In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

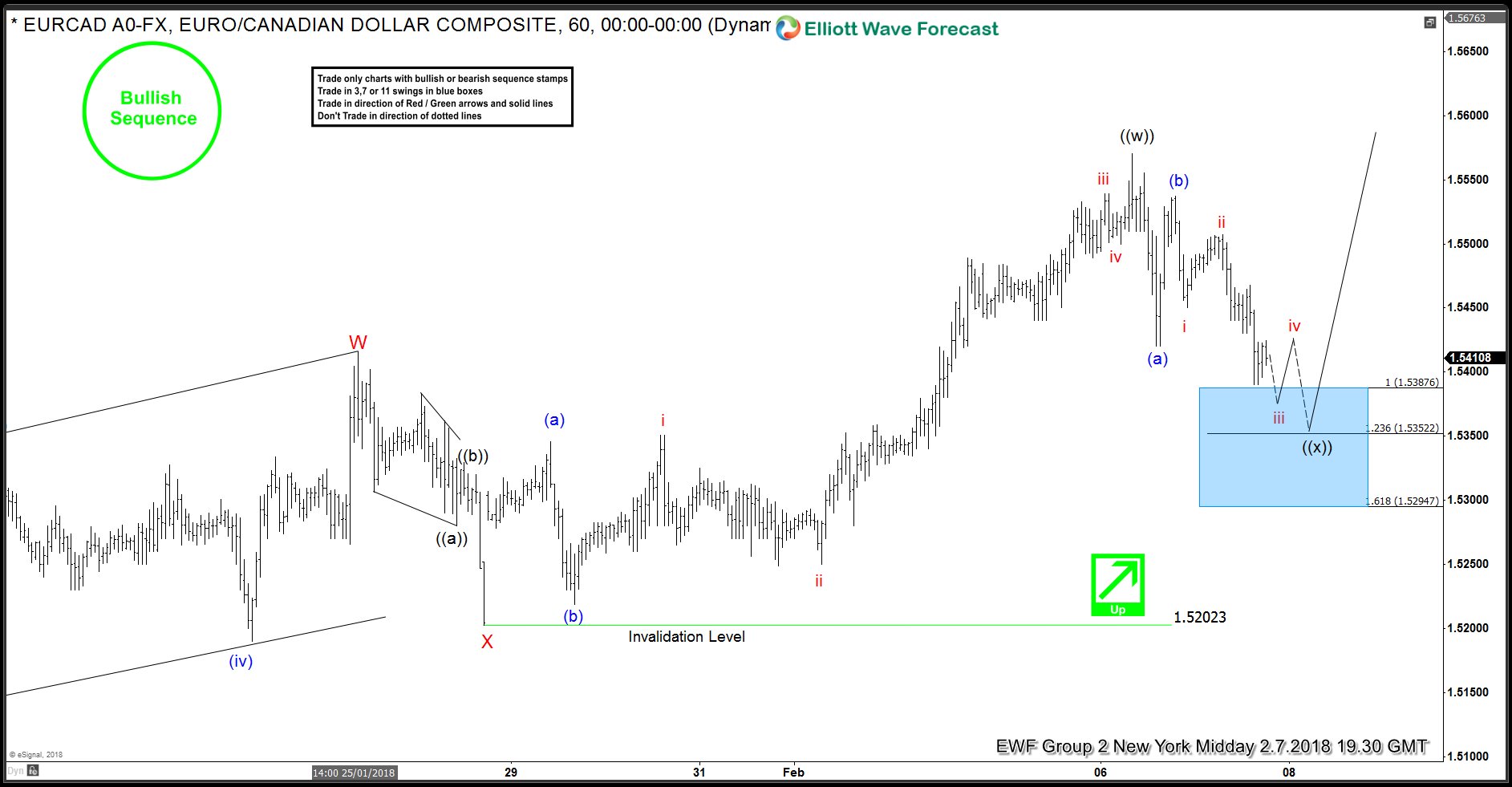

EURCAD: Buying The Dips Using Elliott Wave Sequences

Read MoreHello fellow traders. As our members know, we have traded EURCAD recently. The pair have had incomplete bullish sequences in the 4 Hour cycle,suggesting further rally. We advised our members to avoid selling the pair and keep on buying the dips in the sequences of 3,7,or 11 swings whenever there was an opportunity to do […]

-

Elliott Wave Analysis: Calling the low in place in Bitcoin

Read MoreBitcoin ticker symbol: ( BTCUSD ) Short Term Elliott Wave view suggests that the decline from December 17.2017 peak to February 05.2018 low (5920.72) ended the Super Cycle wave “(b)” lower. Above from there, the rally is unfolding as a leading diagonal Elliott Wave structure. Where Intermediate wave (1) ended at 9090.8 high as Elliott Wave Double three structure. Where internals of Intermediate wave […]

-

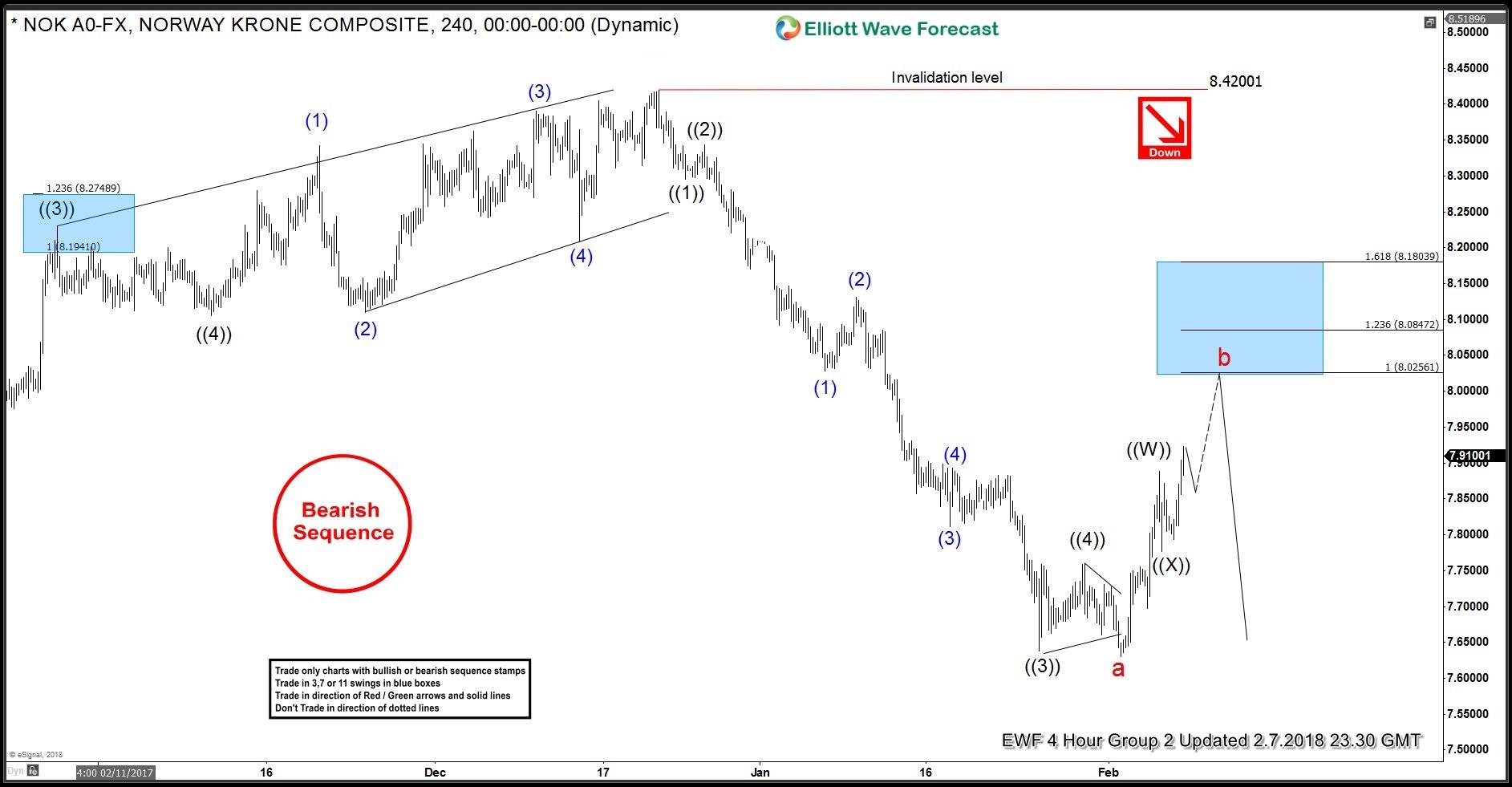

USDNOK Turns Lower From The Selling Area

Read MoreHello traders, in this blog I want to discuss with you a trade setup we advised to our members in our Live Trading Room. It was USDNOK. Let’s have a quick look at some past Elliott Wave charts of USDNOK we published in our member’s area of www.elliottwave-forecast.com. Our members know that USDNOK has an incomplete bearish sequence […]

-

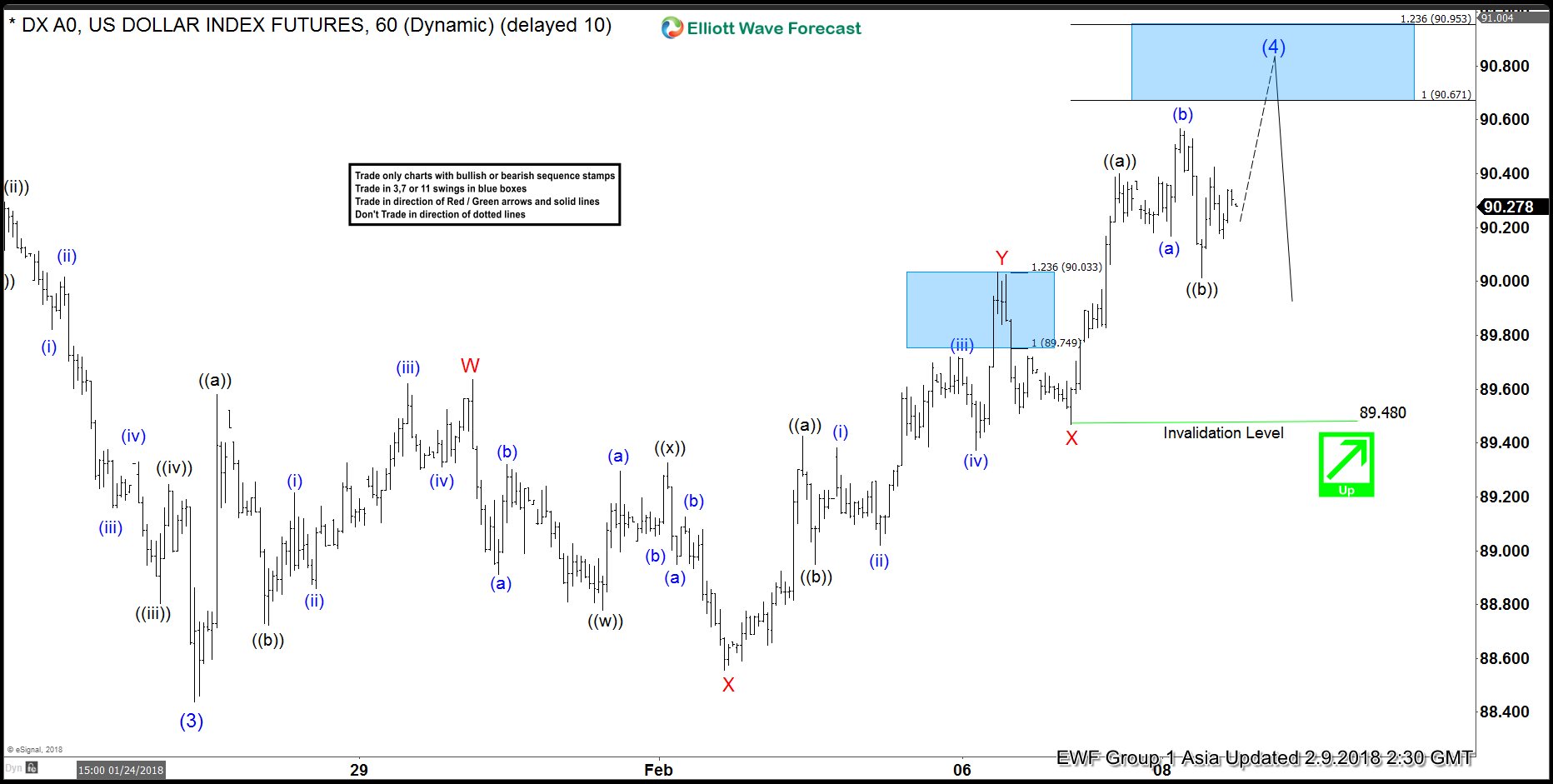

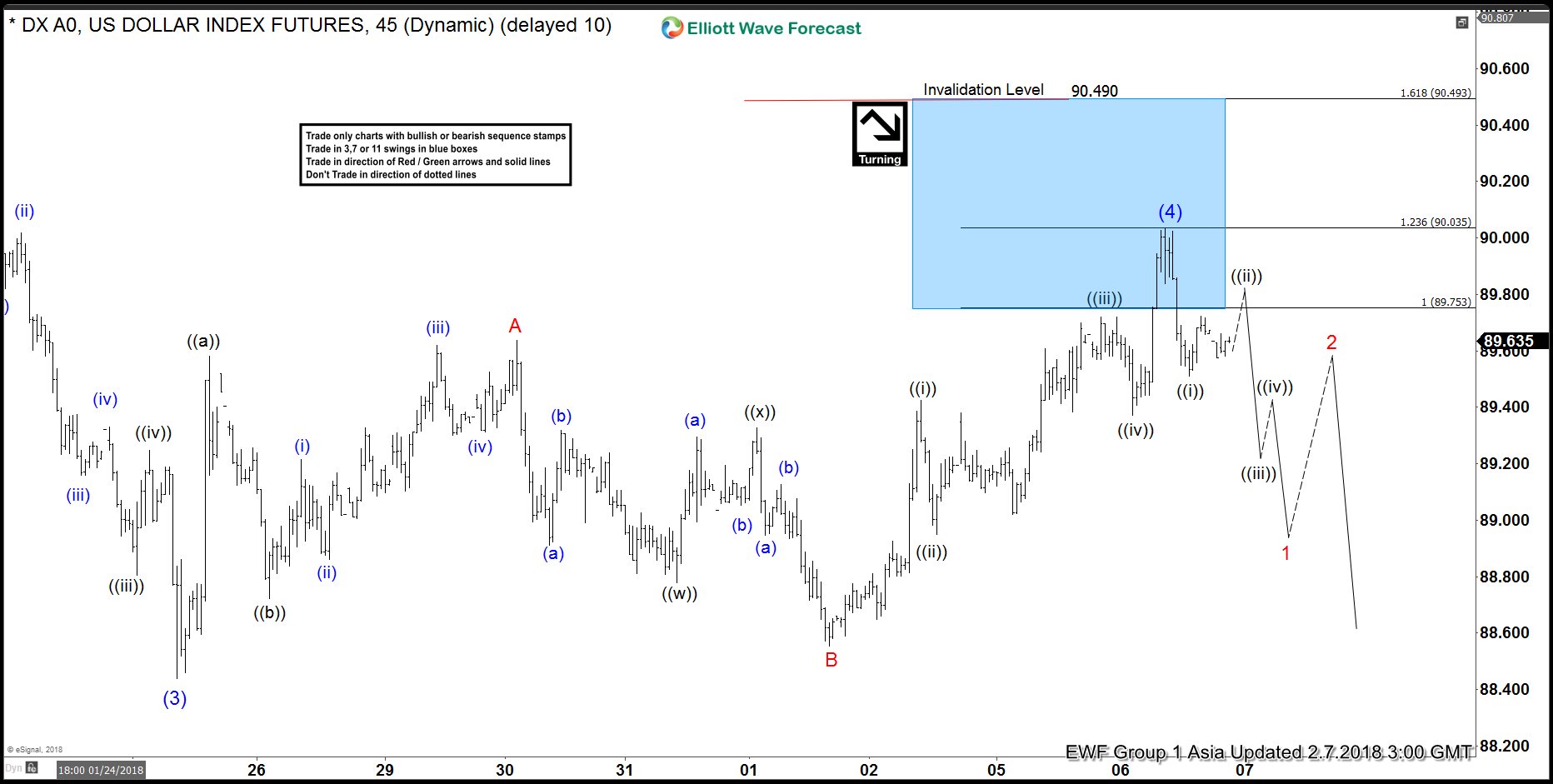

Elliott Wave Analysis: DXY Near Turn

Read MoreDXY Short Term Elliott Wave view suggests that Intermediate wave (3) ended at 88.44. Up from there, Intermediate wave (4) bounce is in progress as a triple three Elliott Wave structure. Rally to 89.64 ended Minor wave W, Minor wave X ended at 88.55, Minor wave Y ended at 90.03 and Minor second wave X ended […]

-

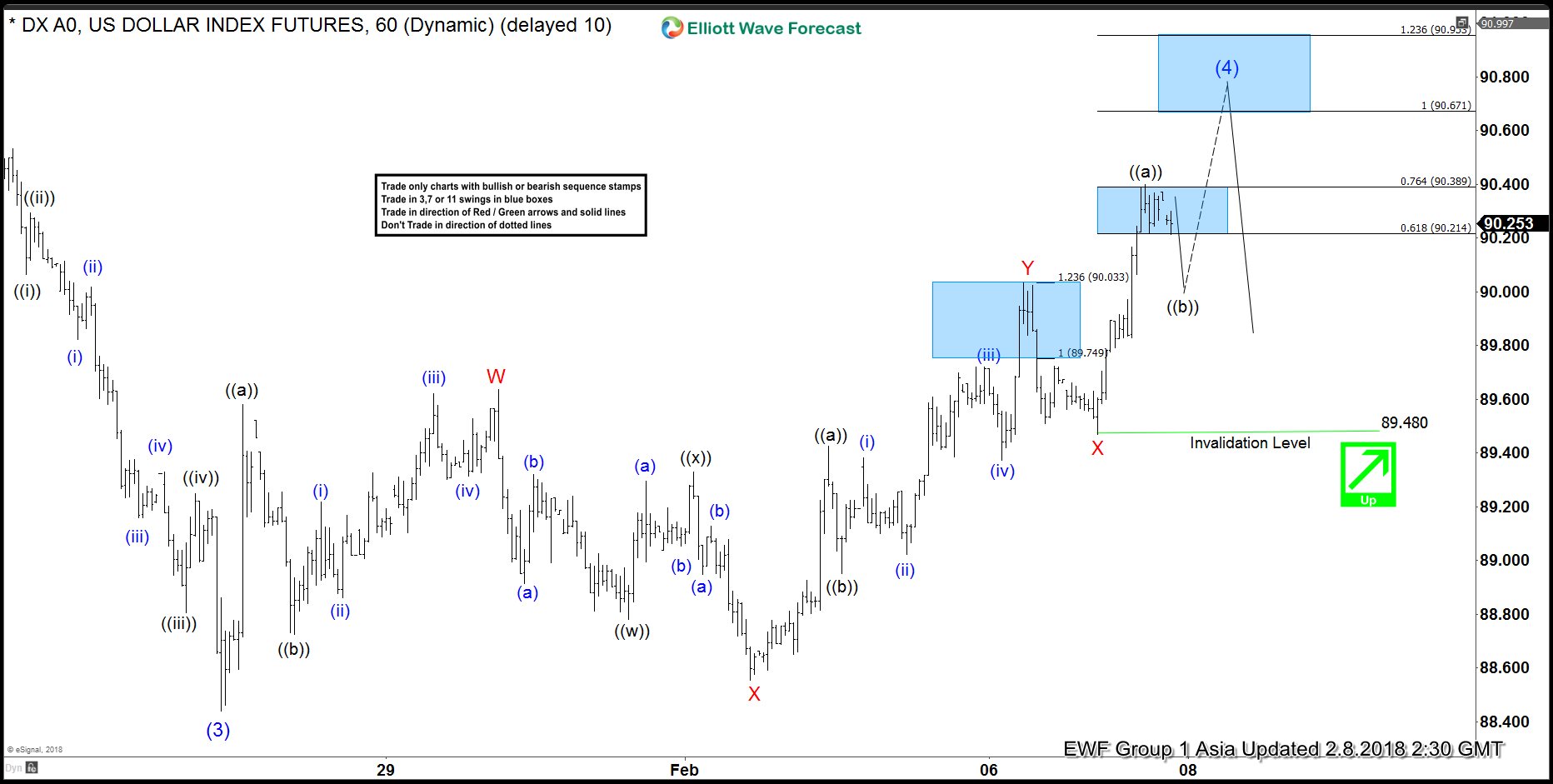

Elliott Wave Analysis: DXY extended correction as triple three

Read MoreDXY Short Term Elliott Wave view suggests that the decline to 88.44 ended Intermediate wave (3). Up from there, correction in Intermediate wave (4) is in progress as a triple three Elliott Wave structure. Rally to 89.64 ended Minor wave W, decline to 88.55 ended Minor wave X, Minor wave Y ended at 90.03 and Minor […]

-

Elliott Wave Analysis: DXY ended correction

Read MoreDXY Short Term Elliott Wave view suggests that the decline to 88.44 ended Intermediate wave (3). Intermediate wave (4) bounce unfolded as a flat Elliott Wave structure. Up from 88.44, Minor wave A ended at 89.64, Minor wave B ended at 88.55, and Minor wave C of (4) appears complete at 90.03. Near term, while bounces […]