In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

USDCAD Elliott Wave Analysis: Ending an impulse

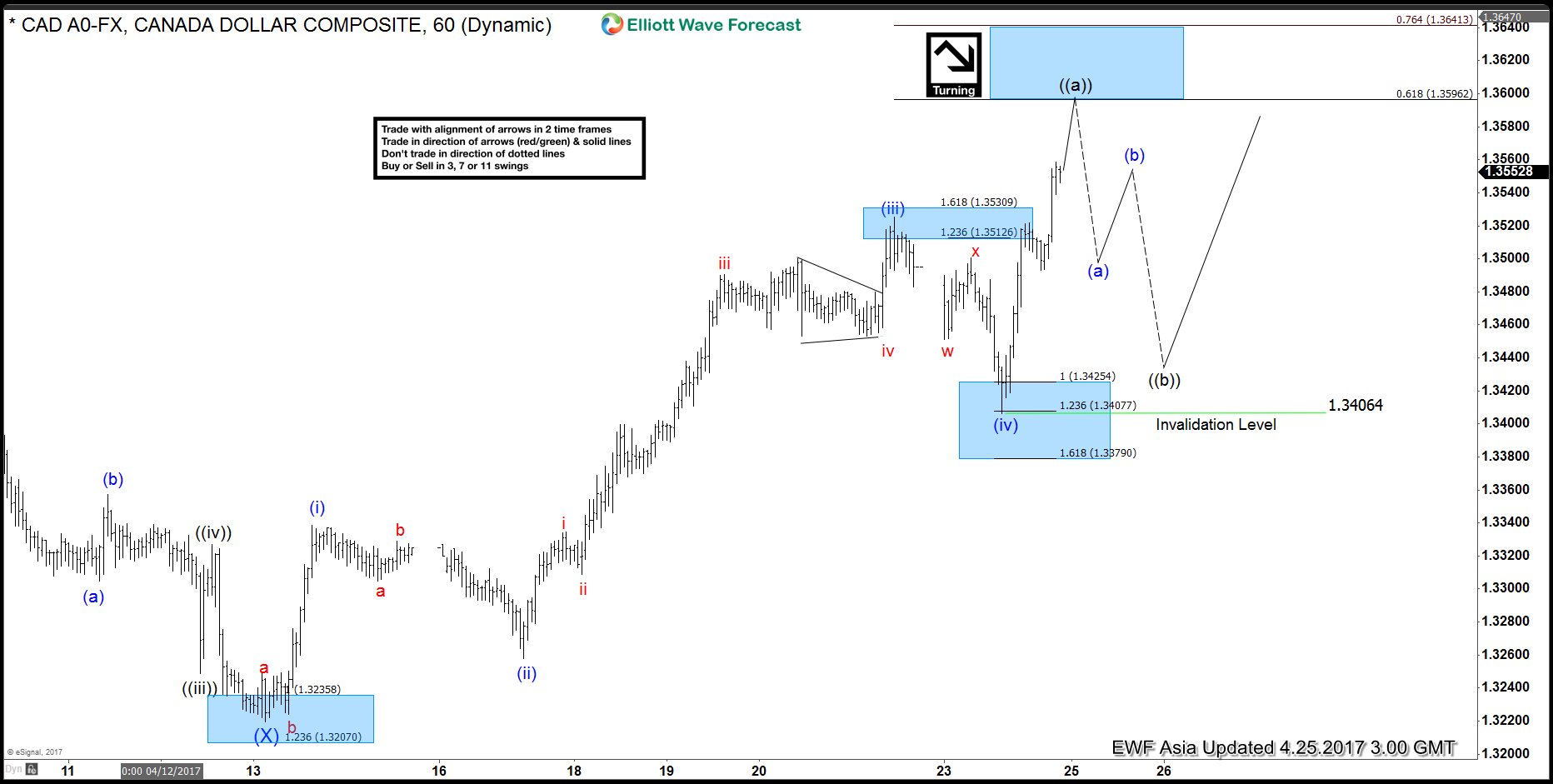

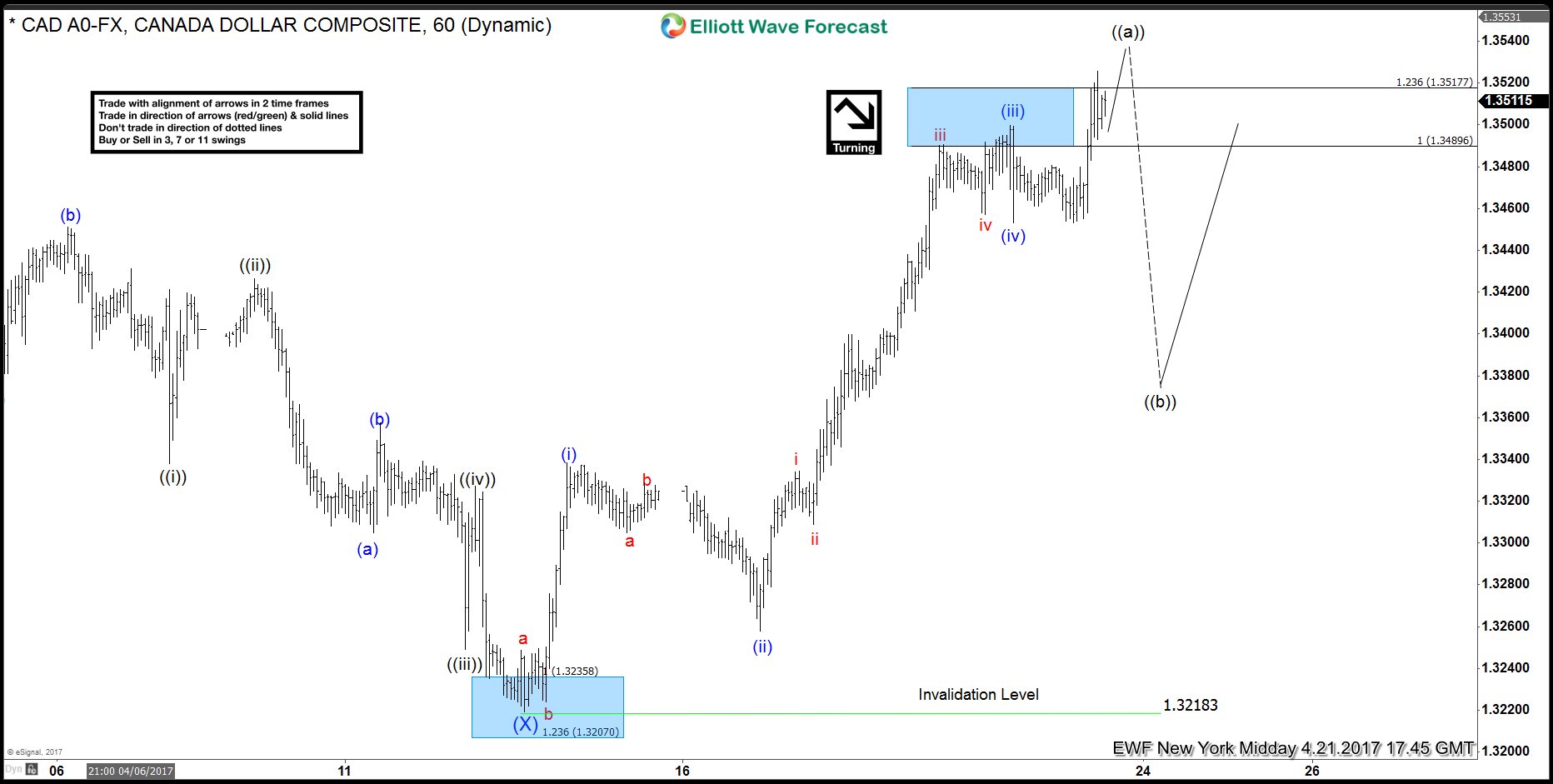

Read MoreShort term Elliott Wave view in USDCAD suggest the decline to 1.322 ended Intermediate wave (X). Up from there, the pair is showing 5 waves impulse structure where Minutte wave (i) ended at 1.3338, Minutte wave (ii) ended at 1.3258, Minutte wave (iii) ended at 1.3525, and Minutte wave (iv) ended at 1.3406. Near term focus is on […]

-

USDCAD Elliott Wave View: Ending 5 wave Impulse

Read MoreShort term Elliott wave view in USDCAD suggest that the cycle from 4/13 low (1.3218) is unfolding as an impulsive Elliott wave structure . This 5 wave move could be wave ((a )) of an Elliott wave zigzag structure structure or wave ((c )) of FLAT correction. In either case, after 5 wave move ends, pair should pull back […]

-

AUDJPY swings sequence calling the decline

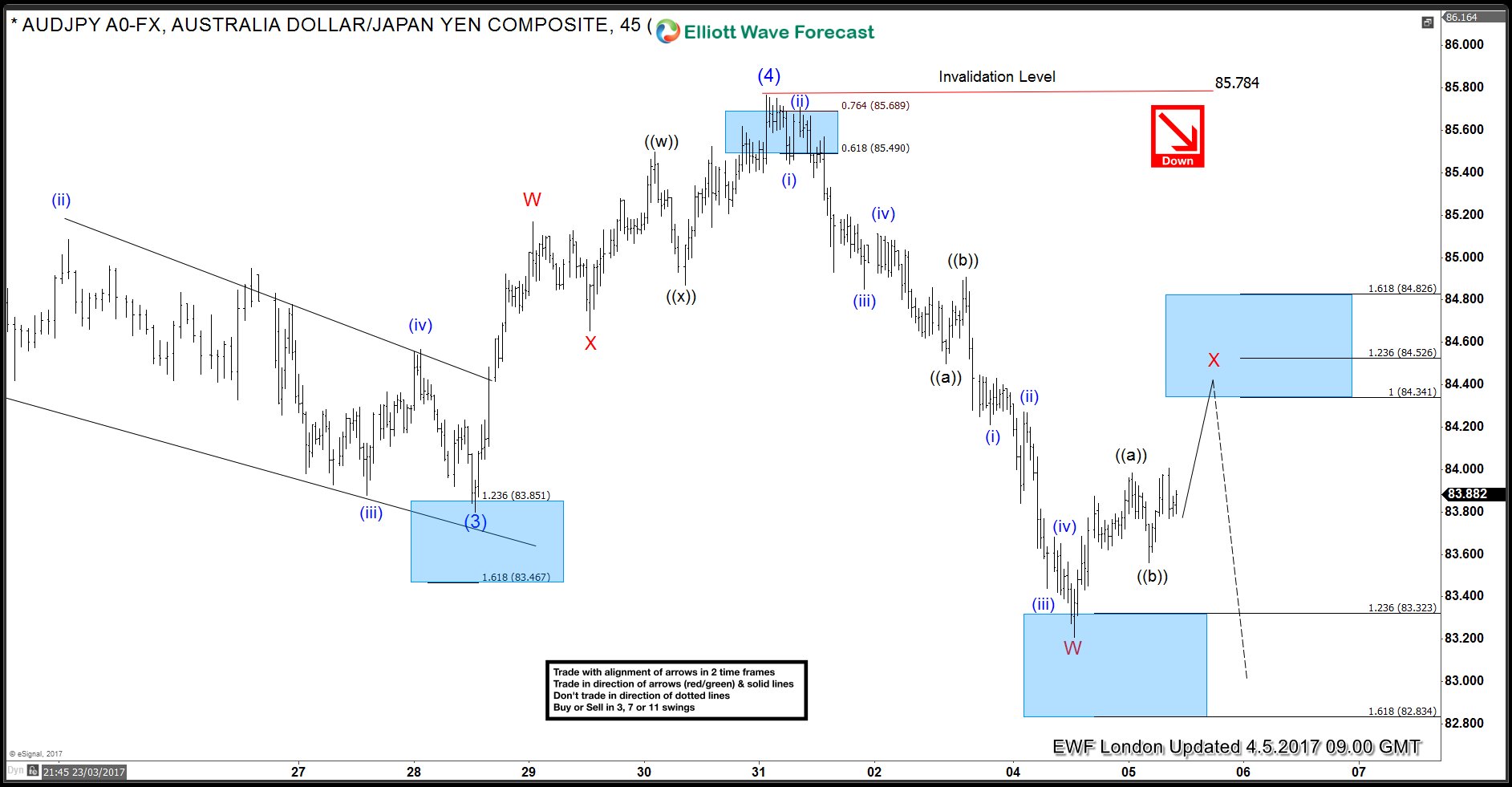

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of AUDJPY published in members area of www.elliottwave-forecast.com. We’re going to explain the structure and see how we forecasted the path. The chart below is AUDJPY 4 hour chart from 04.04.217. Our analysis suggests that cycle […]

-

AUDCAD Elliott waves calling the decline

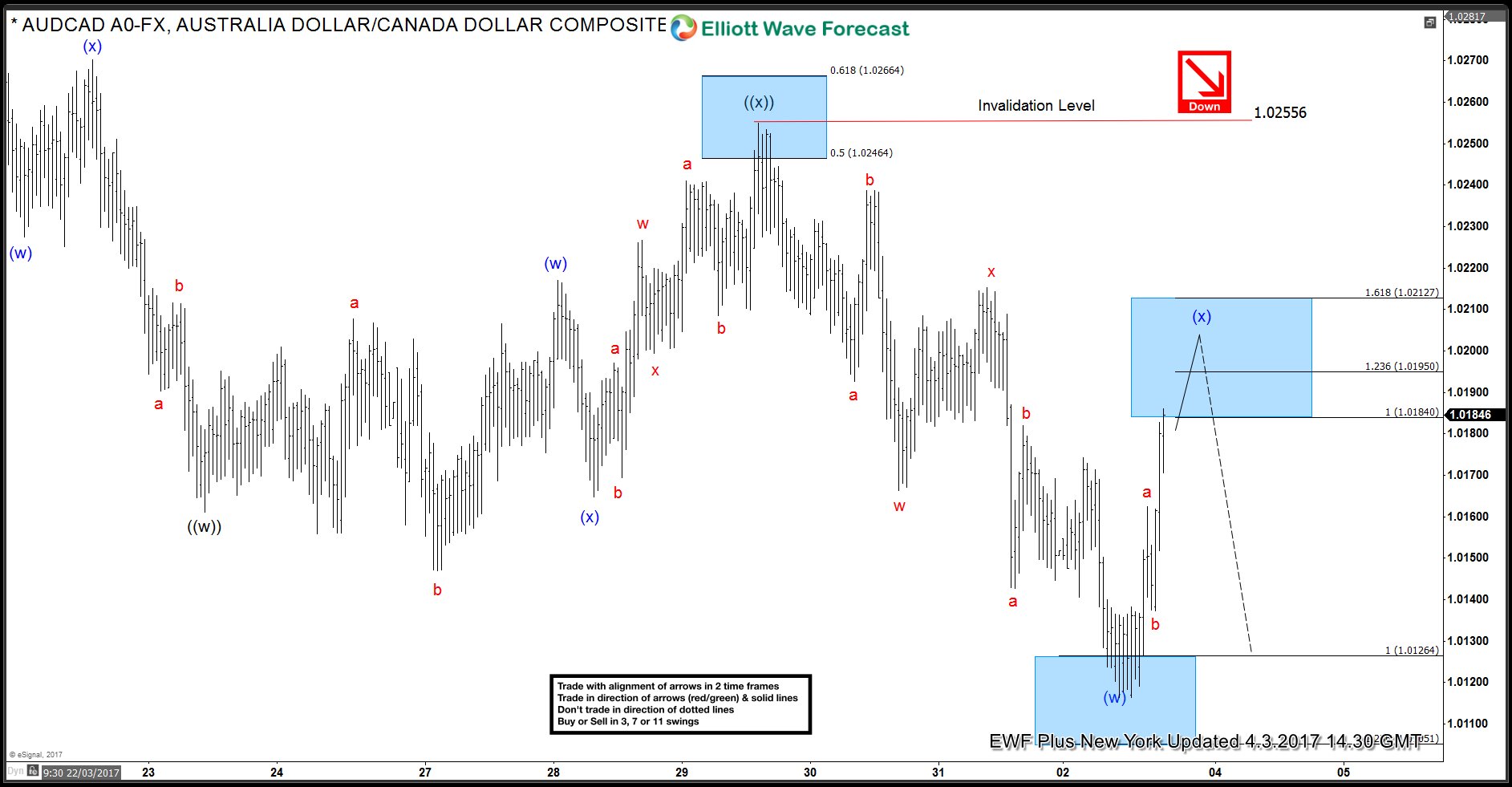

Read MoreIn this Technical blog we are going to take a quick look at the past 1 hour Elliott Wave performance of AUDCAD cycle from March 20 peak (1.0332), which we presented to our clients at elliottwave-forecast.com We are going to explain the structure from that peak below AUDCAD 3/29 1 Hour NY Updated Chart The cycle from […]

-

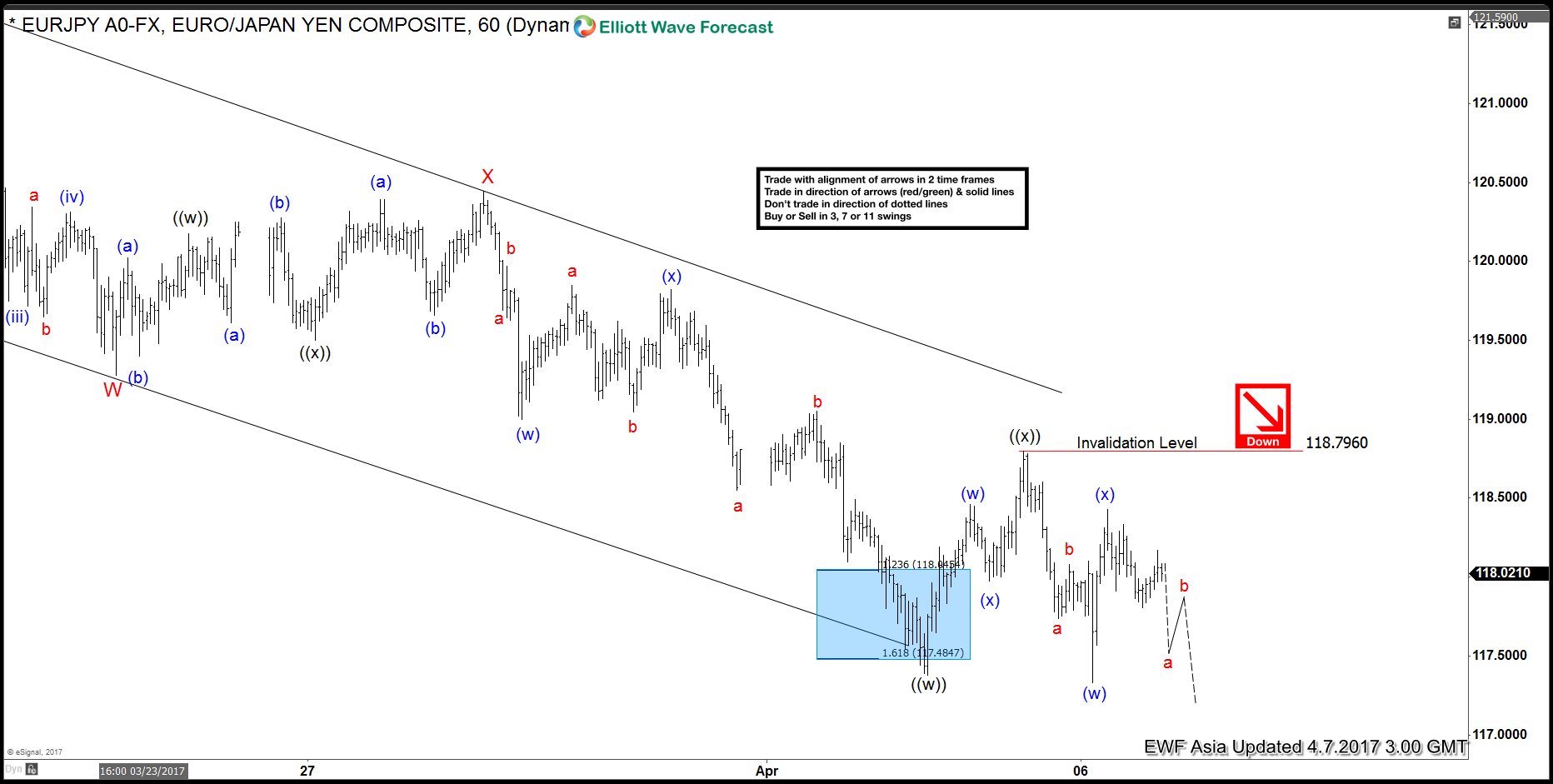

EURJPY Elliott wave View: Further downside

Read MoreShort term Elliott Wave view in EURJPY suggests that cycle from 3/12 peak (122.89) is unfolding as a double three Elliott wave structure where Minor wave W ended at 119.28 and Minor wave X ended at 120.45. Minor wave Y is in progress and the internal is unfolding also as a double three Elliott wave […]

-

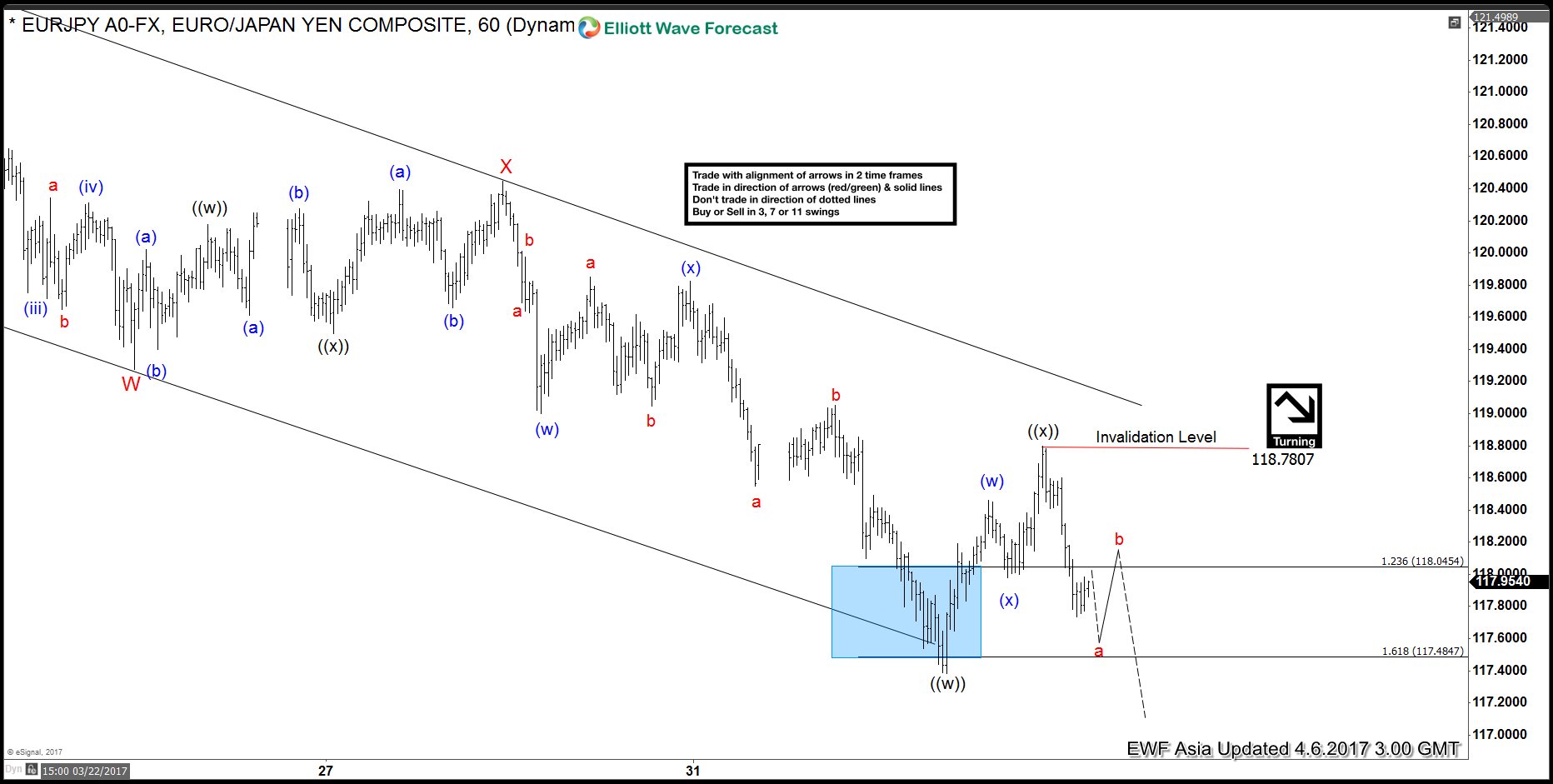

EURJPY Elliott wave View: Continuation lower

Read MoreShort term Elliott Wave view in EURJPY suggests that cycle from 3/12 peak (122.89) is unfolding as a double three Elliott wave structure where Minor wave W ended at 119.28 and Minor wave X ended at 120.45. Minor wave Y is in progress and the internal is unfolding also as a double three Elliott wave […]