In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

$AUDCAD Medium Term Elliottwave Analysis 9.29.2015

Read MoreThis is a medium term Elliottwave Analysis video on $AUDCAD. Wave (X) bounce is likely still in progress to correct the decline from 1.0345, and more downside is likely after wave (X) bounce is complete. As more downside is still expected at a later stage, we don’t like buying the proposed wave (X) bounce. EWF currently covers […]

-

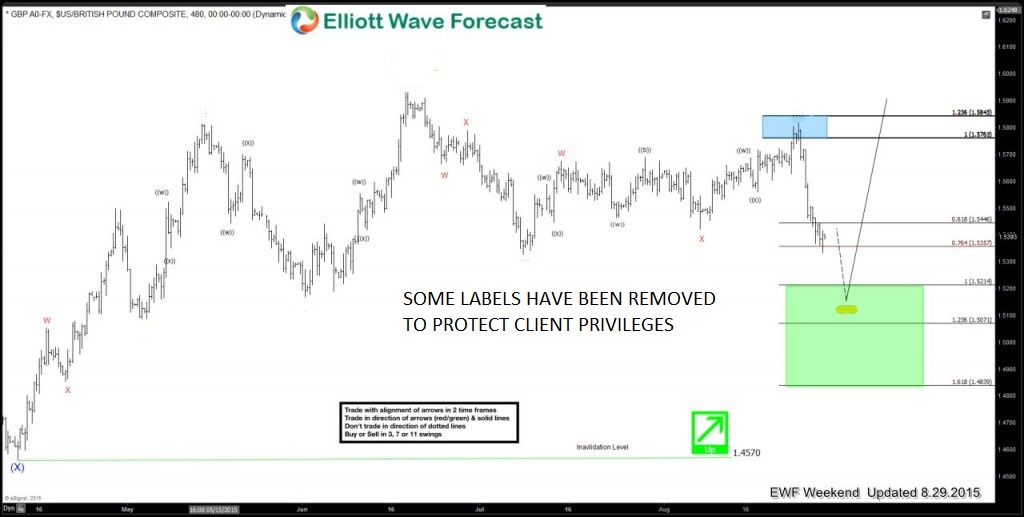

GBPUSD: Anticipating the Bounce for a Swing Move Higher

Read MoreAt EWF we are not just a market forecasting service, we also try to guide our clients to trade on the right side of the markets. And if our 24 hour chatroom, technical and trade setup videos, live analysis sessions, live trading room, educational videos and market reports are not enough enough, we also added Green Boxes(Buy […]

-

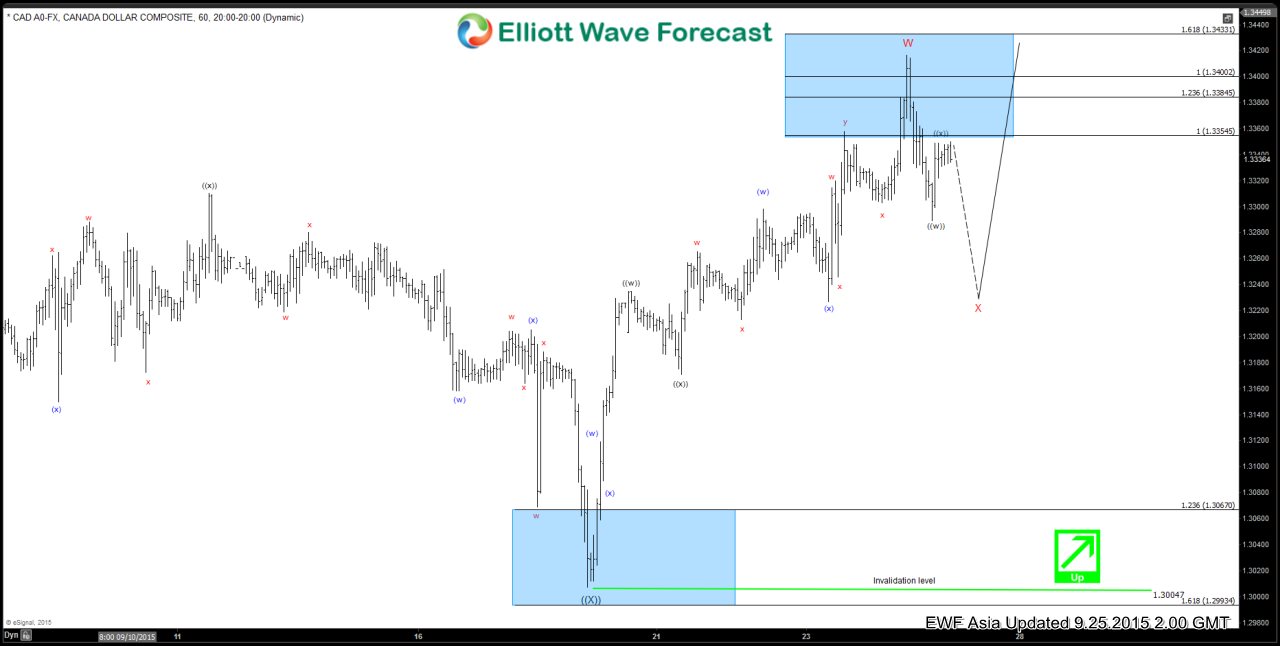

USDCAD Short Term Elliott Wave Update 9.25.2015

Read MoreBest reading of the Elliottwave cycle suggests wave ((W)) ended at 1.3353. Decline from this level ended at 1.3 as wave ((X)). The rally higher from 1.3 unfolded as a double three structure ((w))-((x))-((y)) where wave ((w)) ended at 1.33, wave ((x)) ended at 1.317, and wave ((y)) of W ended at 1.341. Wave X pullback […]

-

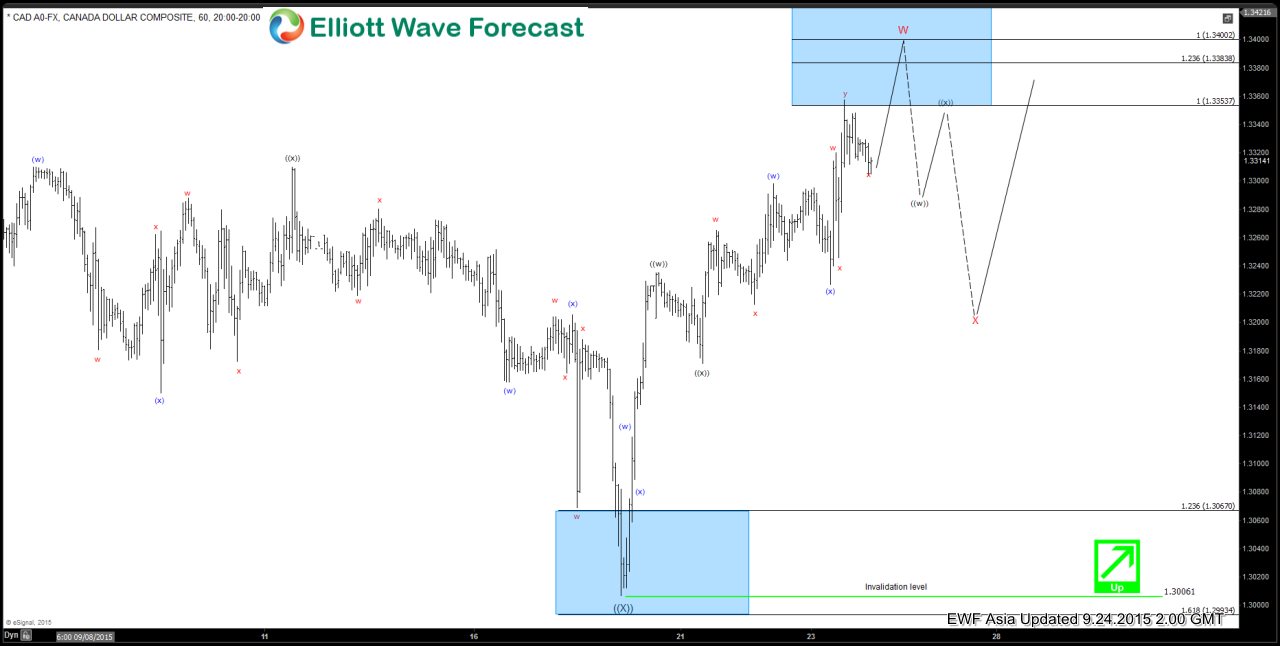

USDCAD Short Term Elliott Wave Analysis 9.24.2015

Read MoreCurrent best reading of the Elliottwave cycle suggests wave ((W)) ended at 1.3353. Decline from this level ended at 1.3 as wave ((X)). The rally higher from 1.3 is unfolding as a double three structure ((w))-((x))-((y)) where wave ((w)) ended at 1.33, wave ((x)) ended at 1.317, and wave ((y)) is in progress towards 1.338 […]

-

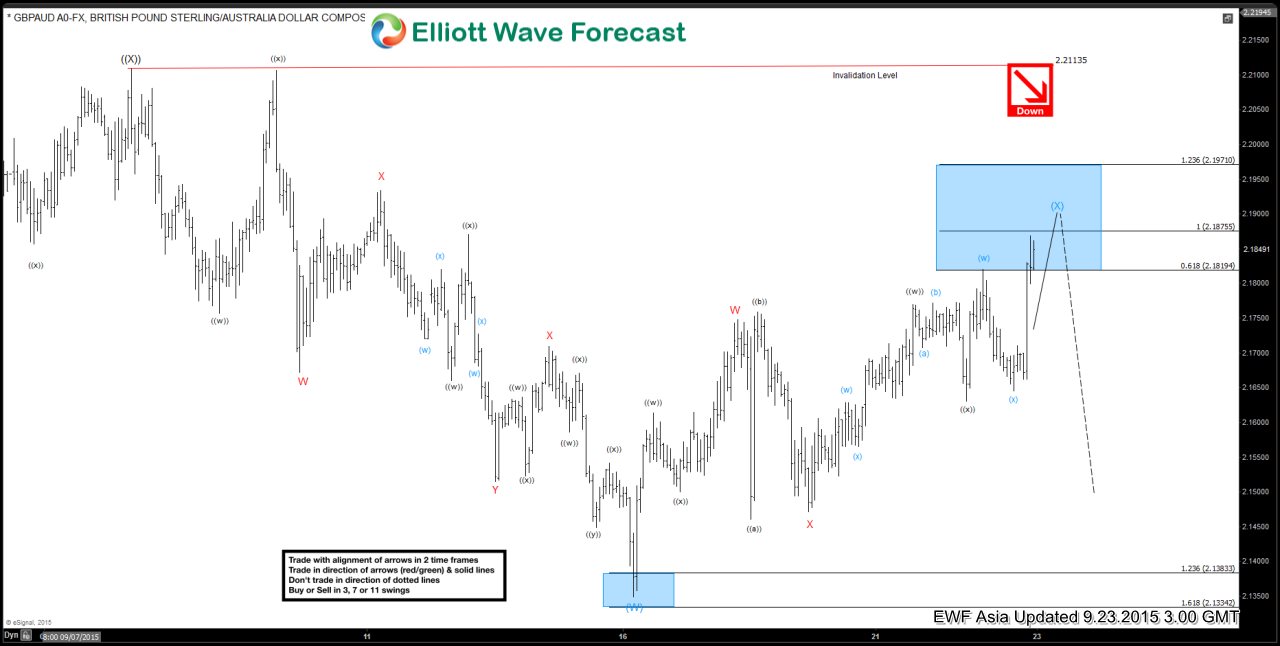

GBPAUD Short Term Elliott Wave Update 9.23.2015

Read MoreShort term Elliottwave view suggests the decline from wave ((X)) at 2.21 unfolded in a triple three structure WXYZ where wave W ended at 2.167, wave X ended at 2.193, wave Y ended at 2.151, second wave X ended at 2.17, and wave Z of (W) ended at 2.135. Wave (X) bounce is currently in progress as a double […]

-

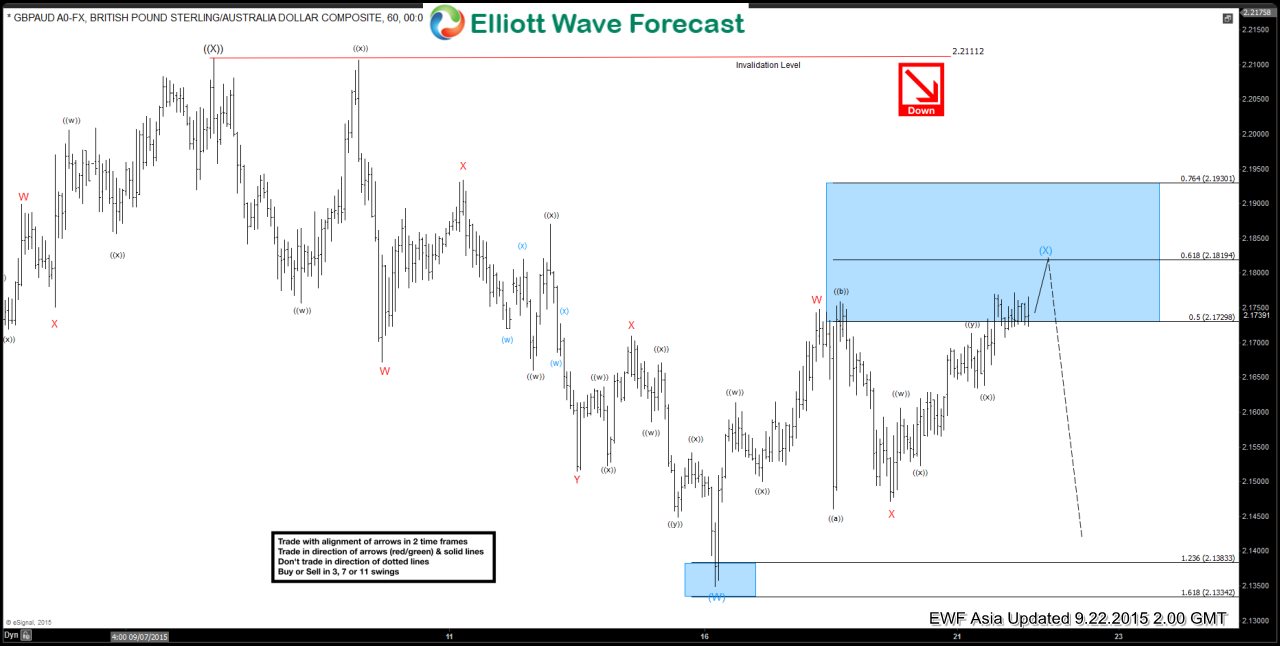

GBPAUD Short Term Elliott Wave Update 9.22.2015

Read MoreShort term Elliottwave view suggests the decline from wave ((X)) at 2.21 unfolded in a triple three structure WXYZ where wave W ended at 2.167, wave X ended at 2.193, wave Y ended at 2.151, second wave X ended at 2.17, and wave Z of (W) ended at 2.135. Wave (X) bounce is currently in progress as a double […]