In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

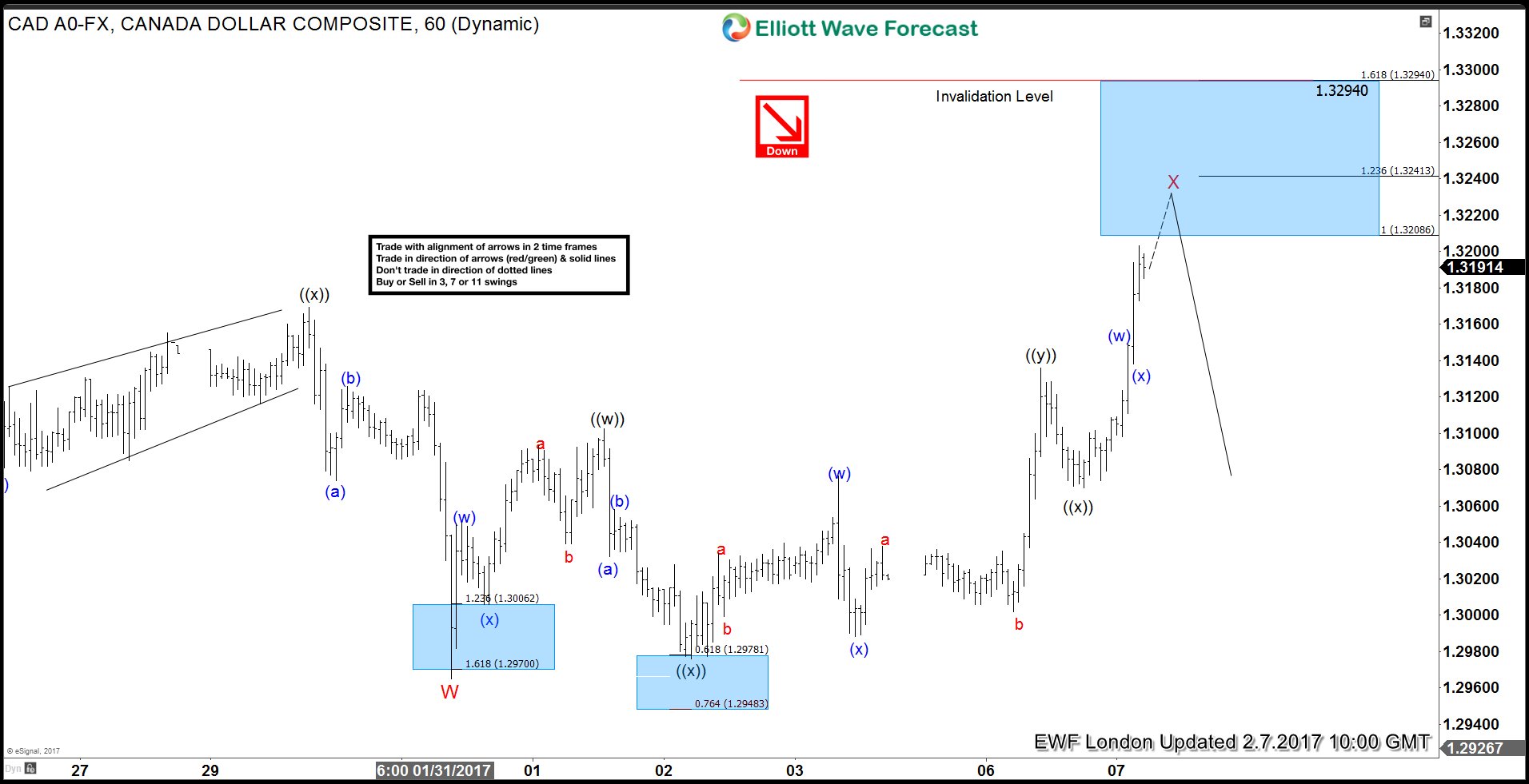

USDCAD Elliott Wave View: More downside

Read MorePreferred Elliott wave view in USDCAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is proposed complete as a triple three structure where Minute wave ((w)) ended at 1.3102, and Minute wave ((x)) ended at […]

-

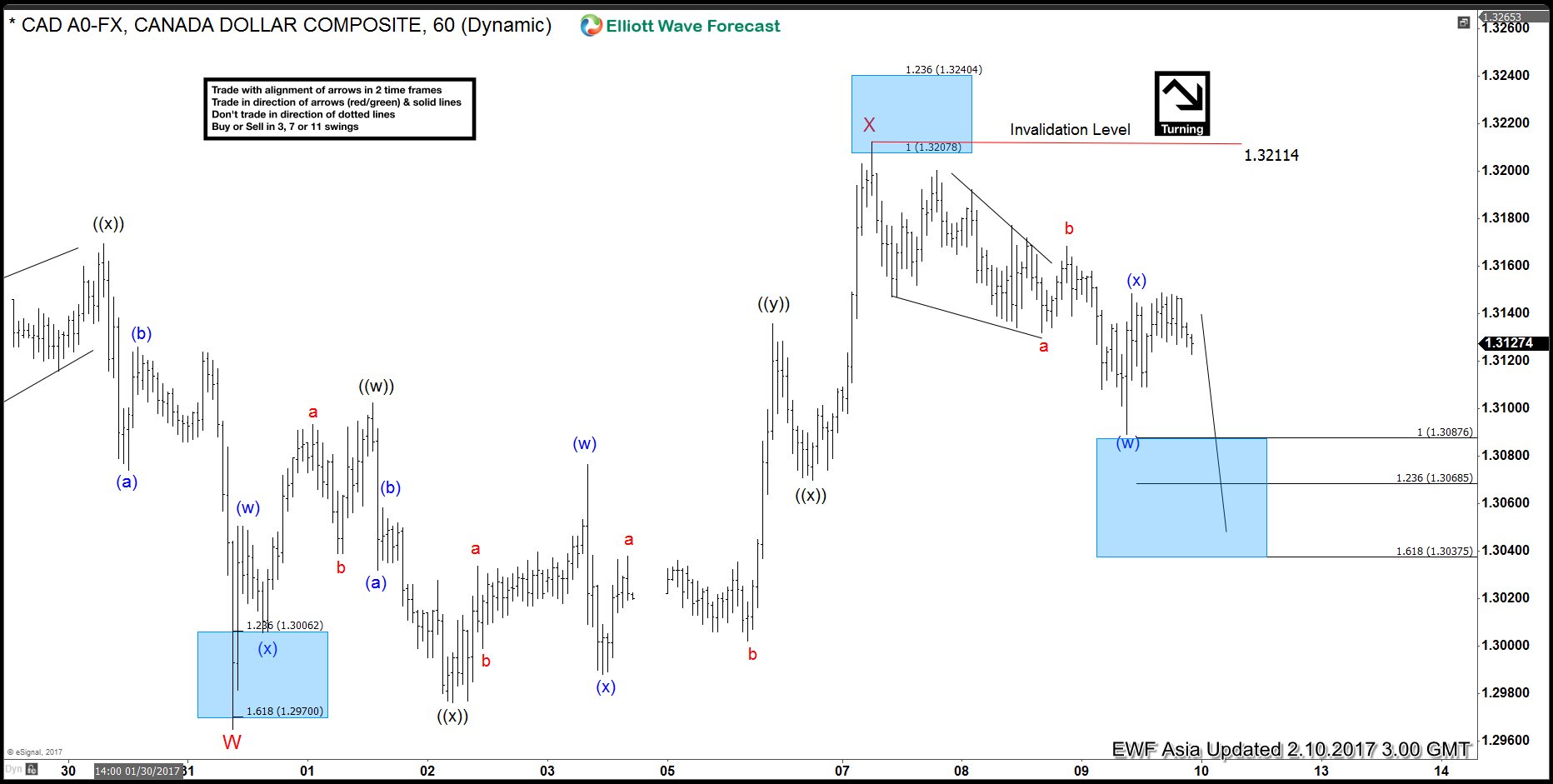

USDCAD Short Term Elliott Wave: Turning Lower

Read MorePreferred Elliott wave view in USDCAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is proposed complete as a triple three structure where Minute wave ((w)) ended at 1.3102, and Minute wave ((x)) ended at […]

-

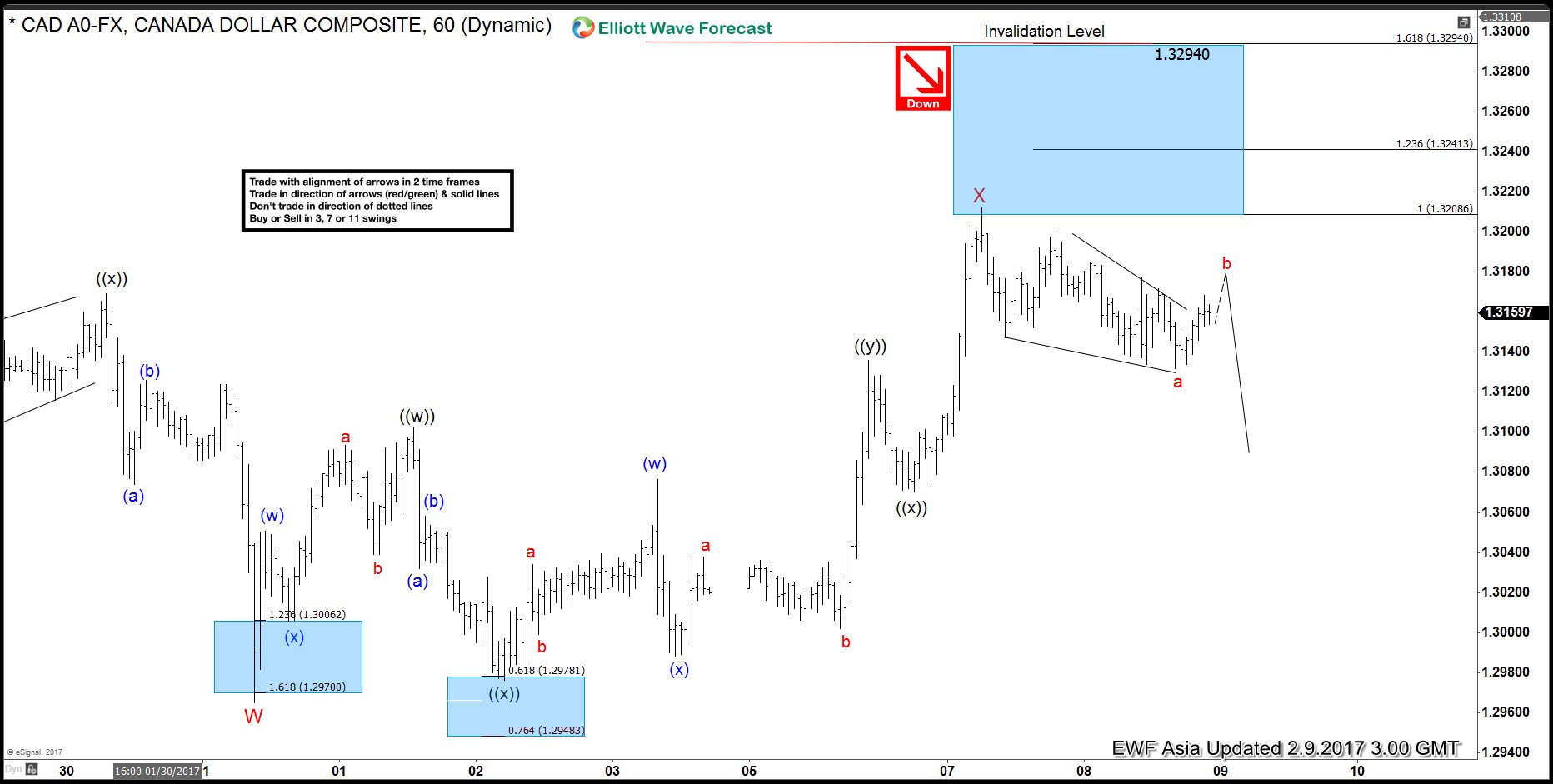

USDCAD: Expect turn lower soon

Read MorePreferred Elliott wave view in USDCAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is unfolding as a flat where Minute wave ((a)) ended at 1.3102, and Minute wave ((b)) ended at 1.2976. Minute […]

-

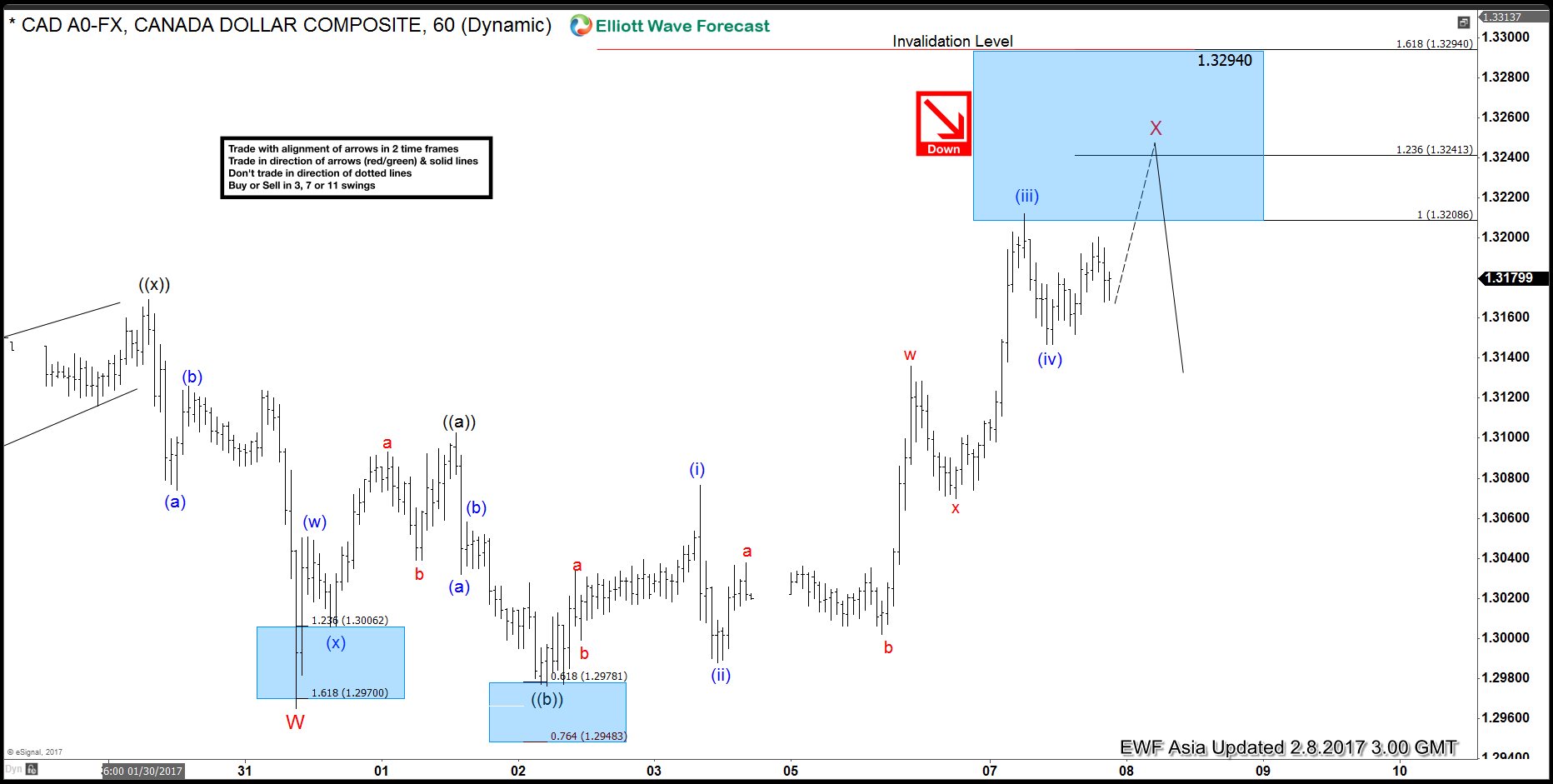

USDCAD: Bearish sequence favors more downside

Read MorePreferred Elliott wave view in USDCAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is unfolding as a triple three where Minute wave ((w)) ended at 1.3102, Minute wave ((x)) ended at 1.2976, Minute […]

-

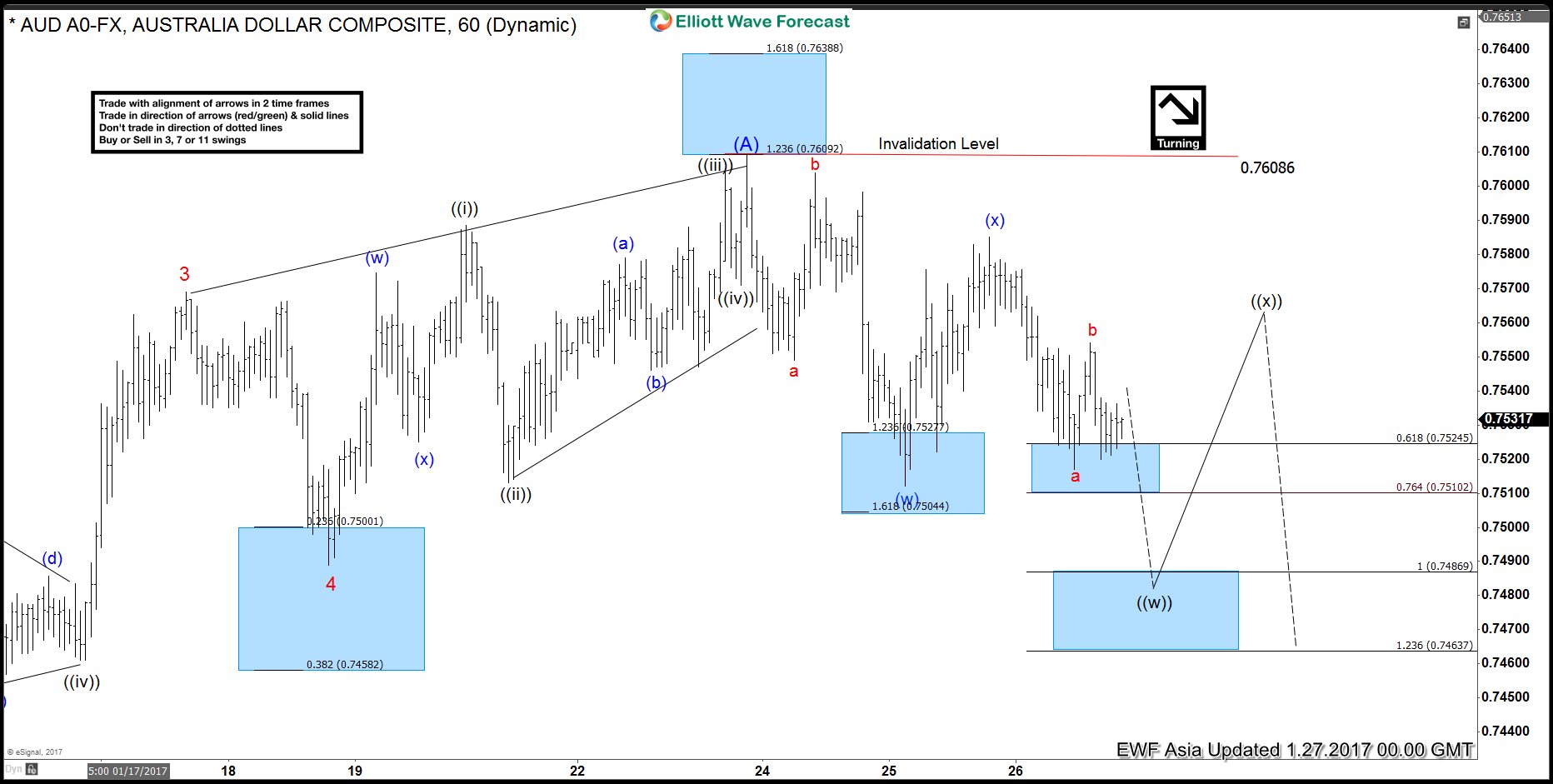

AUDUSD 5 wave cycle completed: Now turning lower

Read MoreAUDUSD 5 wave cycle from 12/23 low is proposed to be over at 0.7608 and pair is now turning lower. Yesterday, we mentioned that a break below 0.7511 would negate another high to complete wave (A) and suggest that 5 wave cycle from 12/23 low ended already at 0.7608. Today, pair failed to make a new […]

-

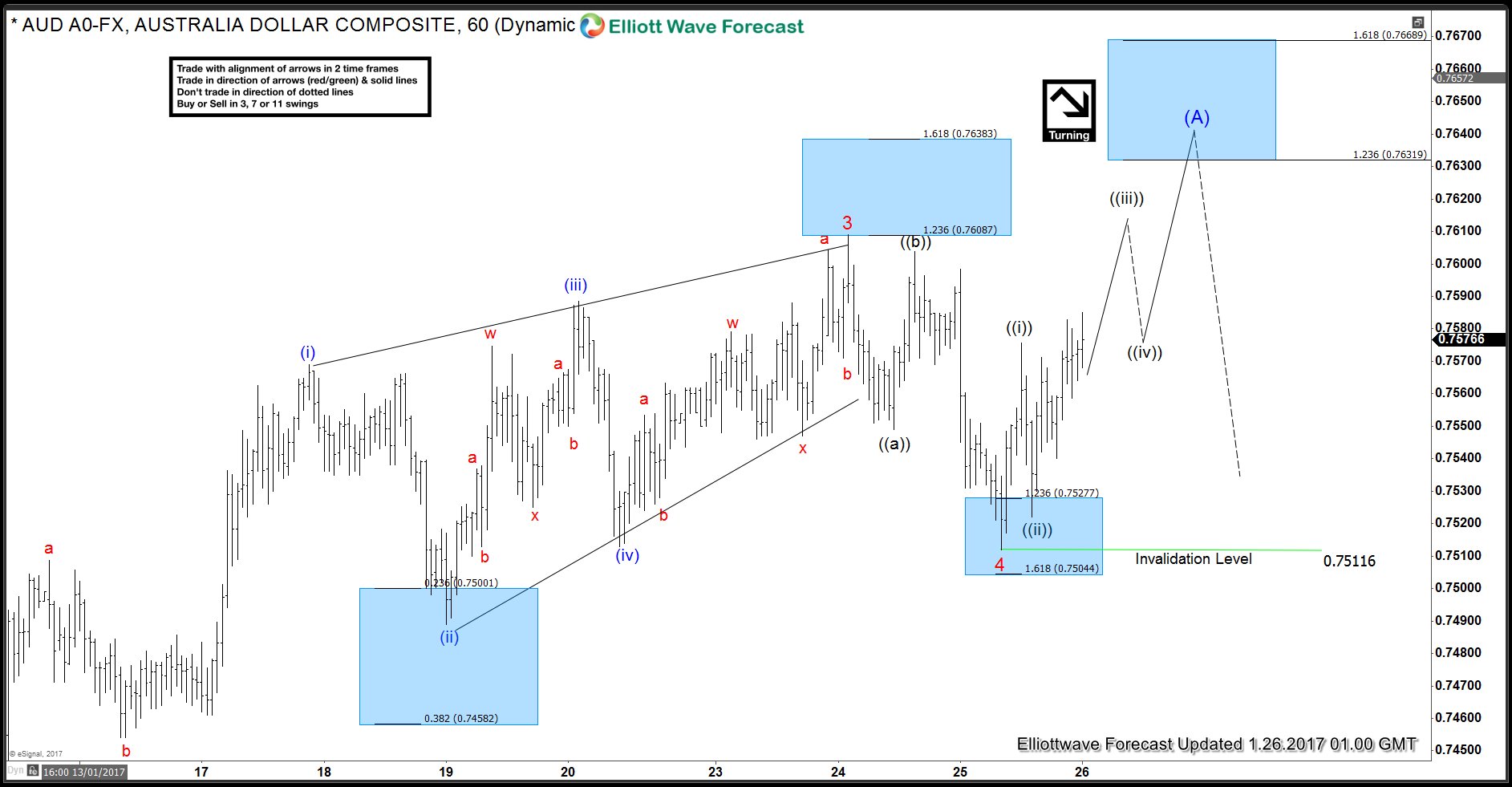

AUDUSD: 5 Wave move nearing completion

Read MoreAUDUSD 5 wave move up from 12/13 low can already be counted completed at 0.7609. However, while above 0.7511 low, another high to 0.7631 – 0.7699 area can’t be ruled out within this 5 wave move up from 12/23 low. As per the updated wave count, wave 3 is at 0.7609 and dip to 0.7511 was […]