In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

CADJPY Elliott Wave : Forecasting the Rally After 3 Waves Pull Back

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of CADJPY , published in members area of the website. As our members know we are favoring the long side in YEN pairs. Recently the pair has given us 3 waves pull back that found buyers right at the […]

-

AUDJPY Elliott Wave: Forecasting the Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDJPY Forex pair, published in members area of the website. As our members know we have been favoring the long side in YEN pairs. Recently we got a pull back that has made a clear […]

-

USDNOK Found Sellers After Elliott Wave Double Three

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of USDNOK published in members area of the website. As our members know USDNOK has recently made recovery that has unfolded as Elliott Wave Double Three Pattern. It made clear 7 swings from the December 27th […]

-

GBPUSD May See Support Soon From Inflection Area

Read MoreGBPUSD is looking to end 5 waves impulse soon. This article and video look at the short term Elliott Wave path of the pair.

-

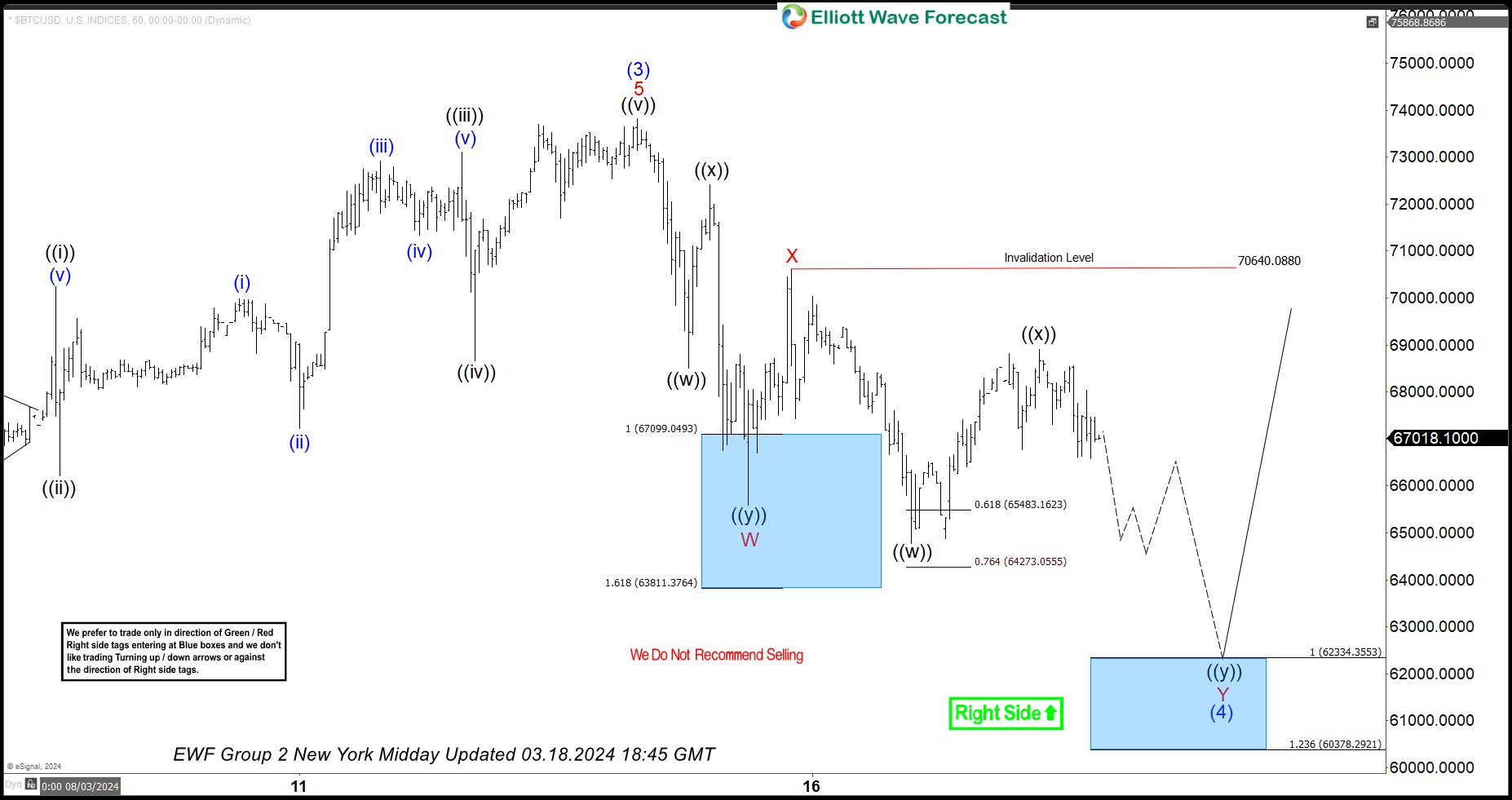

Bitcoin Perfect Reaction Higher From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of Bitcoin charts. The BTCUSD produced a perfect reaction higher from blue box area.

-

GBPJPY Elliott Wave View: 5 Swings Down Suggests Correction To Extend

Read MoreGBPJPY has ended a cycle from 14.12.2023 low. Up from 14.12.2024 low, wave (1) ended at 191.32 and pullback in wave (2) is in progress. The pair resumes lower in wave ((i)) with internal subdivision as 5 waves. Down from wave (1), wave (i) ended at 190.34 and wave (ii) pullback ended at 190.99. Pair […]