In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

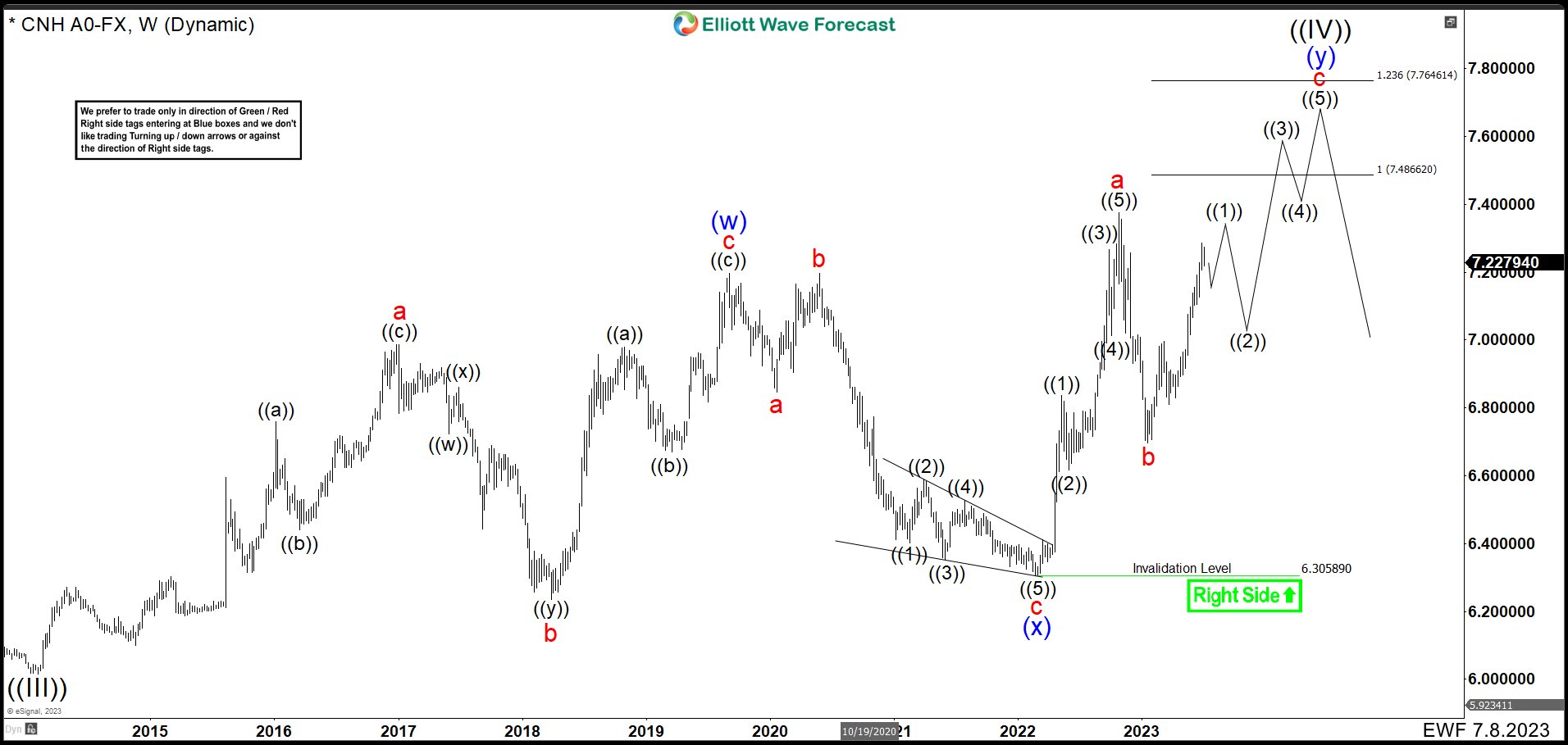

Renminbi (USDCNH) Broke The High And Entered In A Double Correction

Read MoreIn the last years, the renminbi made a pause in his attempt to get stronger against USD dollar. In February 2014, renminbi found support at 6.0153 and from there it made a perfect zig – zag correction structure to equal legs at 7.1964 in June 2020. After that, the USDCNH continue with the downtrend. Renminbi […]

-

EURGBP Sell Setup From Blue Box Works As Expected

Read MoreIn our service, we provide members trade setup in Live Trading Room. However, our setup is based on certain conditions. To trade, we need these conditions: There’s a bullish sequence (for buying) and bearish sequence (for selling) We can see clear correction in 3 swing or 7 swing. In addition, we can measure with higher […]

-

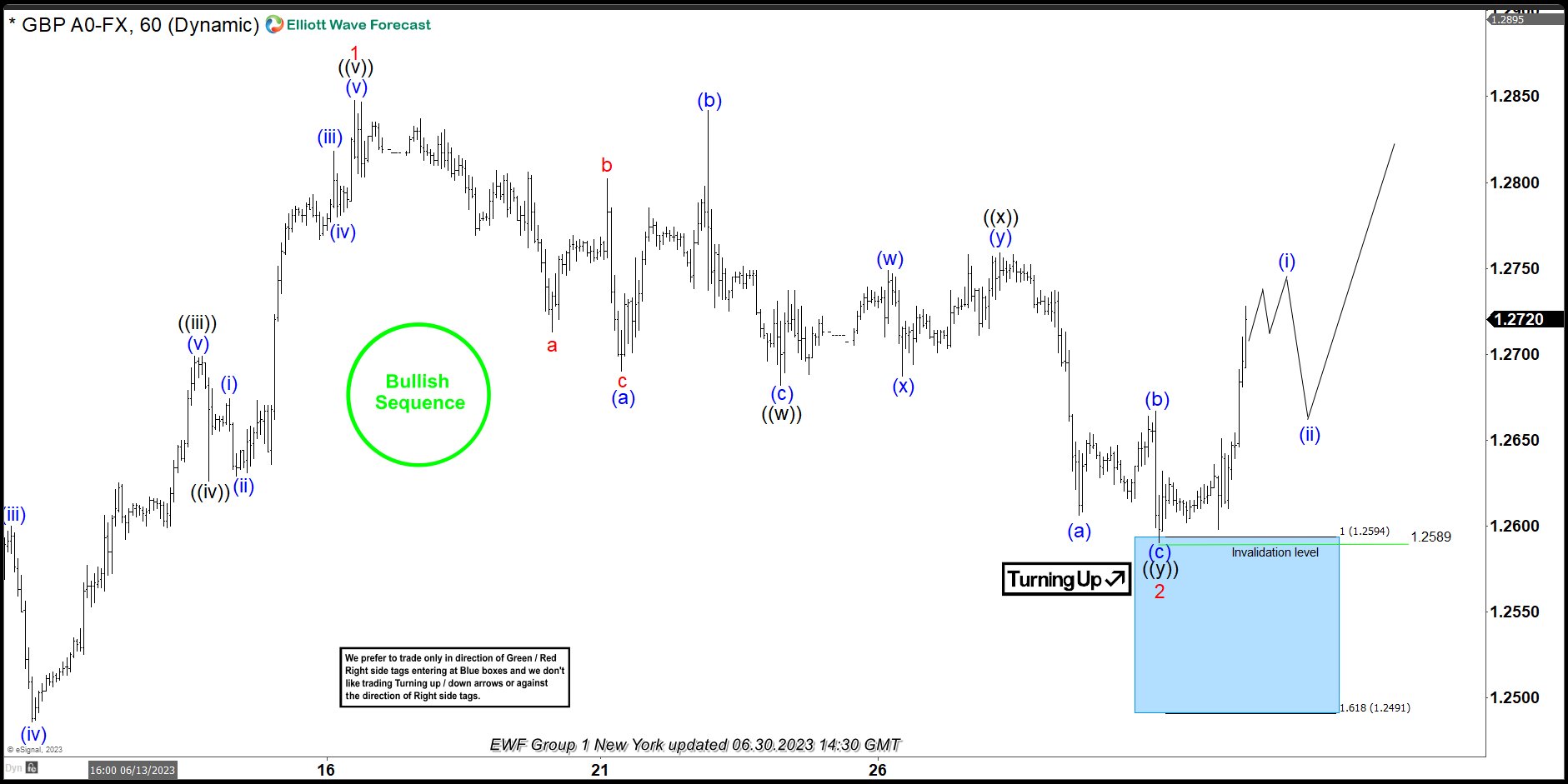

GBPUSD Reacted From The Blue Box After A Double Three Structure

Read MoreA Double three structure is a sideways combination of two corrective patterns. There are several corrective patterns including zigzag, flat, and triangle. When two of these corrective patterns are combined together, we get a double three. A combination of two corrective structures labelled as WXY. Wave W and wave Y subdivision can be zigzag, flat, double […]

-

EURJPY Bullish Impulse Elliott Wave Structure Calling Higher

Read MoreEURJPY rallies as an impulse structure from 5.11.2023 low and should continue higher. This article and video look at the Elliott Wave path of the pair.

-

GBPUSD Bullish Sequence Suggests Pullback to Find Support

Read MoreGBPUSD shows an incomplete bullish sequence from 9.26.2022 low & 3.8.2023 low favoring further upside. This article and video look at the Elliott Wave path.

-

GBPCAD Reacting Perfectly From Equal Legs Area

Read MoreIn this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of GBPCAD. In which, the decline from 03 May 2023 high ended 5 waves in a leading diagonal sequence and made a bounce higher. Therefore, we knew that the structure of GBPCAD is incomplete to the downside & […]