In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

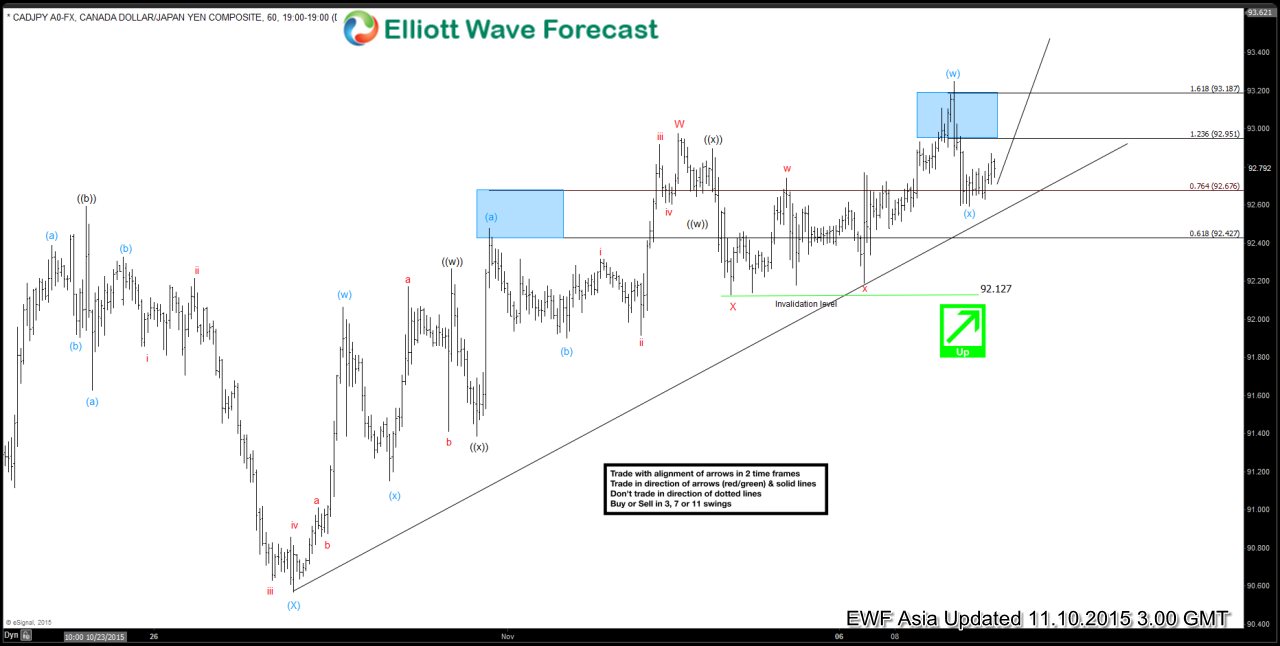

CADJPY Short Term Elliott Wave Analysis 11.10.2015

Read MoreBest reading of the Elliott Wave cycle suggests there are 5 swings from wave (X) low at 10/28 and another swing higher is ideal to complete a 7 swing structure as far as 92.12 pivot stays intact. Rally from wave (X) low at 90.56 is unfolding in a double three structure where wave W ended at 92.97, […]

-

Forecasting the weakness in $GBP before BoE announcement

Read MoreHere in Elliott Wave Forecast, we don’t pay attention to the news and we believe that Fundamentals are used to justify the moves that have happened already. As EWF members already know, our forecasts are pure technicals, based on Elliott Wave theory, Cycles, Fibonacci levels,Market Correlations and proprietary Pivot system. Last week during the 11.05 […]

-

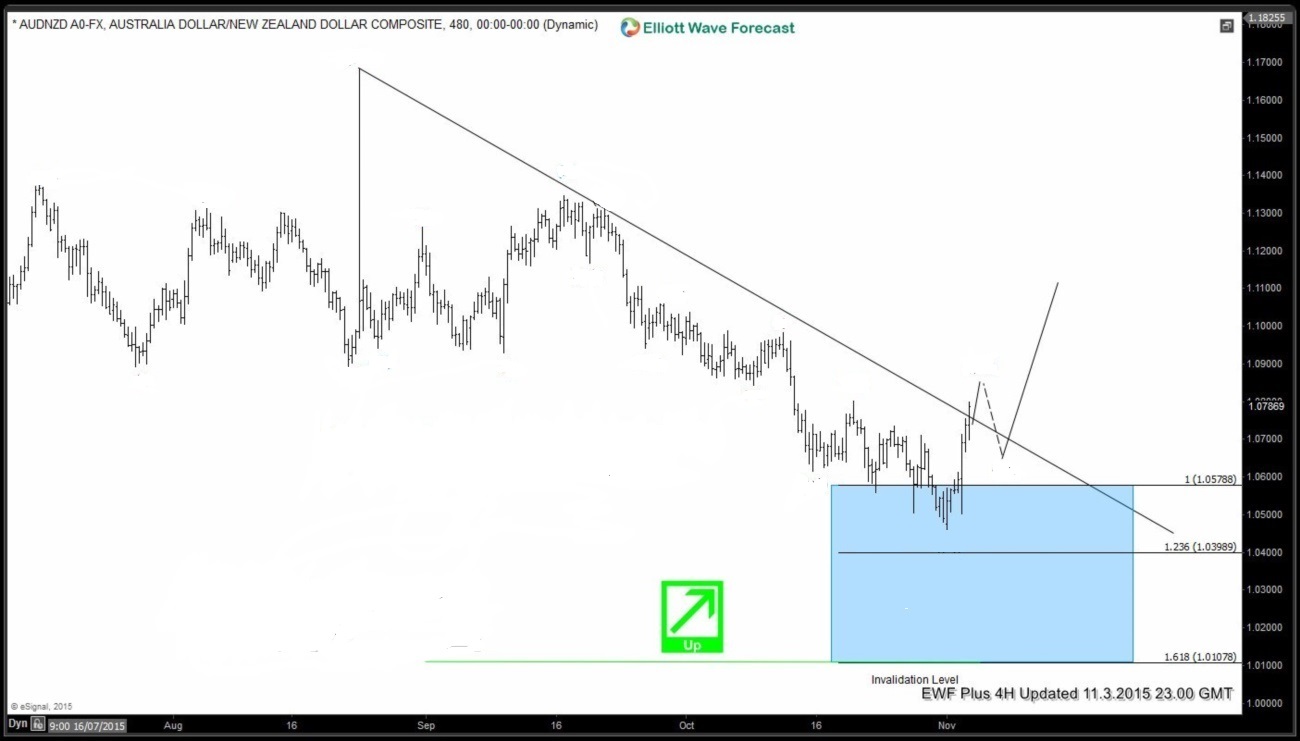

AUDNZD : Scenario for Another Swing Higher

Read MoreAUDNZD has been moving lower since August 24/2015 and it’s possible that the pair has found a temporary bottom at the 1.0446 October 30 low. The pair has since bounced and on November 3/2015 it made a rally to break above the trend line which can possibly be signalling that more Aussie strength against the […]

-

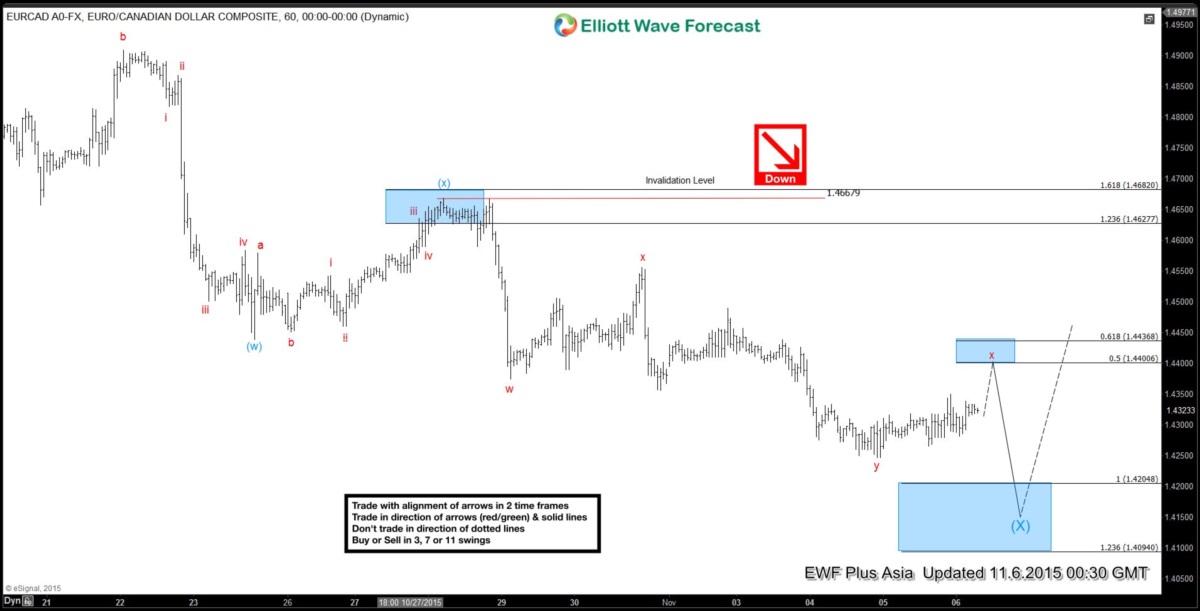

EURCAD Short Term Elliott Wave Analysis 11.06.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a triple three, where wave w ended at 1.4374, wave x ended at 1.455, wave y ended at 1.4247, and second […]

-

Will NFP help US Dollar break out higher?

Read MoreUS Dollar Bulls: Don’t Run before you Walk! US Dollar has been trending higher since making marginal new lows in the daily chart on 8.24.2015. It is also closing in on 8.7.2015 peak, a break above that and the only hurdle left to break out higher would be 3.13.2015 peak. We keep hearing that FED could […]

-

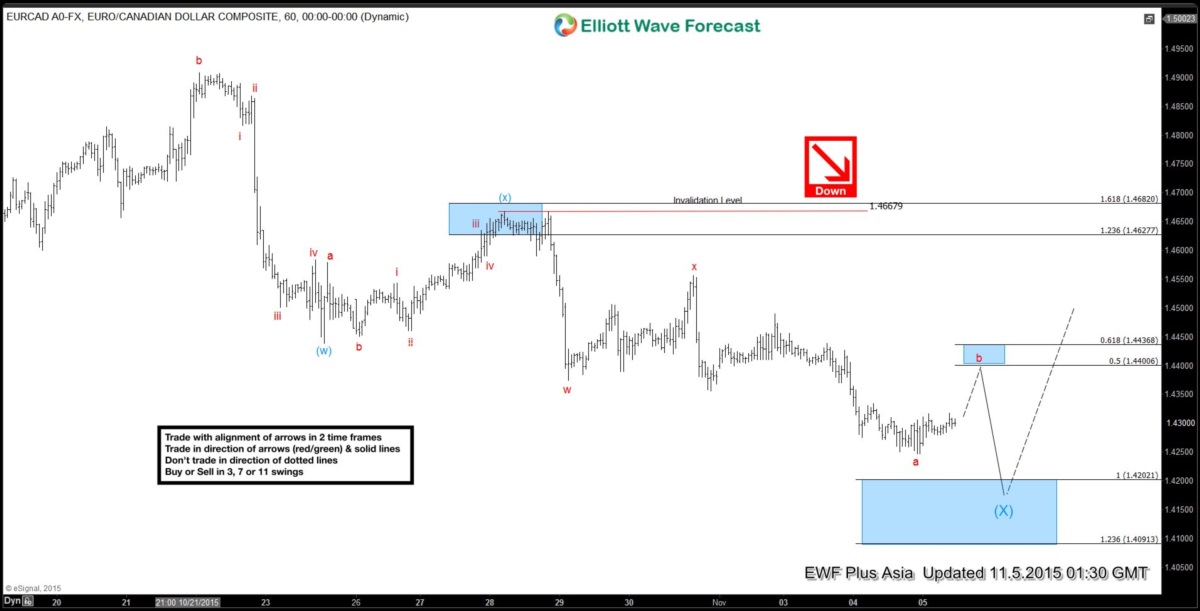

EURCAD Short Term Elliott Wave Analysis 11.05.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a triple three, where wave w ended at 1.4374, wave x ended at 1.455, wave y ended at 1.4247, and second […]