In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

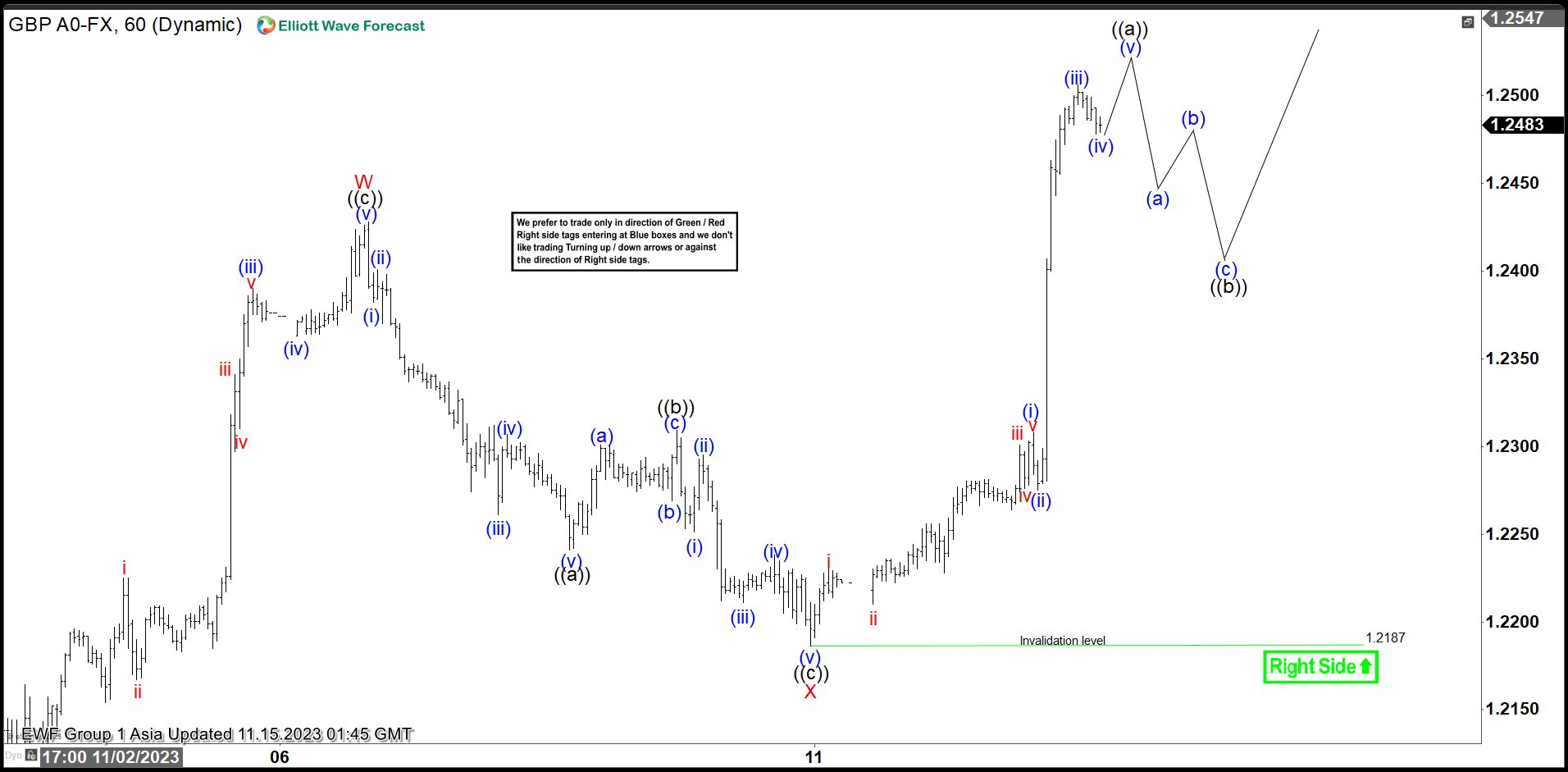

GBPUSD Short Term Elliott Wave Structure Suggests Further Upside

Read MoreGBPUSD shows incomplete 5 swing sequence from 10.4.2023 low favoring more upside. This article and video look at the Elliott Wave path.

-

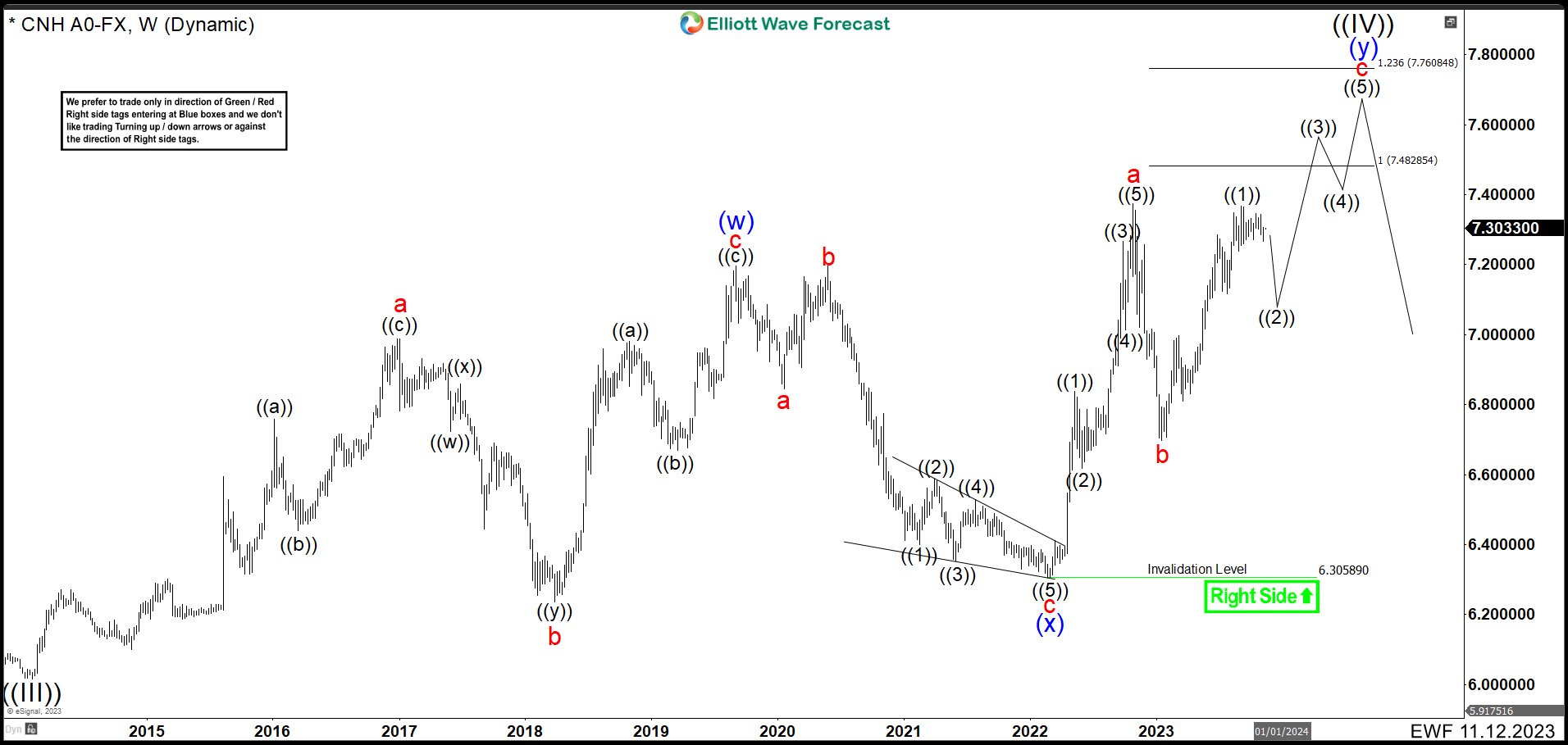

Renminbi (USDCNH) Pullback Is Coming Before More Upside

Read MoreIn the last years, the renminbi made a pause in his attempt to get stronger against USD dollar. In February 2014, renminbi found support at 6.0153 as wave ((III)) and from there it made a perfect zig – zag correction structure to equal legs at 7.1964 in June 2020. After these 3 swings, USDCNH should […]

-

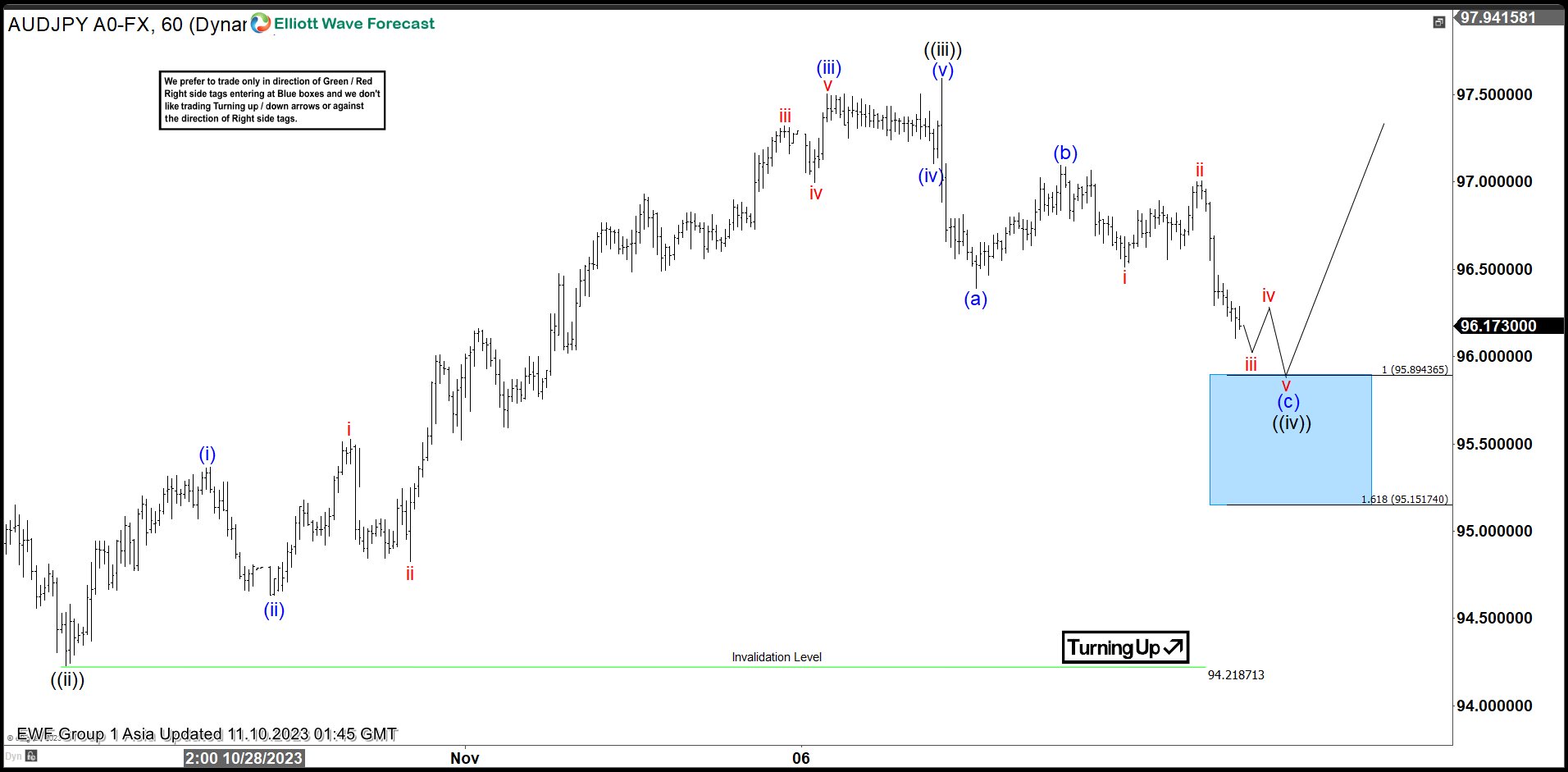

AUDJPY Elliott Wave Support Area For More Upside

Read MoreAUDJPY is correcting as a zigzag structure into a support zone. This article and video look at the Elliott Wave path of the pair.

-

USDX Elliott Wave : Forecasting The Path

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Dollar Index ($USDX ) published in members area of the website. As our members know USDX has ended cycle from the 99.5 low as 5 waves structure. We were calling cycle completed at the 107.34 […]

-

NZDJPY Making Strong Comeback From Blue Box

Read MoreIn this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

AUDUSD Elliott Wave Bounce Corrective Or Simple A-B-C?

Read MoreAUDUSD has started the bounce against 02 February 2023 high, which is expected to unfold either in a corrective or simple A-B-C. This article and video look at the Elliott Wave path.