In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

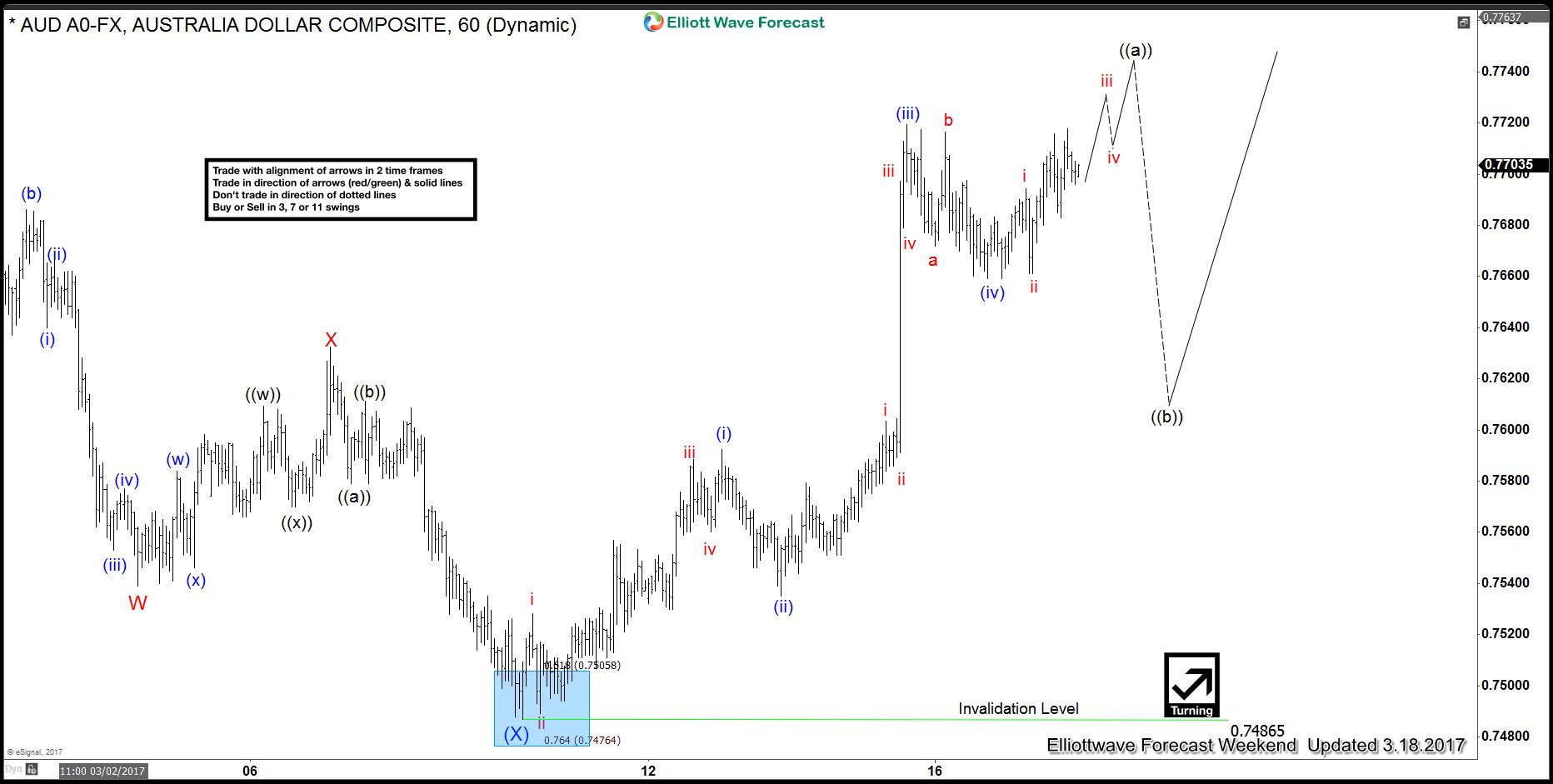

AUDUSD Elliott Wave View : 5 waves move

Read MoreAUDUSD ended the correction in Intermediate wave (X) after reaching 0.7486 and then started rallying from there. With today’s new high the pair is showing 5 waves impulsive move from 03/09/2017 low and has already reached the minimum target area for Minutte wave (v) to end. The minimum target for Minutte wave (v) can be calculated as the […]

-

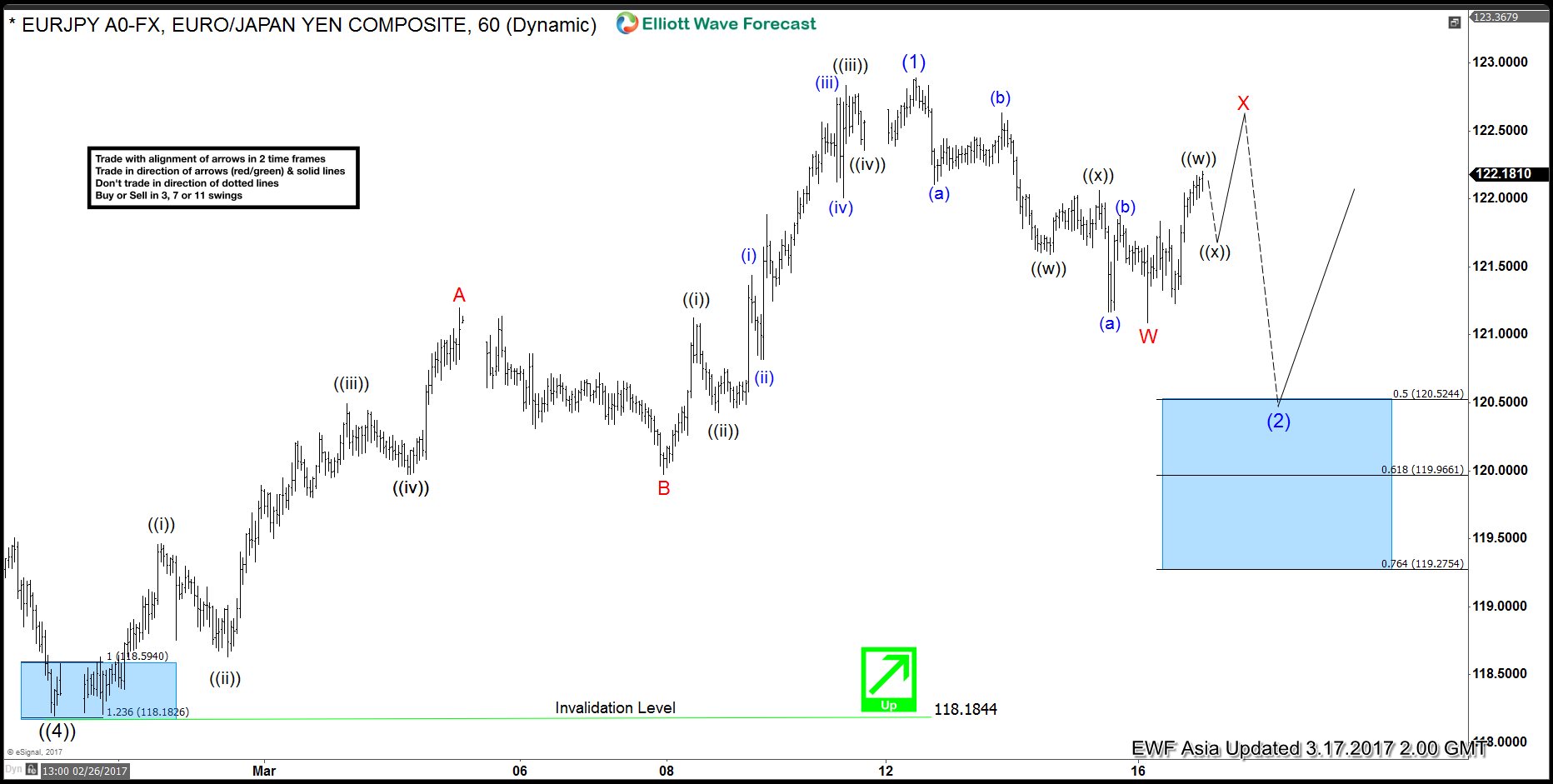

EURJPY Elliott Wave View: Correction in progress

Read MoreShort term Elliott Wave view in EURJPY suggests that the decline to 118.18 on 2/24 ended Primary wave ((4)). Primary wave ((5)) is currently in progress higher and the rally from Primary wave ((4)) low at 118.18 is unfolding as an ending diagonal Elliott wave structure where Intermediate wave (1) ended at 122.88. The subwaves of Intermediate […]

-

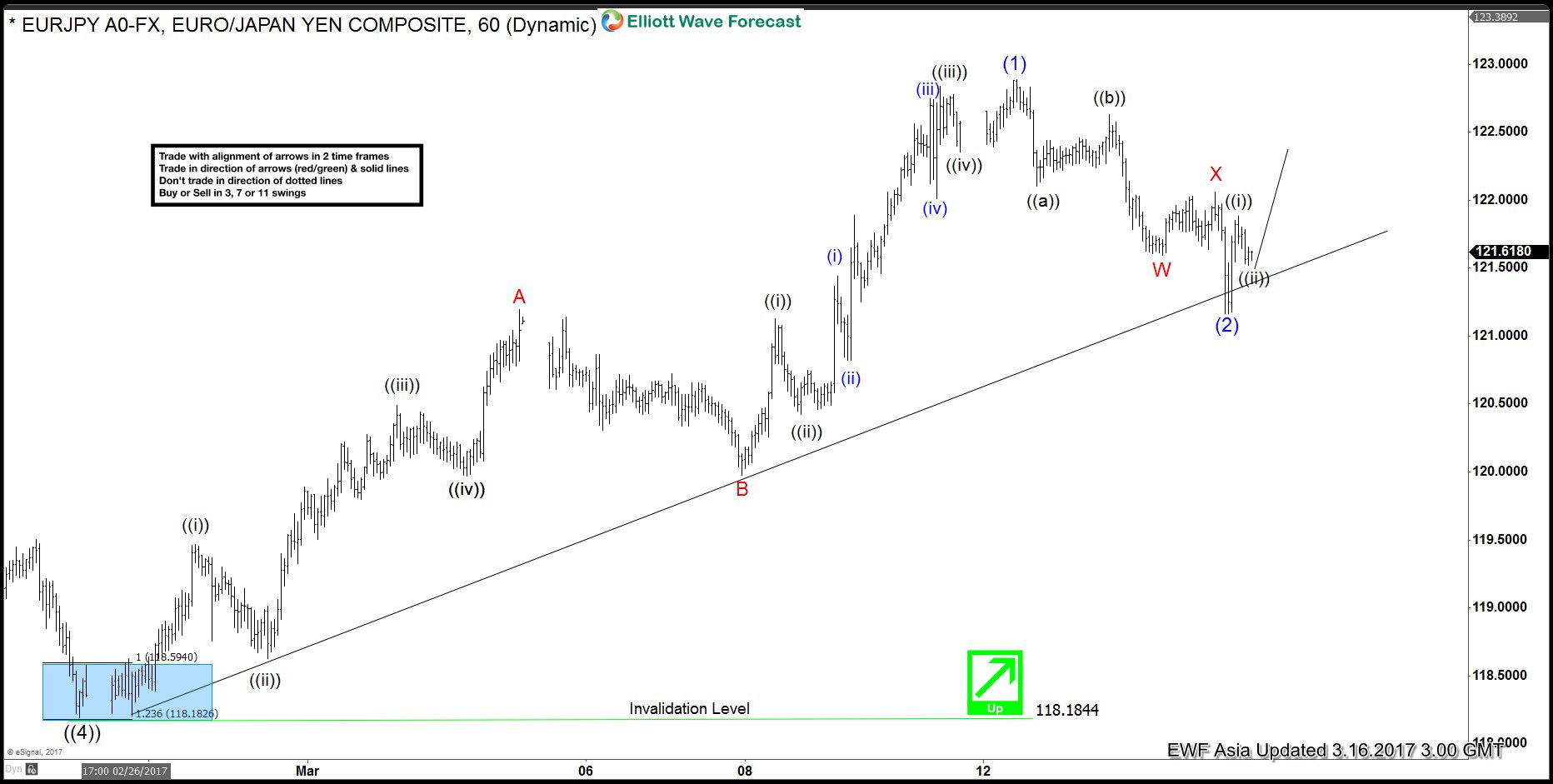

EURJPY Elliott Wave View: Pullback ended

Read MoreShort term Elliott Wave view in EURJPY suggests that the decline to 118.18 on 2/24 ended Primary wave ((4)). Primary wave ((5)) is currently in progress higher and the rally from Primary wave ((4)) low at 118.18 is unfolding as an ending diagonal Elliott wave structure where Intermediate wave (1) ended at 122.88. The subwaves of Intermediate […]

-

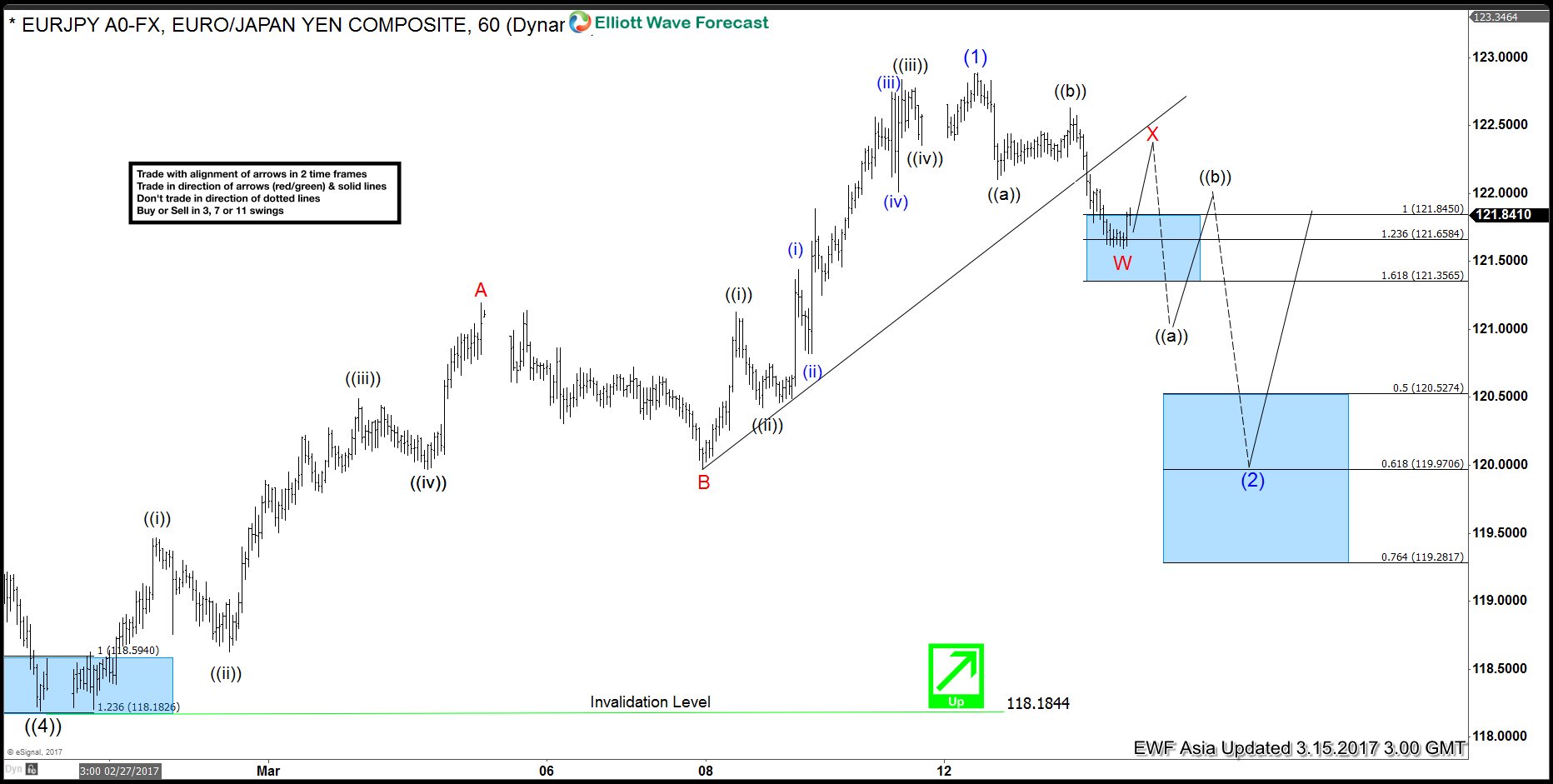

EURJPY Elliott Wave View: Pullback in progress

Read MoreShort term Elliott Wave view in EURJPY suggests that the pair has ended the cycle from 2/24 low (118.18) and the instrument is pulling back to correct that cycle before turning higher again. Primary wave ((5)) is currently in progress higher and the rally from Primary wave ((4)) low at 118.18 is unfolding as an ending diagonal […]

-

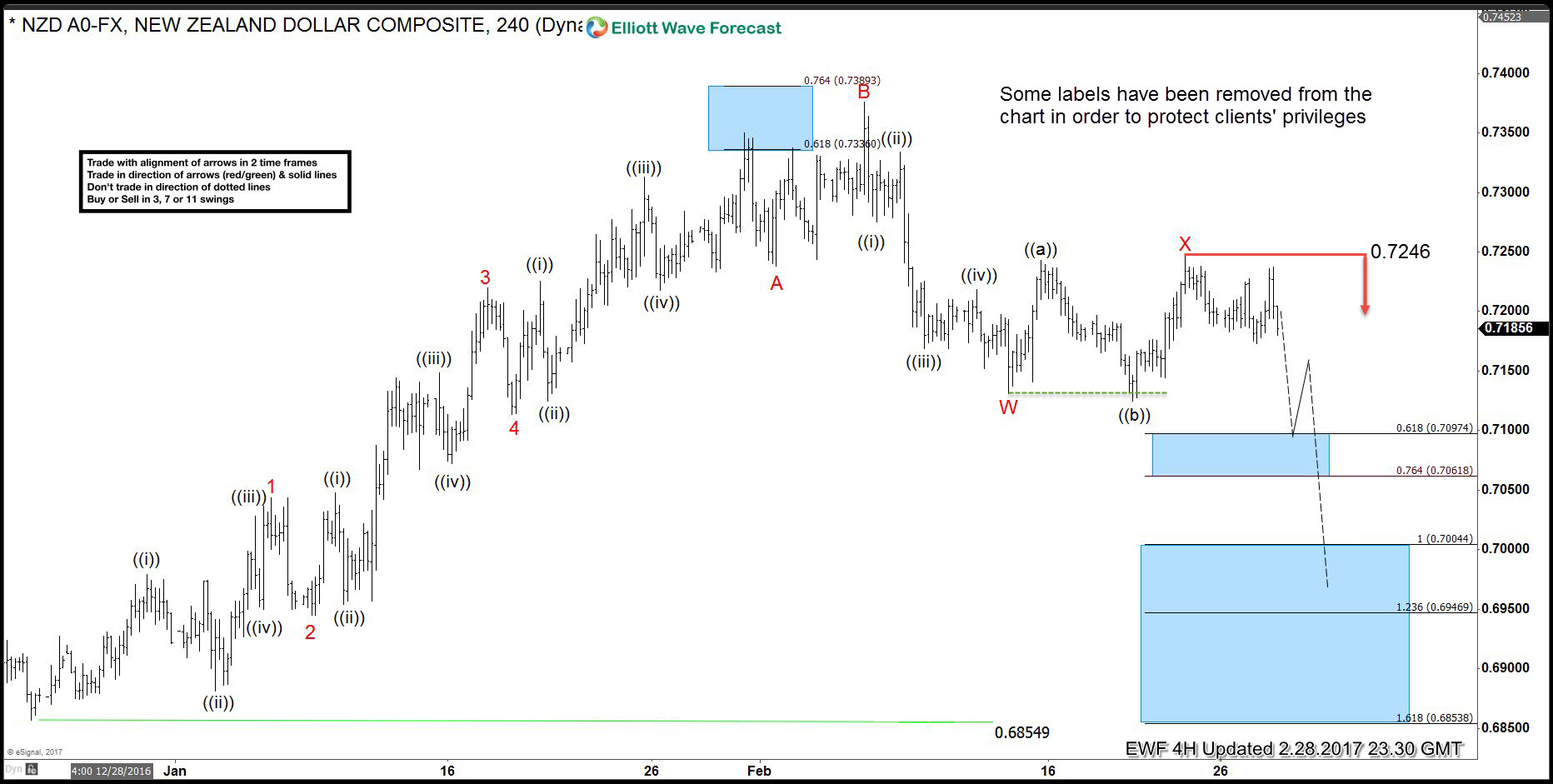

NZDUSD: Elliott Wave Forecasting the decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of NZDUSD. We’re going to explain the structure and see how we guided our members through this instrument. The chart below is $NZDUSD 4 hour chart from 02.28.2017. Our analysis suggests the price is correcting […]

-

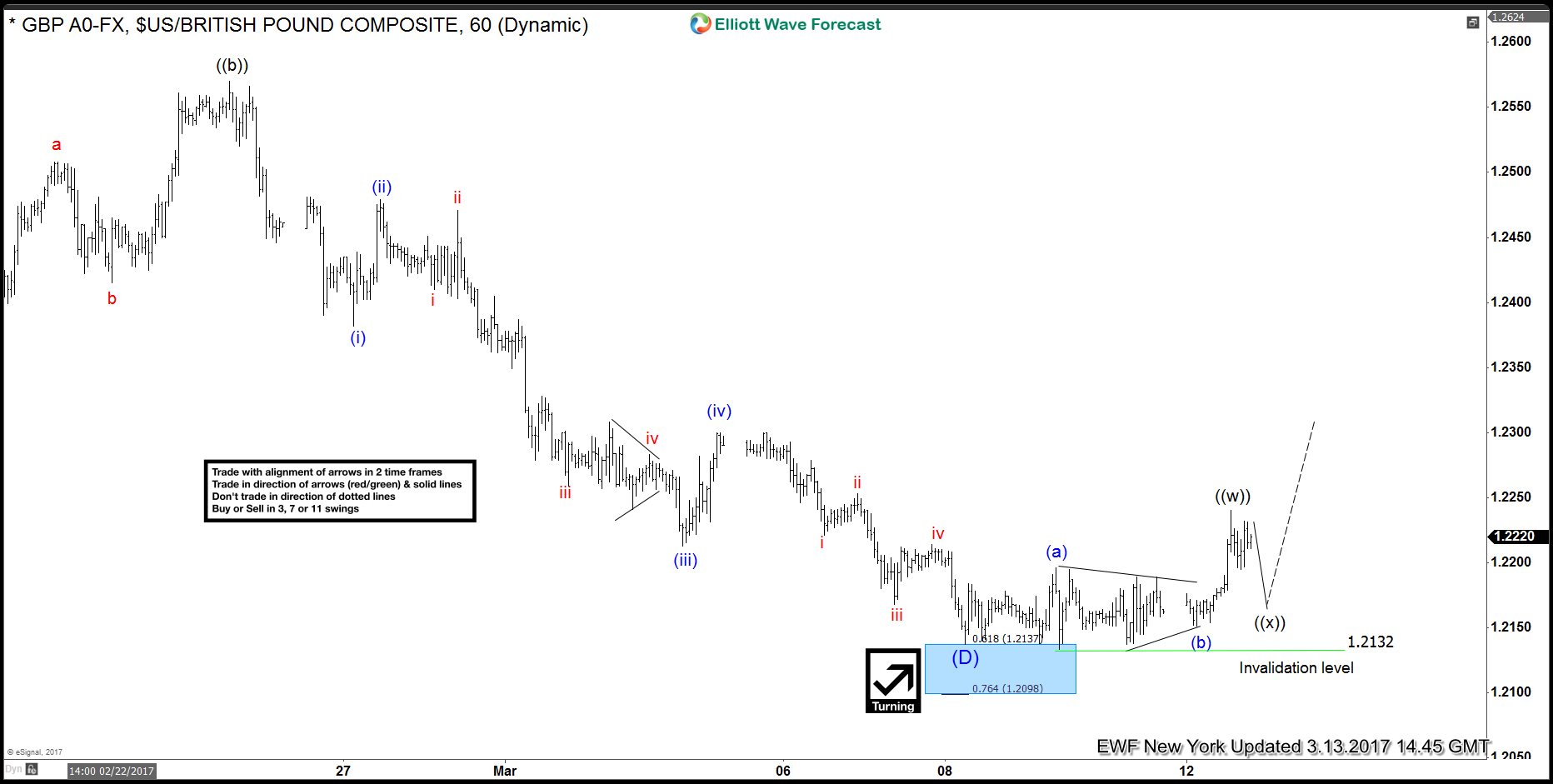

GBP USD Elliott Wave View: Bounce Started

Read MoreLast week , GBP USD ended the cycle from 02/02/2017 peak which unfolded as a double three Elliott wave structure with a FLAT in the Y leg. Pair slightly exceeded 123.6 Fibonacci extension (1.2145) of the first 3 swings lower from 2/2 peak before making a push higher today. With the bounce seen today, it has […]