In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

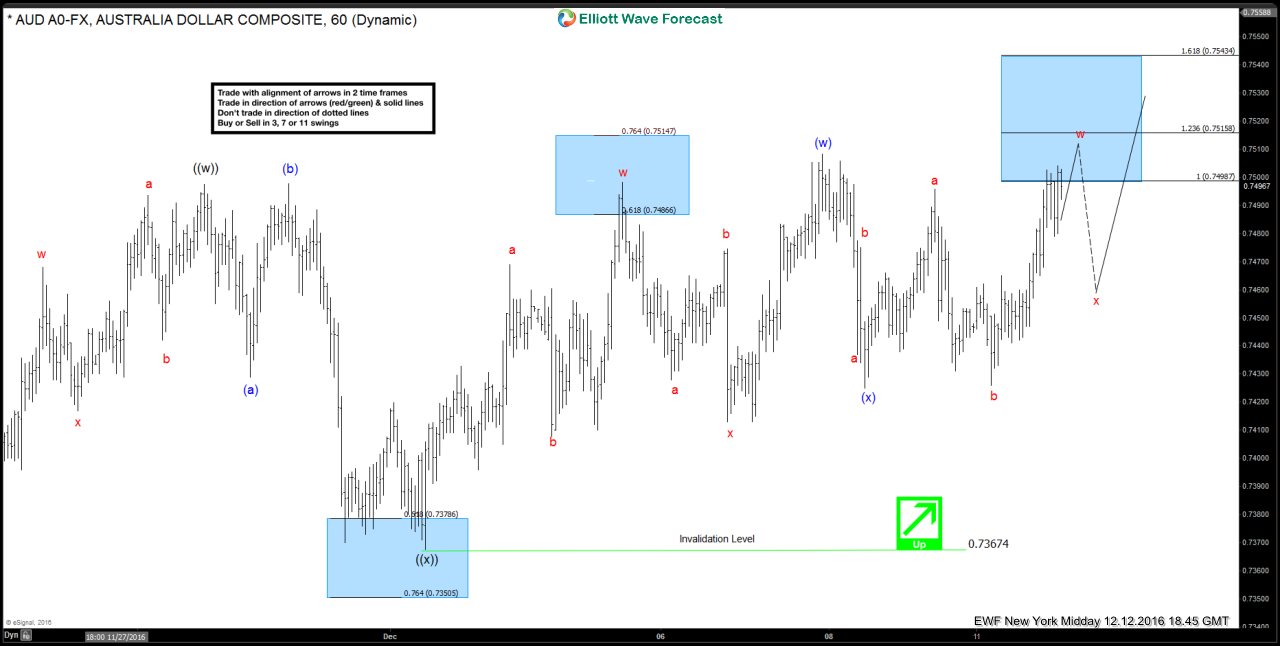

AUDUSD Elliott Wave Forecast 12.13.2016

Read MoreShort Term AUDUSD Elliott wave forecast suggests that the decline to 0.7306 on 11/21 low ended wave (X). Up from there, pair is showing a 5 swing sequence from 11/21 low and suggest more upside. Rally from 11/21 low is unfolding as a double three structure where wave ((w)) ended at 0.749 and wave ((x)) ended […]

-

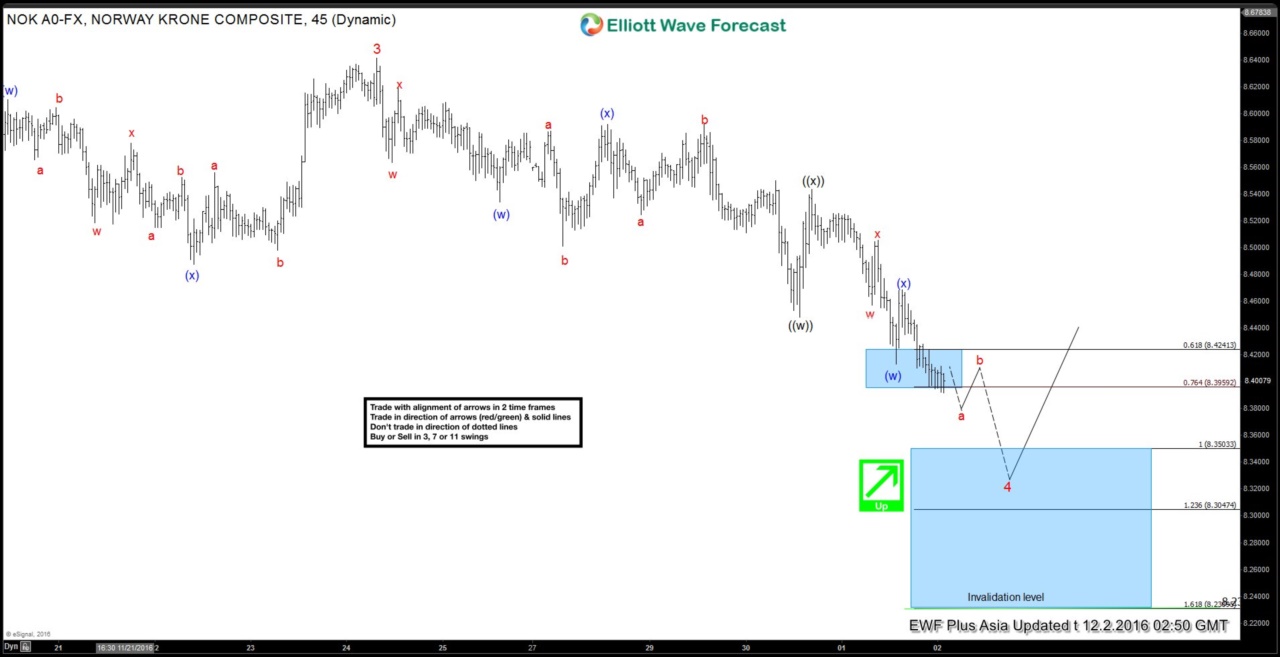

USDNOK Short-term Elliott Wave Analysis 12.2.2016

Read MoreRevised USDNOK short Term Elliott wave cycles suggests that rally to 8.641 ended wave 3 and wave 4 pullback is unfolding as a double three where wave ((w)) ended at 8.447, wave ((x)) ended at 8.543 and wave ((y)) of 4 is in progress towards 8.304 – 8.35 area. Near term, while pullbacks stay below wave ((x)) at […]

-

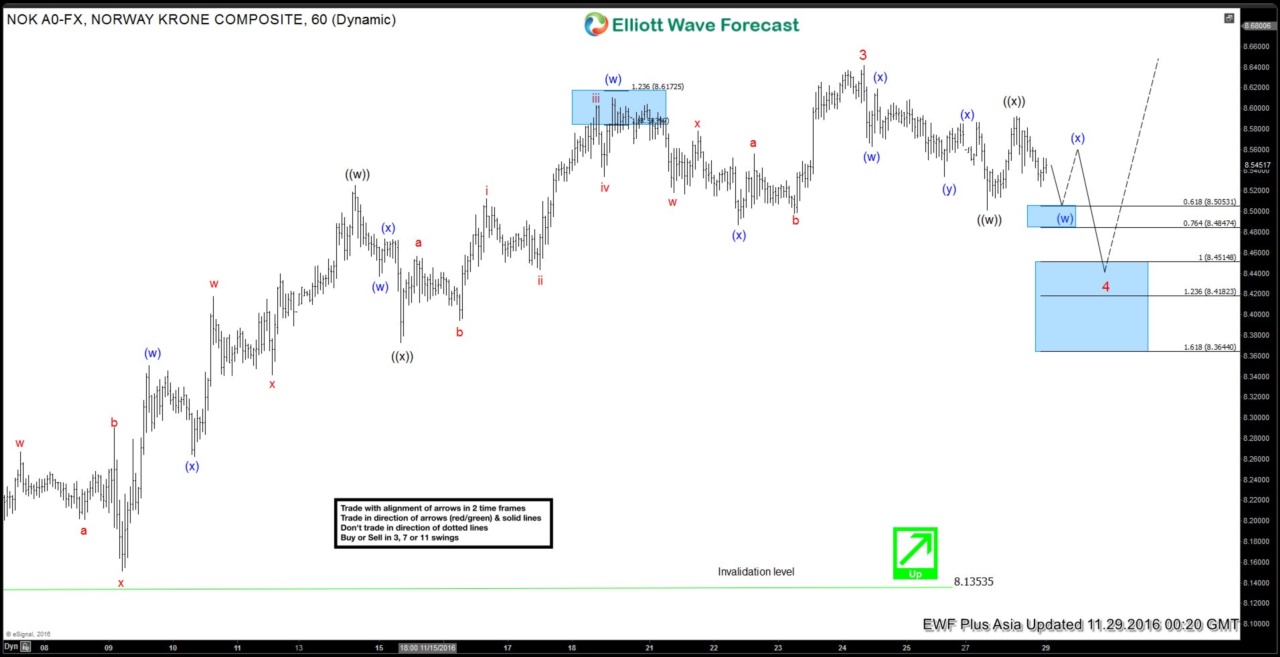

USDNOK Short-term Elliott Wave Analysis 11.30.2016

Read MoreUSDNOK Short Term Elliott wave cycles suggests that rally to 8.641 ended wave 3 and wave 4 pullback is in progress to correct cycle from 11/7 low (8.135) before turning higher. Internal structure of wave 4 is unfolding in a double three where wave ((w)) ended at 8.501 and wave ((x)) ended at 8.592. Near term, while USDNOK stays […]

-

USDNOK Short-term Elliott Wave Analysis 11.29.2016

Read MoreUSDNOK Short Term Elliott wave cycles suggests that rally to 8.641 ended wave 3 and wave 4 pullback is in progress to correct cycle from 11/7 low (8.135) before turning higher. Internal structure of wave 4 is unfolding in a double three where wave ((w)) ended at 8.501 and wave ((x)) ended at 8.592. Near term, while USDNOK stays […]

-

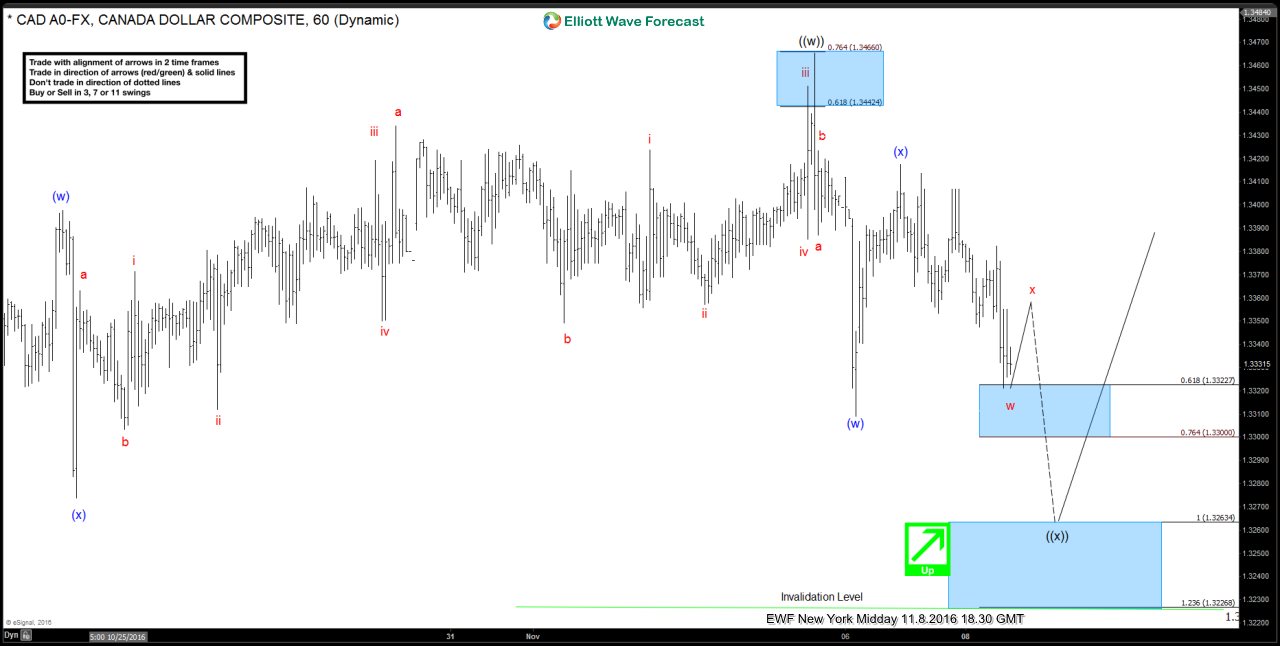

$USDCAD Elliottwaves Forecasting The Rally & Buying The Dips

Read MoreThe video below is a short capture from the NY Live Analysis Session held on November 8th by EWF Founder & Chief Currency Strategist Eric Morera. Eric presented Elliott Wave count of $USDCAD suggesting potential double in wave ((x)) pull back toward 1.2363-1.3226 before further rally takes place. Back then, $USDCAD was showing incomplete swings […]

-

AUDJPY Short-term Elliott Wave Analysis 11.16.2016

Read MoreAUDJPY Short Term Elliott wave cycles suggests that decline to 76.75 ended wave (X). Rally from there is unfolding as double three where wave W ended at 82.46 and wave X ended at 80.23. Wave (Y) is currently in progress with the internal structure as a zigzag where wave (a) is proposed complete at 82.59. Near term, expect […]