In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Elliott Wave Analysis: GBPUSD doing an ending diagonal

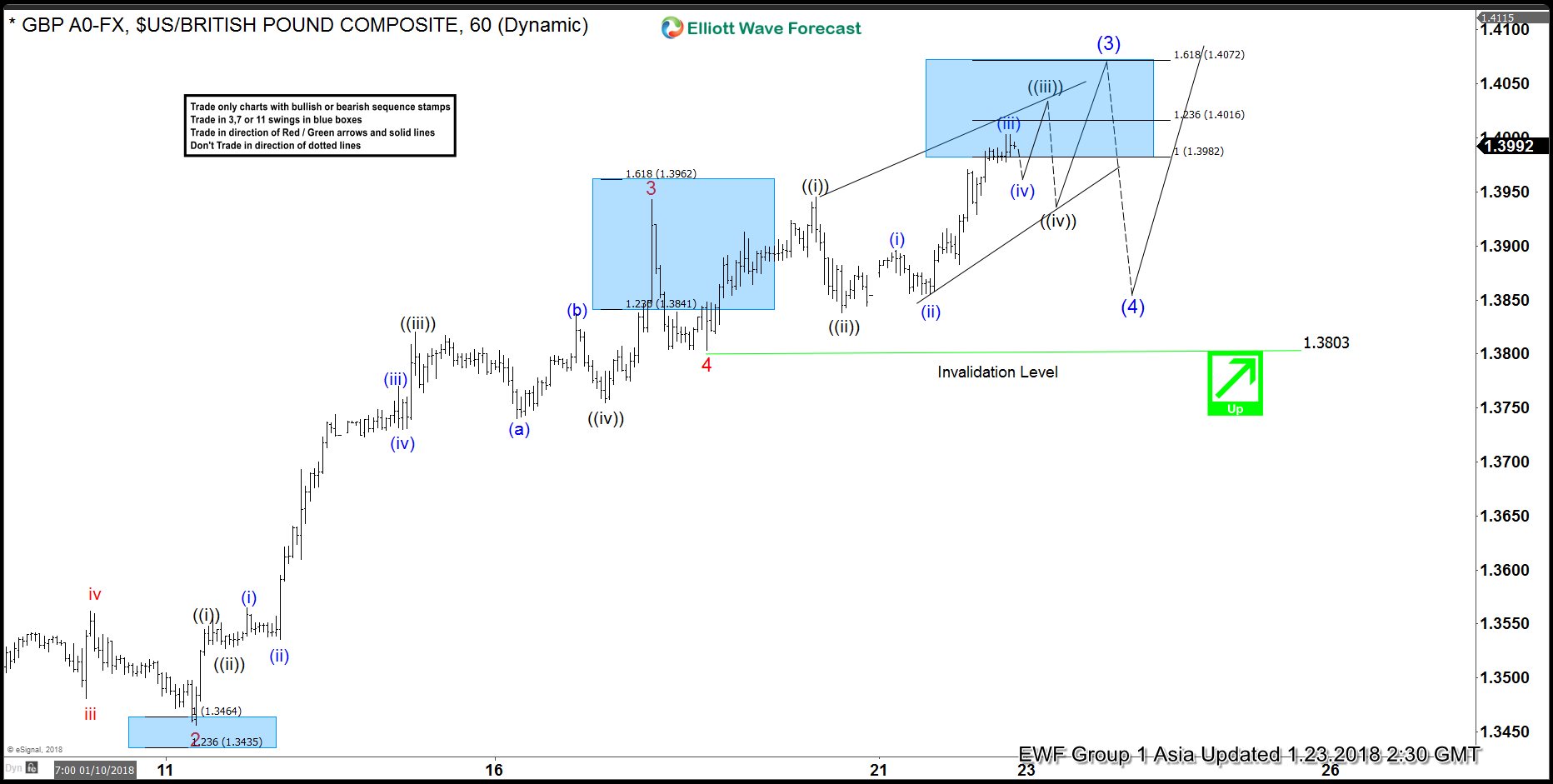

Read MoreGBPUSD Short Term Elliott Wave view suggests that the pair rallies as 5 waves impulse Elliott Wave structure from 16 December 2017 low. Up from 16 December 2017 low (1.33), Minor wave 1 ended at 1.3613, pullback to 1.3456 ended Minor wave 2, rally to 1.3943 ended Minor wave 3, and Minor wave 4 ended at 1.3803. […]

-

GBPUSD Elliott Wave Analysis: More Upside Expected

Read MoreGBPUSD Short Term Elliott Wave view suggests that rally from 16 December 2017 low is unfolding as 5 waves impulse Elliott Wave structure. Up from 16 Dec 2017 low (1.33), Minor wave 1 ended at 1.3613, Minor wave 2 ended at 1.3456, Minor wave 3 ended at 1.3943, and Minor wave 4 ended at 1.3803. Pair has […]

-

NZDUSD Impulsive Elliott Wave Advance

Read MoreNZDUSD has been in a strong up trend since 11/17/2017 (0.6776) low. Pair has gained 7.7% since then advancing from a low of 0.6776 to a high of 0.7331 before backing off a bit from the highs. Advance from 0.6776 low is unfolding as an Impulse where blue wave (1) ended at 0.6945, blue wave […]

-

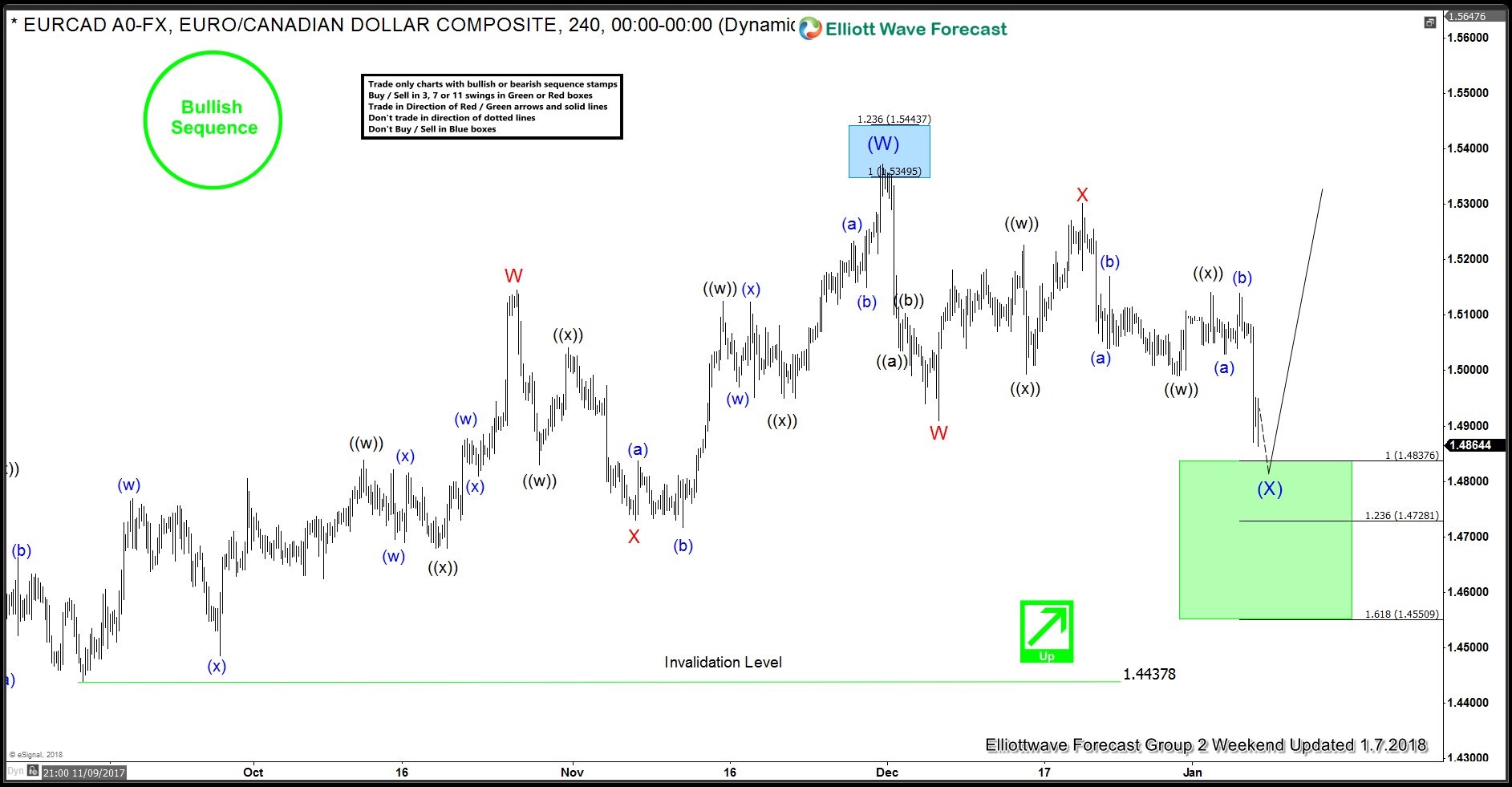

EURCAD Forecasting Rally & Buying Dips

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of EURCAD published in members area of www.elliottwave-forecast.com. As our members know, EURCAD have had incomplete bullish sequences in the 4 Hour cycle, suggesting further strength . Consequently , we advised our members to avoid selling the pair and […]

-

The Rise of Cryptocurrencies

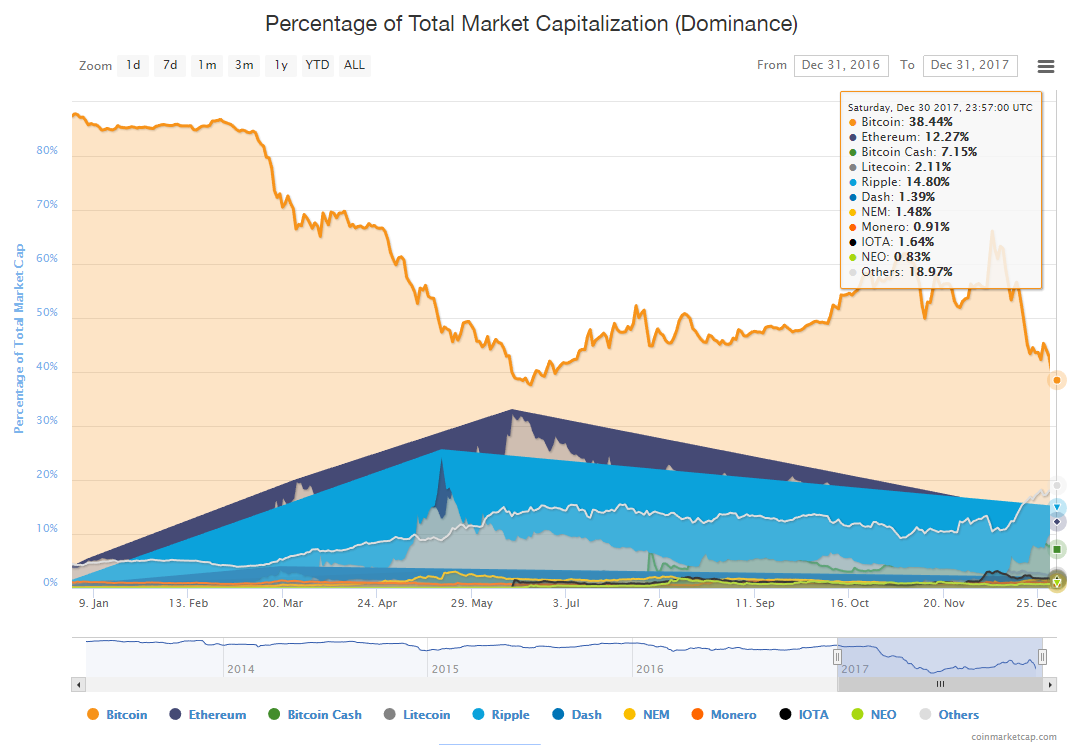

Read More2017 was the mania year of cryptocurrencies without a doubt, ICOs (Initial coin offering) exploded in 2017 raising more then $3.5 billion in cryptocurrency and currently there are more then 1,400 new coin in the market compared to six years ago as bitcoin was the only cryptocurrency people talked about. The cryptocurrency market continued its growth in 2017 […]

-

Bitcoin: Technical and Psychological Perspective

Read MoreHello fellow traders, in this blog post, we will discuss the most hyped cryptocurrency Bitcoin in a technical as well as psychological perspective. From the zero line, we are calling bitcoin completed in the super cycle blue wave (a) at 17/12/17 top. From that high, the market completed the first leg of 3 of a double correction. […]