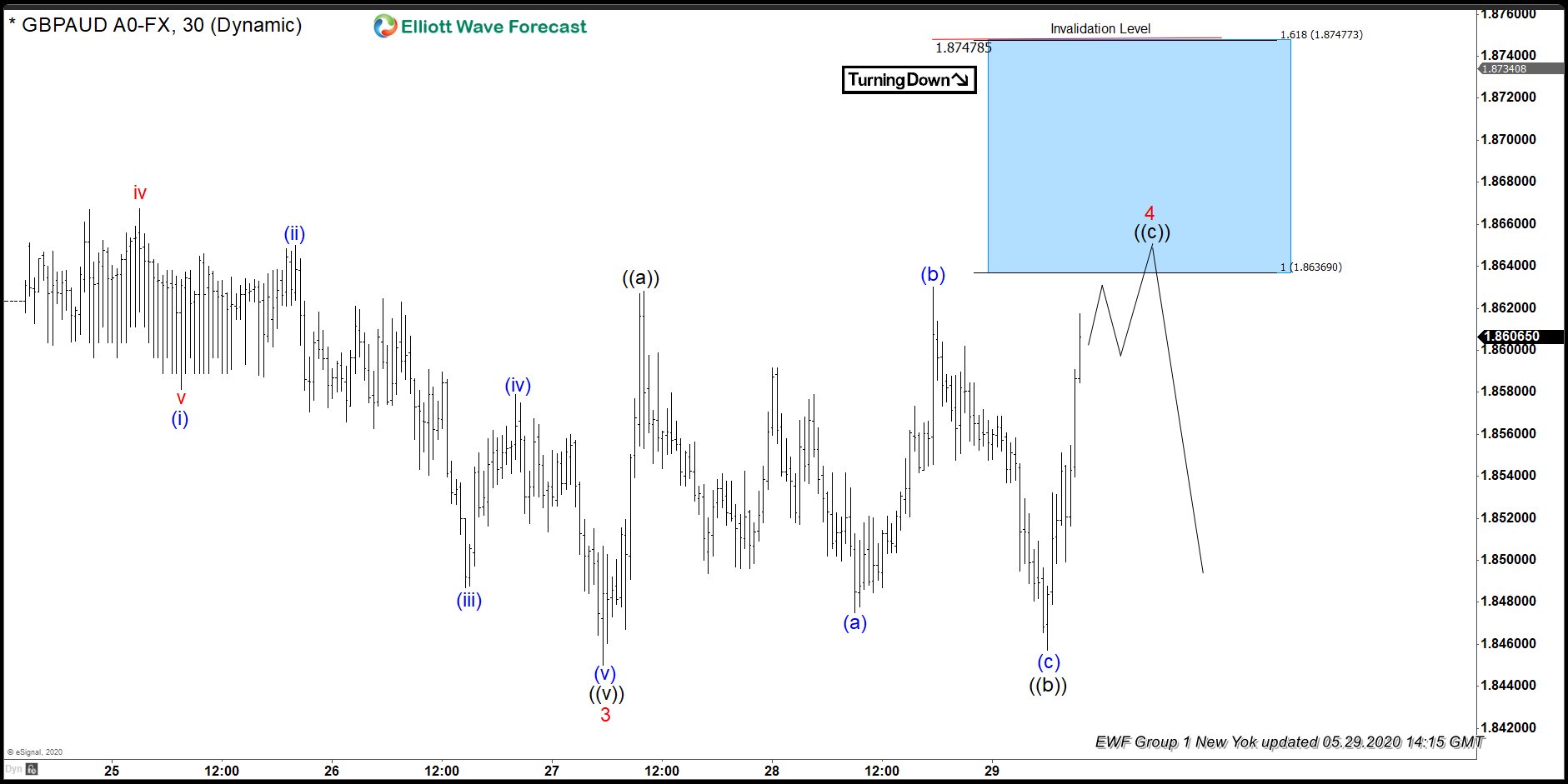

GBPAUD: Saw Sellers At The Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of GBPAUD, In which our members took advantage of the blue box areas.

-

Elliott Wave View: Further Downside in GBPAUD

Read MoreGBPAUD shows an impulsive Elliott Wave structure from 5.4.2020 high and has scope to see more downside. This article & video look at the Elliott Wave path.