In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

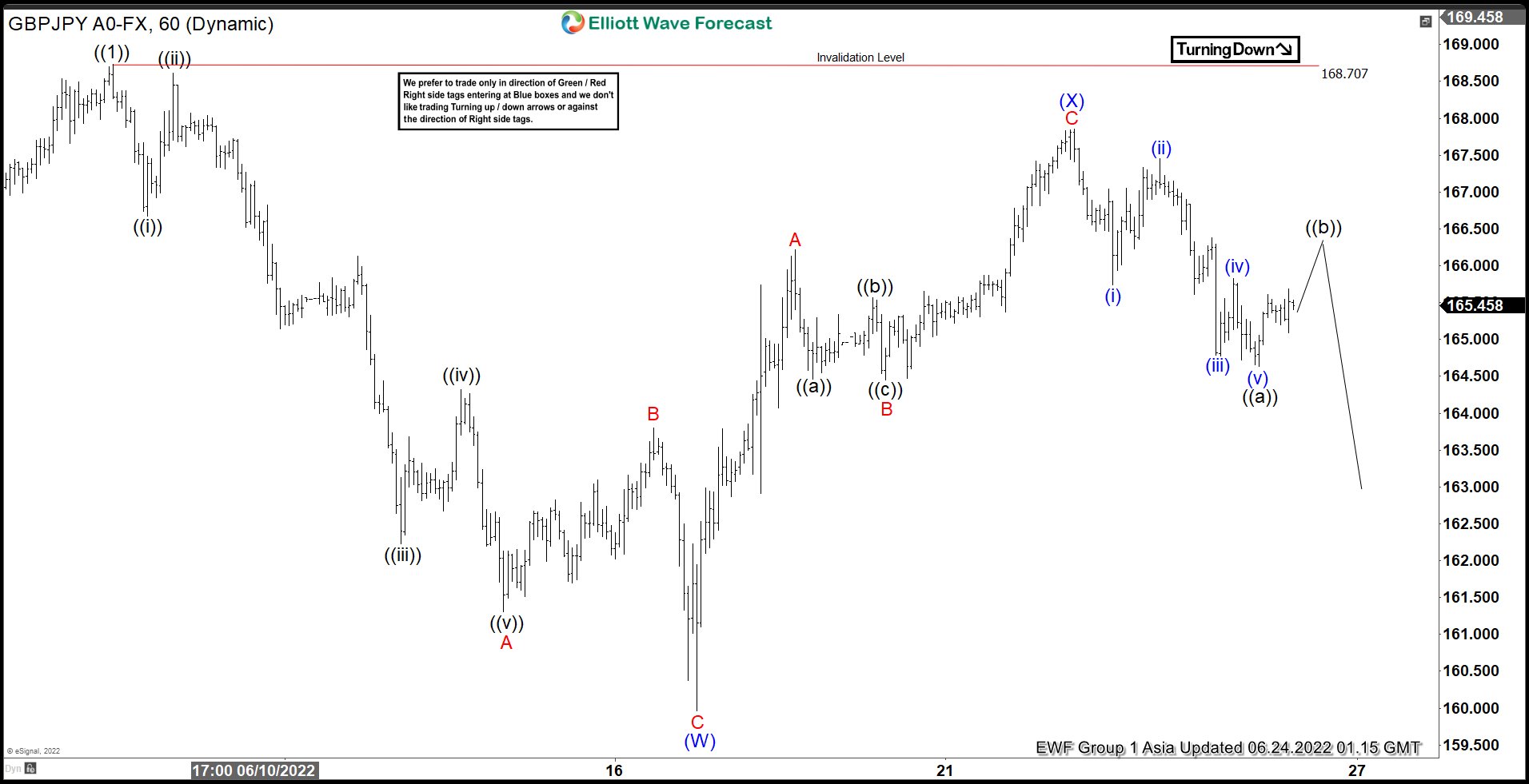

Elliott Wave View: GBPJPY Correction Can Extend

Read MoreShort term Elliott Wave in GBPJPY suggests cycle from 12/3/2021 low has ended as wave ((1)) with the rally to 168.7. Wave ((2)) pullback is currently in progress to correct cycle from December 2021 low. Internal subdivision of wave ((2)) is unfolding as a double three Elliott Wave structure. Down from wave ((1)), wave A […]

-

USDNOK – Dollar Sees a Reaction from Blue Box

Read MoreWe have been pretty bullish on the USDNOK throughout the year and Dollar has more strength to come to support this pair. Recently, we posted a trade idea on USDNOK that the market was correcting in a 3 or 7 swing structure and we took advantage of this. This has been a pretty successful trade […]

-

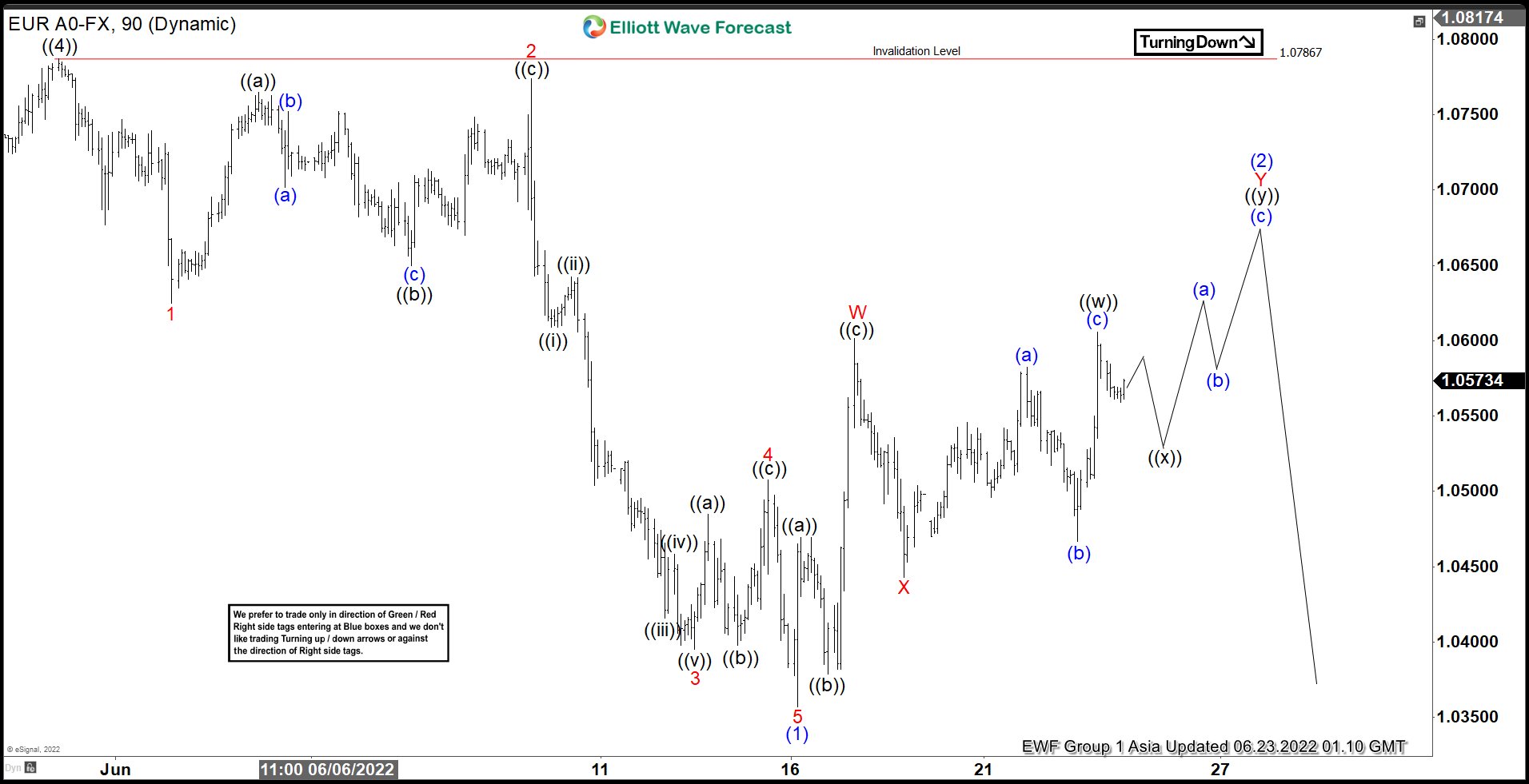

Elliott Wave View: EURUSD 7 Swing Rally

Read MoreEURUSD shows a 7 swing rally from 6/16/2022 low before pair resumes lower. This article and video look at the Elliott Wave path.

-

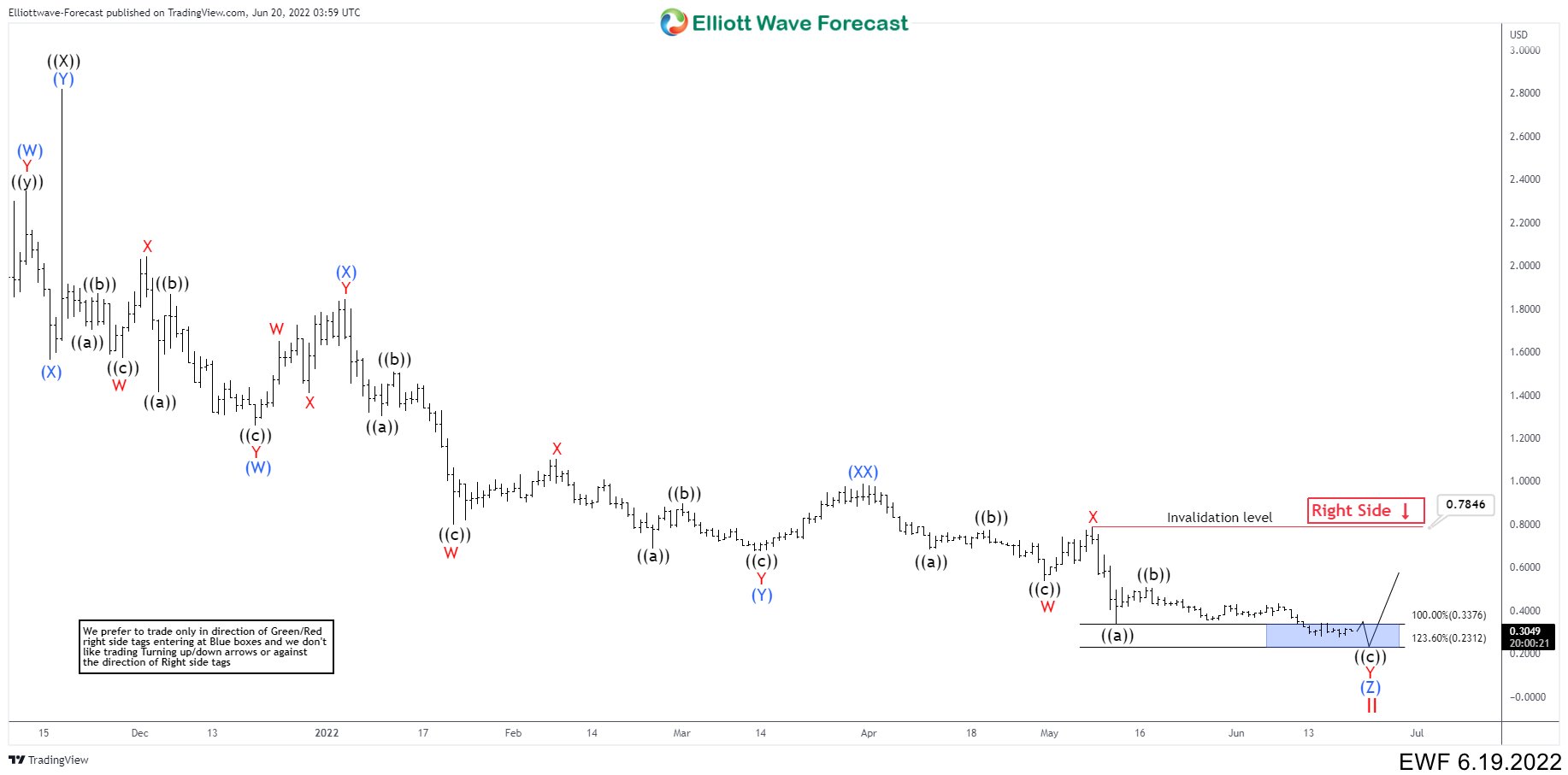

How We Saw Algorand Cryptocyrrency (ALGO) And What To Expect

Read MoreAlgorand is a proof-of-stake blockchain cryptocurrency protocol. Algorand’s native cryptocurrency is called ALGO. It was founded in 2017 by Silvio Micali, a professor at MIT, composed of a company and a foundation. Algorand Foundation manages ecosystem growth, award funding, cryptographic research primitives, on-chain governance, and decentralization of the Algorand network, including nodes. The core development […]

-

Elliott Wave View: Russell 2000 (RTY_F) Sellers Remain in Control

Read MoreRussell 2000 (RTY) broke below 5/12/2022 low favoring further downside. This article and video look at the Elliott Wave path.

-

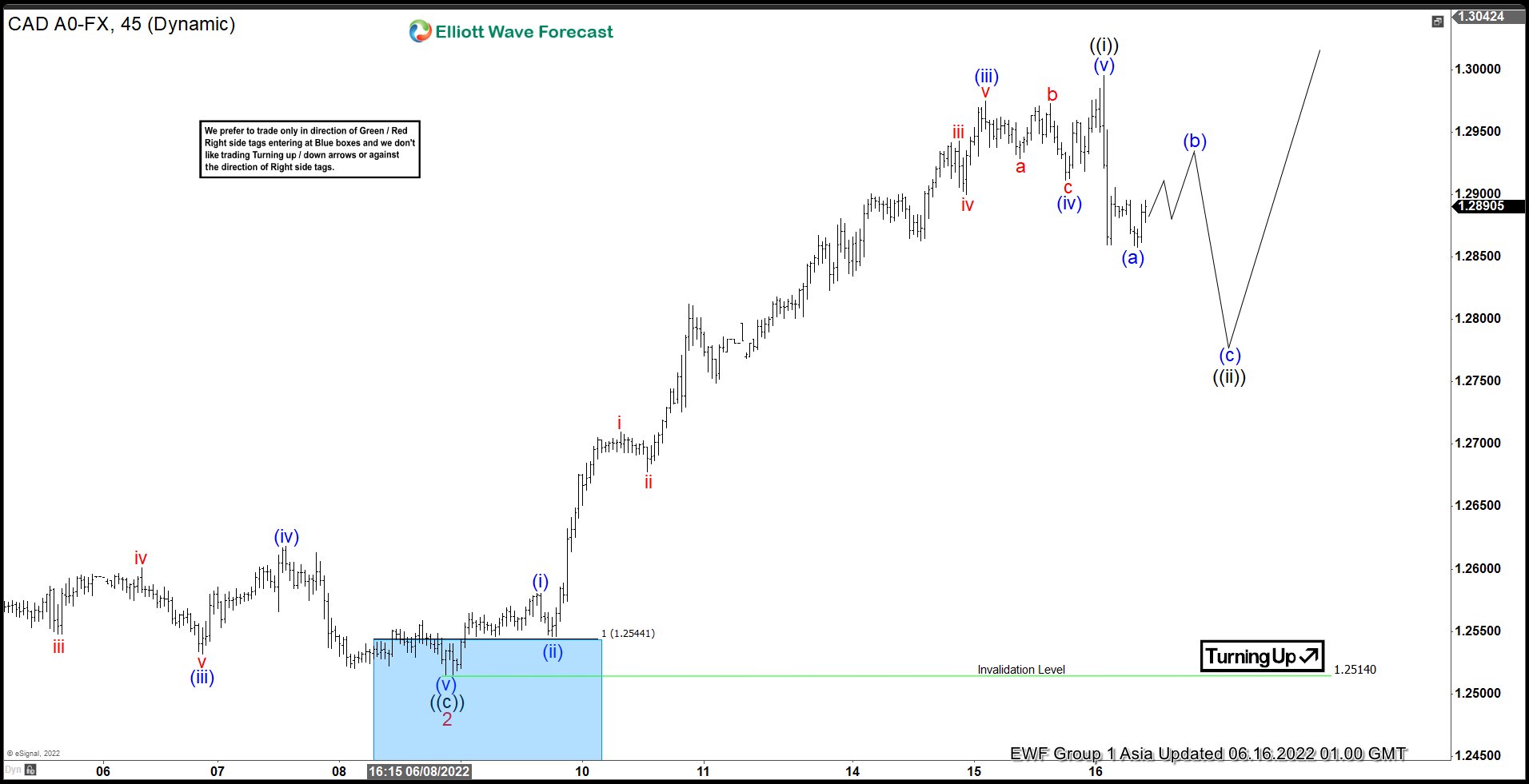

Elliott Wave View: USDCAD Pullback Should Find Buyers

Read MoreUSDCAD shows an impulsive rally from 6/8/2022 low favoring more upside. This article and video look at the Elliott Wave path.