In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

EURUSD Resume Downside After Finding Sellers At Blue Box

Read MoreIn this blog, we take a look at the past performance of EURUSD charts. In which, the pair provided a selling opportunity at the blue box area.

-

Elliott Wave View: GBPCAD Rally Should Fail for Further Downside

Read MoreShort Term Elliott Wave View in GBPCAD suggests rally to 1.5367 ended wave ((iv)). Wave ((v)) lower is in progress to complete a cycle from August 2, 2022 high. Internal subdivision of wave ((iv)) unfolded as a zig zag Elliott Wave structure. Up from wave ((iii)), wave (a) ended at 1.5314 and pullback in wave […]

-

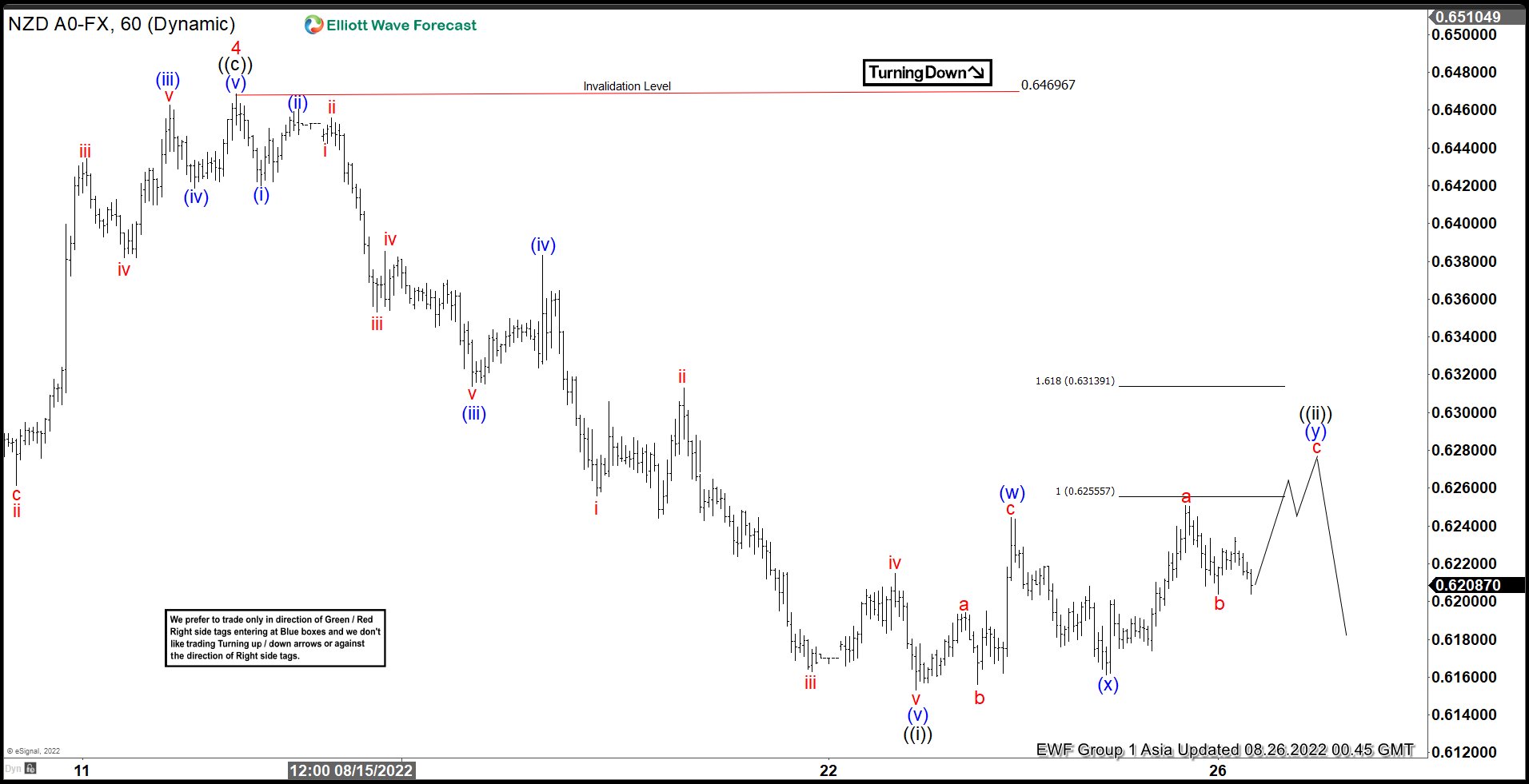

Elliott Wave View: NZDUSD Rally Likely Fail in 3, 7, 11 Swing

Read MoreNZDUSD has completed a wave 4 and it should continue lower in wave 5. Wave ((i)) of 5 done and we are correcting in wave ((ii)) before turning lower again.

-

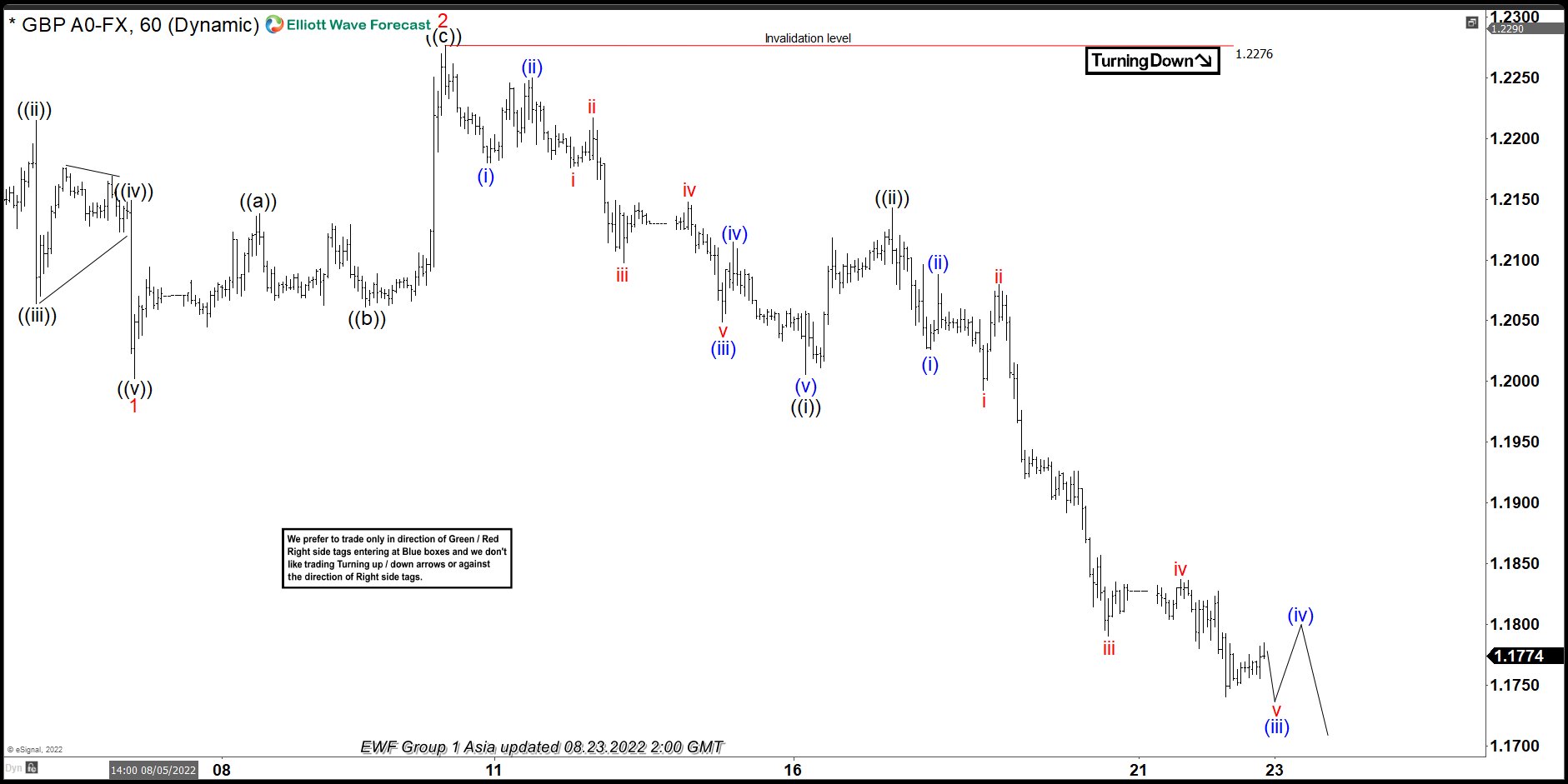

Elliott Wave View: GBPUSD Should Complete an Impulse Lower

Read MoreShort Term Elliott Wave View in GBPUSD suggests the rally from 7.14.2022 low ended a wave (4) hit our blue box in 4 hour chart at 1.2298. Then pair was rejected and did a leading diagonal structure as wave 1 ended at 1.2000. The market bounce doing a zig zag correction, testing the high and […]

-

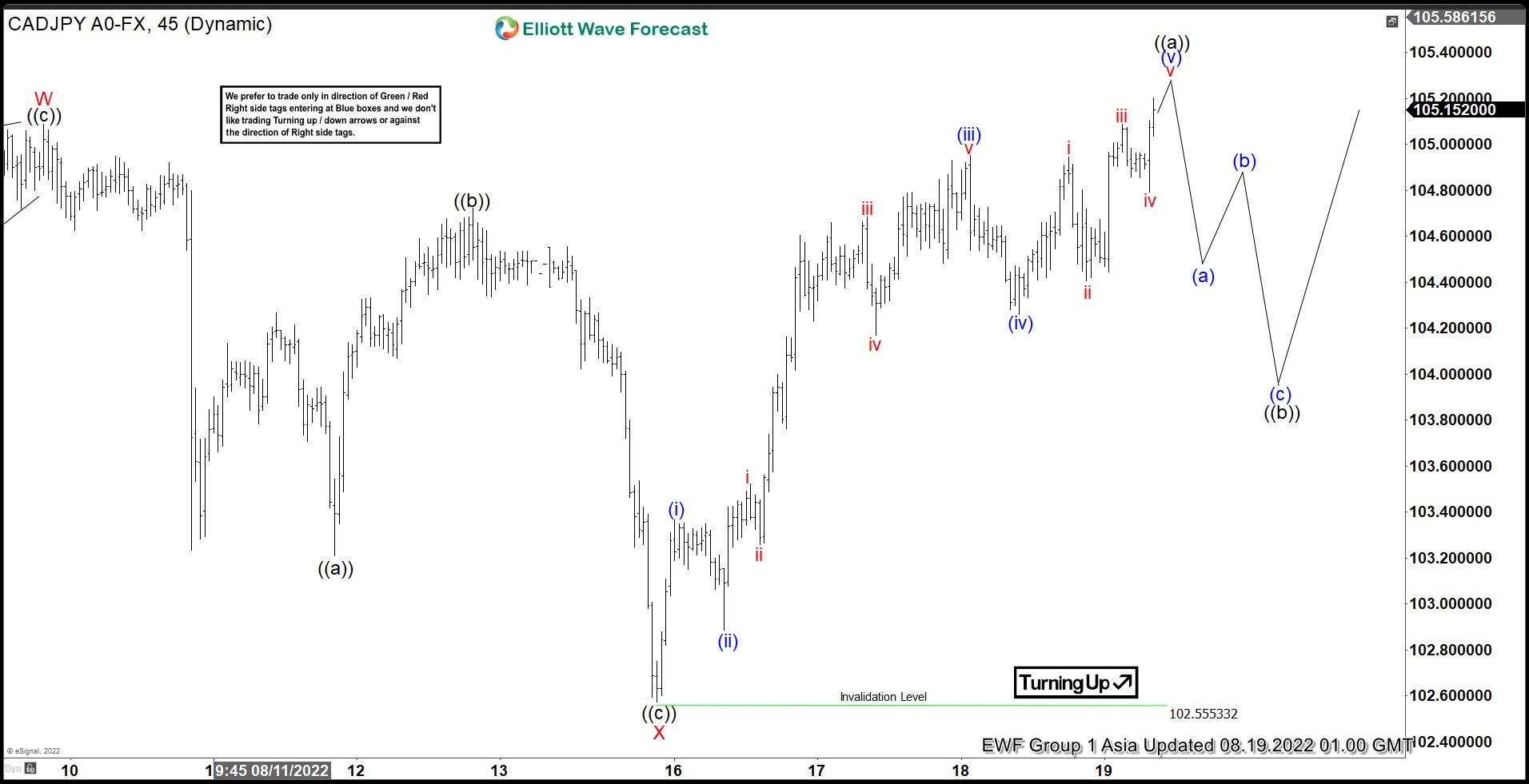

Elliott Wave View: CADJPY Looking for 7 Swing

Read MoreCADJPY rally from 8.2.2022 low is in the form of 7 swing double correction. This article and video explain the Elliott Wave path.

-

Elliott Wave View: Further Downside Likely in $EURUSD

Read MoreEURUSD shows an impulsive structure down from 8.10.2022 high. This article and video look at the Elliott Wave path of the pair.