In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Equal leg in AUD/JPY

Read MoreIn today’s trading environment, market seldom moves in 5 impulsive waves and 3 waves corrections like in the past. Today’s market is driven by High Frequency Trading and algos, and it moves in corrective manner most of the time with equal leg ABC or WXY ruling the market. In this blog, we will take a look at equal […]

-

AUDJPY Technical Update and Trade Plan

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:00 PM EST (5:00 PM BST), join Dan there for more insight into these proven methods of […]

-

USDJPY Technical Update and Trade Plan Update

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. USDJPY […]

-

USDJPY 240 min Technical Update and Trade Plan

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. This […]

-

AUDUSD: Elliott Wave analysis calling the 300 pips drop

Read MoreAt the begining of September 2014. our Elliott Wave analysis for AUDUSD was calling for the 300 pips drop. As we can see on this H4 EWF chart ,decline from the 0.95046 high was marked as complex double three structure – wave(A) which is done at 0.92354 and we were in in wave (B) recovery […]

-

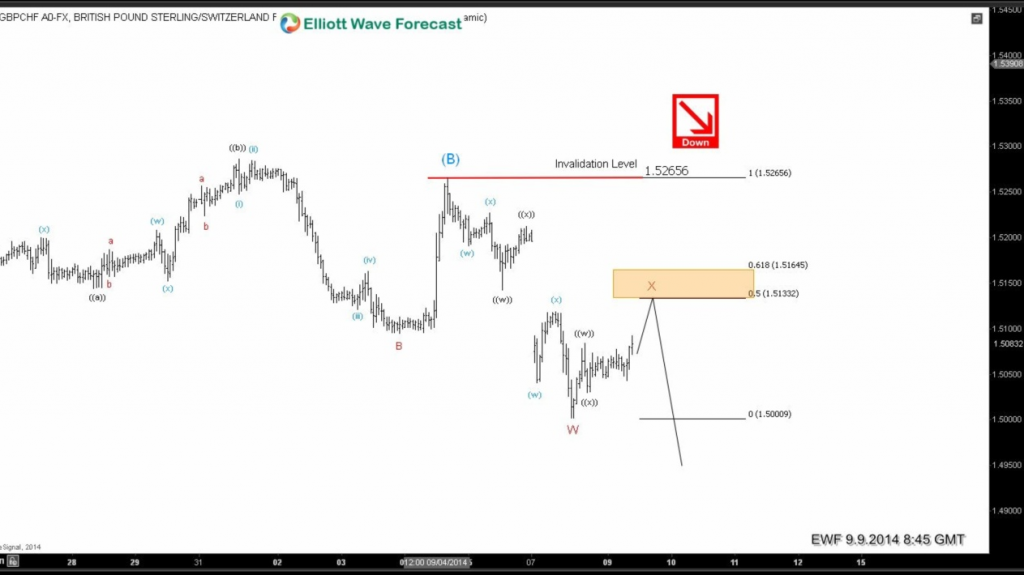

GBPCHF: Elliott Wave analysis calling the drop (Part 2)

Read More*** To view Part 1 click here > PART 1 *** Continuing from where we left off from part 1 of GBPCHF, another selling opportunity presented itself according to our Elliott Wave analysis. As you will see in the charts below we were calling for a sell off after the red wave X correction structure completed. […]