In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Bitcoin rallies 34% since September. Will the Rally Continue or Fail?

Read MoreBitcoin has been rallying for the last few weeks and this week it managed to make a new high above August 17, 2020 peak. The low seen on 8th September 2020 was 9825 and last week’s high was 13235 which makes it 3410 and equates to 34.7% rally since 8th September 2020. In today’s article, […]

-

Elliott Wave View: Further Weakness in AUDJPY Expected

Read MoreAUDJPY rally is expected to find sellers in 3, 7, 11 swing for further weakness. This article and video look at the short term Elliott Wave path.

-

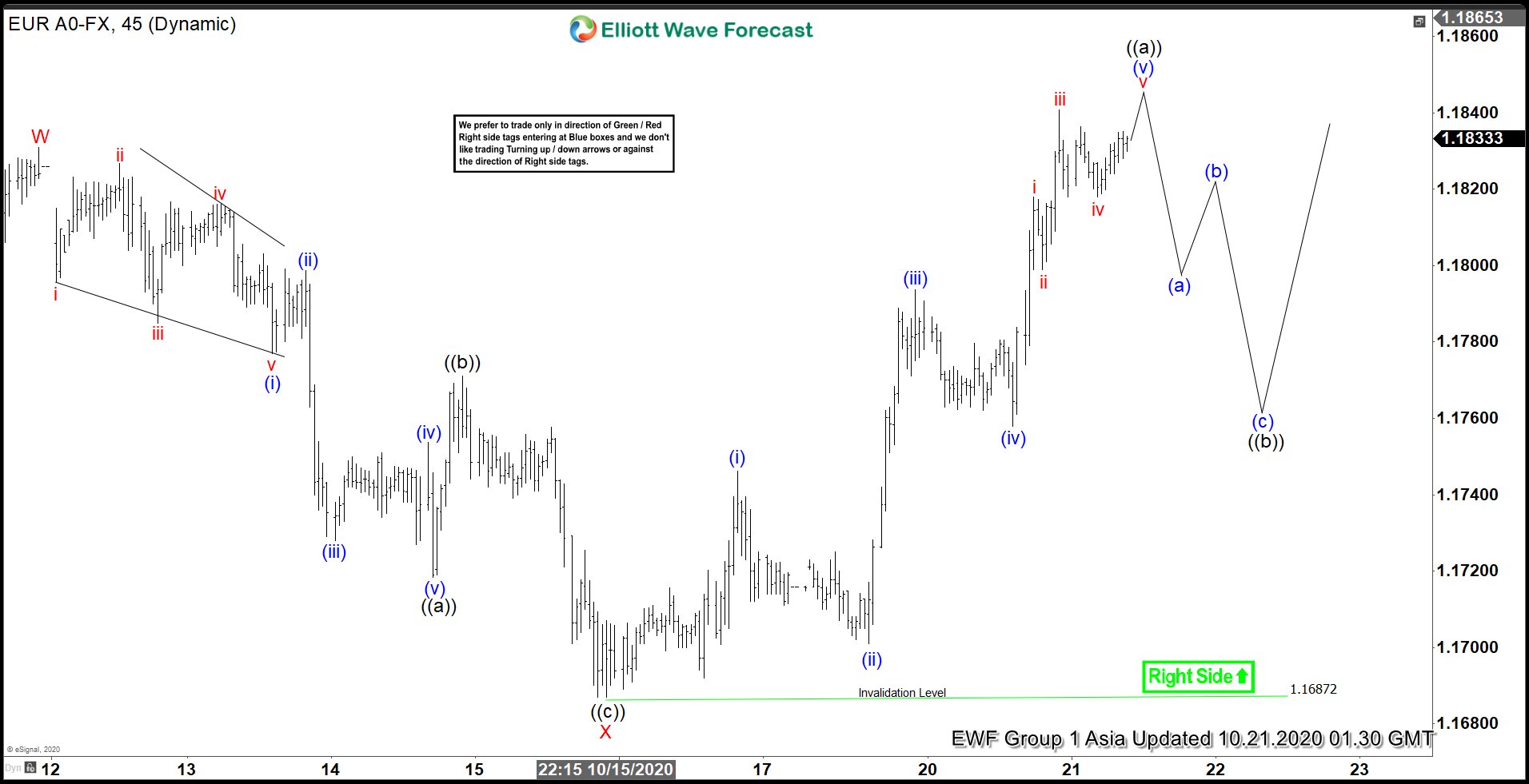

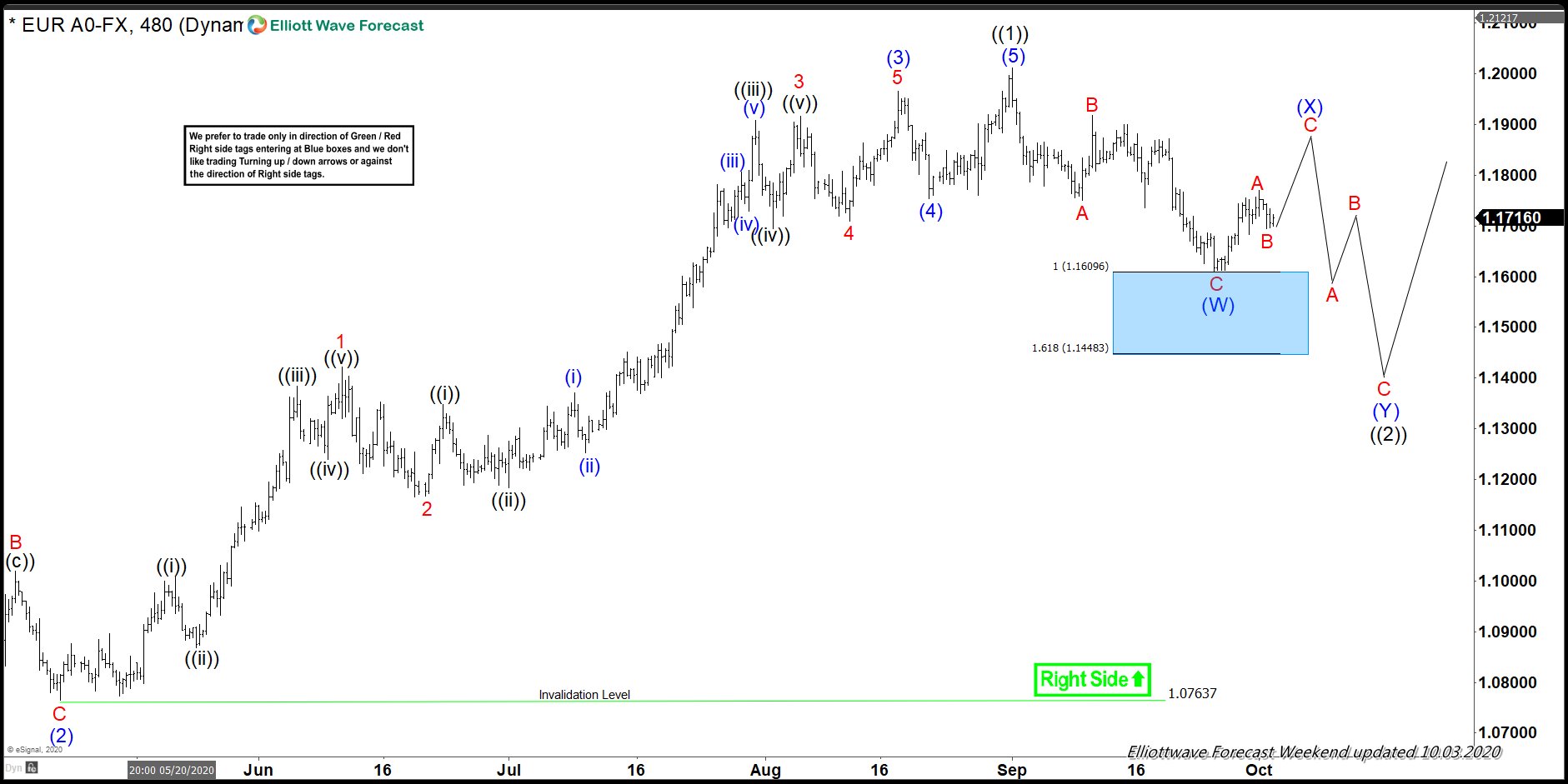

Elliott Wave View: Impulse Rally in EURUSD Favors More Upside

Read MoreEURUSD shows incomplete sequence from September 25 low favoring more upside. This article and video look at the Elliott wave path.

-

Elliott Wave View: AUDUSD Ready To Turn Lower?

Read MoreAUDUSD is showing 5 waves decline from the peak suggesting that it should be ready to turn lower. This article & video look at the Elliott wave path.

-

Is Fiscal Stimulus the Next Catalyst for US Dollar Decline?

Read MoreThe second stimulus bill currently under negotiation may be the next catalyst for the decline in US Dollar. The negotiation between Democrat and Republican gained urgency last week as President Trump contracted the virus and required hospitalization. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin continues to negotiate a proposal to send second stimulus […]

-

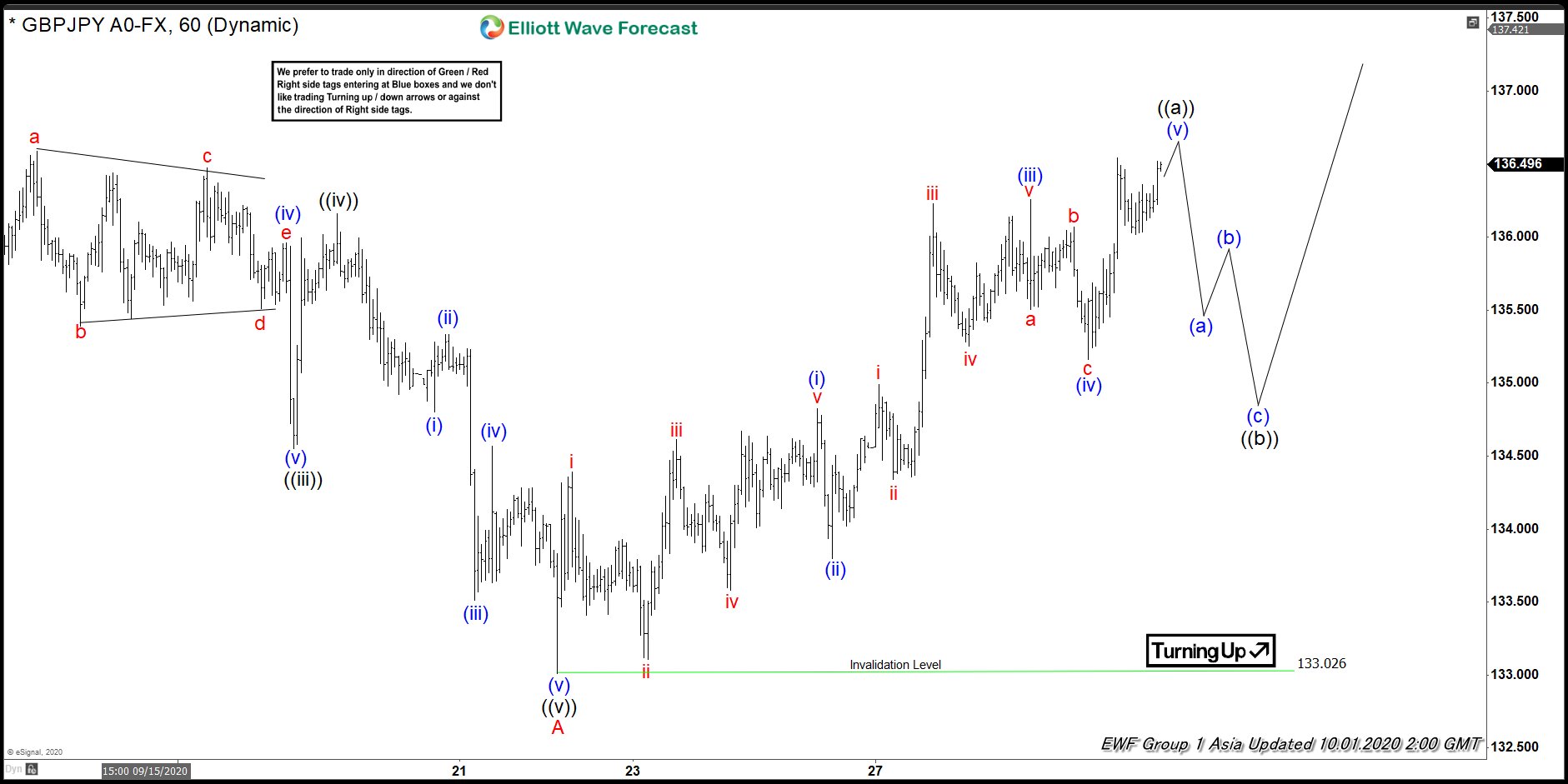

GBPJPY Elliott Wave View: Bulls Are Expected To Remain In Control

Read MoreGBPJPY is showing 5 waves rally from the lows suggesting that bulls remain in control. This article and video look at the Elliott wave path.