In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

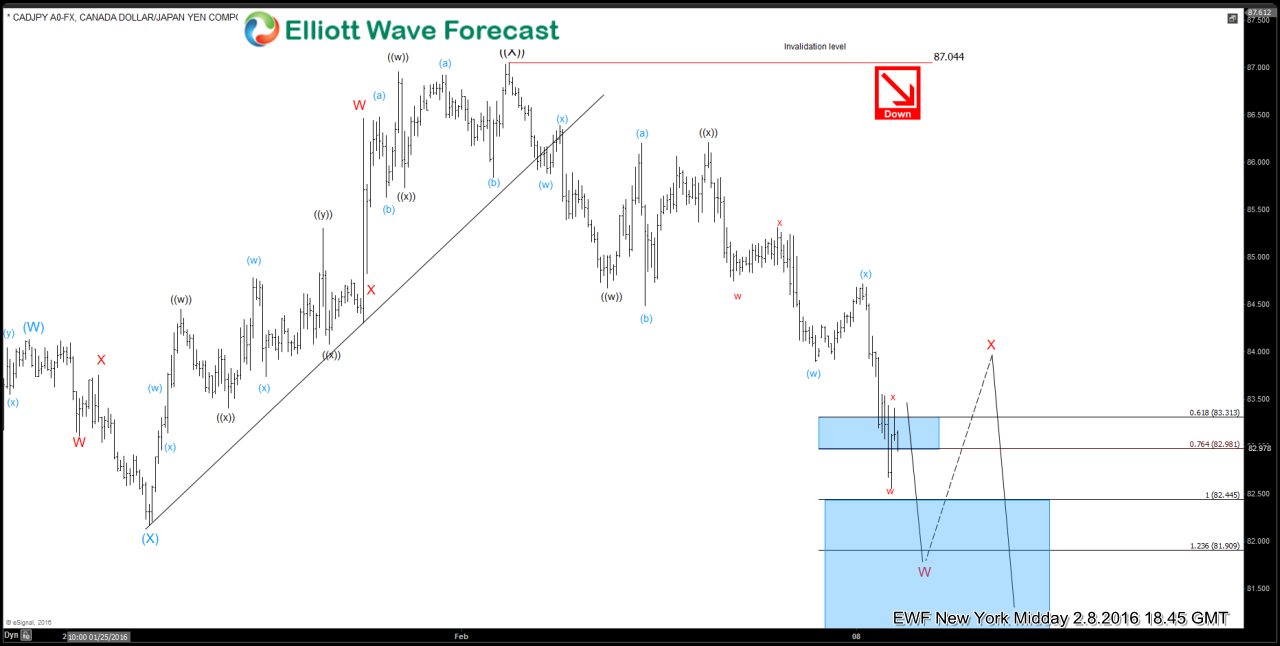

$CADJPY Short Term Elliott Wave Analysis 02.08.2016

Read MoreShort term Elliottwave structure suggests wave ((X)) bounce ended at 87.06. From this level, pair turned lower in a double three structure where wave ((w)) ended at 84.67, wave ((x)) FLAT ended at 86.2, and pair has resumed lower in wave ((y)). Equal legs of (w)-(x) in ((y)) comes at 82.44 which is where a cycle […]

-

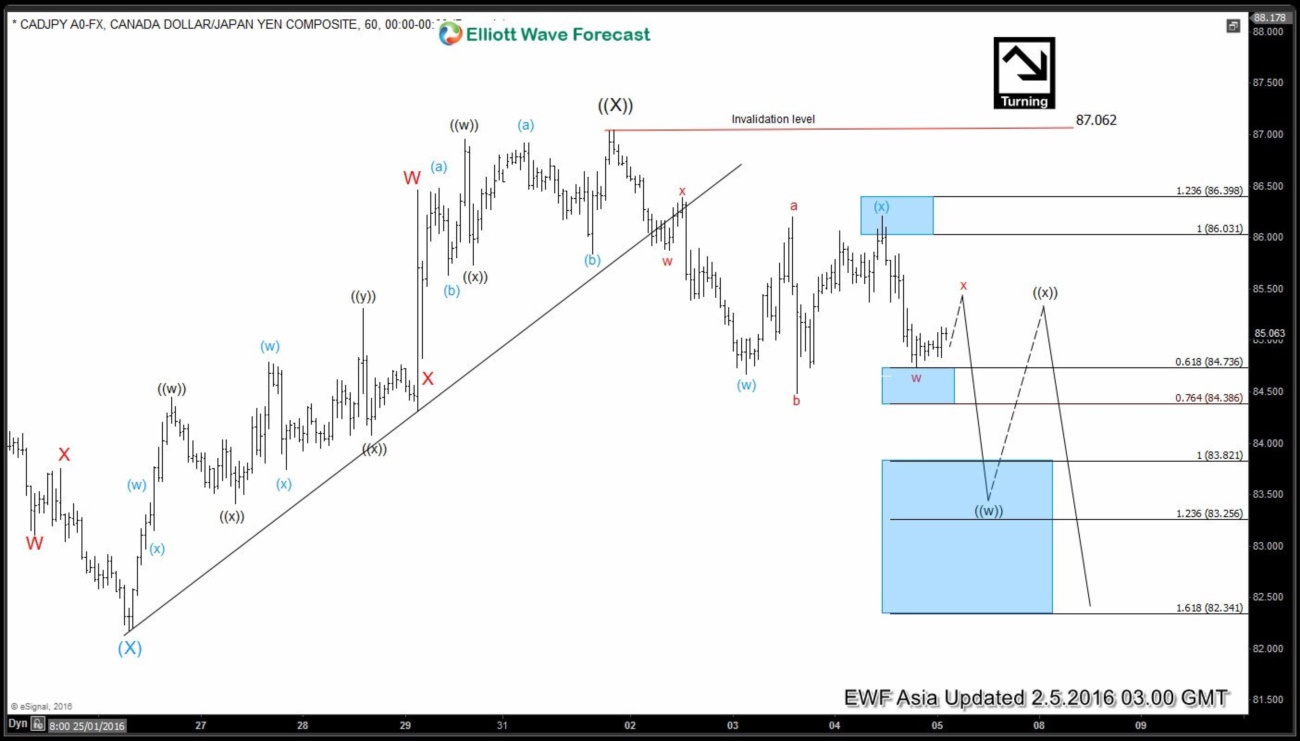

$CADJPY Short Term Elliott Wave Analysis 02.05.2016

Read MoreShort term Elliottwave structure suggests wave ((X)) bounce ended at 87.06. From this level, pair turned lower in a double three structure where wave (w) ended at 84.67, wave (x) FLAT ended at 86.2, and pair has resumed lower in wave (y). Bounces now are expected to stay below 86.2, but more importantly below 87.06, for […]

-

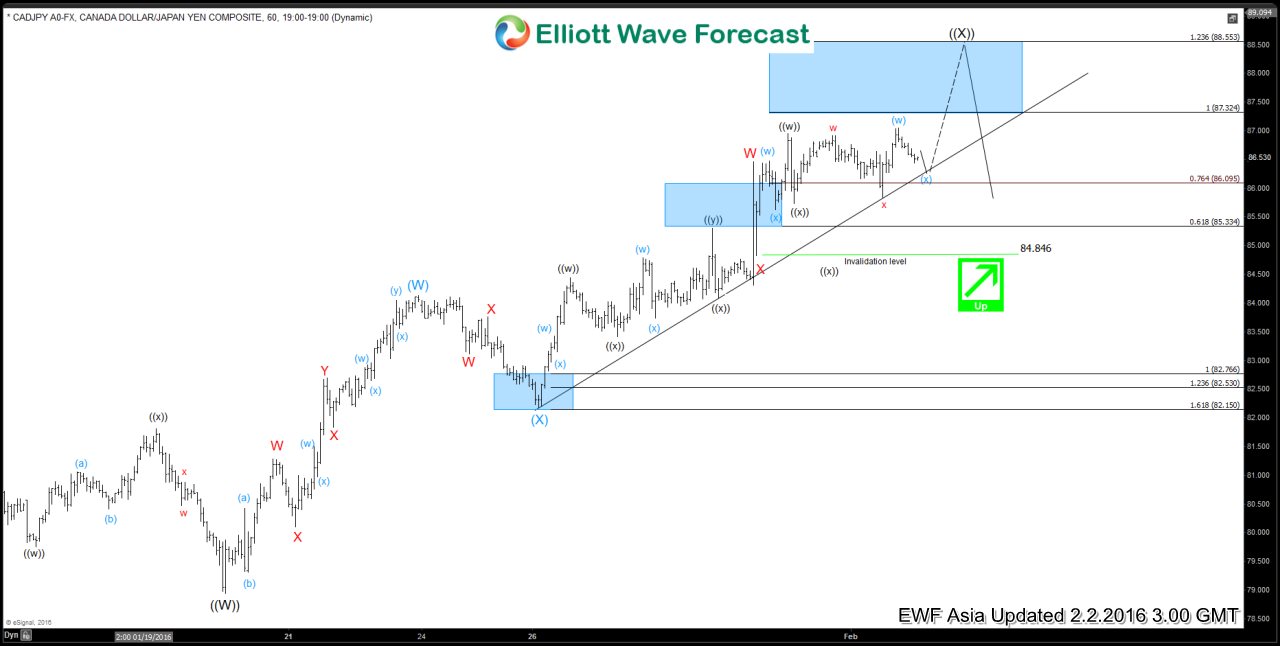

$CADJPY Short Term Elliott Wave Analysis 02.04.2016

Read MoreShort term Elliottwave structure suggests decline to 78.93 at 1/20 ended wave ((W)) and wave ((X)) bounce is unfolding as a double three (W)-(X)-(Y) structure where wave (W) ended at 84.1, wave (X) ended at 82.17, and wave (Y) of ((X)) ended at 87.03. From this level, pair turned lower in a double three where […]

-

$CADJPY Short Term Elliott Wave Analysis 02.03.2016

Read MoreShort term Elliottwave structure suggests decline to 78.93 at 1/20 ended wave ((W)) and wave ((X)) bounce is unfolding as a double three (W)-(X)-(Y) structure where wave (W) ended at 84.1, wave (X) ended at 82.17, and wave (Y) of ((X)) ended at 87.03. Bounces are now expected to stay below 87.03 for at least another […]

-

$CADJPY Short Term Elliott Wave Analysis 02.02.2016

Read MoreShort term Elliottwave structure suggests decline to 78.93 at 1/20 ended wave ((W)). From this level, wave ((X)) bounce is unfolding in a double three structure where wave (W) ended at 84.12, wave (X) ended at 82.17, and wave (Y) is in progress towards 87.3 – 88.55 area to end the cycle from 1/20 low. Near term, while pullback stays […]

-

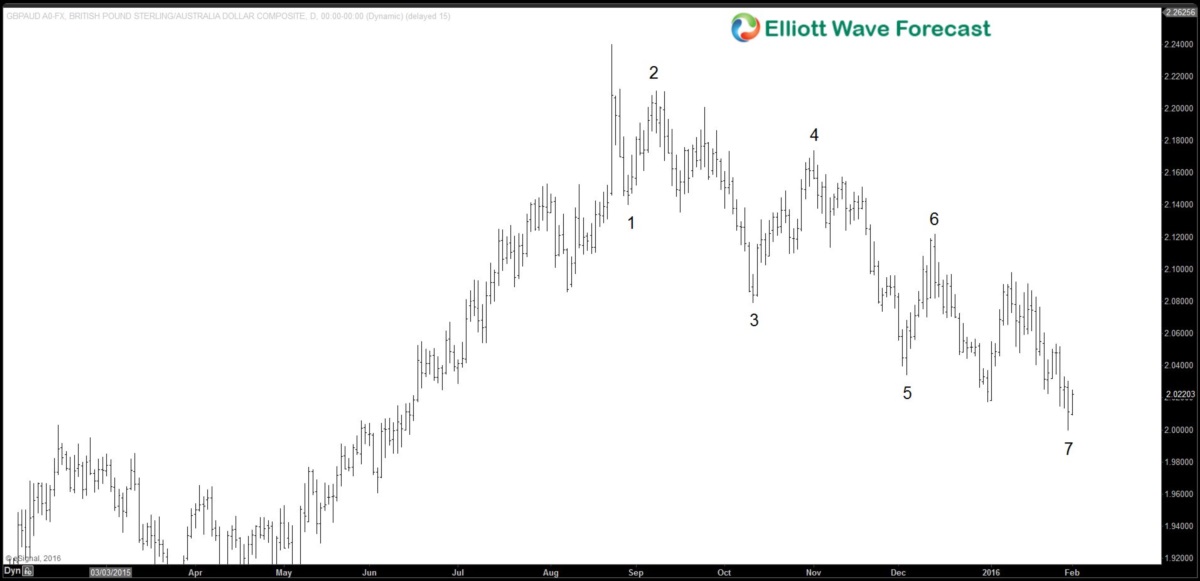

UK’s demands addressed this month: impact on Poundsterling?

Read MoreWe argued in our article on Dec 30, 2015 titled Will Euro Referendum and Brexit affect GBP that Poundsterling can perform poorly in 2016 due to the domestic and political uncertainty surrounding U.K’s membership in the European Union (Brexit). For brief background about the Brexit issue, you can read the old article from the link above. In the same article, we pick $GBPJPY to extend […]