In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

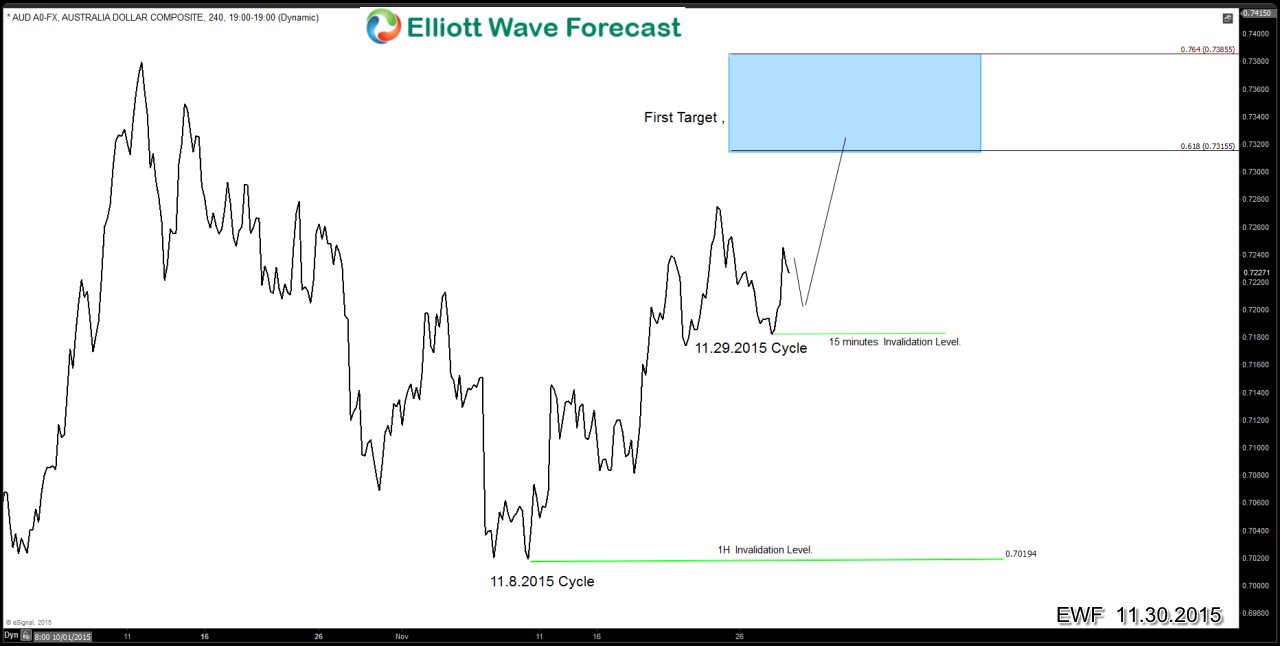

RBA Rate Decision & AUDUSD

Read More– RBA Rate Decision (Dec 1): 10:30 PM EST / 3:30 PM GMT Australia’s Reserve Bank is due to interest Rate Decision in few hours and while Market anticipates official cash rate to hold stable at 2.00%, Traders will be looking for the Statement Release scheduled at 03:30 UTC Time, concerning the RBA’s monetary policy and […]

-

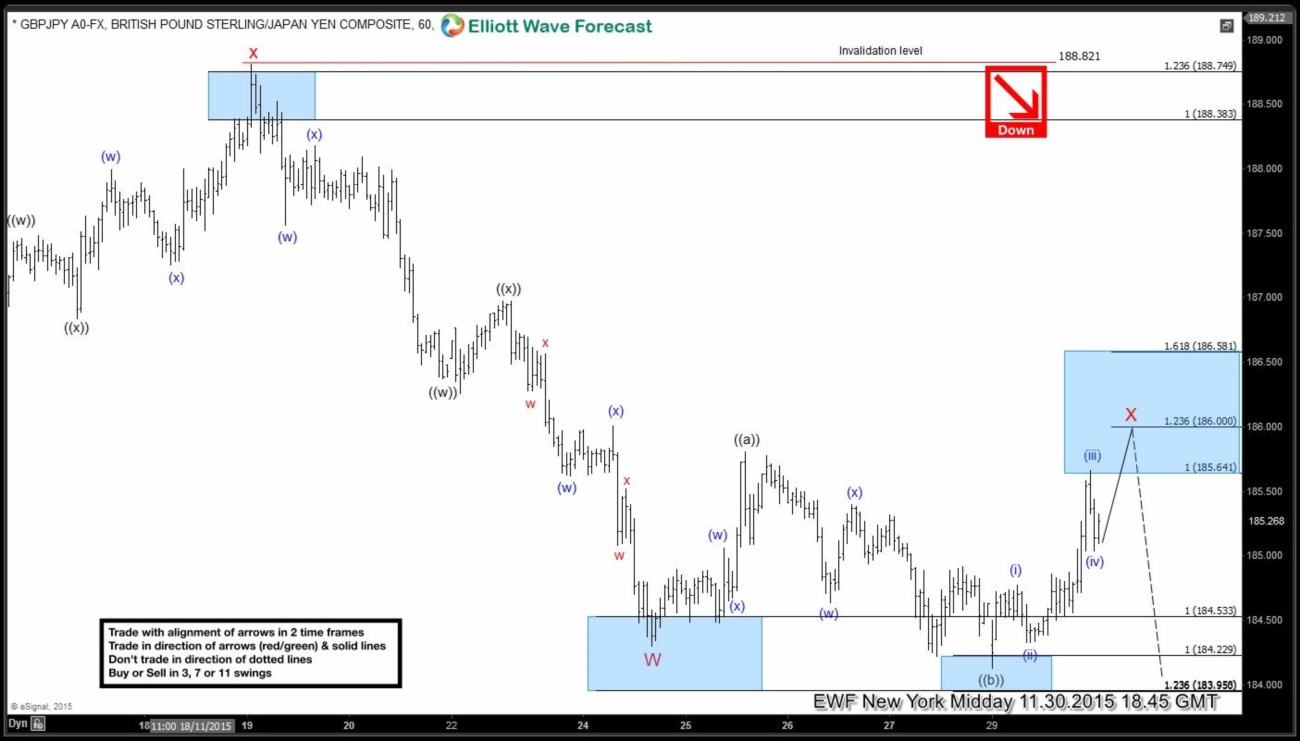

$GBPJPY Trading Plan Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. GBP/JPY Live Trading […]

-

USDX and USDPLN | Technical & Fundamental Outlook

Read MoreThursday December 03 2015 – ECB Interest Rate Decision 14.45 – ECB Monetary Policy Statement and Press Conference 15.30 Friday December 04 2015 – European Gross Domestic Product (Q3 and YoY) – US Average Hourly Earnings – US Unemployment Rate – US Non-Farm Payrolls Wednesday December 16 2015 – FOMC ECB Monetary Policy Statement and […]

-

EURGBP Short Term Elliott Wave Update 11.20.2015

Read MoreShort term reading of the Elliott Wave cycle suggests decline to 0.705 ended wave (W) and bounce to 0.7197 ended wave (X). From this level, pair has resumed the decline lower in a double three structure where wave W ended at 0.7038, wave X ended at 0.711, and wave Y is in progress. Internal of wave Y is unfolding as a […]

-

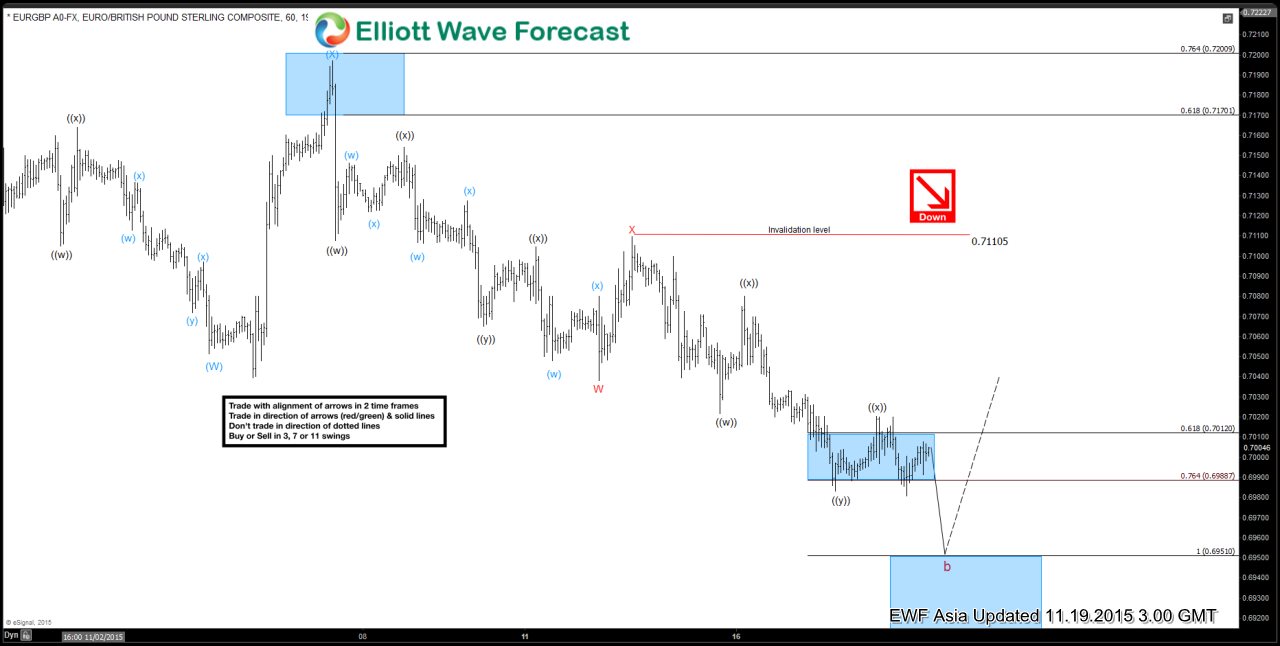

EURGBP Short Term Elliott Wave Update 11.19.2015

Read MoreShort term reading of the Elliott Wave cycle suggests decline to 0.705 ended wave (W) and bounce to 0.7197 ended wave (X). From this level, pair has resumed the decline lower in a double three structure where wave W ended at 0.7038, wave X ended at 0.711, and wave Y is in progress. Internal of wave Y is unfolding as a […]

-

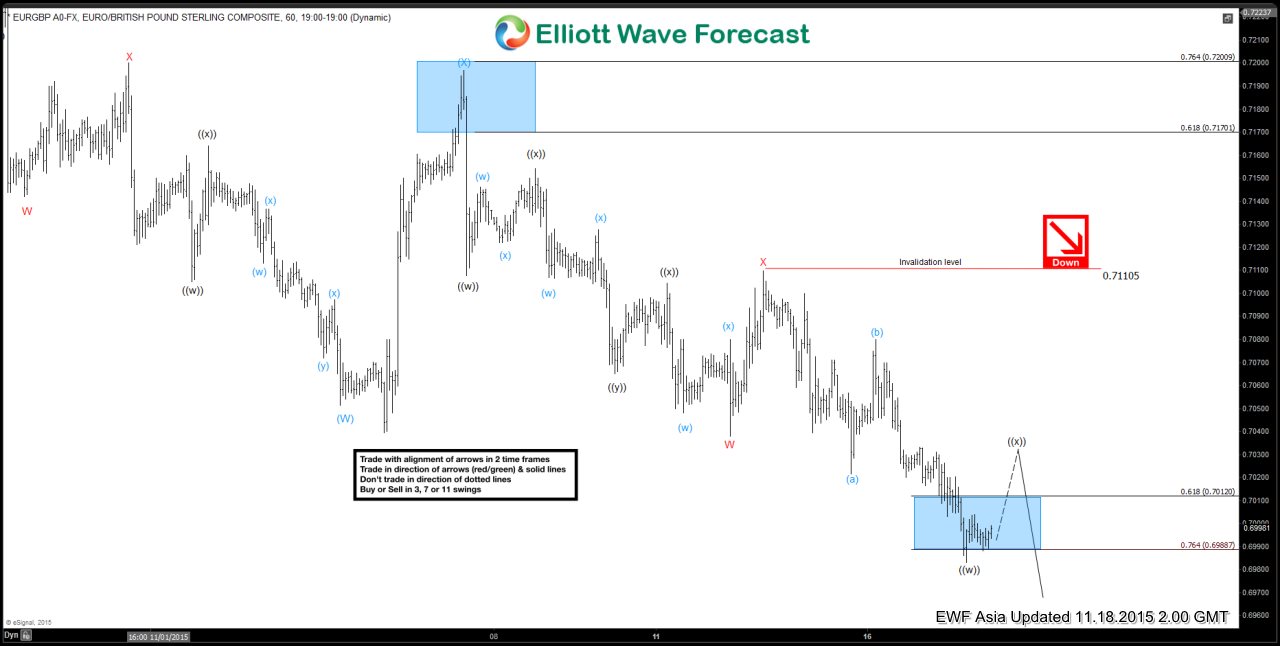

EURGBP Short Term Elliott Wave Update 11.18.2015

Read MoreShort term reading of the Elliott Wave cycle suggests decline to 0.705 ended wave (W) and bounce to 0.7197 ended wave (X). From this level, pair has resumed the decline lower in a double three structure where wave W ended at 0.7038, wave X ended at 0.711, and wave Y is in progress. Internal of wave Y is unfolding as a […]