In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

DXY Elliott Wave View: Zigzag Correction

Read MoreDXY Dollar Index Short Term Elliott Wave view suggests that the Index ended Primary wave ((3)) at 91.01 and currently in a Primary wave ((4)) bounce. Internal of Primary wave ((4)) is unfolding as a zigzag Elliott wave structure. Preferred view suggests rally to 92.01 completed Intermediate wave (A) and dip to 91.71 ended Intermediate wave (B) […]

-

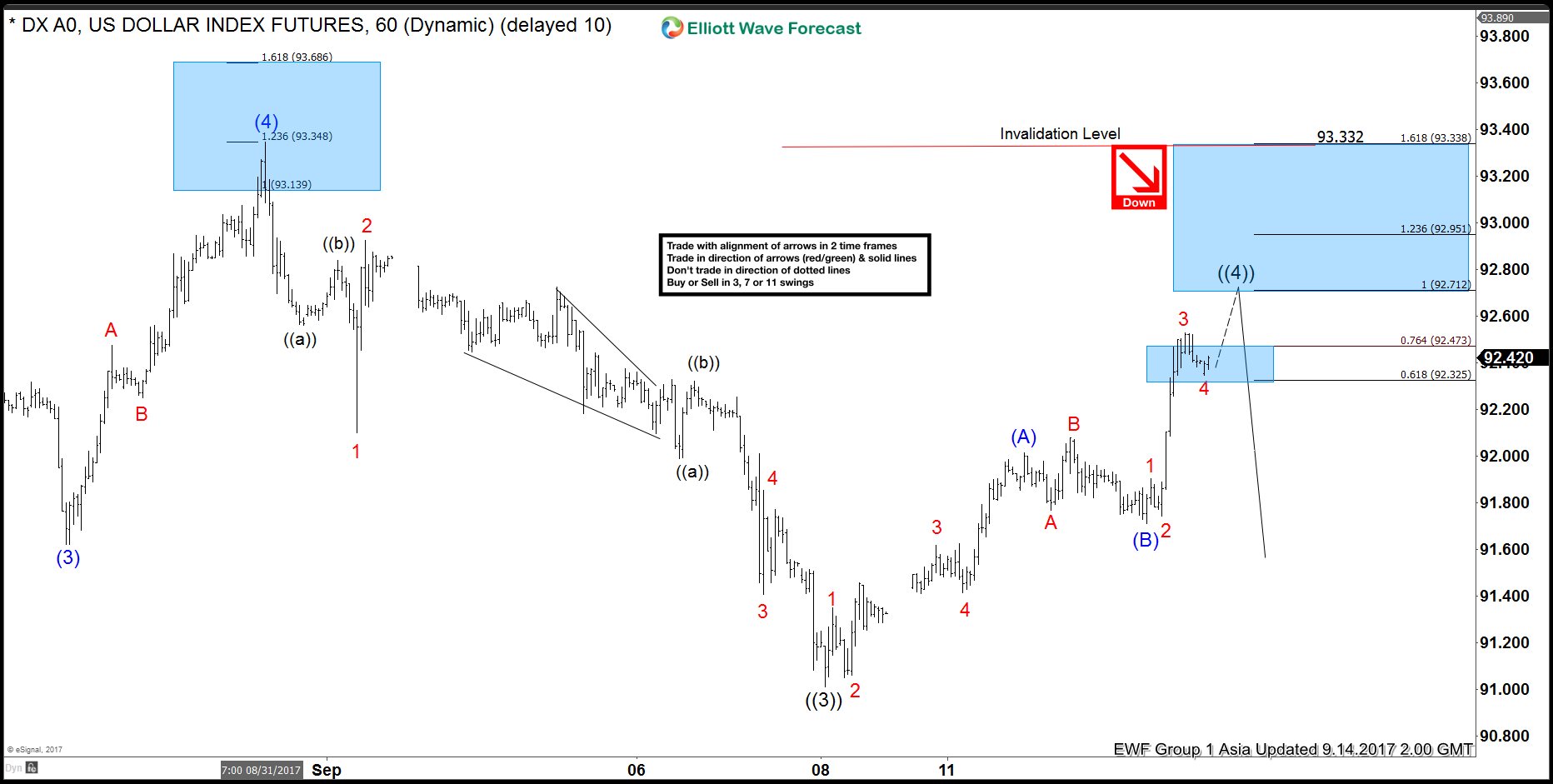

DXY Dollar Index Elliott Wave View: Wave (4) in Progress

Read MoreDXY Dollar Index Short Term Elliott Wave view suggests that the Index ended wave (3) at 91.01 and currently in a wave (4) which is proposed to be unfolding as a double three Elliott wave structure. Preferred view suggests rally to 92.01 completed wave W where as dip to 91.71 completed wave X as an Elliott […]

-

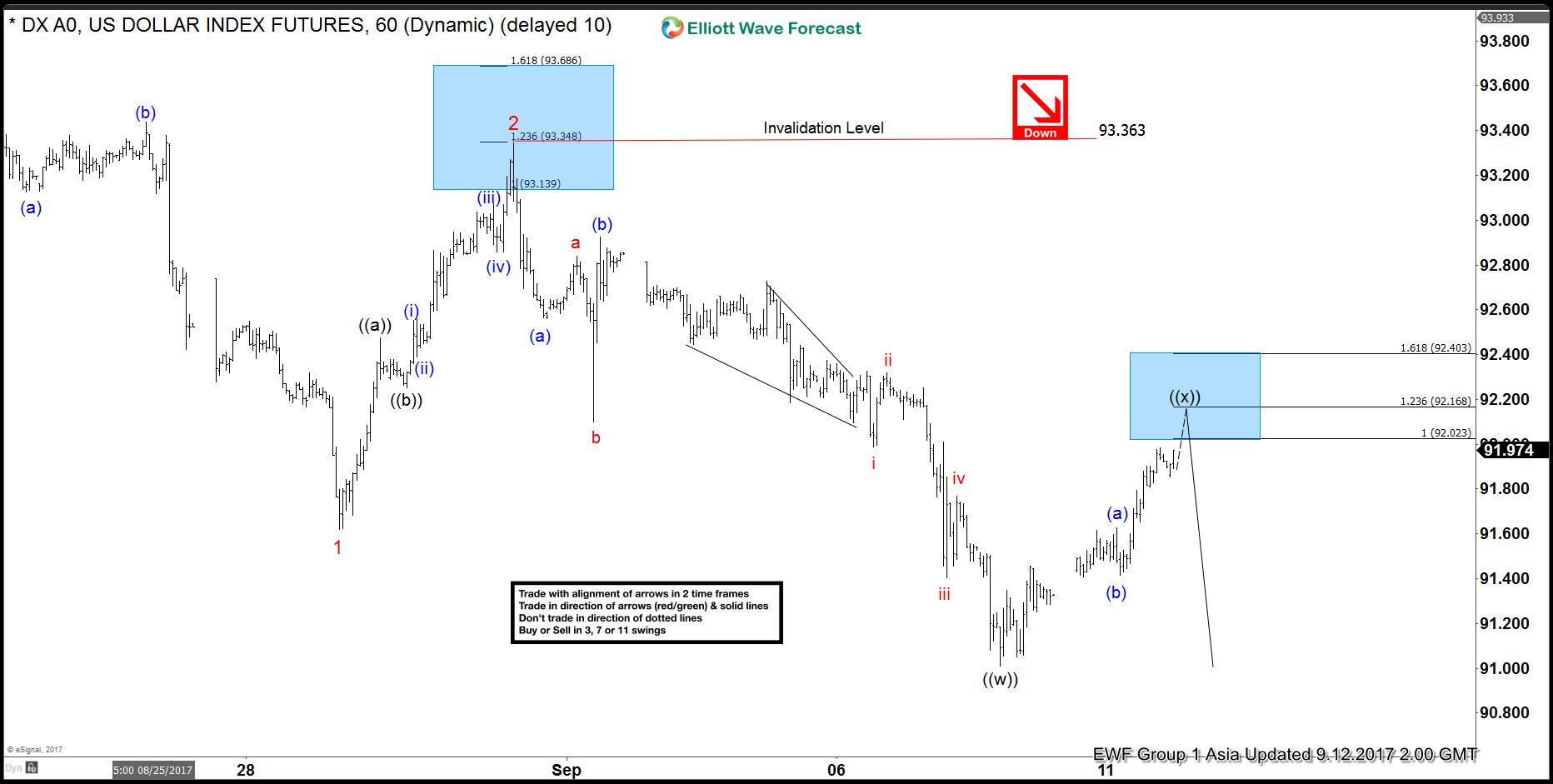

DXY Dollar Index Elliott Wave View: 9.12.2017

Read MoreDXY Dollar Index Short Term Elliott Wave view suggests that the decline from 8/16 peak is unfolding as an Ending Diagonal Elliott Wave structure. Down from 8/16 high, Minor wave 1 ended at 91.62 and Minor wave 2 ended at 93.347. Minor wave 3 is unfolding as a double three Elliottwave structure. Minute wave ((w)) of […]

-

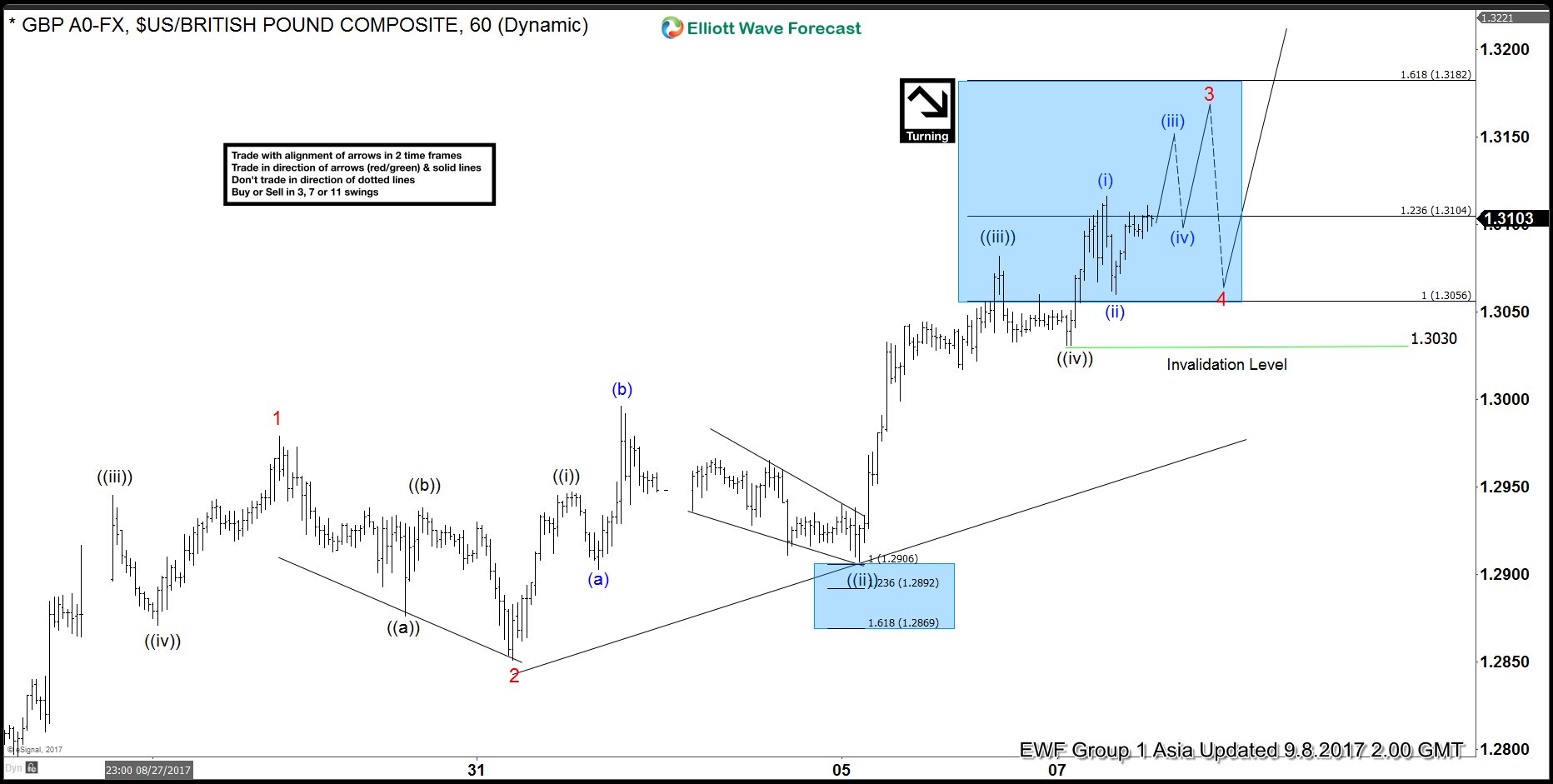

GBPUSD Elliott Wave View: More Upside

Read MoreGBPUSD Short Term Elliott Wave view suggests that the rally from 8/24 low is unfolding as an impulse Elliott Wave structure. Up from 8/24 low (1.2773), Minor wave 1 ended at 1.2979 and Minor wave 2 ended at 1.2851. Minor wave 3 is in progress and the subdivision is unfolding as an impulse Elliott Wave structure. Minute […]

-

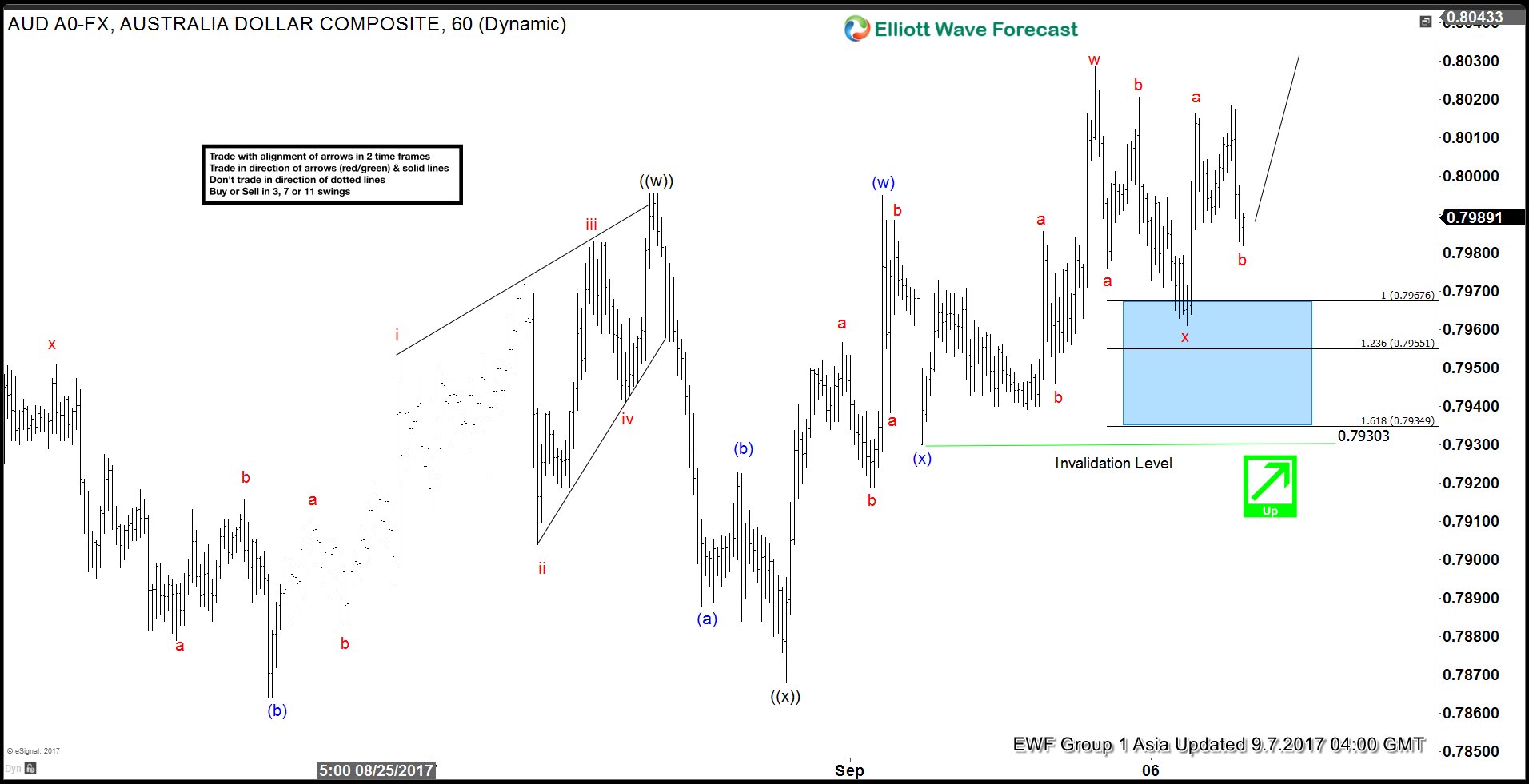

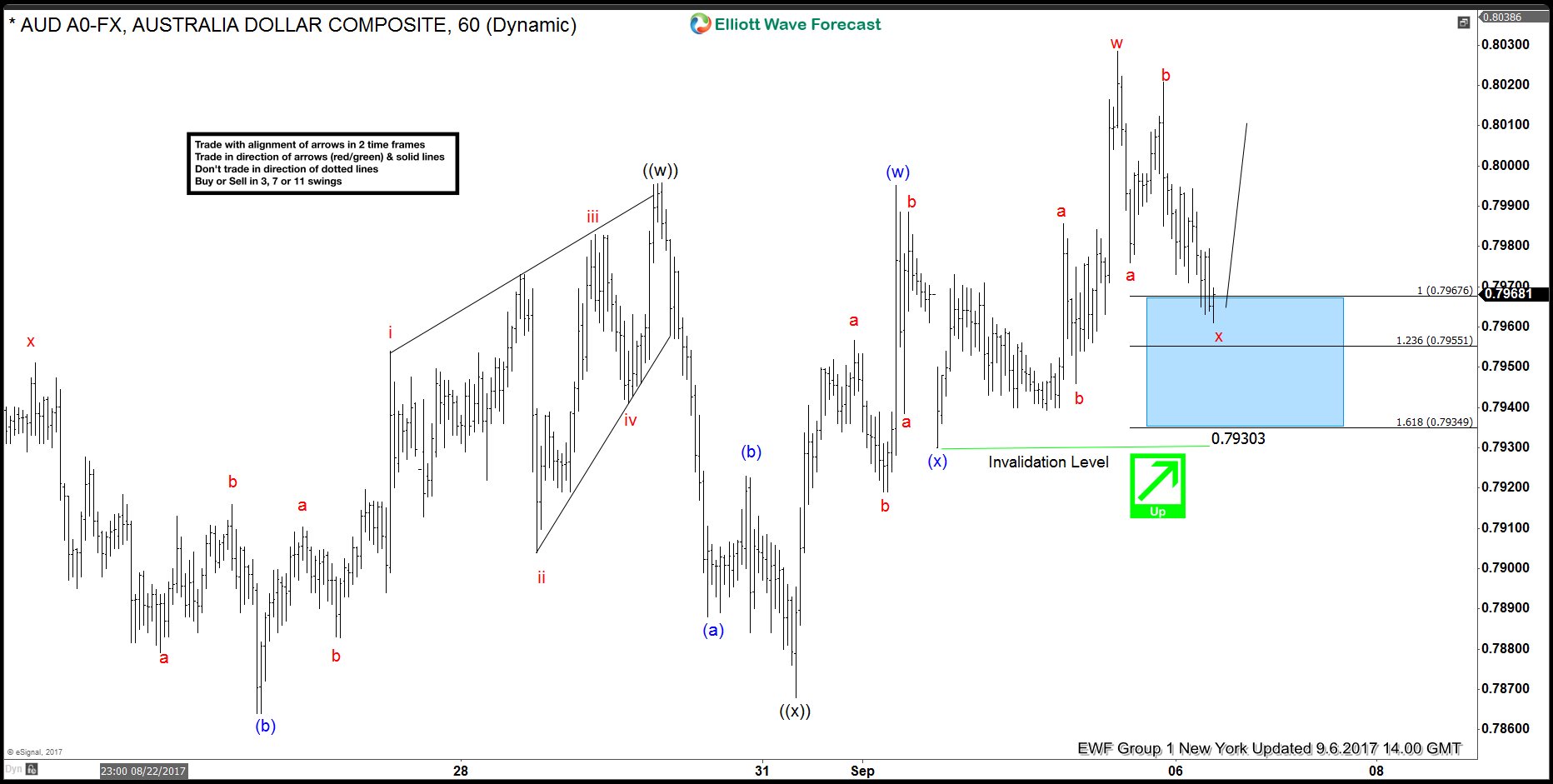

AUDUSD Elliott Wave View: Bullish above 0.787

Read MoreAUDUSD Short Term Elliott Wave view suggests that the rally from 8/15 low is unfolding as a double three Elliott Wave structure. Up from 8/15 low, Minute wave ((w)) ended at 0.79957 and Minute wave ((x)) ended at 0.7868. Minute wave ((y)) is in progress and the subdivision also unfolds as a double three. Minutte wave (w) of […]

-

AUDUSD Elliott Wave View: More Upside

Read MoreAUDUSD Short Term Elliott Wave view suggests that the rally from 8/15 low is unfolding as a double three Elliott Wave structure. Up from 8/15 low, Minute wave ((w)) ended at 0.79957 and Minute wave ((x)) ended at 0.7868. Minute wave ((y)) is in progress and the subdivision also unfolds as a double three. Minutte wave (w) of […]