In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

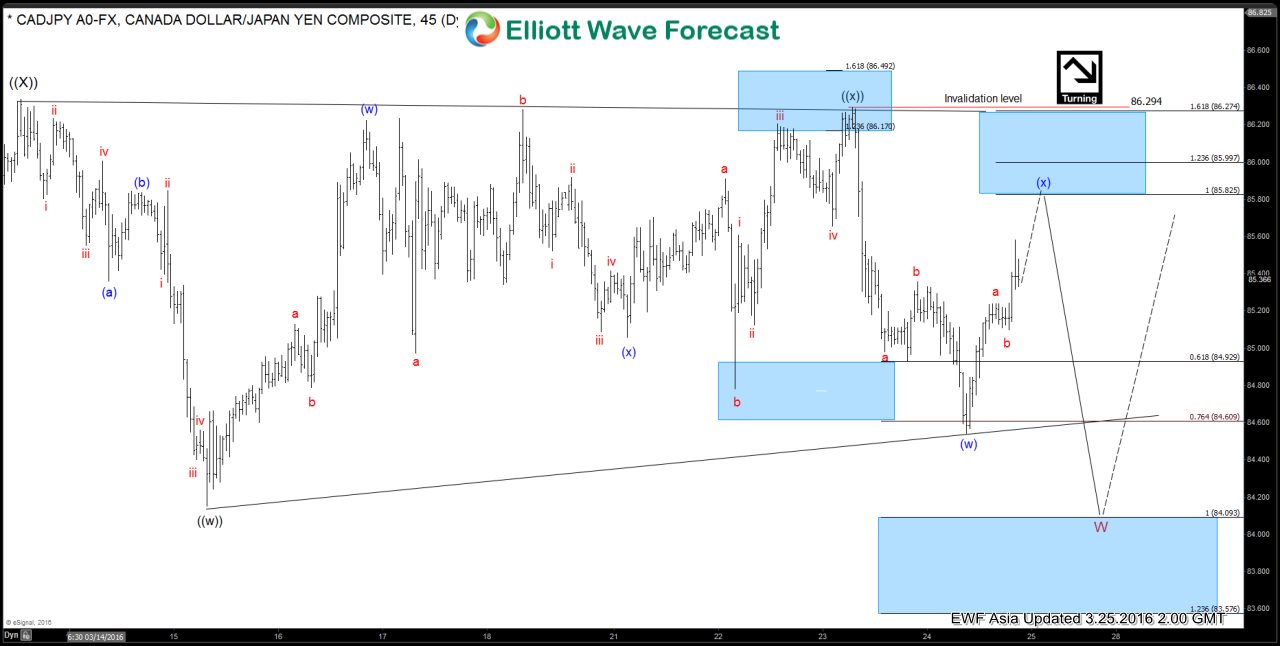

$CADJPY Short-term Elliott Wave Analysis 3.25.2016

Read MoreShort term Elliottwave structure suggests dips to 84.15 ended wave ((w)) and wave ((x)) bounce is proposed complete at 86.3 as a double correction. From 86.3 wave ((x)) high, pair has resumed lower with wave (w) ended at 84.54 and wave (x) bounce is currently in progress towards 85.82 – 86 area before the decline resumes […]

-

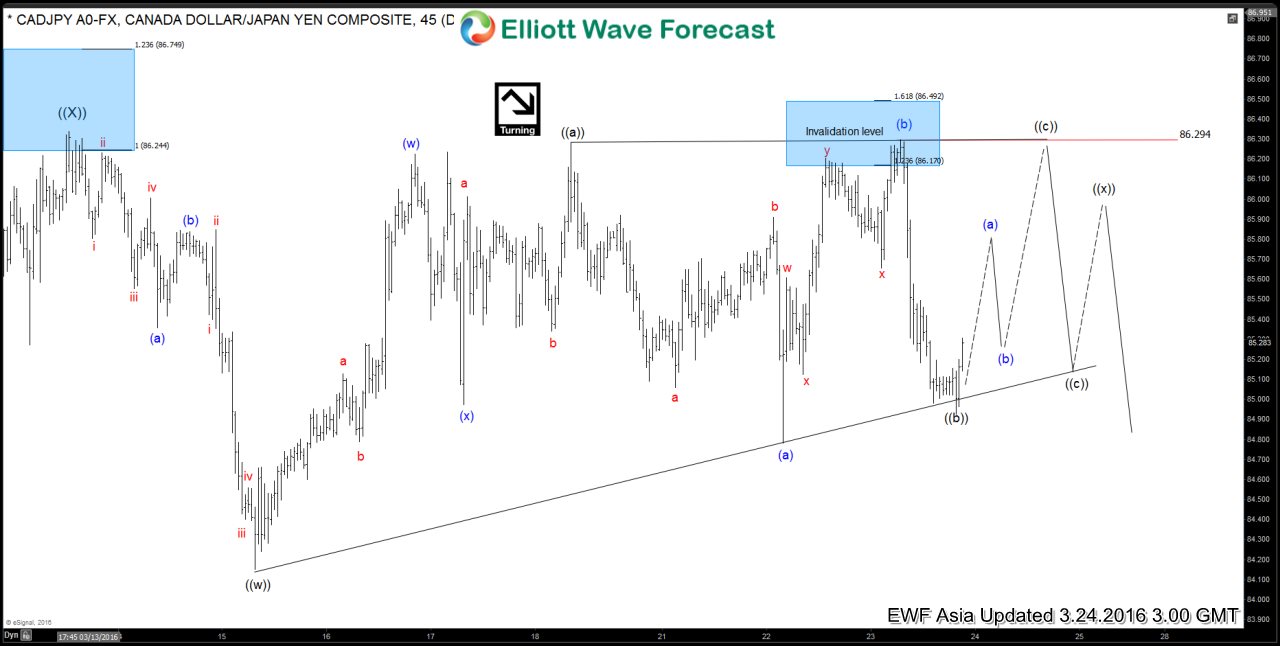

$CADJPY Short-term Elliott Wave Analysis 3.24.2016

Read MoreRevised short term Elliottwave structure suggests dips to 84.15 ended wave ((w)). Wave ((x)) bounce from there is unfolding as a triangle where wave ((a)) ended at 86.29, wave ((b)) ended at 84.92, and wave ((c)) is currently in progress. Pair is expected to do sideways movement and consolidate in the triangle while wave ((a)) at 86.294 needs […]

-

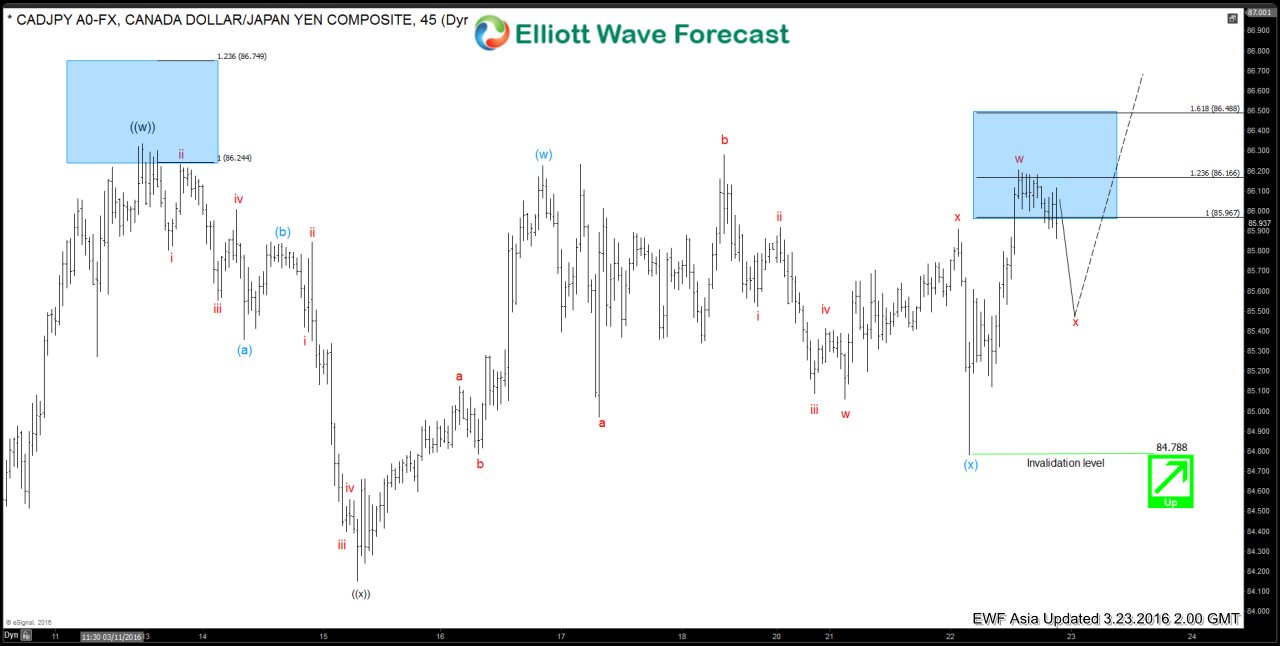

$CADJPY Short-term Elliott Wave Analysis 3.23.2016

Read MoreShort term Elliottwave structure suggests dips to 84.15 ended wave ((x)). Rally from there is unfolding in a double correction where wave (w) ended at 86.22, and wave (x) ended at 84.78. Near term, wave x pullback is in progress with an ideal target of 85.3 – 85.5 (50 – 61.8 back of the rally from 84.78), […]

-

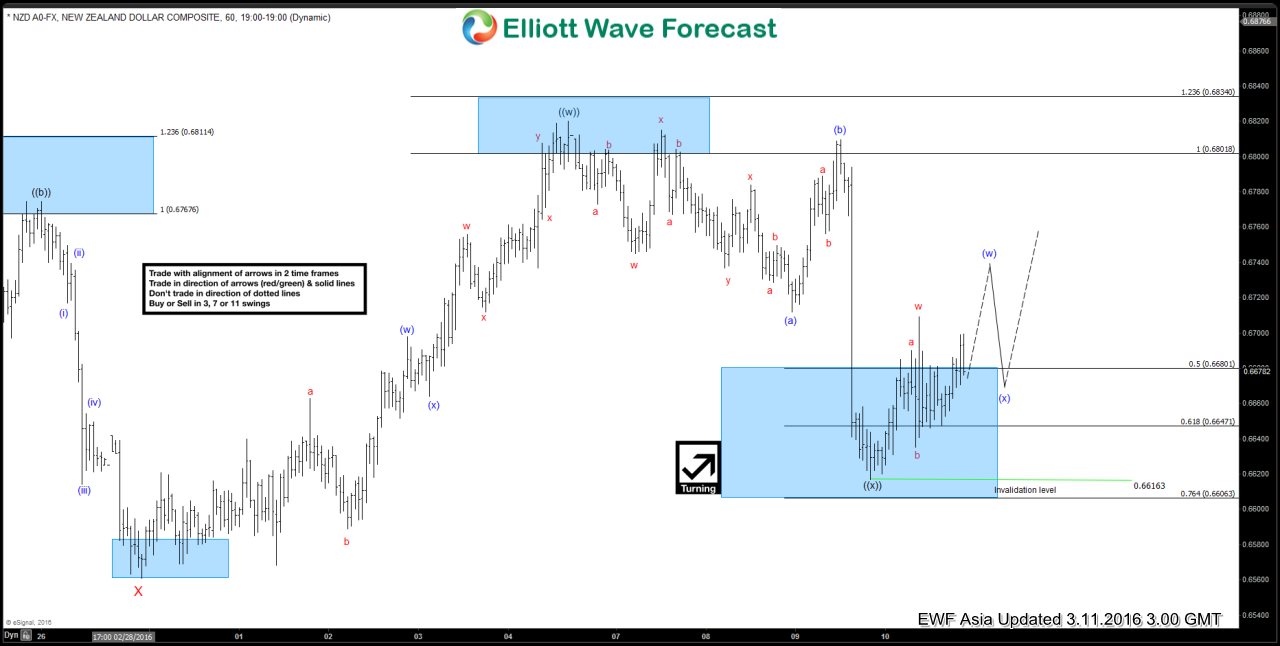

NZDUSD Short-term Elliott Wave Analysis 3.11.2016

Read MoreShort term Elliottwave structure suggests cycle from 2/29 low ended with wave ((w)) at 0.682. Wave ((x)) pullback is unfolding as a FLAT where wave (a) ended at 0.6712, wave (b) ended at 0.6809, and wave (c) of ((x)) is proposed complete at 0.6616. While pullback stays above 0.6616, pair is expected to extend higher. At EWF we offer […]

-

NZDUSD Short-term Elliott Wave Analysis 3.10.2016

Read MoreShort term Elliottwave structure suggests cycle from 2/29 low ended with wave ((w)) at 0.682. Wave ((x)) pullback is unfolding as a FLAT where wave (a) ended at 0.6712, wave (b) ended at 0.6809, and wave (c) of ((x)) is expected to complete at 0.66 – 0.664 area. As far as pivot at 0.6561 remains intact, pair is […]

-

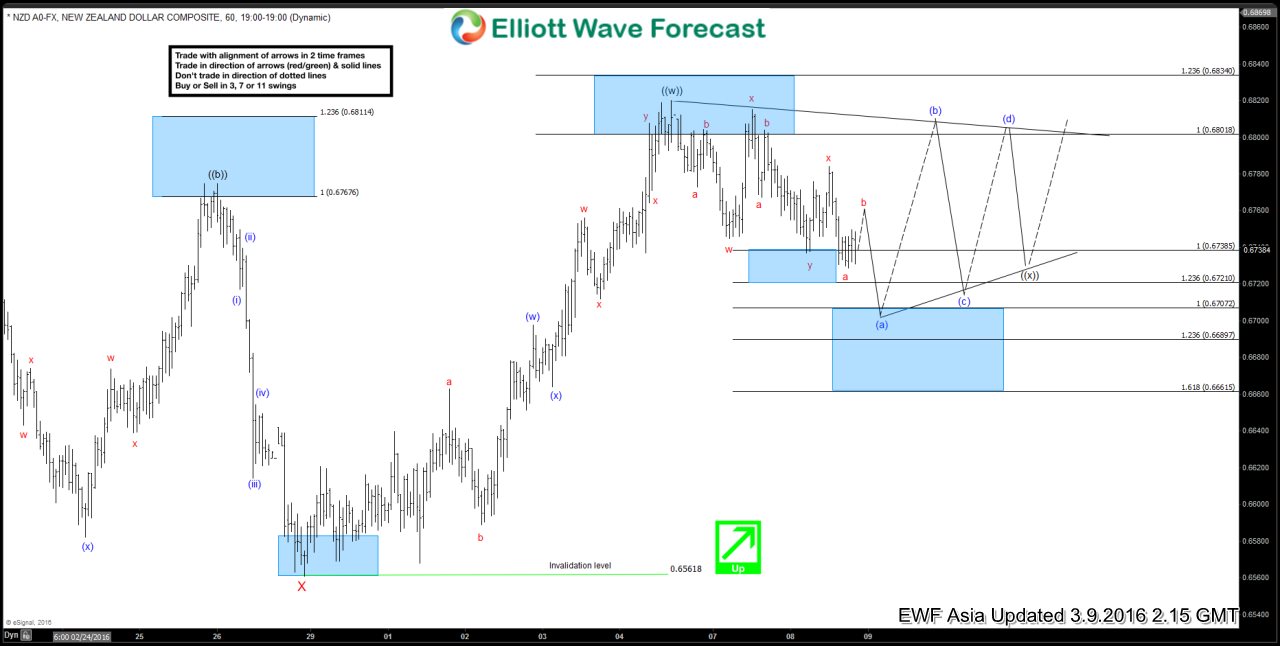

NZDUSD Short-term Elliott Wave Analysis 3.9.2016

Read MoreShort term Elliottwave structure suggests cycle from 2/29 low ended with wave ((w)) at 0.682. Wave ((x)) pullback is proposed to be unfolding as a triangle where wave (a) is expected to complete at 0.6689 – 0.6707 area, then it should turn higher in wave (b) and continue triangle consolidation. Once wave ((x)) triangle is complete, […]