In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

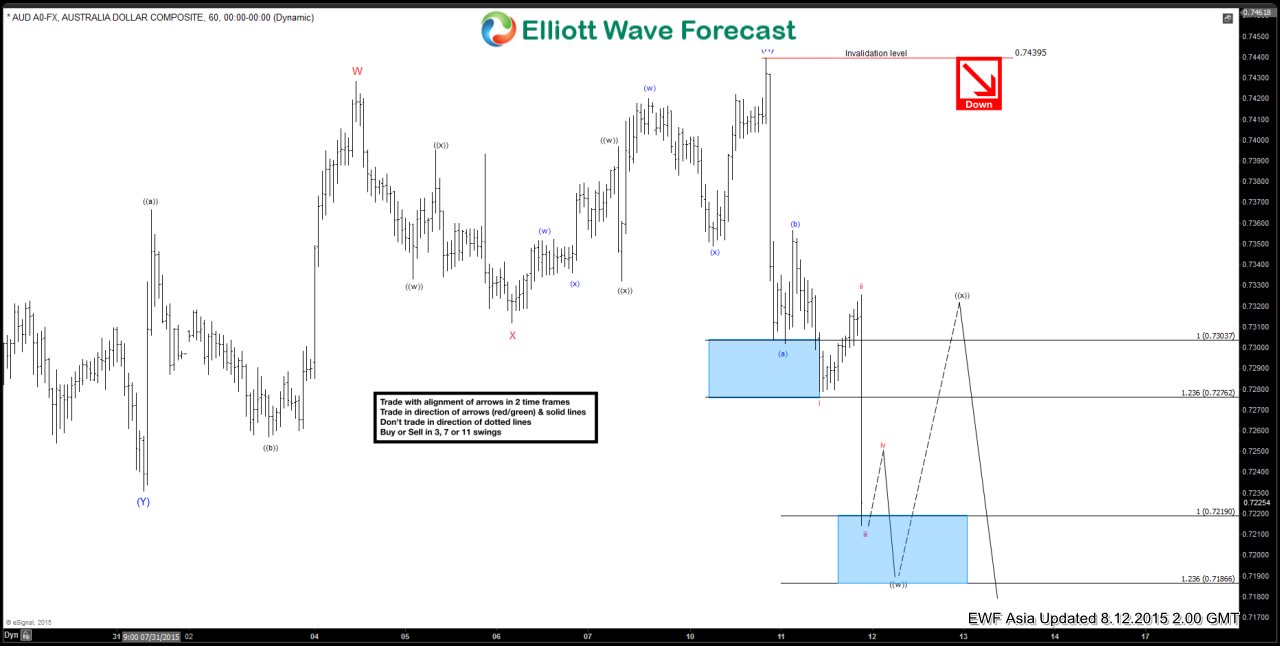

$AUD/USD Short Term Elliott Wave Analysis 8.12.2015

Read MoreRally to 0.7439 ended wave (X). Wave ((w)) decline from this level is unfolding in a zigzag structure where wave (a) ended at 0.73, wave (b) ended at 0.7356, and wave (c) of ((w)) is in progress as five waves and expected to complete with one more swing lower towards as low as 0.7186. The pair should […]

-

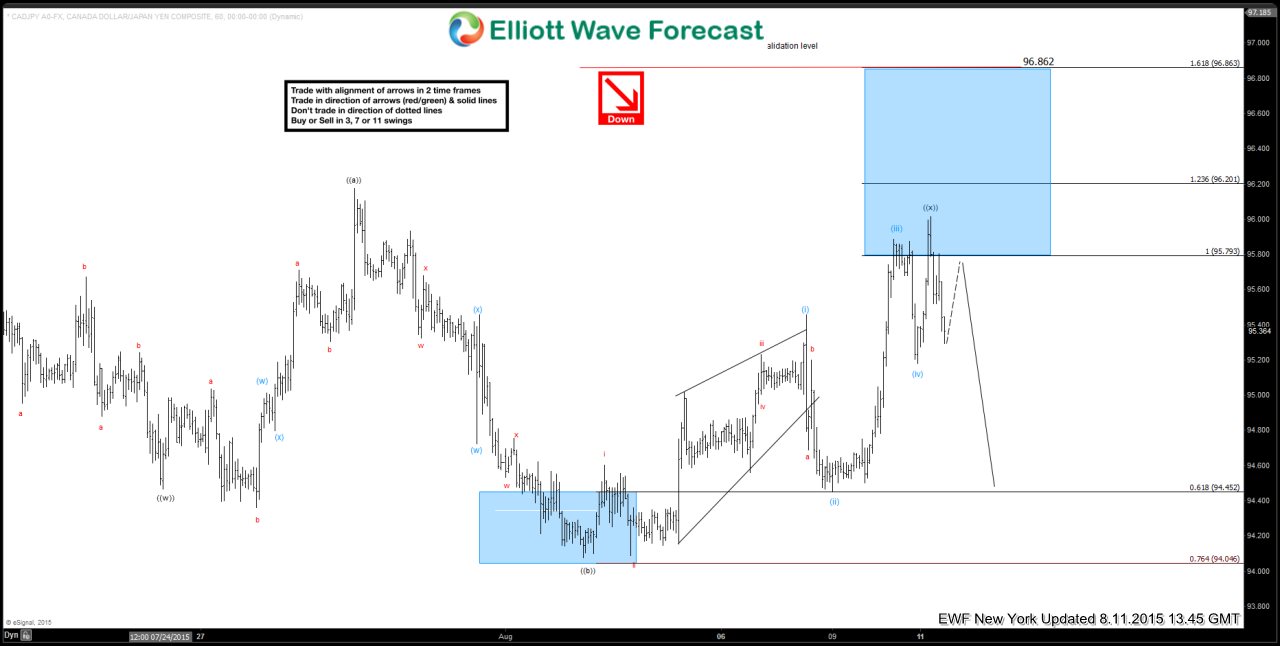

$CAD/JPY Short Term Elliott Wave Update 8.11.2015

Read MoreShort term Elliott Wave view suggests decline to 94.47 ended wave ((w)). Wave ((x)) bounce unfolded in the form of a FLAT structure where wave ((a)) ended at 96.17, wave ((b)) ended at 94.08, and wave ((c)) of ((x)) is proposed complete in 5 waves at 96.02. As far as price stays below 96.02, and more […]

-

$CAD/JPY Short Term Elliott Wave Update 8.7.2015

Read MoreShort term Elliott Wave view suggests wave ((w) decline from 96.18 is in progress and taking the form of a double three wxy where wave w ended at 94.09. Wave x bounce is currently in progress as a FLAT, and there’s enough swing to call it complete, but a marginal high still can’t be ruled out towards 95.37. Once wave x […]

-

$CAD/JPY Short Term Elliott Wave Update 8.6.2015

Read MoreShort term Elliott Wave view suggests wave ((w) decline from 96.16 is in progress and taking the form of a double three wxy where wave w ended at 94.09, wave x bounce is in progress and expected to complete at 94.94 – 95.37 as a FLAT, then it should turn lower one more leg in wave y towards 92.74 […]

-

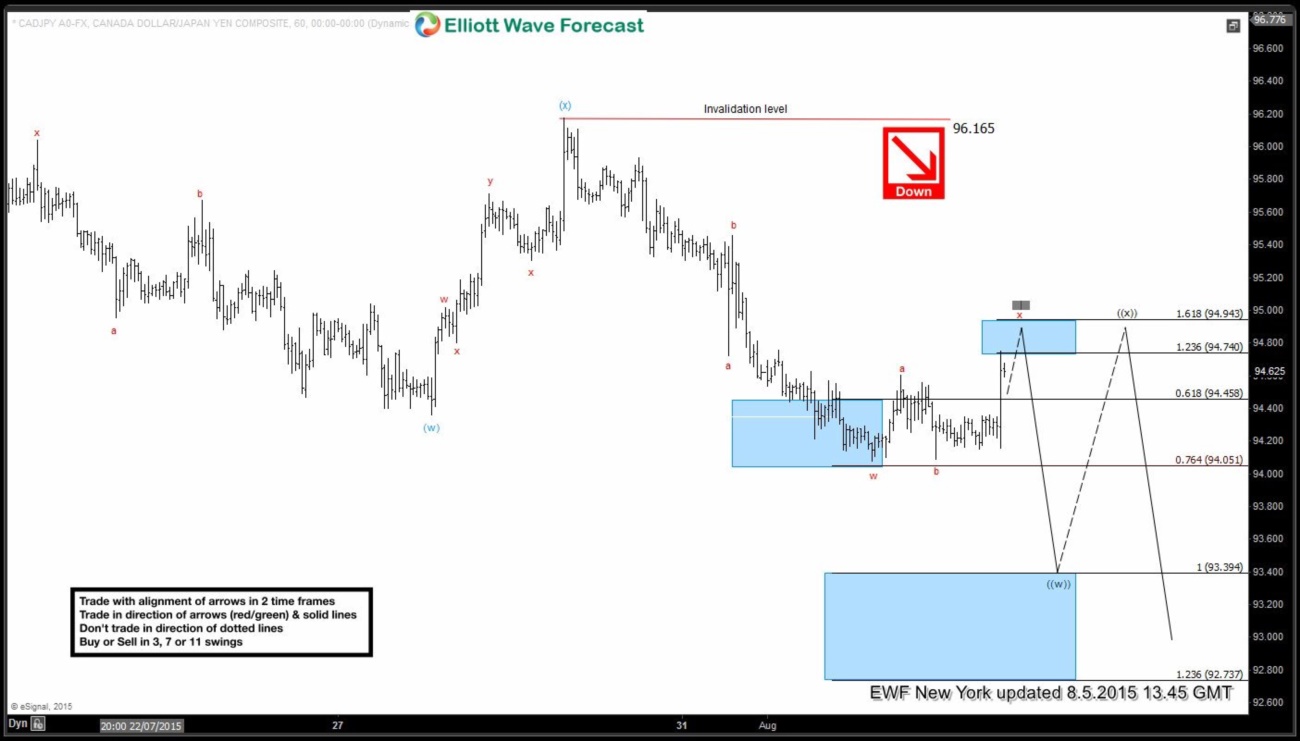

$CAD/JPY Short Term Elliott Wave Update 8.5.2015

Read MoreShort term Elliott Wave view suggests wave ((w)) decline from 96.16 is in progress and taking the form of a double three wxy where wave w ended at 94.09, wave x bounce is in progress and expected to complete at 94.74 – 94.94, then it should turn lower one more leg in wave y towards 92.74 – 93.4 […]

-

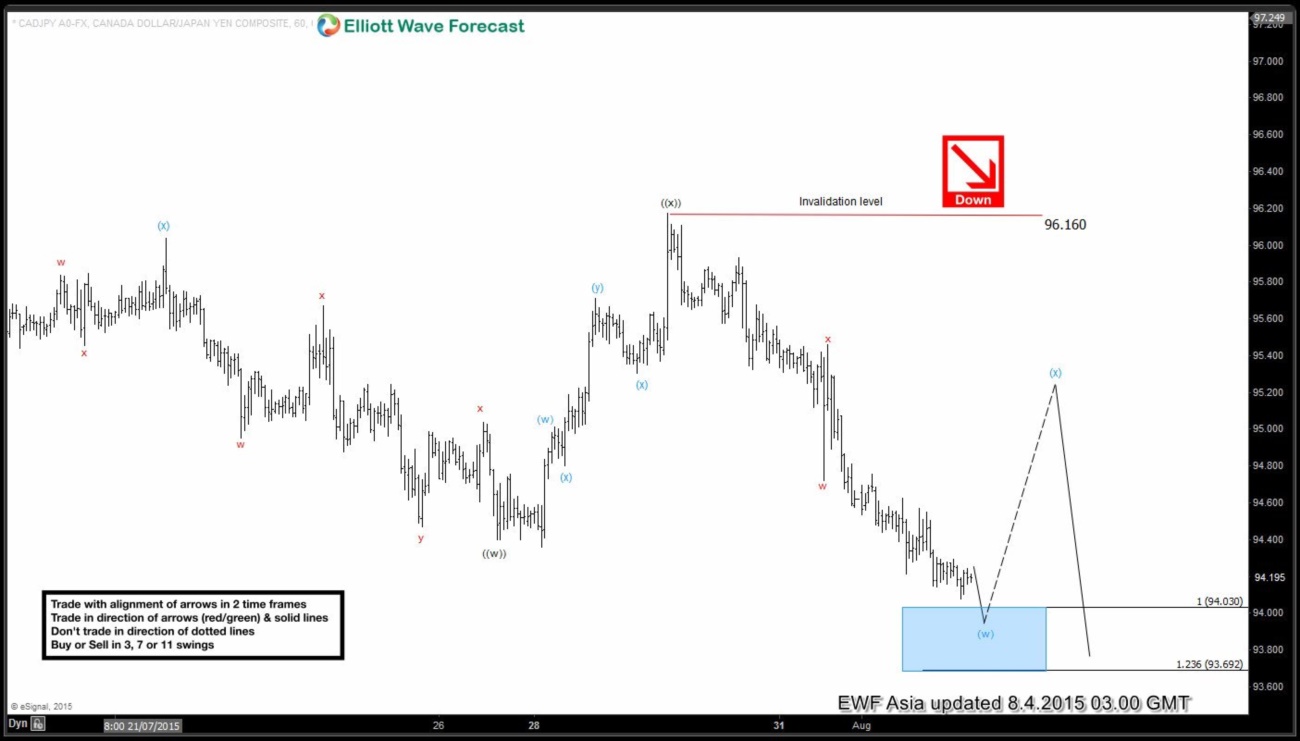

$CAD/JPY Short Term Elliott Wave Update 8.4.2015

Read MoreThe short term Elliott Wave structure suggests the pair should be closing in on the completion of the blue (w) into the 94.00 handle. We expect the pair to rally in a corrective 3, 7, or 11 wave structure off this inflection zone to form blue (x) wave higher in the near term. This three […]