In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

EURUSD Close to Ending Elliott Wave Impulse Decline

Read MoreEURUSD is close to ending cycle from 5.4.2023 high as an impulse. Pair soon can see at least 3 waves rally. This article & video shows the path.

-

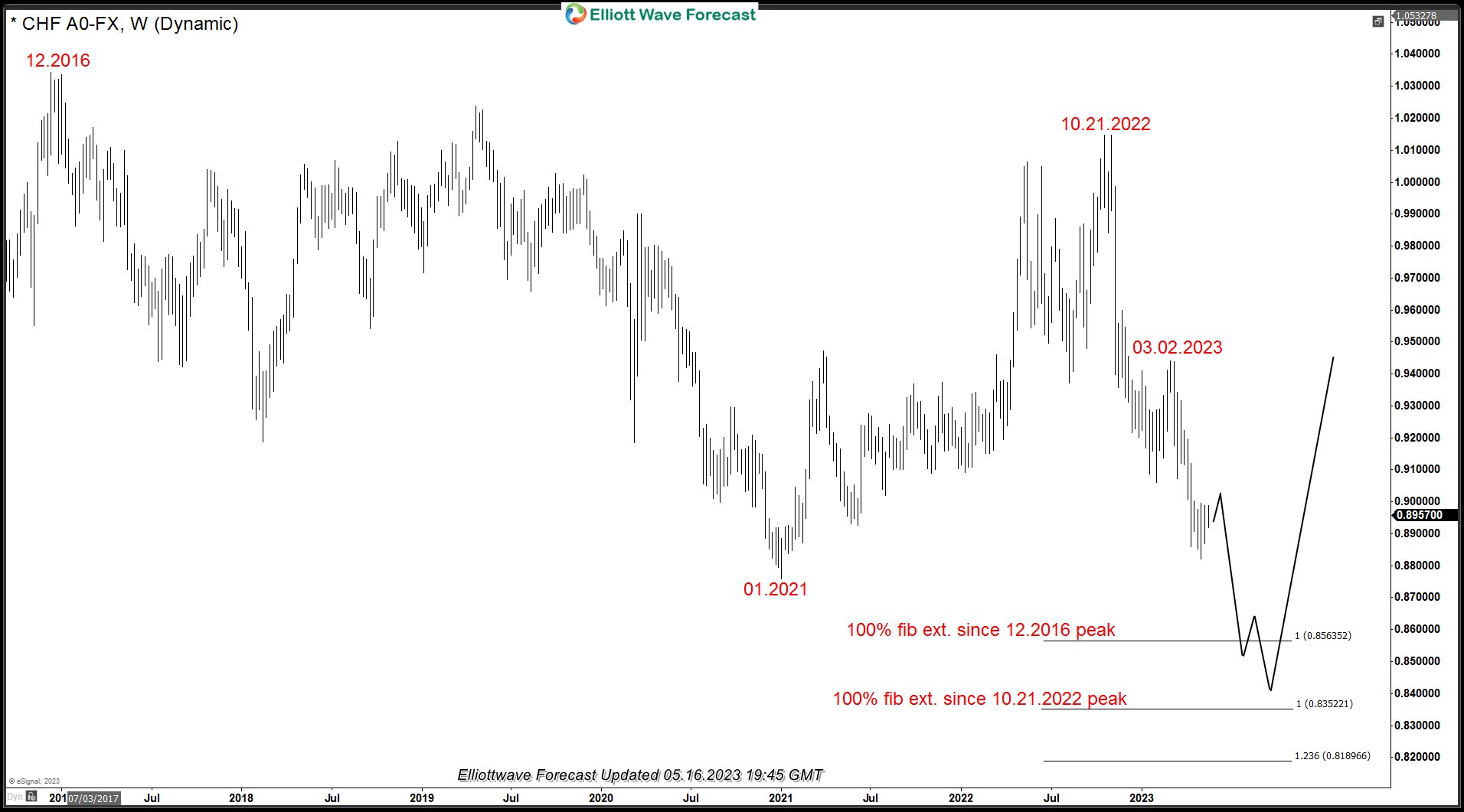

USDCHF: Elliott Wave Bearish Sequence & Next Extreme Areas

Read MoreUSDCHF has seen a strong decline since October 2022 peak with shallow bounces in-between. In today’s blog, we will take a look at the Elliott wave structure of the decline from October 21, 2022 peak, market sequence and next extreme areas which should be potential entry areas for both sellers and buyers. We will also […]

-

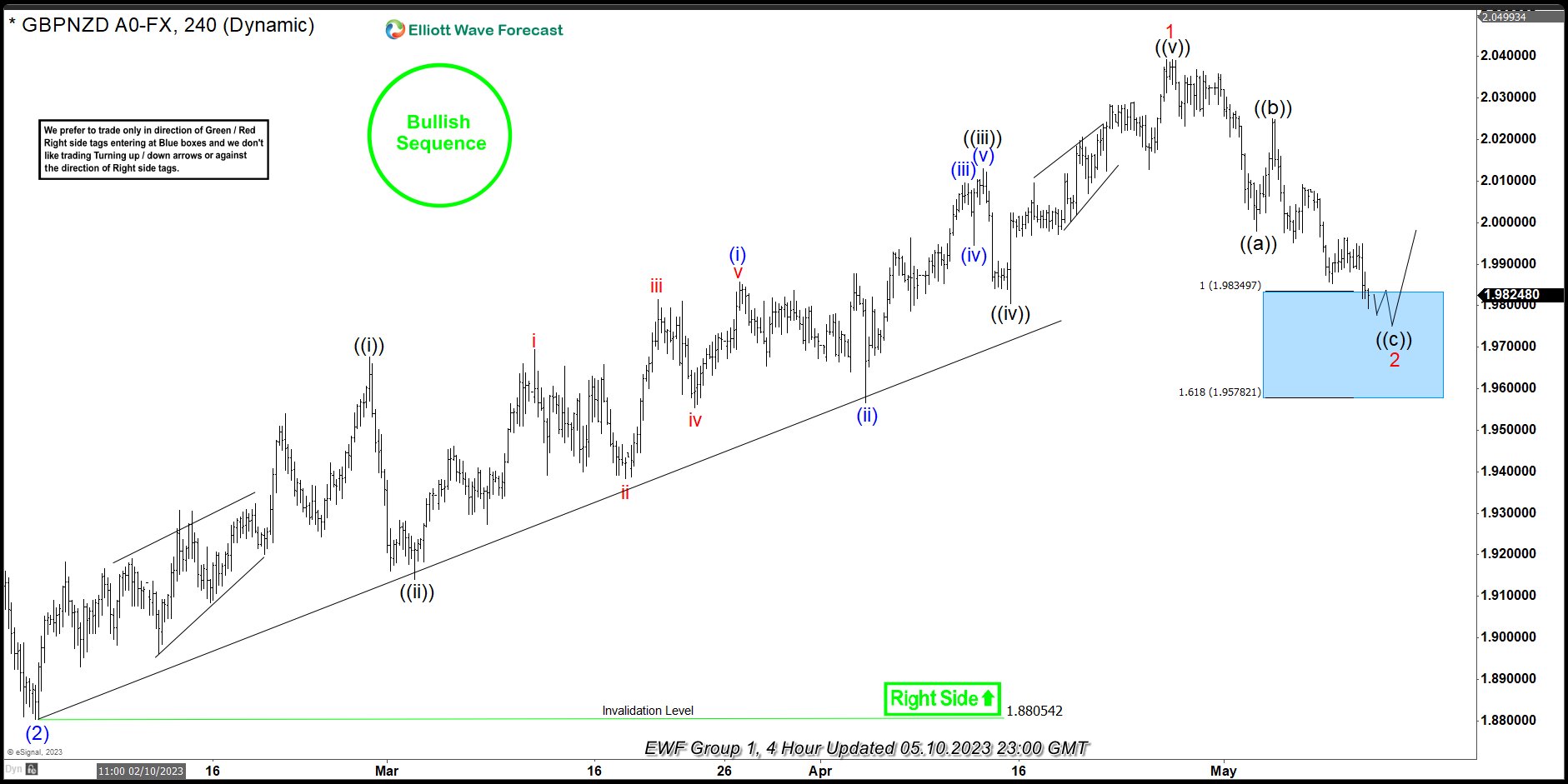

GBPNZD Reacting Strongly From The Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of GBPNZD. In which, the rally from the 03 February 2023 low unfolded as an impulse sequence and showed a higher high sequence with a bullish sequence stamp. Therefore, we knew that the structure in GBPNZD is incomplete & should […]

-

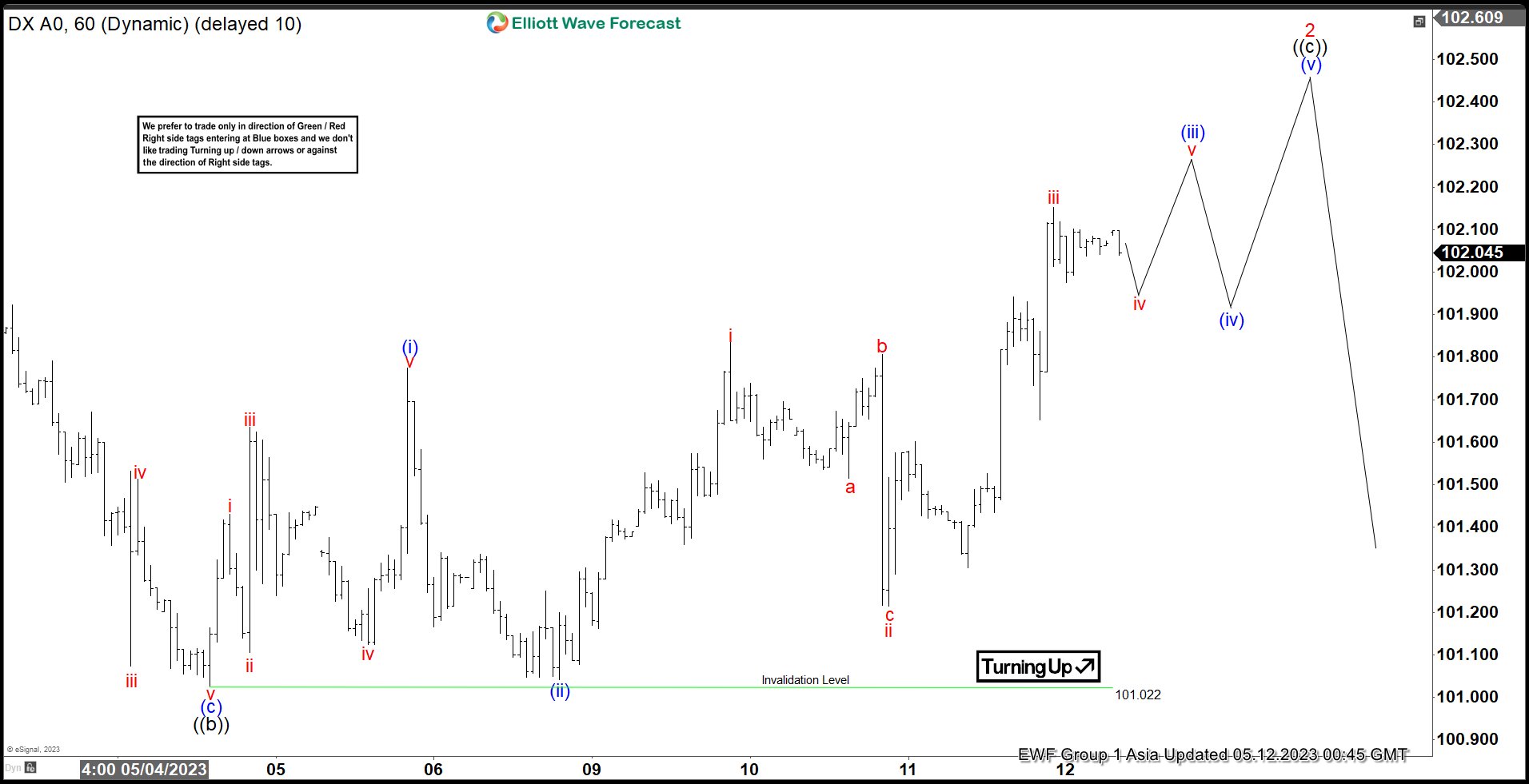

Elliott Wave Forecast: Dollar Index ($DXY) Rally Should Fail

Read MoreDollar Index (DXY) is rallying as a zigzag from 4.14.2023 low before it resumes lower. This article and video look at the Elliott Wave path.

-

$USDSEK and $USDMXN Holding the $USDX

Read MoreThe $USDX peaked back on 09.29.2022. Since then, the Index has been dropping. The Index is at risk of ending the cycle since the lows back in 2008. This means a huge selling could be happening now. We explained the idea in this article, published on 09.21.2022. We knew the $USDX was about to enter […]

-

Elliott Wave Suggests Short Term Bullish Outlook in GBPJPY

Read MoreGBPJPY shows impulsive structure from 5.5.2023 low favoring more upside. This article and video look at the Elliott Wave path.