In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

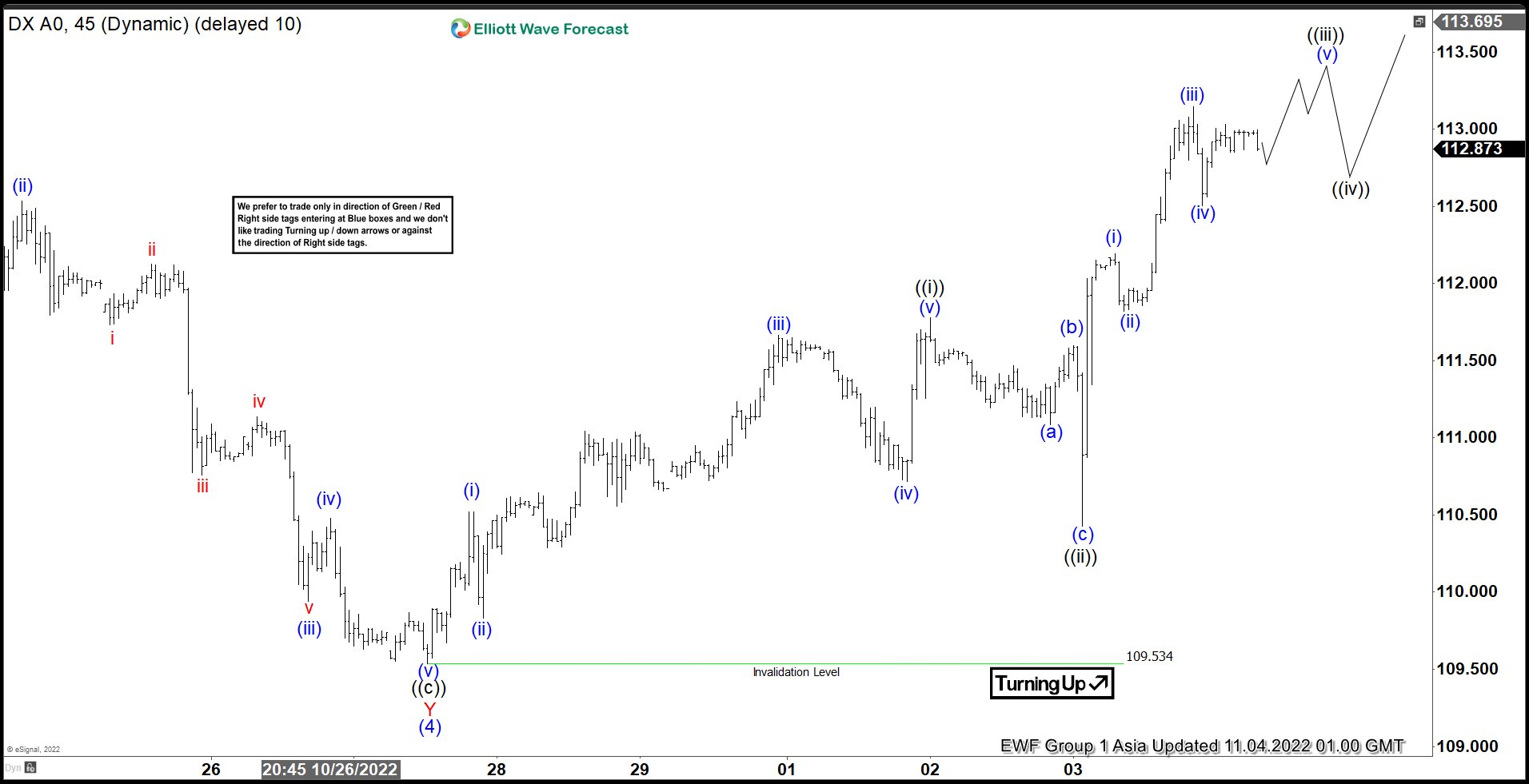

Elliott Wave View: Dollar Index (DXY) Has Resumed Higher

Read MoreDollar Index (DXY) ended cycle from 9.28.2022 high and resumes higher. This article and video look at the Elliott Wave path.

-

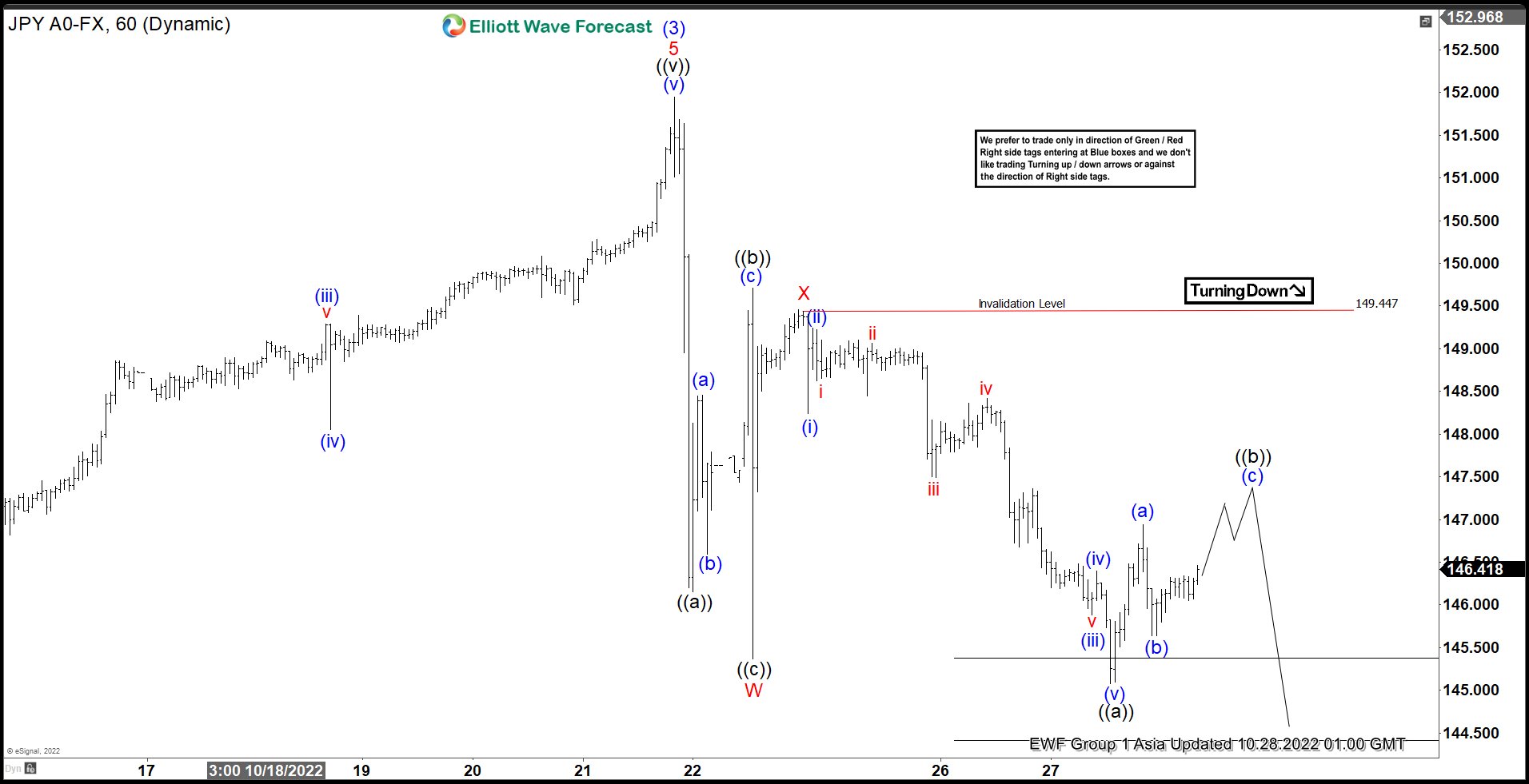

Elliott Wave View: USDJPY Looking for Double Correction

Read MoreUSDJPY shows 5 swing sequence from 10.21.2022 high looking for downside to end 7 swing correction. This article and video look at the Elliott Wave path.

-

Elliott Wave View: EURUSD Should Be Near To Pullback

Read MoreShort term Elliott Wave view on EURUSD suggests the cycle from 10.04.2022 high is over at 0.9630 low as a double correction structure. The market bounced and a new double correction is in progress to end the cycle from 9.28.2022. Up from 10.13.2022 low, wave (a) ended at 0.9808 and dips in wave (b) ended […]

-

Elliott Wave Forecast: EURJPY Has Resumed Higher

Read MoreEURJPY broke above suggests the previous high on 9.12.2022 and shows bullish sequence favoring further upside against 140.87 in the first degree.

-

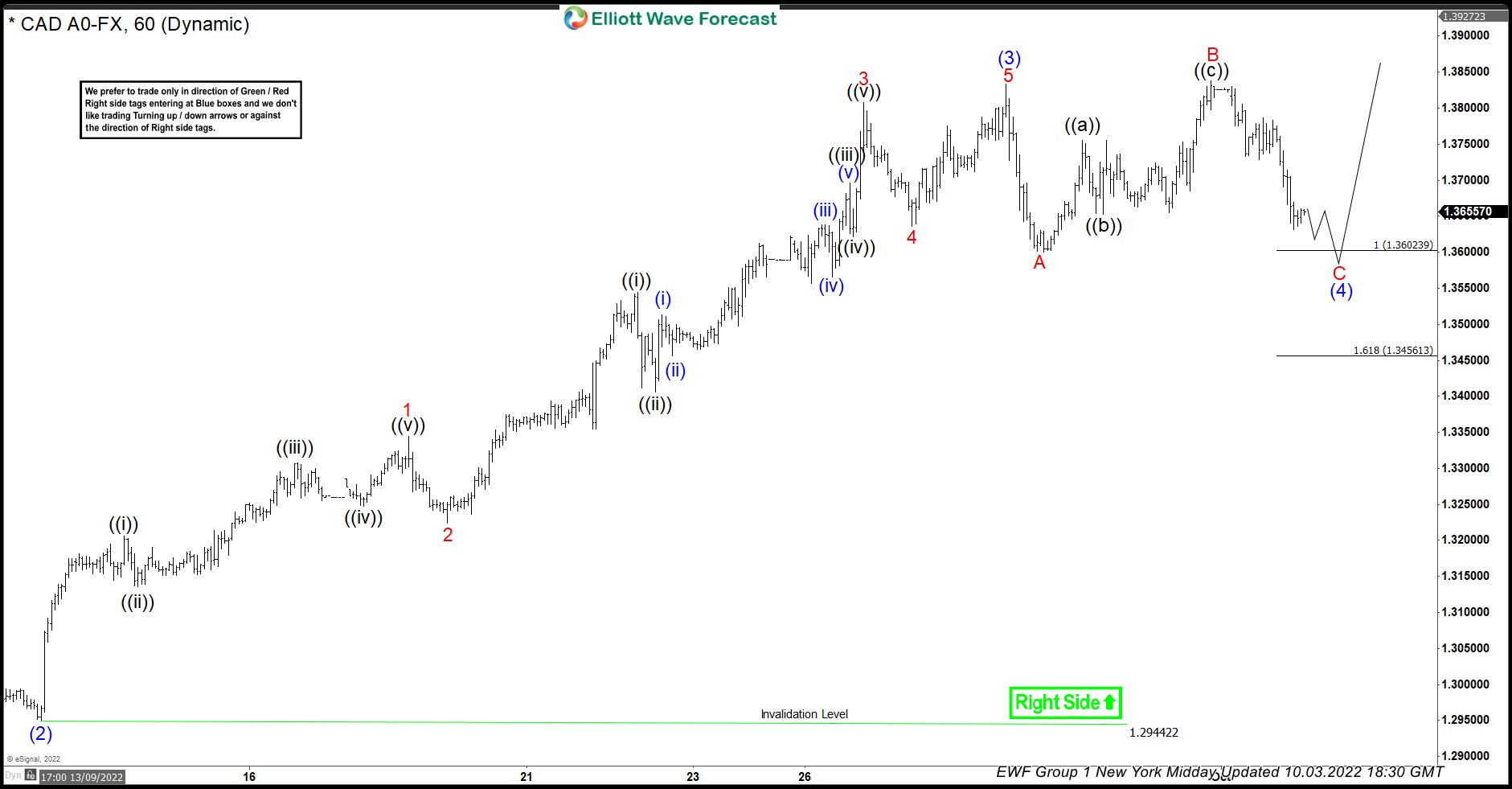

Elliott Wave View: USDCAD Should Continue to Extend Higher

Read MoreUSDCAD rallies as an impulse from 8.11.2022 low and can see further upside while above 10.5.2022 low. This article and video look at the Elliott Wave path.

-

USDCAD Reacting Higher From The Equal Legs Area

Read MoreIn this technical blog, we will look at the past performance of 1-hour Elliott Wave Charts of USDCAD. In which, the rally from 11 August 2022 high is unfolding as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in USDCAD is incomplete to the upside & should see […]