In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

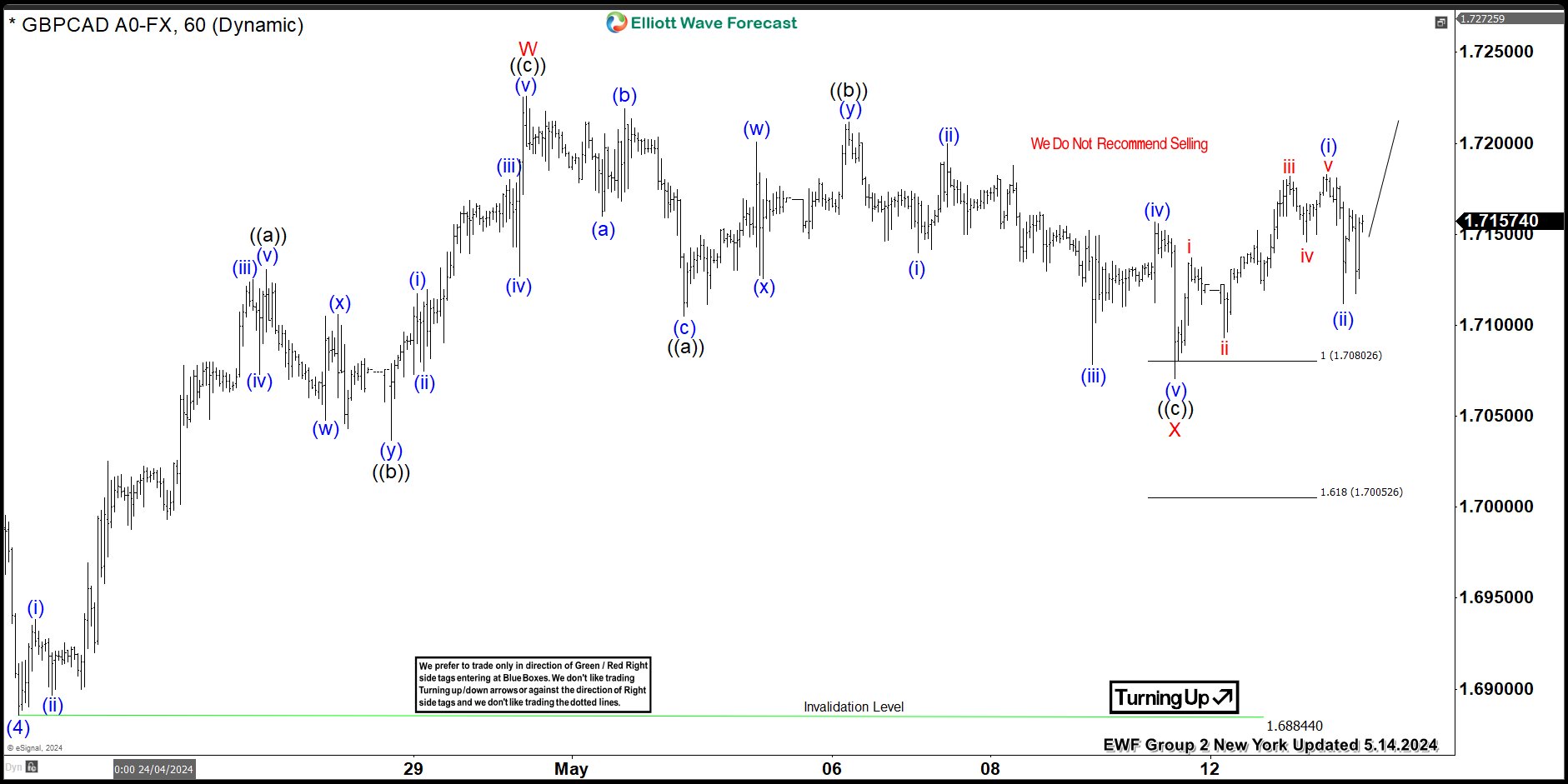

GBPCAD advances bullish sequence from equal leg

Read MoreHello traders. In this blog post, we will look at how GBPCAD advances bullish sequence from late 2023 after it bounced from an equal leg area. As you know, we analyze and trade 78 instruments with members at ElliottWave-Forecast. These 78 instruments are grouped into three categories. This currency pair is in group 2 along […]

-

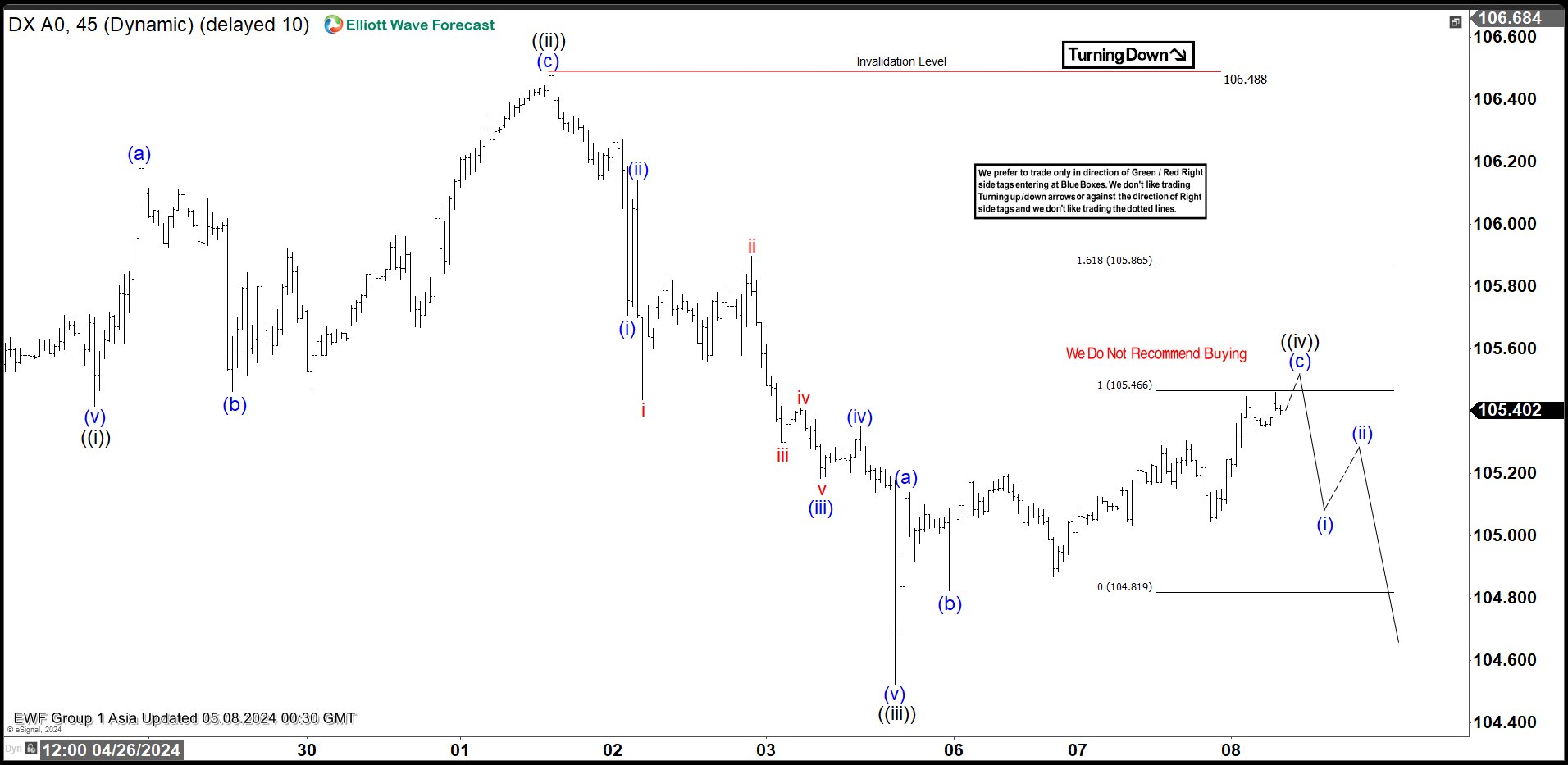

USDX Elliott Wave: Forecasting the Decline from Equal Legs Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Dollar Index, published in members area of the website. As our members know, USDX has ended the cycle from the December’s 2023 low. The index has recently given us bounce in a 3-wave pattern, when […]

-

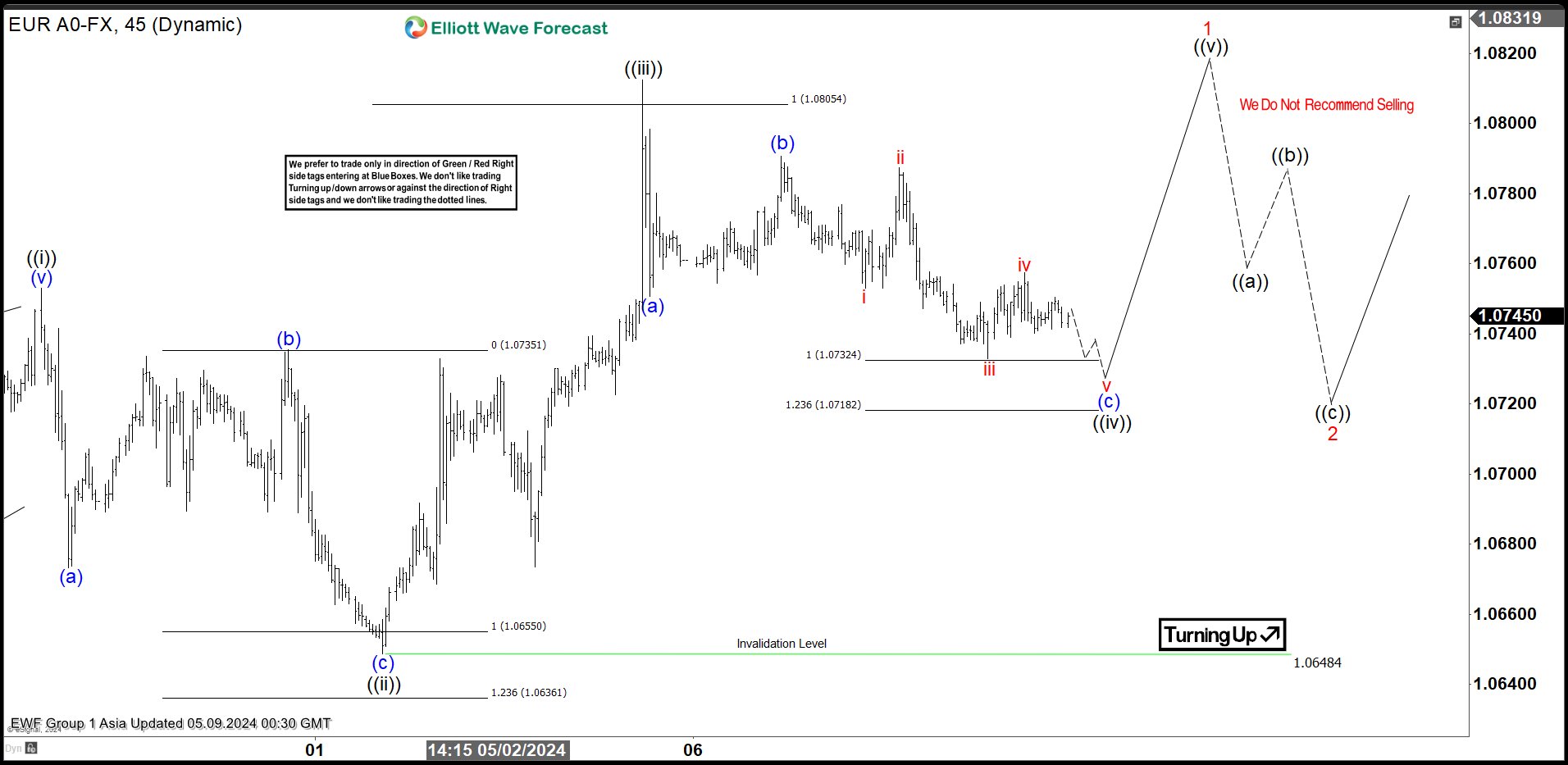

EURUSD Elliott Wave: Forecasting the Rally from Equal Legs Area

Read MoreGreetings fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of EURUSD, published in members area of the website. As our members know, EURUSD has ended the cycle from the December’s 2023 peak. The pair has recently pulled back in a 3-wave pattern, with buyers stepping […]

-

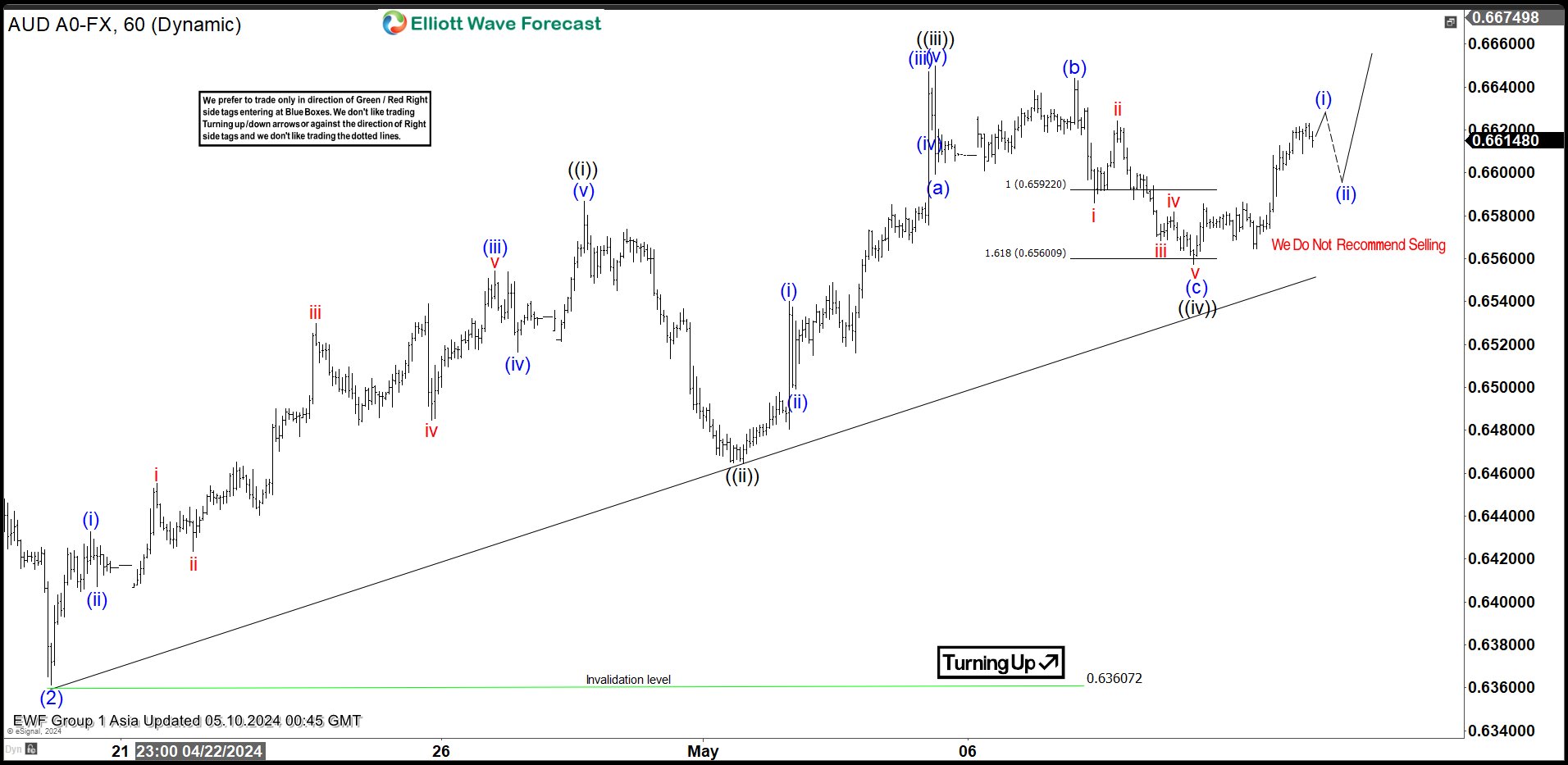

Elliott Wave Expects $AUDUSD to Break Higher

Read MoreAUDUSD is looking to start a new impulsive rally from 4.19.2024 low. This article and video look at the Elliott Wave path.

-

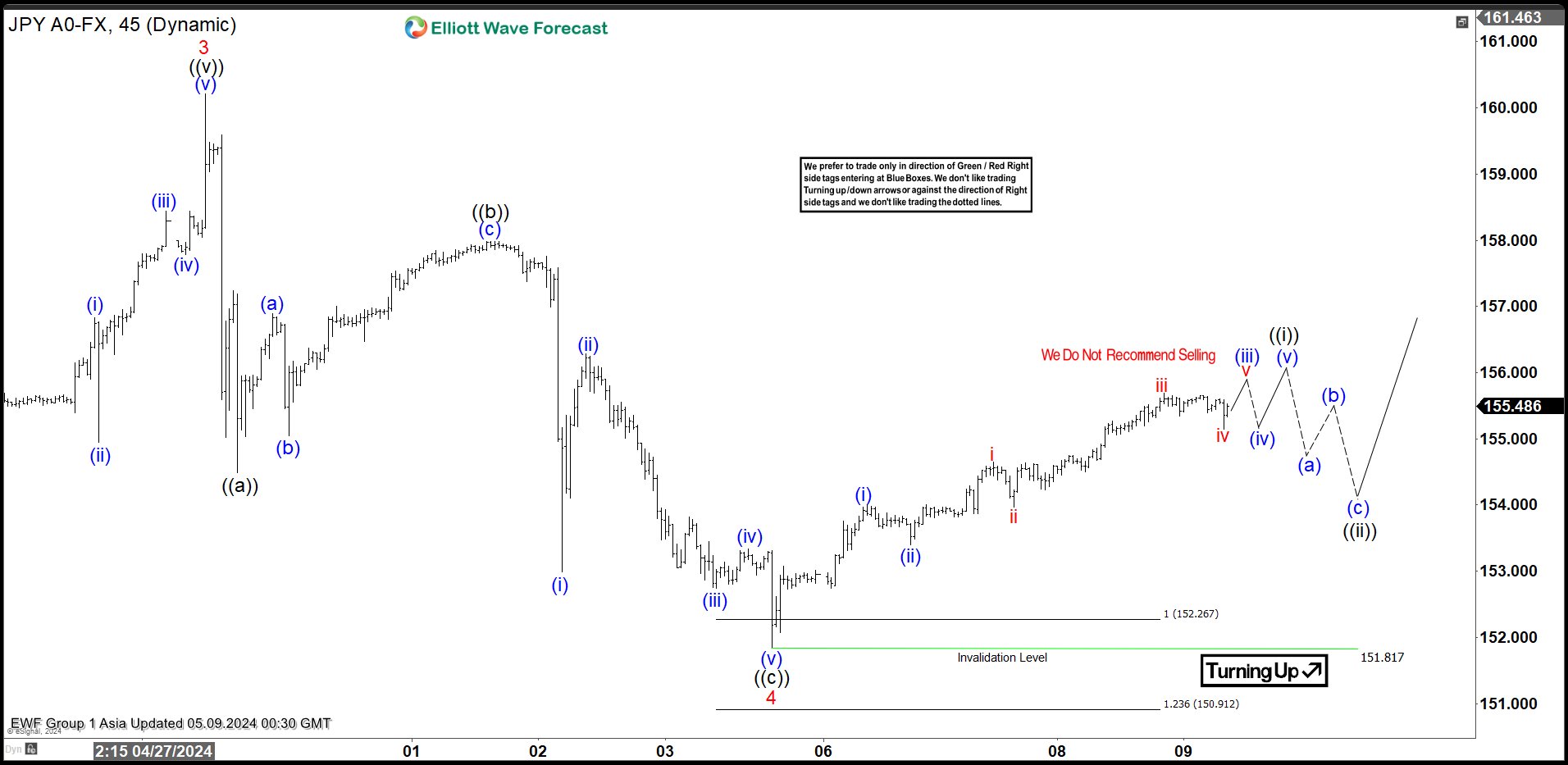

Elliott Wave Analysis on USDJPY Recovery Post BOJ Intervention

Read MoreUSDJPY has started a rally after the Bank of Japan (BOJ) intervention. This article and video look at the Elliott Wave path.

-

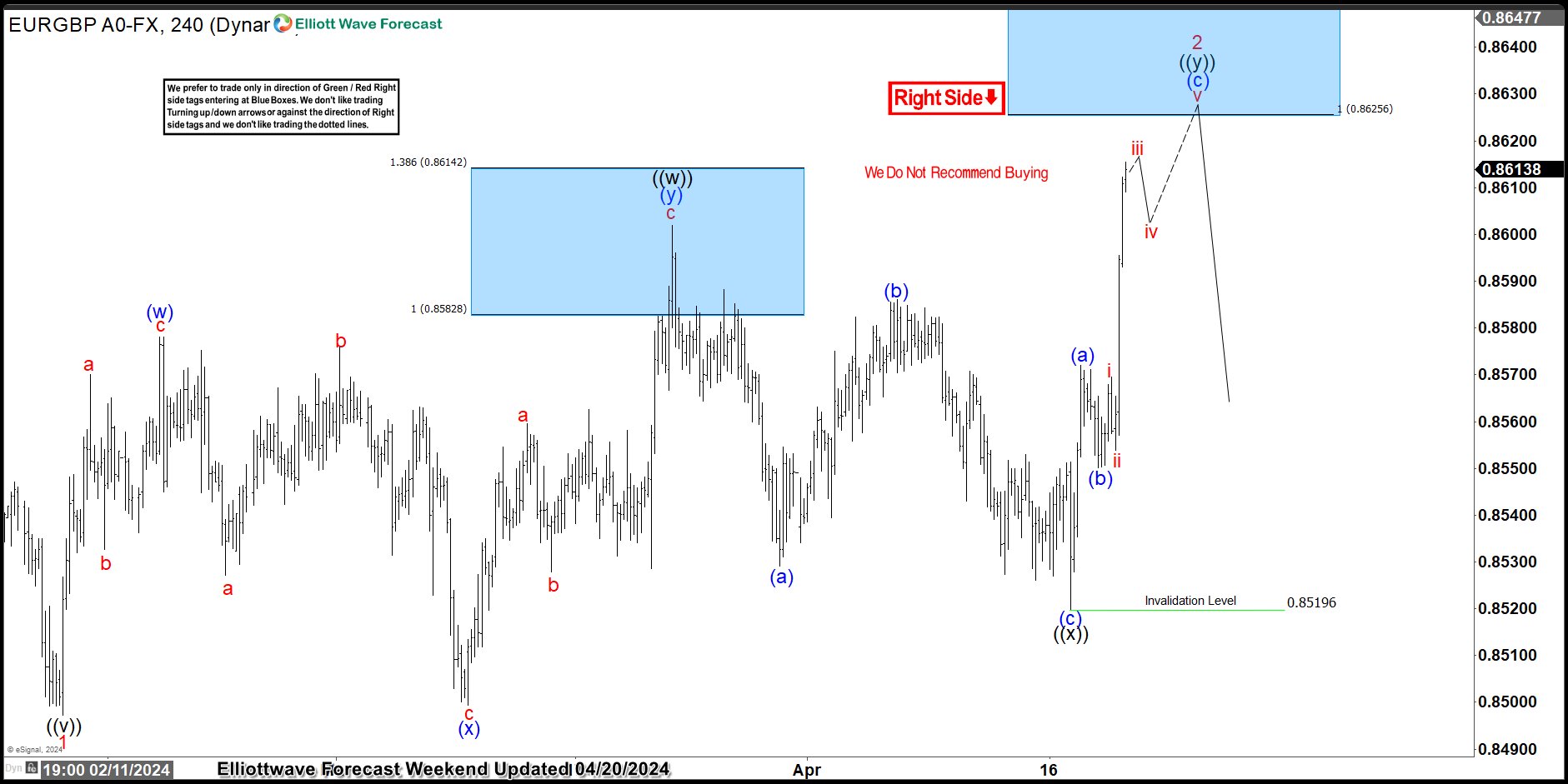

EURGBP Perfectly Reacting Lower From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 4-Hour Elliott Wave charts of EURGBP In which our members took advantage of the blue box areas.